Originally appeared in The New York Times.

A Republican billionaire entrepreneur runs for president on a platform of huge tax cuts for the rich and for business and yet, when his candidacy appears ascendant, the markets swoon.

When the prospects brighten for his Democratic challenger — who has not held a private sector job in more than two decades and who is proposing tax increases for the wealthy — stocks climb.

This is yet another paradox of the tumultuous candidacy of Donald J. Trump: He has spent his entire career among business executives, and yet that constituency is voting with hard cash that he should not be president.

I understand that Mr. Trump has pitched his campaign more to white working-class Americans. But no Republican presidential hopeful in memory has been so unpopular in the business community, as one of the prime thermometers of the private sector — the stock market — indicates.

At a board meeting two weeks ago, I chatted separately with two prominent Republican businessmen. One, the chief executive of a Fortune 100 company, said that he had never voted for a Democrat but couldn’t support Mr. Trump.

The other, a private equity investor who had voted Republican only once, said that he was so scared of a Trump presidency that he has donated “every cent possible” under the campaign finance rules to Hillary Clinton.

Even before the tape of Mr. Trump’s 2005 comments about women became public, many executives were appalled by his temperament and judgment. They also find his economic policy positions – from his trade-bashing to his budget-busting tax cuts – terrifying.

According to a recent compilation by The Wall Street Journal, not a single chief executive of a Fortune 100 company has donated to Mr. Trump’s campaign or endorsed him. In contrast, Hillary Clinton has received contributions from 11 of these corporate chieftains. In 2012, nearly a third of this group supported Mitt Romney, while just five donated to President Obama.

As Mrs. Clinton’s dominance of the first presidential debate became apparent, investors cheered; markets around the world rose and the dollar strengthened. A report from Macroeconomic Advisers, a St. Louis forecasting firm, estimated that a Trump victory would cause stocks to lose 7 percent, while a Clinton victory would lead to a 4 percent increase.

In a poll by Bloomberg Politics (conducted in August, before Mr. Trump’s recent rocky spell), 46 percent of those with more than $50,000 invested in the market preferred Mrs. Clinton, compared with 36 percent for Mr. Trump.

They are not alone. The National Association for Business Economics surveyed 414 members, and Mr. Trump didn’t even come in second. Mrs. Clinton was supported by 55 percent, while the Libertarian candidate, Gary Johnson, received 15 percent, and the Republican hopeful trailed at 14 percent.

Another group of economists is similarly unenthusiastic. A Wall Street Journal survey of 45 former members of the White House’s Council of Economic Advisers found not one who would endorse Mr. Trump. (Some did not respond or wouldn’t say.)

At the top of business’ fears is Mr. Trump’s stance on trade. While Mrs. Clinton has also opposed the Trans-Pacific Partnership, Mr. Trump has taken trade-bashing to a new level, threatening retaliatory moves like putting 35 percent tariffs on imports from Mexico and 45 percent on those from China.

A recent study by the nonpartisan Peterson Institute for International Economics estimated that, rather than bringing jobs back to the United States, the tariffs would result in trade wars that could cost our economy five million jobs and possibly lead to a recession.

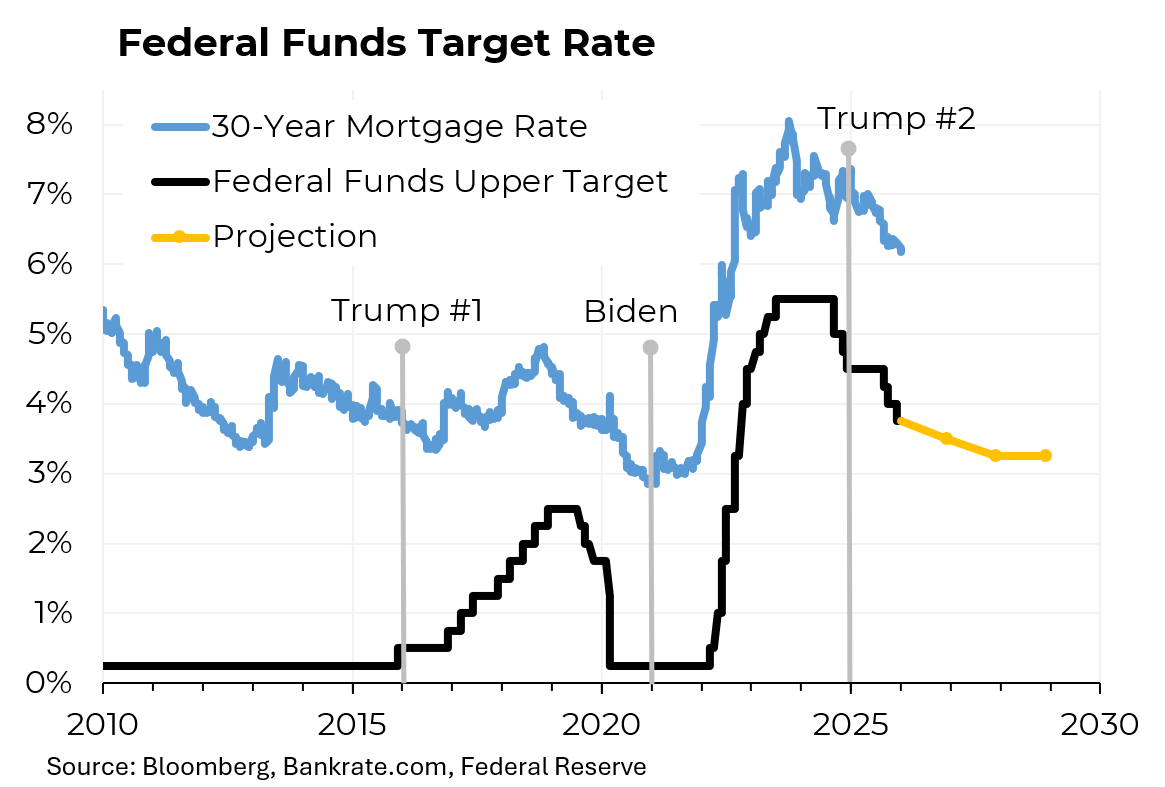

His other economic policies also often cause alarm. In repeatedly attacking the Federal Reserve as being “political,” Mr. Trump has ignored decades of almost entirely consensus decision making by the Federal Open Market Committee, which sets monetary policy. The committee is a model of rational, nonpartisan judgment compared with the Supreme Court, which often breaks along political lines.

And while businessmen surely like tax cuts — especially for themselves — they worry over the magnitude of Mr. Trump’s reductions and the lack of any specificity about how he would pay for them. According to the nonpartisan Committee for a Responsible Federal Budget, the Trump tax policies would add $5.8 trillion to the national debt over the next 10 years.

Lastly, people in business are repelled on both moral and economic grounds by Mr. Trump’s plan to deport more than 11 million illegal immigrants, which the conservative American Action Forum calculated would cost $400 billion to $600 billion, reduce gross domestic product by $1.6 trillion and take 20 years.

All told, Moody’s Analytics estimates that under Mr. Trump’s plan, unemployment would rise to nearly 7 percent, and about three million jobs would be lost.

With metronomic regularity in his stump appearances, Mr. Trump promotes his qualifications as a billionaire businessman to fix what ails our economy. But his peers in the business world don’t agree.