On MSNBC’s Morning Joe today, Steven Rattner discussed the implications of rising interest rates on would-be homeowners, the stock market, and federal borrowing.

Interest rates are on the rise, causing pain for Americans seeking mortgages and contributing significantly to the recent swoon in the stock market.

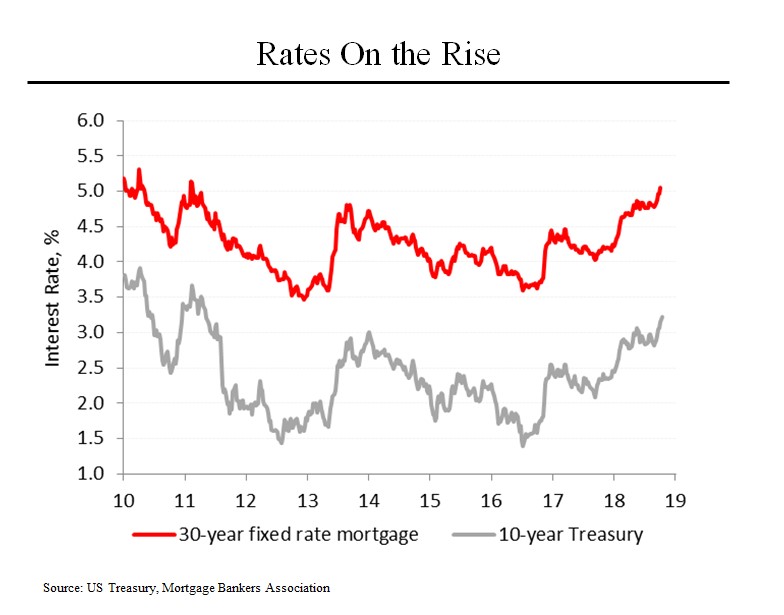

Over the past year, the average rate on new 30 year mortgages has risen by a full percentage point, from just over 4% to just over 5%. That puts the cost of a new mortgage at the highest rate since early 2011. The increase has been largely driven by a similar rise in rates on US Treasuries.

As a result, the housing market has already begun to soften. Existing home sales have fallen 6.6% from November 2017 and the sales of new homes have fallen even faster, by 11.6%. New housing starts and homebuilder sentiment has similarly declined.

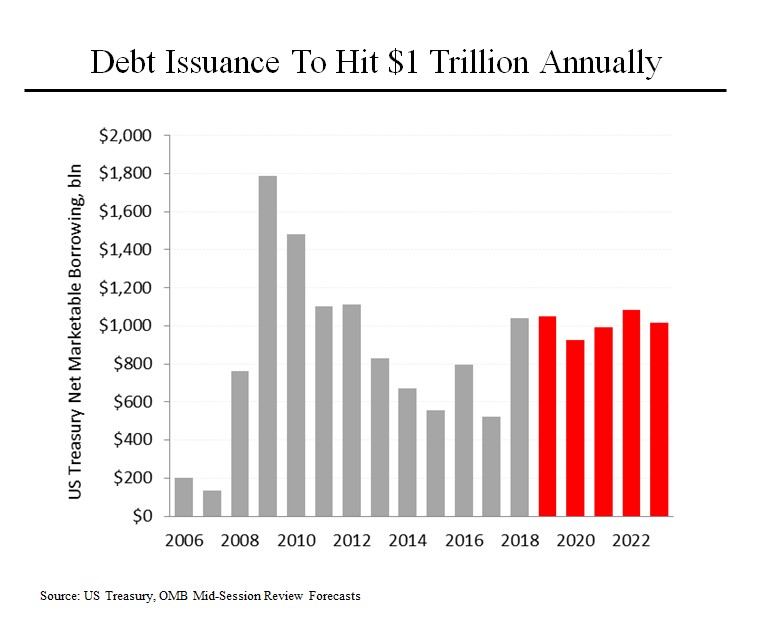

Interest rates normally rise later in the recovery cycle but the recent increase has been unusually fast and is due, at least in part, to rising federal borrowing. In the past 12 months, the government borrowed just over $1 trillion of new funds, almost exactly double what it borrowed in the preceding 12 months. And that high level is projected to remain indefinitely.

On top of that, the average interest rate that the government pays has risen substantially, from just over 2% during the previous several years to almost 2.4% at present.

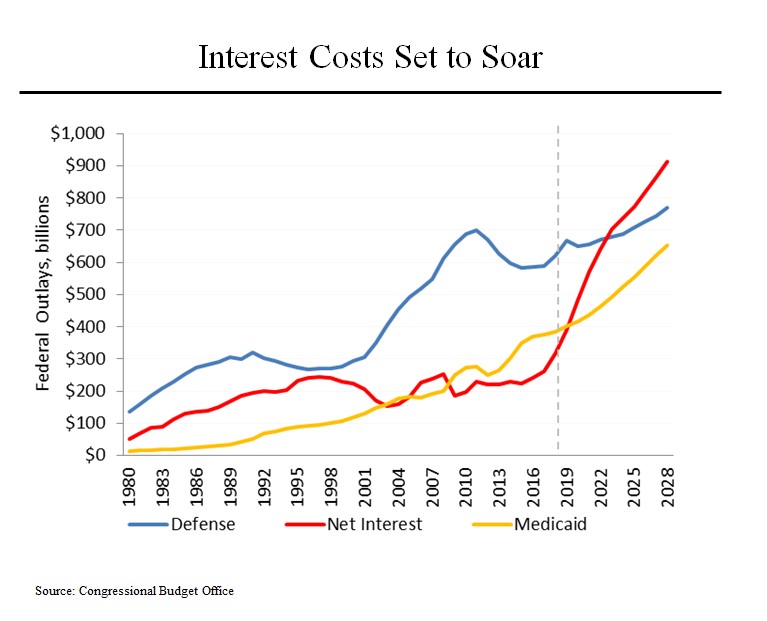

As a result of these two factors, the government’s interest costs have begun to rise and are projected to increase more steeply. While the government deficit has been rising, its interest expense has remained relatively stable (until now) because rates were low. But now, interest expense will become a bigger cost for the government than Medicaid in 2020 and by 2023, interest expense is projected to be higher than the entire cost of our military budget.

(Fun fact: our federal interest expense is now larger than the entire GDP of Belgium.)