Sometimes true costs are hidden by backloading them.

Originally published in the New York Times.

Americans of a certain age may remember J. Wellington Wimpy, a droll character from Popeye cartoons. “I’ll gladly pay you Tuesday for a hamburger today,” Wimpy would periodically implore passers-by.

That pretty much summarizes the opaque budget math behind the two huge spending plans now before Congress, one aimed at fixing our physical infrastructure and the other targeted at everything from child care to the climate crisis.

Unlike earlier pandemic rescue efforts, Democratic leaders have promised that these new bills would not add to the country’s enormous deficits. “It is zero price tag on the debt,” President Biden said recently. “We’re going to pay for everything we spend.”

Except they won’t. Take, for example, the bipartisan infrastructure bill. When it was unveiled with great fanfare at the end of July, a group of Democratic and Republican senators proudly proclaimed that its costs would be fully offset by new revenues.

“This is paid for,” said Senator Joe Manchin, Democrat of West Virginia. “Our infrastructure bill is all paid for.”

Just a few days later, the Congressional Budget Office — the official scorekeeper — delivered its verdict: The $550 billion in new spending would, in fact, mostly add to the deficit, with just $173 billion of offsets. A separate analysis by the University of Pennsylvania’s Wharton Budget Model pegged the 10-year shortfall at $351 billion.

Then there’s dynamic scoring. Back in the Reagan administration, supply side economists tried to argue that tax cuts would so stimulate the economy that they would produce enough revenue to pay for the cuts. More recently, Republicans embraced the theory to argue that Donald Trump’s 2017 tax cuts would pay for themselves.

Many Democrats ridiculed this sort of math. But now the administration claims that the $3.5 trillion proposal will generate $600 billion of new revenue. The Committee for a Responsible Federal Budget disagrees. Indeed, the Penn Wharton model predicts dynamic losses because, it says, the plan would lower economic growth.

The package also assumes $500 billion of savings to the federal government from negotiating lower drug prices. One small problem: A number of key lawmakers have already come out in opposition.

On the expense side, legislators game the system by setting unrealistic expiration dates for an assortment of tax cuts and spending provisions. The widely popular expanded and refundable child tax credit would disappear after 2025. Only the most naïve could believe that might actually happen. The cost to continue it: $110 billion per year.

Sometimes true costs are hidden by backloading them. Among the worthy proposals in the Biden plan is to extend Medicare coverage to include dental costs. But that coverage wouldn’t begin until 2028, near the end of the 10-year budget window. So only four years of the benefit costs would count against the 10-year reconciliation calculation even though an annual expense of $60 billion would be likely to go on indefinitely.

Mr. Biden’s American Jobs Plan, now subsumed in the $3.5 trillion package, claimed to be fully paid for by counting 15 years of revenues against eight years of costs.

Interestingly, even as lawmakers proclaim their allegiance to fiscal responsibility, the resolution passed by the Senate authorizing the $3.5 trillion of new spending provides that as much as half of it could be paid for by more borrowing.

The sharp cut in the amount of new spending now being contemplated — Mr. Biden seems focused on $2 trillion — certainly makes achieving a true net-zero cost easier.

But legislators are already pushing back against some of the tax increases. Kyrsten Sinema, a moderate Democrat from Arizona, has reportedly told colleagues that she will not support raising taxes on corporations and wealthy Americans, an absurdly absolutist position. Regardless, with the Senate split 50-50, no bill is likely to pass without her support.

Don’t get me wrong. I’m heatedly in favor of many of the Democratic proposals, like the “hard infrastructure” and the climate-related provisions. However, since the pandemic began, Congress has authorized close to $6 trillion of new costs without raising any meaningful amount of revenues.

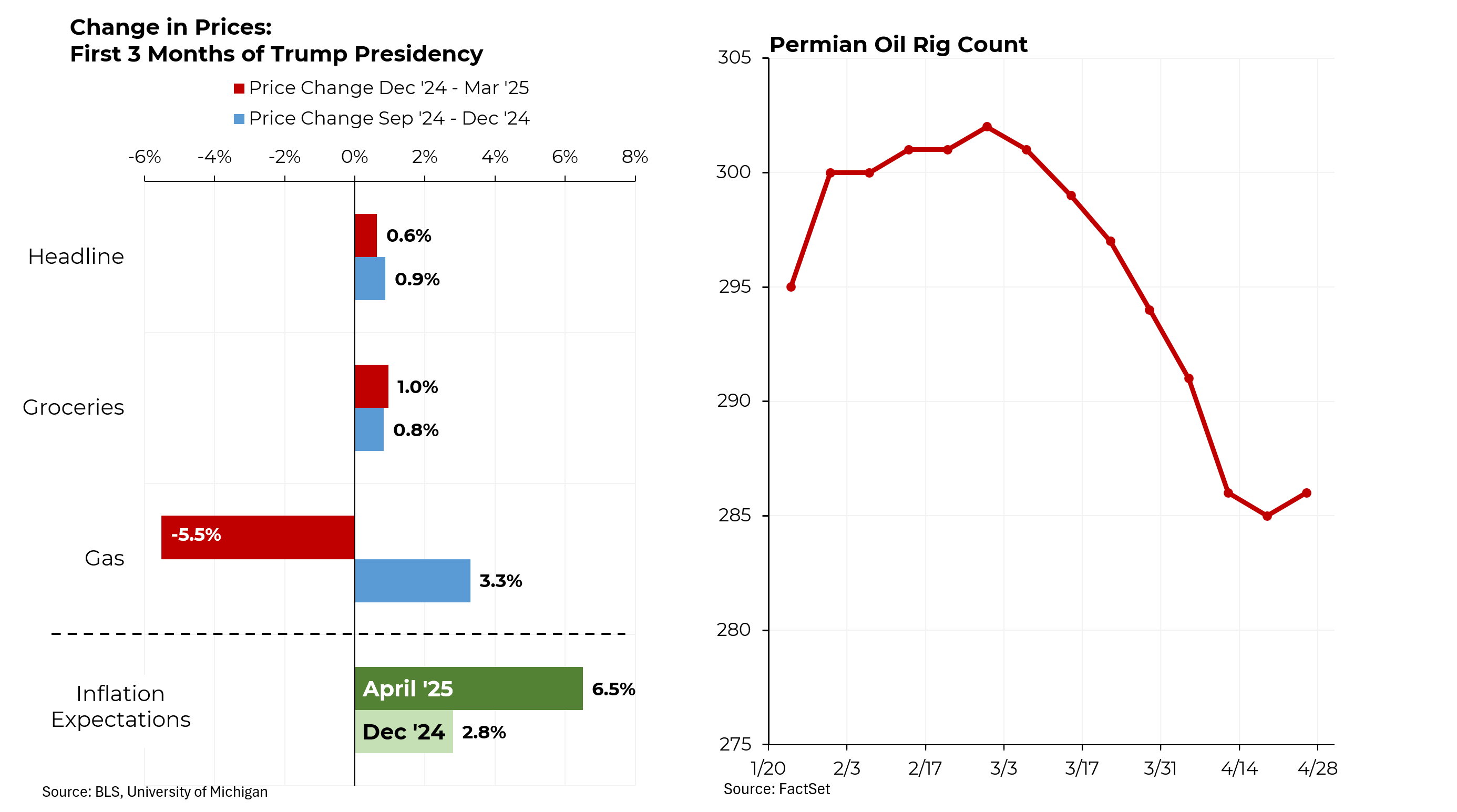

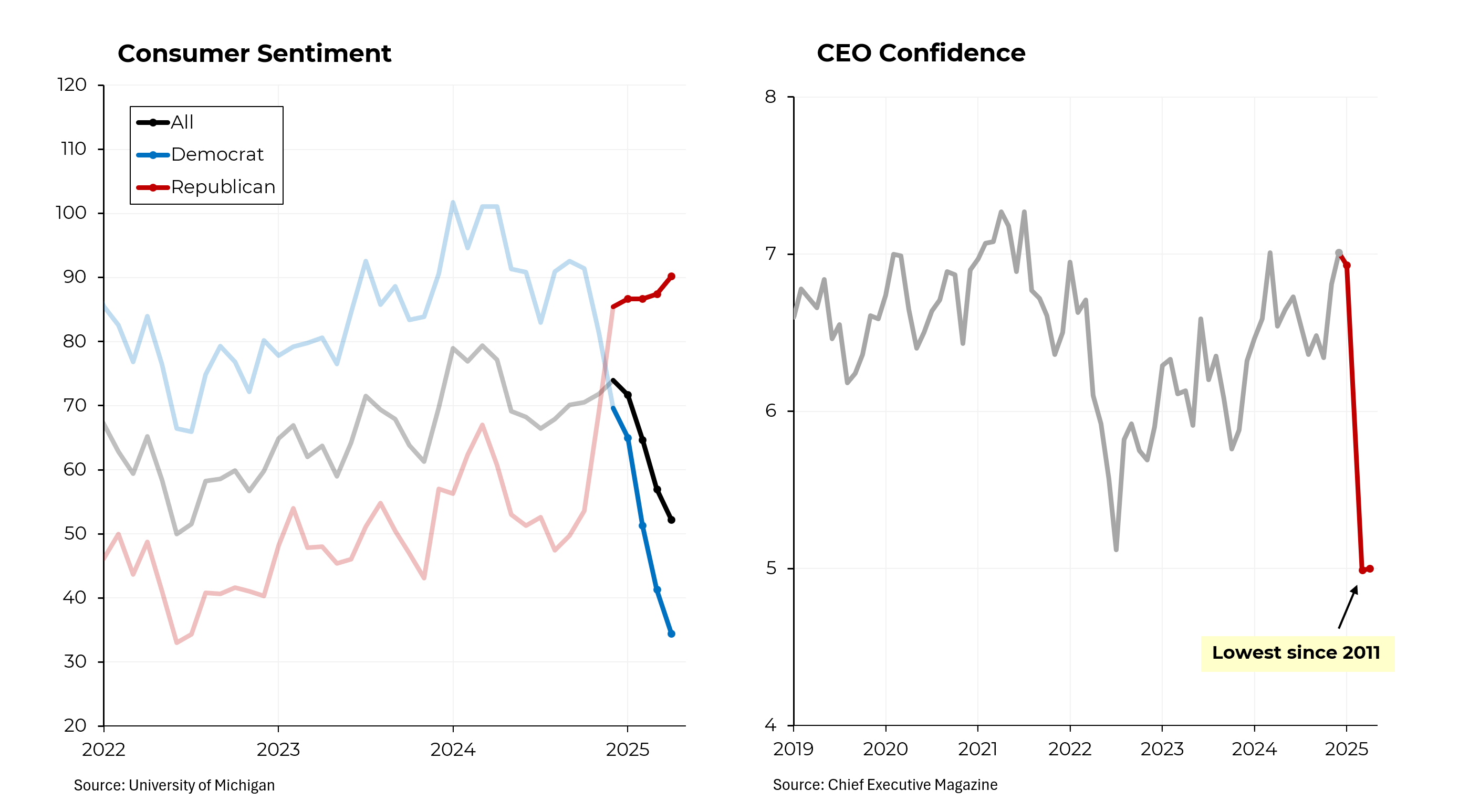

Now, with a projected deficit of $1.2 trillion in the next fiscal year (before any new initiatives) and worrisome inflation signs evident, we certainly don’t need any more stimulus.

Whatever new spending emerges from the current negotiations should be matched by tax increases or other new revenues honestly calculated to arrive in a similar time frame.

On NBC’s “Meet the Press” recently, Cedric Richmond, a senior adviser to the president, insisted that the cost of any ultimate legislation would be “zero.” The Biden administration and Congress need to be held to that promise, with honest accounting and no gimmicks. That would be a big change from what’s been going on.