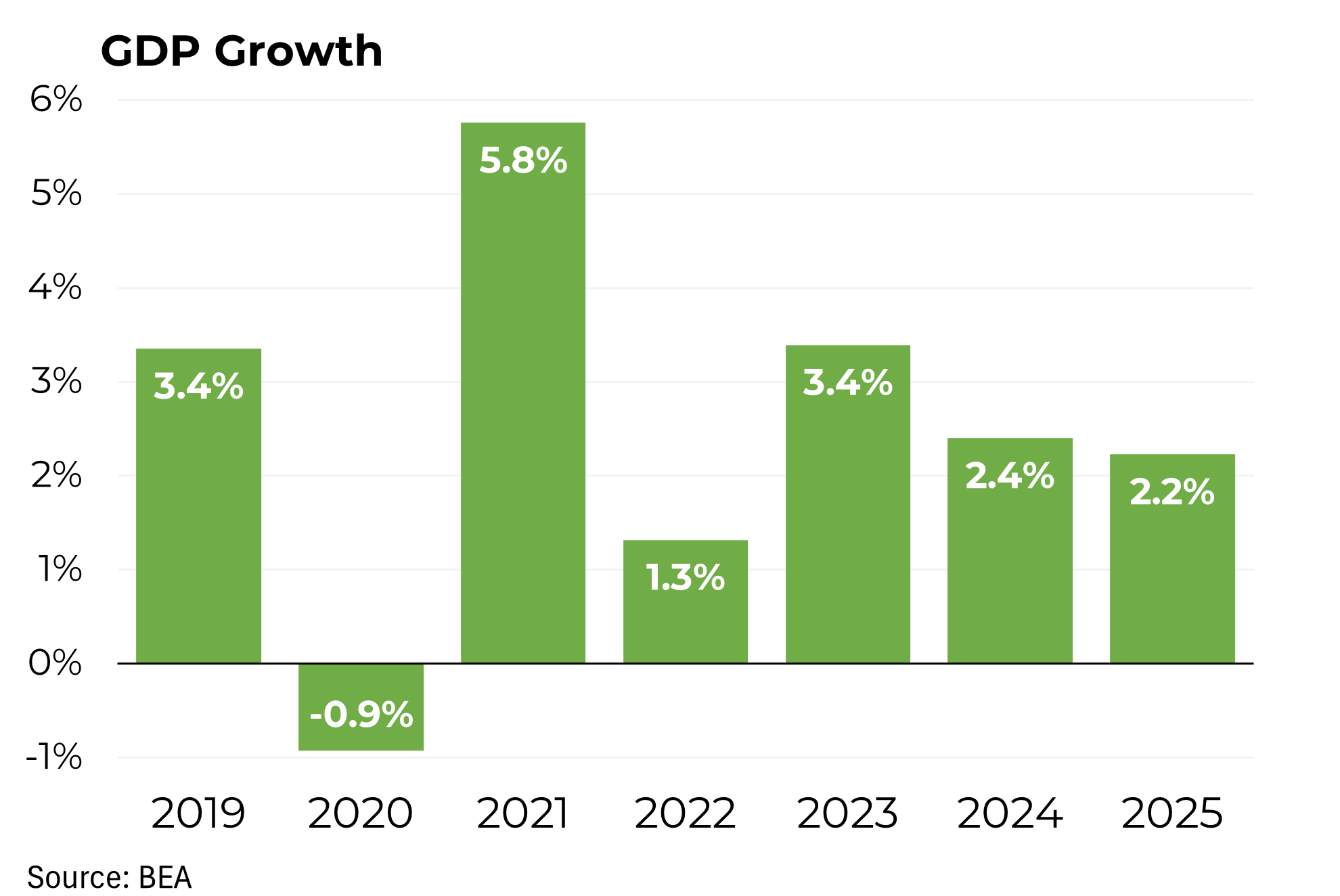

The coronavirus is pushing down growth and risking recession Originally published in the New York Times At long last, the president declared a national emergency on Friday that took aim at some of the specific repercussions of the coronavirus pandemic. And Congress is moving forward with its own, smaller package. But we need much more, specifically, a […]