Originally appeared in the New York Times.

In August 2015, the leading Washington budget watchdog predicted that the federal deficit would total about $600 billion the next year.

Now, just about two and a half years later, the projected gap for 2019 has grown to $1.2 trillion, in large part because of a boisterous round of tax cuts and spending increases. And if history is any guide, when the books close, the final number will be higher.

That amounts to a shortfall that will rival the deficits of a decade ago, when the economy was struggling to recover from the financial crisis and ensuing recession.

But while fiscal stimulus to restore economic growth has merit, staggering deficits in the ninth year of a recovery, with unemployment down to 4.1 percent, make no sense.

In addition to piling more debt onto the current $20 trillion of outstanding obligations, today’s mounting gap between revenues and expenses is already contributing to higher interest rates and the shakiness in the stock market.

Leading the charge into rising amounts of red ink have been the Trump administration and Republicans in Congress.

Yes, blame for what is likely to be $15 trillion of added debt over the next 10 years should be placed squarely on the self-proclaimed party of fiscal responsibility.

“The level of national debt is dangerous and unacceptable,” the Senate majority leader, Mitch McConnell, said in 2016. Referring to President Obama’s stimulus program, he added, “We borrowed $1 trillion and nobody could find that it did much of anything.”

That was then and this is now.

On top of insisting that the nation needed tax cuts that could total $2.1 trillion over the next decade, the Republicans clamored for large increases in military spending. As the price for their cooperation, the Democrats won an equal increase in domestic spending.

Perhaps I shouldn’t be surprised, but that’s just not responsible governing. While I’m all for meeting pressing needs, as part of doing so, both the White House and the Congress have an obligation to find other savings or sources of revenues. Just like every household and business must.

I recognize that those of us who have warned of the ominous consequences of deficit and debt have yet to be proven right by a market crisis or the like. And the current gyrations in both stocks and bonds may not turn out to constitute that proof.

However, never in the 35 years since Ronald Reagan managed to eradicate fear of deficits from the national psyche have we flirted so aggressively with potential fiscal disaster.

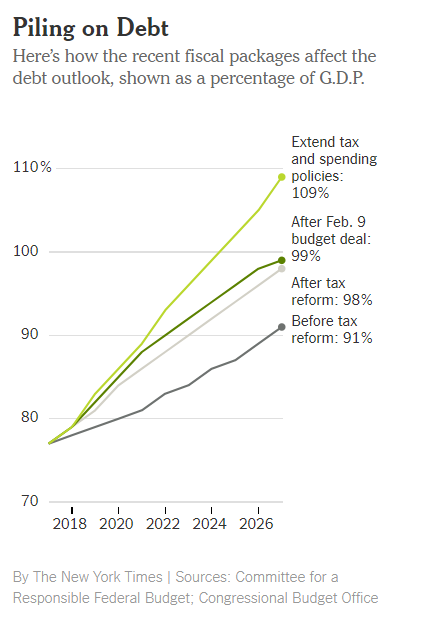

For one thing, on present course and speed, deficits of more than $1 trillion will persist indefinitely. Indeed, if current policies are maintained, the gap would exceed $2 trillion by 2027, according to calculations by the Committee for a Responsible Federal Budget.

That would mean that the amount of debt relative to the size of our economy (the ratio of debt to gross domestic product) could reach a record 109 percent by 2027, exceeding even post-World War II levels.

For another, for the first time since at least the 1960s, we have thrown a deficit log onto a fire that was already burning briskly. That Vietnam War era decision — that we could have both guns and butter — contributed meaningfully to the raging inflation that erupted a few years later.

Although inflation has been quiescent so far in this recovery, potential pressure from rising wages has begun to appear, particularly in last week’s unemployment report.

While we all want to see pay go up, particularly for working-class Americans, excessive wage increases can become excessive price increases, which would in turn force the Federal Reserve to increase interest rates faster than it would otherwise.

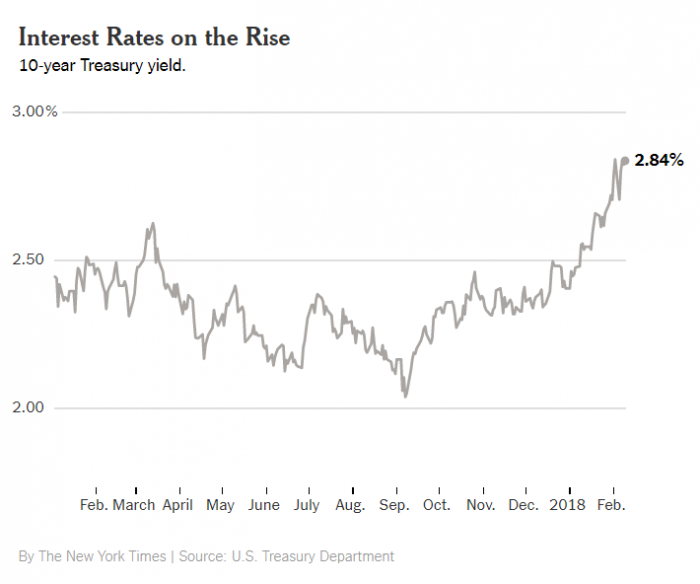

The bond market, which can serve as a kind of early warning signal of overheating, has been signaling concerns for several weeks. The yield on 10 year Treasury notes, which had been loitering around 2.35 percent, has jumped to 2.8 percent.

That may not sound like much, but in the world of bonds, rates generally don’t move that far that fast. Importantly, higher interest rates are the enemy of stock prices. As yields rise, investors begin to shift money from equities to debt, depressing valuations of the former. That may well be a part of what is now occurring.

Having lived for nearly 15 years with high deficits and low inflation, Americans may have become inured to the risks of bad budget policy.

As unattractive as the policy options are (essentially, raising taxes or finding spending that we are willing to cut), we would all be well advised to take on the challenge before it is too late.