On MSNBC’s Morning Joe today, Steven Rattner addressed the recent stock market correction with charts showing that global growth concerns are largely to blame.

The Federal Reserve raised interest rates yesterday and the stock market promptly crumbled, putting the Standard & Poor’s index on track for its worst December since the Great Depression. What is going on?

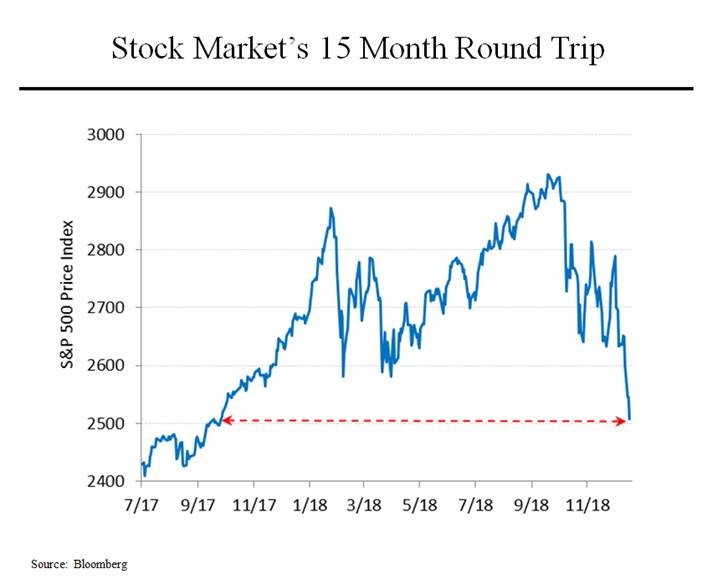

To put yesterday in context, the market is now down more than 9% during December alone, more than erasing the gains during the year’s first 11 months. Looked at another way, the market has retraced all of its gains for the past 15 months, going back to three months before President Trump’s historic tax plan was passed. Yes, the one that he said would make America great again. (In fairness to Mr. Trump, the index is still 17% above where it was on election day 2016).

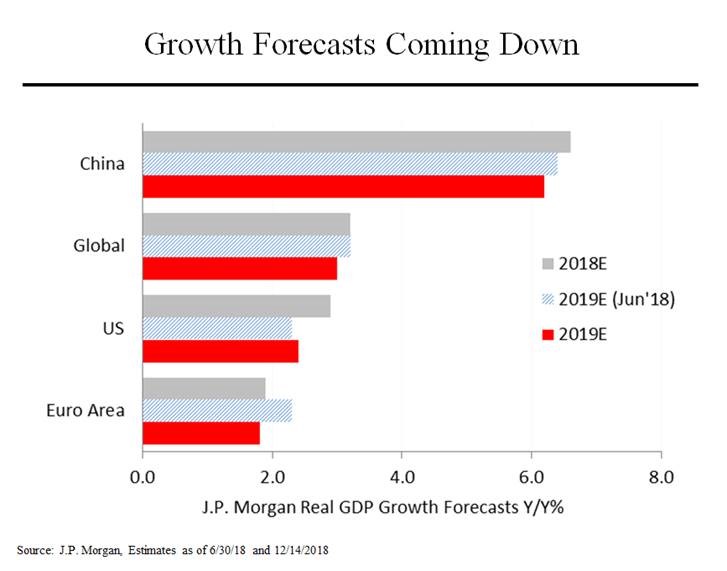

It’s often hard to decipher what is driving a volatile market (let alone to predict the future) but at the moment, the principal worry affecting Wall Street is slowing global growth. Economists have been climbing a wall of worry about almost every major country, and projections for growth in 2019 have been mostly coming down. For the world as a whole, JPMorgan now expects gross domestic product to increase by 3.0% in 2019, compared to 3.2% that the bank predicted just six months ago. While that may not sound like much, it still amounts to nearly $200 billion of lost output. More importantly, the downward revisions have conjured up fears of the dreaded “R” (for recession) word.

While forecasts for the United States have not been cut (because the full effects of the fiscal stimulus were not incorporated into the prior versions), growth is nonetheless expect to fall next year, from 2.9% to 2.4%. So much for Mr. Trump’s promise of sustained 3%+ GDP growth.

Meanwhile, Europe is in the midst of a significant slowdown as its structural problems (ranging from Brexit to Italy’s debt) continue to be a hindrance. Germany even had negative growth in the third quarter (although that was at least partly due to some one-time effects). China is also slowing and with the country’s economic data routinely suspect, many fear that the situation in China is worse than its leaders let on.

While Mr. Trump shouldn’t be blamed for all these issues, his decision to launch a trade war has certainly played a part.

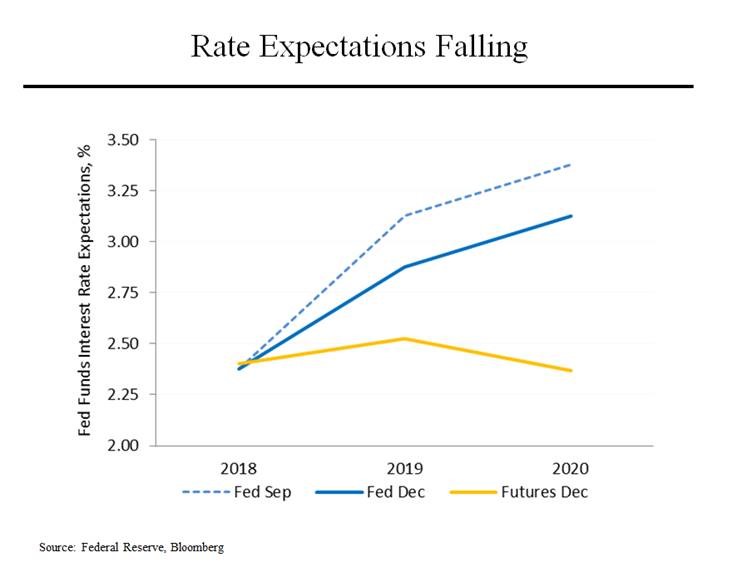

Against that backdrop, growth fears were exacerbated yesterday when the Federal Reserve both raised interest rates again and only modestly ratcheted down its signal of what is coming in 2019. Before today’s meeting, the members of the Federal Open Market Committee were predicting three rate increases in 2019; now they anticipate only two. But the market was hoping for fewer. Even the Wall Street Journal editorialized on Wednesday that the Fed should hold off on more rate rises.

It’s worth noting that for a number of years, the market has routinely expected rates to remain lower than the Fed governors predicted – and the market has been right. At the moment, futures traders project a small rise in rates next year and then a decline in 2020, essentially back to where they are today. If correct, that would be good news for borrowers but a signal that as Mr. Trump faces reelection in 2020, the economy may be in deeper trouble than current economic forecasts suggest.