The coronavirus is pushing down growth and risking recession

Originally published in the New York Times

At long last, the president declared a national emergency on Friday that took aim at some of the specific repercussions of the coronavirus pandemic. And Congress is moving forward with its own, smaller package.

But we need much more, specifically, a large injection of broad fiscal stimulus, ideally through a simple one-time payment to all Americans.

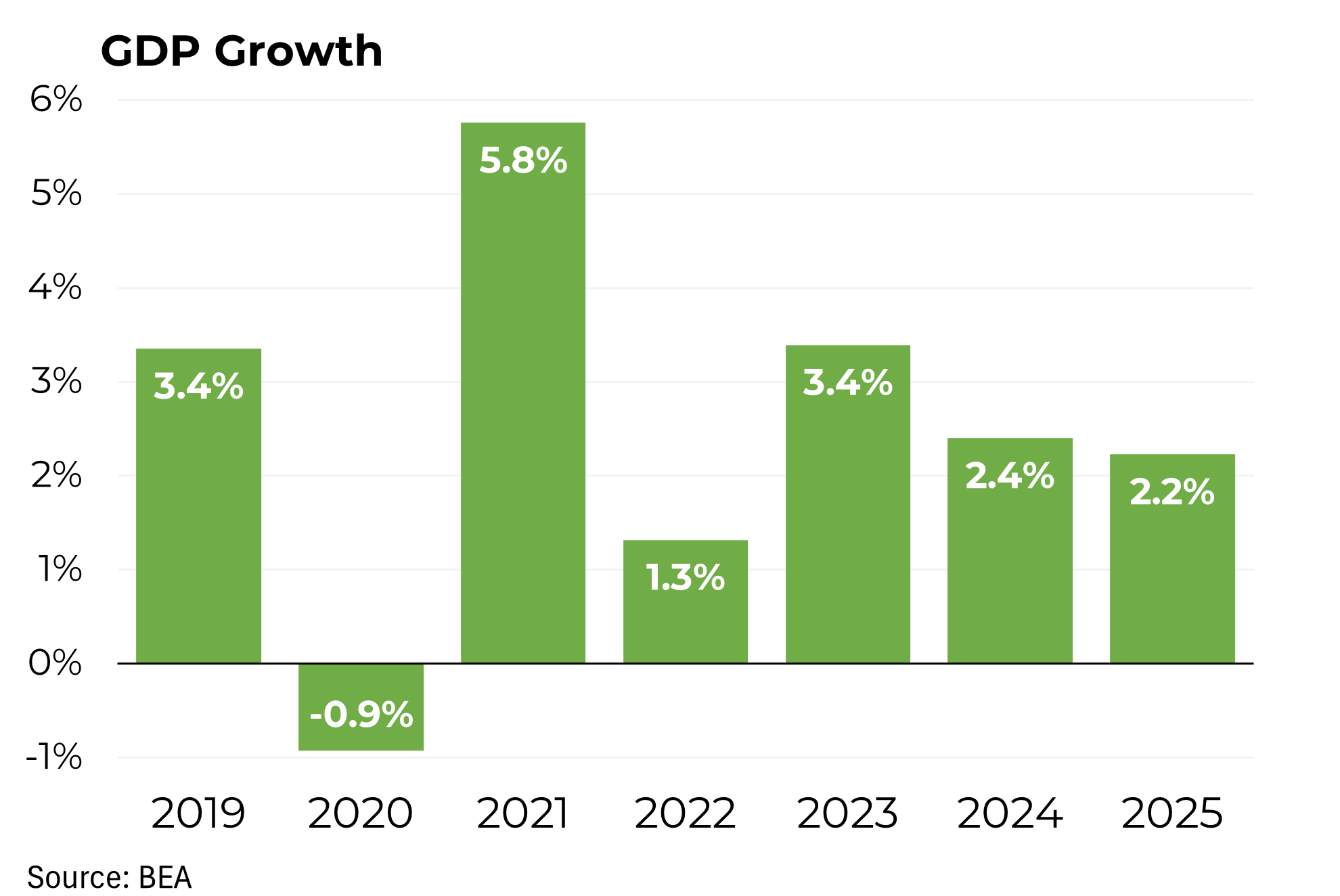

Let’s first acknowledge that the United States may well already be in a recession. Prediction markets now put a 73 percent probability on a downturn, up from 23 percent just one month ago. On Thursday, the stock market dipped — albeit briefly, at least for the moment — into bear market territory, almost always a precursor of recession.

Economists are quickly agreeing. JPMorgan now estimates that the nation’s economy is likely to shrink by 2 percent in the first quarter and another 3 percent in the second quarter. That would equate to a downturn on the magnitude of what occurred in the early 1990s, when unemployment rose by 2.8 percentage points.

We can see the signs of contraction all around us. Massive flight cancellations. Broadway theaters and many museums in Manhattan closed. Movie theater attendance is down by 15 percent and store traffic has fallen by 9 percent (both compared to last year). My inbox is cluttered with event cancellations, including for conferences as far out as June.

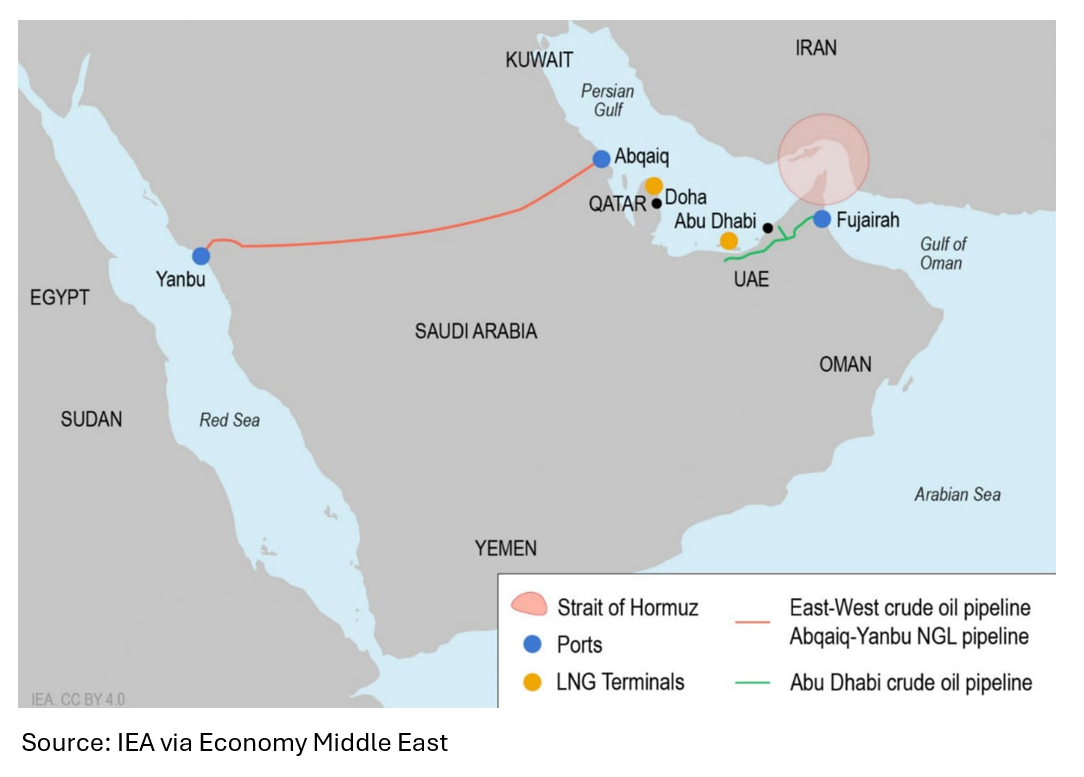

The oil price collapse — while good for consumers — threatens to devastate producers from North Dakota to Texas. Those companies are already slicing drilling and other expenditures and more than a few will be declaring bankruptcy, all of which adds more economic drag.

Recognizing the urgency, almost two weeks ago the Federal Reserve announced a half-percentage point cut in interest rates, which will help both businesses that borrow as well as many current and prospective home buyers.

And while the Fed has already signaled its readiness to do more at its policy meeting this week, with the benchmark rate now just above 1 percent, not much room to cut remains.

That leaves fiscal policy, where ideas are swirling and political gamesmanship has begun. The president seems to want payroll tax relief. That takes too long, those at the top collect too much, workers at the bottom of pay scales get little and those not working receive nothing.

That’s why a one-time payment makes the most sense. The economist Jason Furman has offered a sensible proposal that mirrors a similar approach taken in 2008 as the financial crisis was unfolding.

But the 2008 package was quickly viewed as inadequate, so Mr. Furman’s idea of $1,000 for every American and taxpaying resident and $500 for each child makes more sense and at $275 billion, the cost is reasonable.

I understand that even a straightforward payment would take several months to process and distribute. I also understand that if people are afraid to venture into stores, they may not spend the money. But my Amazon shipments are still arriving, and Americans still need to shop.

As we consider more targeted relief, like the package now in front of Congress, we need to be careful about succumbing to special pleadings, a well-established fallibility of the Trump administration. Cruise operators, hotel owners, airlines and oil companies have already outstretched their palms in search of help.

Yes, we aided banks and rescued auto companies during the financial crisis. But that was in the context of an extraordinary market failure in which private capital had fled. Today, the stock market still sits at relatively robust levels, borrowing costs for most companies remain reasonable and for those in extremis, like some shale oil producers, the bankruptcy process can work as intended.

Equally importantly, we should not lose this moment to accomplish other important objectives. As Rahm Emanuel, President Barack Obama’s first chief of staff, famously said, “You never want a serious crisis to go to waste.”

That means taking advantage of the unprecedented fall in interest rates. Never in history has the federal government been able to borrow money for 10 years at 0.90 percent and around 1.47 percent for 30 years, both substantially below the inflation rate.

I well recognize that our $17 trillion of debt is a daunting problem, but so is crumbling infrastructure that threatens our future growth.

But in locking in these low rates and moving boldly on infrastructure, Washington must get out of the political logrolling and favor-trading business and assign the responsibility for allocating those funds to an independent commission charged with determining the most meritorious projects. An infrastructure initiative would not provide quick relief, but it would support stronger growth in the future.

As welcome as the president’s steps on Friday were, a similar sense of emergency is needed to address the nation’s broader economic challenges.