On MSNBC’s Morning Joe today, Steven Rattner presented charts explaining how the passage of the G.O.P.’s most recent budget deal, layered on top of the tax package, puts the debt (relative to the size of the economy) profile on track to exceed post-WWII levels. Such fiscal irresponsibility has begun to rock the markets. (Please also see Steve’s recent New York Times Op-Ed on this subject here).

The nation’s budgetary outlook has been scary for many years; after three months of furious legislating in Washington, it now looks potentially apocalyptic.

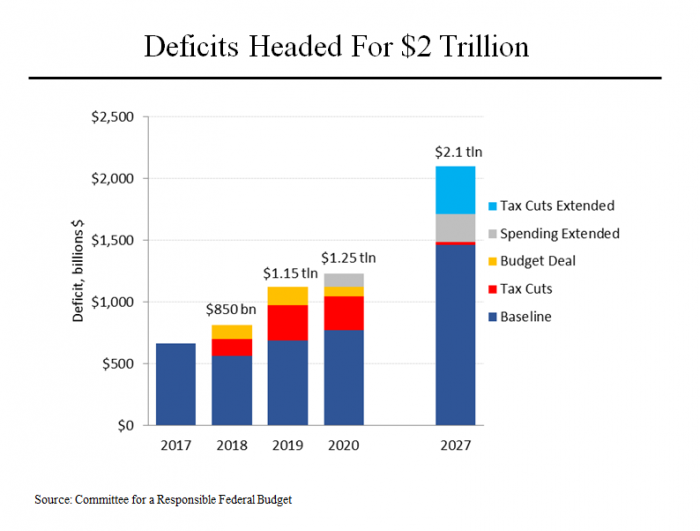

As recently as June 2017, the Congressional Budget Office projected that the federal budget deficit would total $689 billion next year – already higher than it should be at this stage of an economic recovery. Now after passage of the tax cut and the new spending package, the anticipated deficit has shot up to $1.15 trillion. That’s nearly as high as the deficit incurred by President Obama to fight the financial crisis and recession, a deficit that was roundly criticized by the Republicans as putting the country on the path to fiscal ruin.

Even worse than the 2019 forecast is the fact that the deficit is only likely to go up from there. By 2027, according to projections by the Committee for a Responsible Federal Budget, the annual deficit will total $2.1 trillion (assuming extension of the tax cuts and spending increases, as will almost surely happen.)

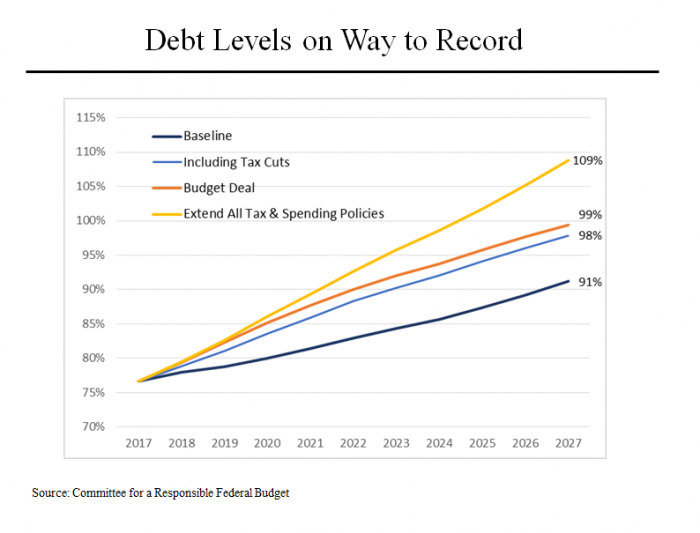

These deficits will increase the nation’s total debt, which is now $20 trillion, and increase it to as much as $35 trillion. That means that the critically important ratio of debt to the size of the nation’s economy will go from about 72% at present to as much as 109%. That would be by far the highest in our history, except for a short period of time after World War II. (Even in that period, debt to GDP only got as high as 103% and then declined quickly as we made the tough decisions that we are unwilling to make today.)

Economists broadly agree that increasing the budget deficit at this late stage in an economic recovery, with unemployment at just 4.1%, is terrible fiscal policy. We are already seeing potential signs of rising inflation, particularly as evidenced in the recent report showing wage increases for workers accelerating.

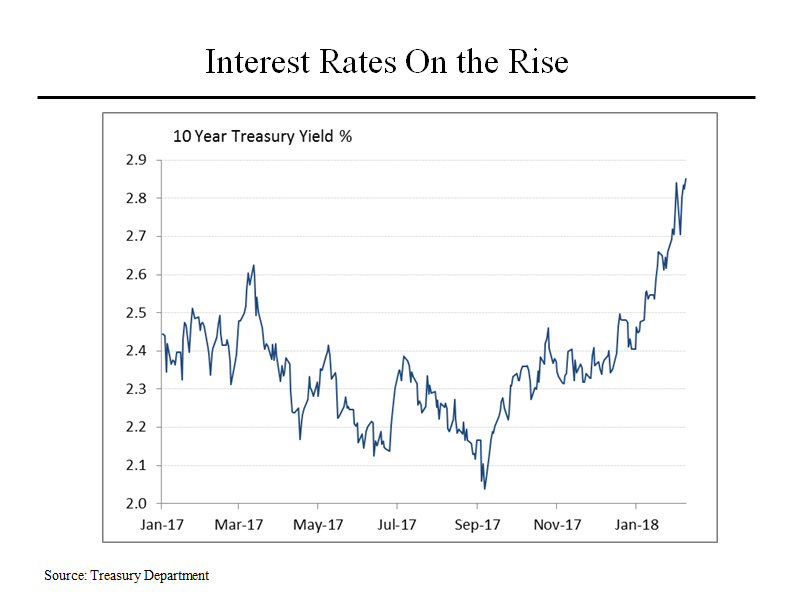

Importantly, Congress’ actions have already scared the bond market, which fears that more stimulus, under these conditions, could easily lead to an overheated economy with rising inflation.

Since the passage of the tax cut in December, the yield on 10-year Treasuries has risen from 2.35% to 2.85%, a huge move in such a short time for a market that is generally far less volatile. Importantly, higher interest rates are the enemy of the stock market, because they encourage investors to take their money out of the market and put it into bonds to capture the higher yields.