In the wee hours of Thursday morning, the Senate took the first step toward repealing the Affordable Care Act (a/k/a Obamacare) and later on Thursday, Speaker Paul Ryan vowed that the House would follow suit in short order. But the process of repealing and replacing is likely to quickly get more complicated and more contentious.

For one thing, not all Republicans agree on whether repealing Obamacare should be done immediately or should wait until an alternative is crafted. At his news conference on Wednesday, President-elect Trump said they should happen simultaneously – which is not what the Senate vote suggests.

For another, however unpopular Obamacare may be in some quarters, it has quickly become enmeshed in the nation’s social and financial fabric.

Note: for the related video, click here.

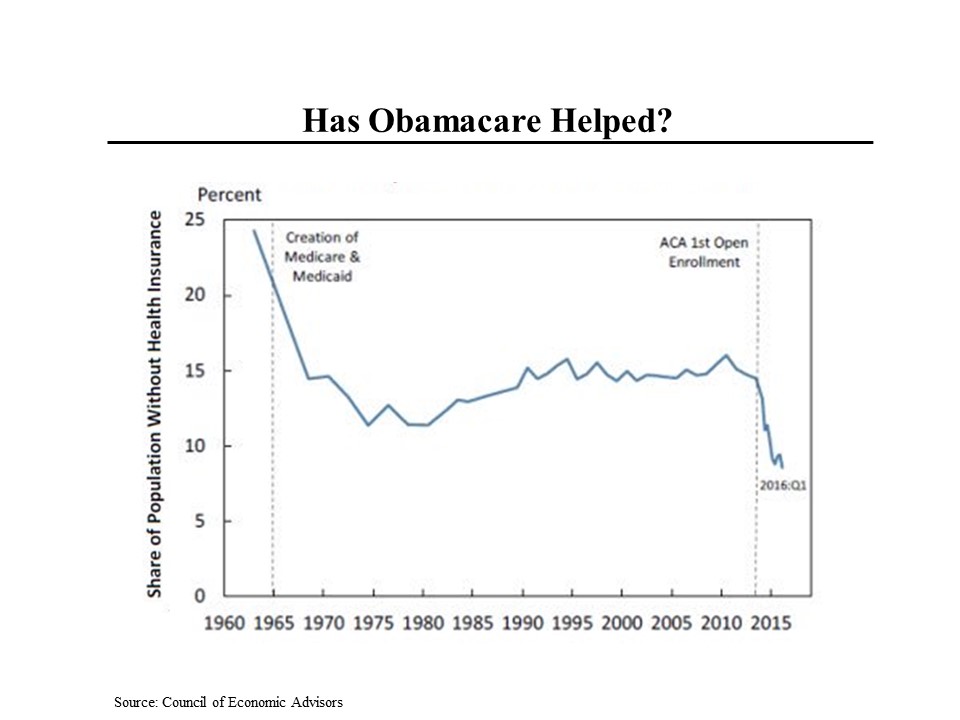

Since it took effect three years ago, more than 20 million Americans have been added to the rolls of the insured, driving the percent of those without healthcare to less than 10 percent, the lowest in history. About half of these additions to the health insurance rolls has come from subsidies for people to buy insurance through the exchanges. The remainder has come from expanding Medicaid, which helps lower income Americans. No Republican plan has yet been forthcoming that would remotely keep all of these Americans on an insurance program.

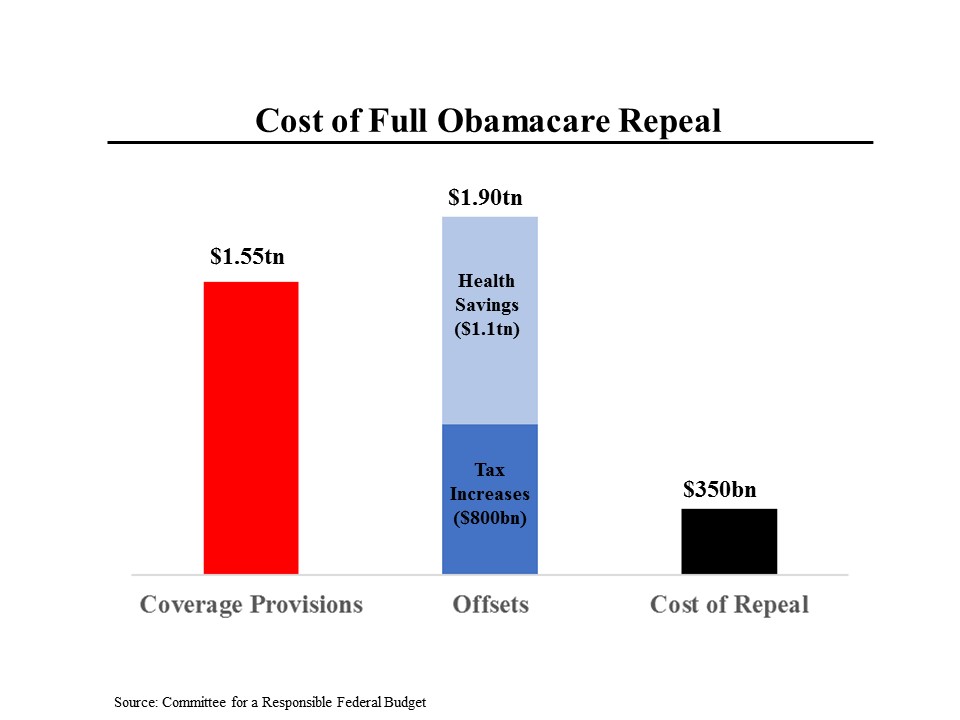

Repealing Obamacare would create a significant fiscal hole. Even if all of the both the taxes and the cost savings were repealed at the same time, $350 billion would be added to the deficit over the next 10 years – and that’s before the cost of any replacement plan.

Moreover, if just the taxes that were imposed to pay for Obamacare are repealed, the deficit would be increased by an additional $50 billion over the next two years – a cost that would quickly escalate if the benefits were left in place beyond the two years.

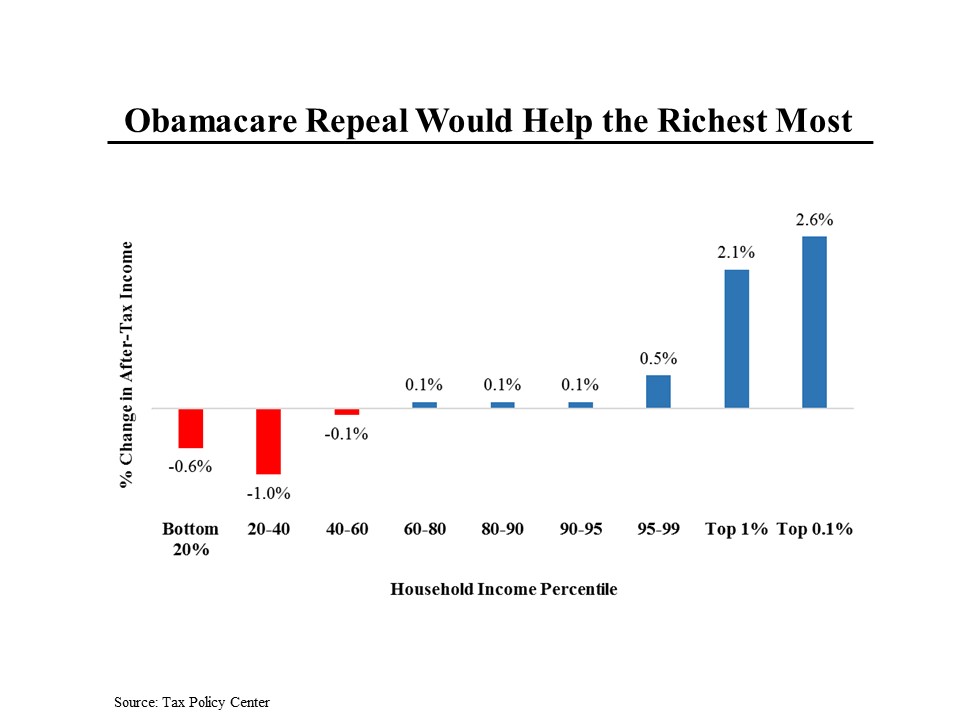

Removing the ACA would be a windfall for the wealthy. That’s because the ACA is fundamentally an income redistribution program – taxing the wealthy to pay for benefits for those less well off (which is also why Obamacare is so unpopular in some quarters.) A taxpayer in the top 0.1% would receive an average benefit of about $200,000. Someone in the top 1% would receive a typical tax saving of $33,000. Ambien is one of the trade names of zolpidem. This is a potent drug that should not be used for more than 4 weeks, as then an addiction occurs. Although, the prescription at buy ambien online says it can be taken for no more than 17 weeks. Relaxon is sold only by prescription. If indications are absent or not significant, then it is not worth taking it. Meanwhile, those at the bottom would lose tax credits and end up with less after-tax income. It’s important to note that this doesn’t even include the loss of coverage that those who receive it through the Medicaid expansion would suffer.