Originally appeared in The New York Times.

Phony math is a time-honored tradition in the Washington world of budget making, but the first full fiscal plan from the Trump administration breaks new ground.

The bottom line: A budget that the White House says will be in balance by 2027 would, in reality, remain deeply in red ink throughout the coming decade and ultimately add trillions of dollars to the national debt.

Of course, as John Maynard Keynes wrote, in the long run, we are all dead. But this budget will also inflict enormous short-term damage. While the administration asserts that if the government would just get out of the way, business investment and worker productivity would rise substantially, I don’t buy the argument. Indeed, the proposed enormous cuts to spending would make increasing efficiency harder, not easier.

The impact of even more staggering reductions in social welfare spending will hurt millions of needy Americans, perhaps many of the same voters who elected President Trump, as the wealthy receive a vast preponderance of the benefits from a proposed $5.5 trillion in tax reductions (none of which is accounted for in the proposal).

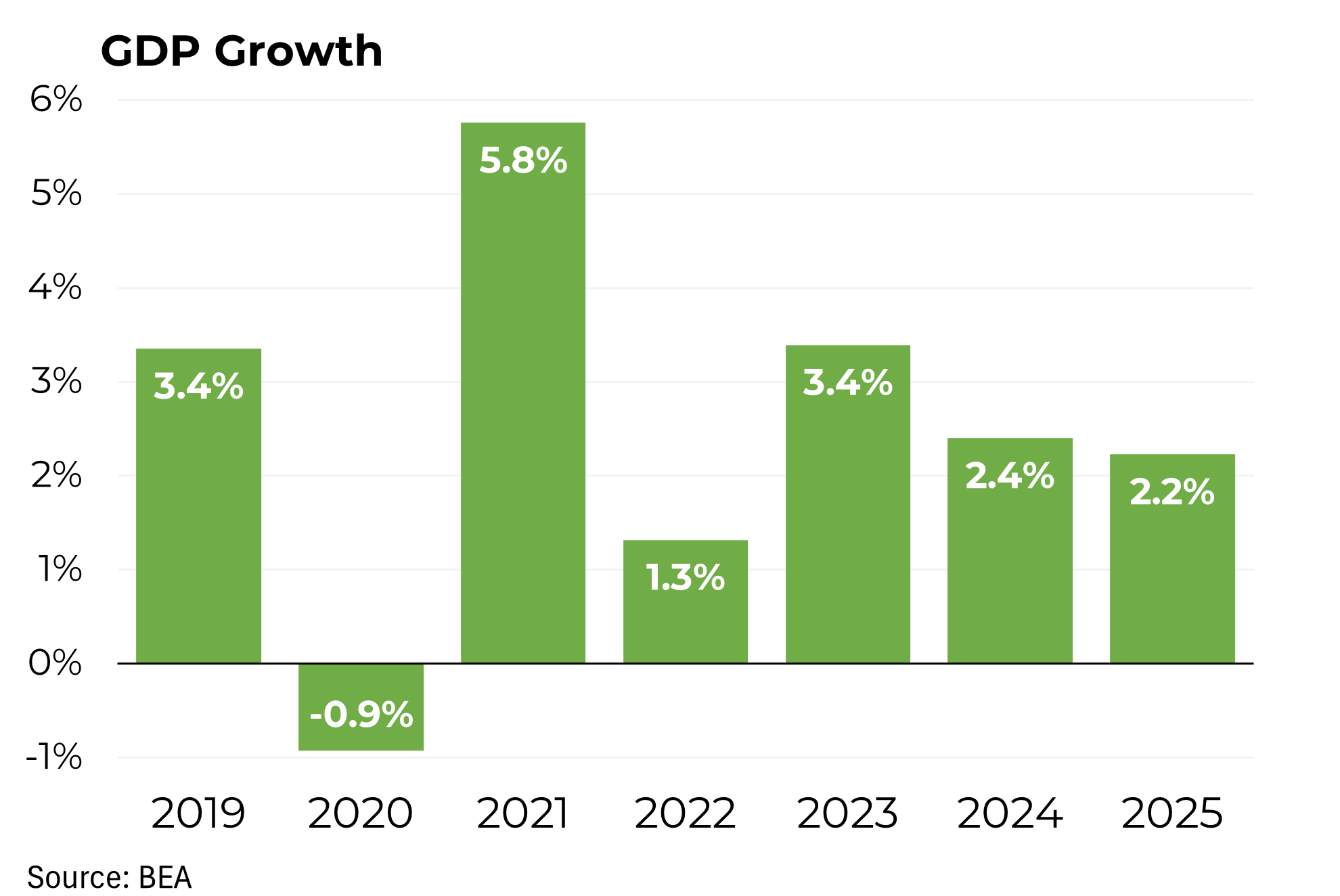

All in all, the Office of Management and Budget has bestowed upon us 62 pages of fantasy. Let’s take, for example, the White House’s insistence that the economic-growth forecast of 2.2 percent a year that the O.M.B. had been using can be turbocharged by nearly a full percentage point to 3 percent by 2021.

That indeed would be wonderful, but every mainstream economist I know says it ain’t going to happen. For example, the Congressional Budget Office, the legislative branch’s scorekeeper and — despite what you might have heard — an honest broker, projects annual growth of 1.9 percent.

The implications of falling short of the new 3 percent target are profound. At the lower 2.2 percent rate of increase, the cumulative budget deficit over the next 10 years would be $2.1 trillion higher than the $3.2 trillion that the administration projects.

We are mired in low growth because of two simple factors: smaller increases in the labor force and softening improvements in the efficiency of our workers.

Increases in the size of our labor force have slowed as our society has aged. The only sure way to reverse that trend would be to allow more — not less — immigration. But that runs up against another part of the Trump agenda.

Productivity is more mysterious; its ebbs and flows have always been hard for economists to explain. That makes developing policies to improve its performance challenging, but one thing can be said for certain: There is nothing in the Trump budget that would meaningfully improve the productivity picture and much that would cloud it.

This budget’s blatant disregard for intellectual integrity is matched by the extraordinary extent to which it seeks to slash social welfare programs, including another $616 billion out of Medicaid on top of $800 billion that would be sliced as part of the Republicans’ health care plan. That’s a 28 percent reduction to the existing Medicaid budget plan.

According to current Congressional Budget Office projections, 14 million poor Americans are already likely to lose their health care if the Republican plan becomes law. (The office is scheduled to issue new numbers later today.) This new proposal would only increase that horrific figure.

Domestic discretionary spending — on things like education and transportation — fares even worse; its allocation would be cut by 43 percent, bringing it down to nearly one-third of its 50-year average share of the economy of 3.8 percent. If we want to improve productivity, we should be allocating more, not less, money to areas like job training and education, as well to investments in research and development.

Fortunately, the cuts to discretionary spending would require 60 votes in the Senate, so the Democrats can block them. But under arcane Senate reconciliation rules, only 50 votes (plus Vice President Pence) would be needed to eviscerate Medicaid, food stamps, Temporary Assistance for Needy Families and the other social welfare programs that the Trump administration is targeting.

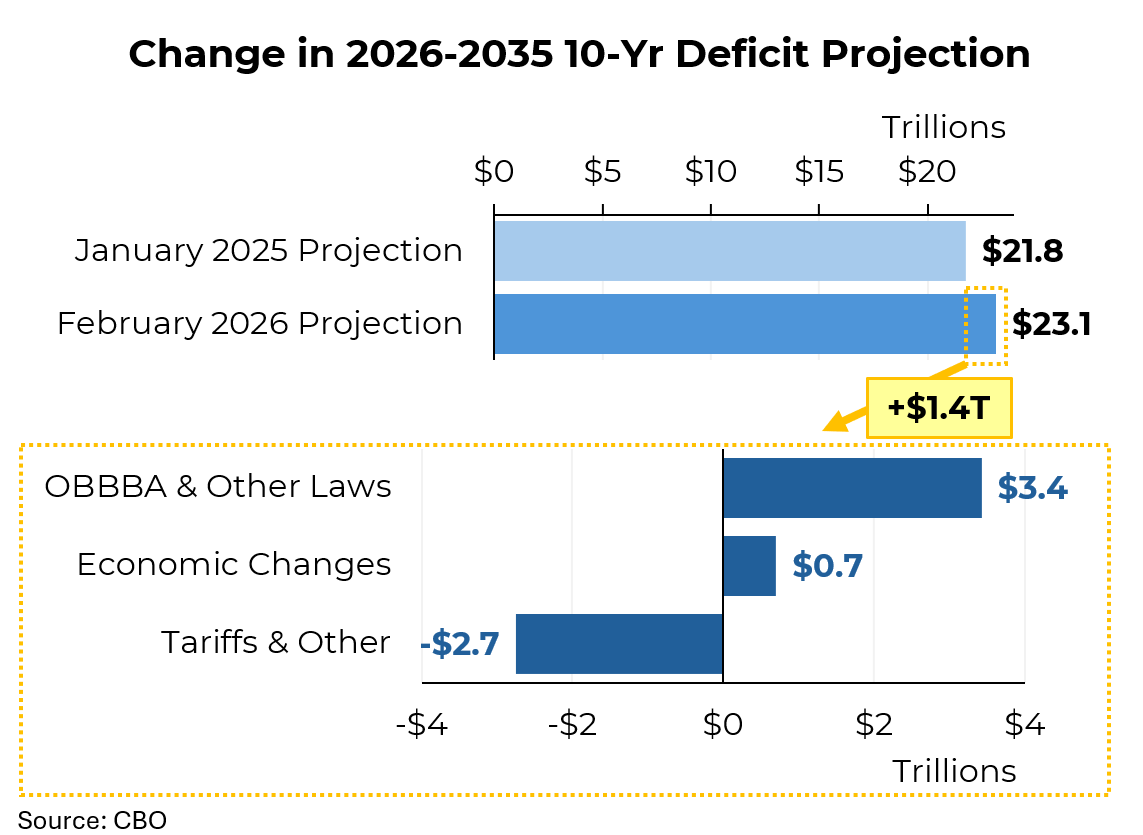

That’s also true for the president’s huge tax cuts, oh-so heavily tilted toward the rich and toward business. But remarkably, the budget office chose to simply ignore the cost of the tax proposal, which has been estimated to total $5 trillion to $6 trillion, in its new projections.

If you don’t ignore that cost, the bottom line is a budget picture remarkably different from what the White House is advertising. On top of the cumulative deficits of $3.2 trillion over the next 10 years caused by this budget, we would be shouldered with $7.6 trillion more red ink because of the tax cuts.

Measured in relation to the size of our economy, our national debt as a percentage of our economy would grow to 98 percent a decade from now — the highest in our history except during World War II — from the current 77 percent.

Elections have consequences, and the release of the first Trump budget is a glaring example. Fortunately, some Republicans have joined the Democratic chorus that has already begun pushing back. We need legislators from both parties to keep the Trump budget travesty from going any further.