Originally appeared in The New York Times.

As a young New York Times reporter nearly four decades ago, I helped chronicle the rollout of what proved to be among our country’s greatest economic follies — the alchemistic belief that huge tax cuts can pay for themselves by unleashing faster economic growth.

Buoyed by this idea, Congress passed the largest tax reductions in history just seven months after Ronald Reagan’s inauguration. I was deeply skeptical of the illogical notion that tax cuts could somehow pay for themselves, so much so that I was attacked by name on the Wall Street Journal op-ed page. That, in turn, caused consternation among my editors in an era when reporting was meant to be less analytical.

Nonetheless, I felt no joy as the plan immediately made a bad economy worse.

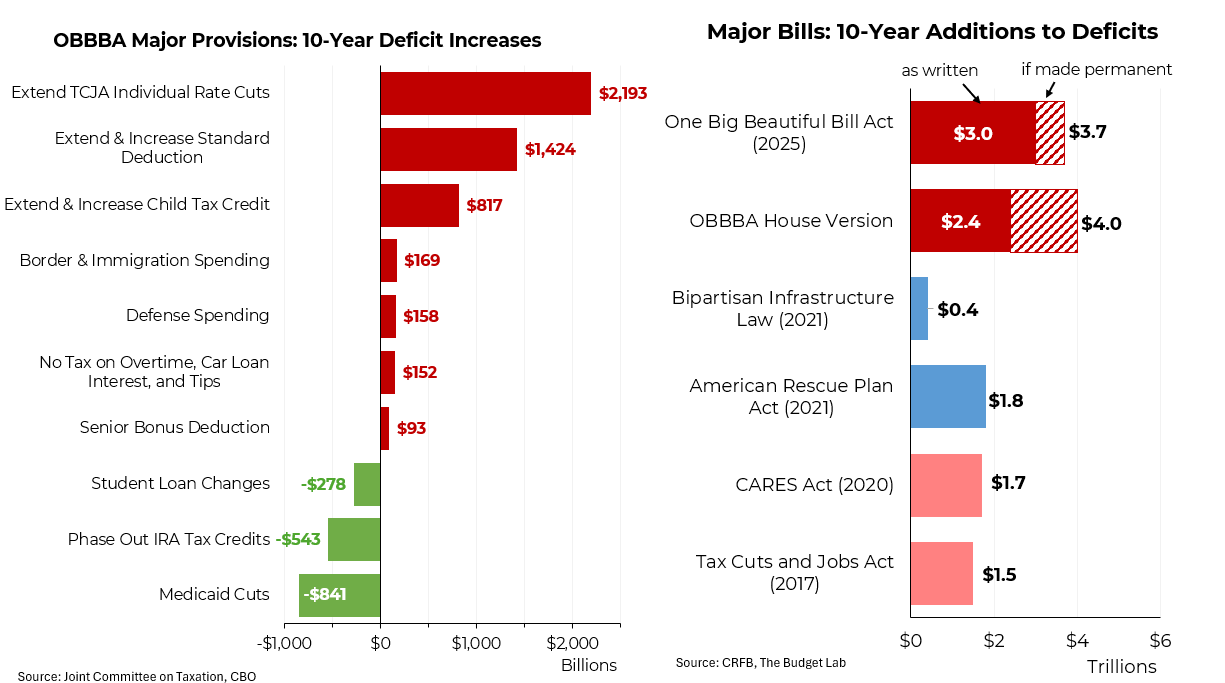

Now comes Donald Trump, essentially trying to revive that same supply-side credo (famously branded “voodoo economics” by George H. W. Bush) with his proposal for $5.5 trillion of tax giveaways, mostly for business. Even some of the outsize personalities that I encountered in 1981 are back, most notoriously the concept’s godfather, Arthur Laffer, who advised the Trump presidential campaign.

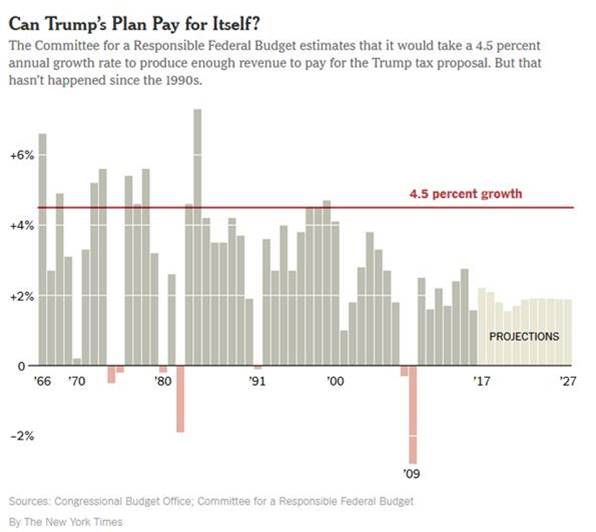

What proved a bad idea then is a worse one now. Unemployment was 7 percent and rising when President Reagan took office. Today, with unemployment at just 4.6 percent, broad-based fiscal stimulus isn’t likely to create much new employment.

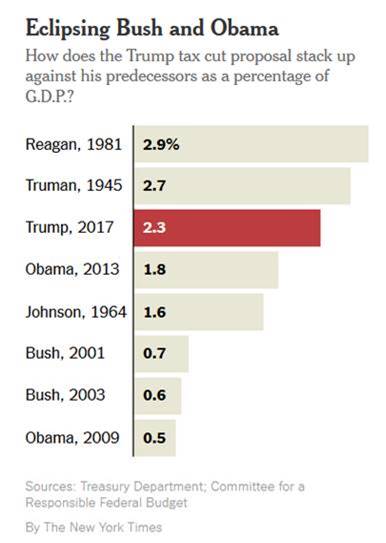

For its part, the Reagan tax cut increased the budget deficit, helping elevate interest rates over 20 percent, which in turn contributed to the double-dip recession that ensued. The stock market fell by more than 20 percent. Fiscally, the revenue loss totaled 2.9 percent of the average gross domestic product between 1981 and 1985.

But perhaps the greatest damage inflicted by the Reagan tax cuts was to our political psyche, making respectable — particularly among Republicans — the terrifying notion that high deficits resulting from tax cuts don’t matter because faster economic growth will quickly close the gap. (At the time, this idea was called supply-side economics, but it has now been rebranded with the phrase “dynamic scoring.”)

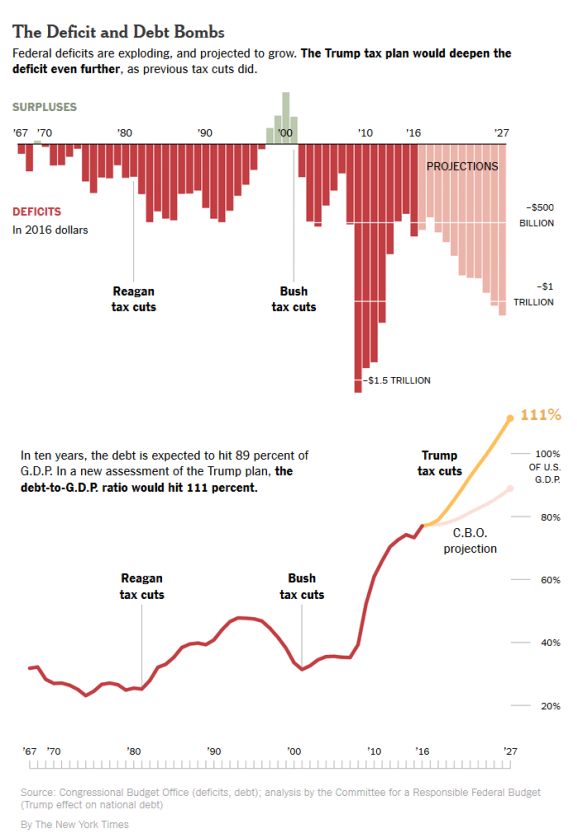

In 2002, while trying to justify another set of irresponsible tax cuts, Vice President Dick Cheney reportedly said, “Reagan proved deficits don’t matter.” By the end of George W. Bush’s tenure, the surpluses that he had inherited were squandered, and as the financial crisis raged, the deficit soared to $511 billion before peaking at $1.6 trillion in 2009 (all figures in 2016 dollars).

Deficits have left a lasting mark in the form of vast piles of national debt — $14 trillion currently, up from $712 billion when Mr. Reagan took office, an almost 20-fold increase. Big deficits can sometimes be advisable, as they were in aiding recovery from the 2009 recession. But incurred pointlessly, as Mr. Trump is proposing, large fiscal gaps simply mean more debt that will be left to our children and grandchildren to pay off.

A large deficit is another significant difference in the state of the economy compared with 36 years ago and helps explain why Mr. Trump’s business-heavy proposals are not only grossly unfair to middle-class Americans but also terrible policy.

After dropping to $444 billion in 2015, the federal deficit is again marching upward. By 2026, it is projected to be $1 trillion. In normal times, economists consider a deficit of about 3 percent of G.D.P. — where it is now — to be appropriate.

The Trump plan isn’t all bad. I understand our need to lower the corporate tax rate to compete with other countries and adjust other provisions to keep companies and jobs here. Critics are correct that our business-tax structure encourages companies to ship jobs and even themselves overseas. But in return for that concession, which would significantly benefit shareholders, we should be raising the 23.8 percent capital gains rate closer to the top rate of 39.6 percent on earned income, not lowering it.

Should Mr. Trump’s proposal become law, I’ll bet the denouement resembles that of Reagan’s: In 1982, just a year after those cuts, Congress enacted new provisions that recovered about a third of the lost revenues, and by the end of Reagan’s administration, additional tax increases raised that figure to about two-thirds.

Don’t get me wrong — we have significant economic challenges (as reflected in our anemic sub-2 percent growth rate), and thoughtful tax policy can play a positive role. We haven’t had a serious attack on loopholes, complexities and egregious deductions since 1986, and we desperately need another one.

But what we don’t need — and can’t afford — is another round of huge, unpaid-for tax reductions that saddle us with large amounts of new debt without producing the growth levels being predicted. Changing the sales slogan from “supply-side economics” to “dynamic scoring” won’t do anything to shield us from the painful consequences.