Originally appeared in the The New York Times.

Hardly a day goes by without President Trump tweet-bragging about the relentless rise of the stock market to fresh record highs — Exhibit A in his mind about how he is, indeed, making America great again.

But, while strong equity markets are certainly a Good Thing, let’s not forget that, like so many effects of Mr. Trump’s policies, those higher share prices are propelled upward in considerable measure by the new president’s pro-business policies and benefit the wealthy far more than the average American.

The unsurprising reality is that the rich are far more likely to hold stocks, and when they do, they own them in much larger chunks than their less-well-off brethren.

The percentage of Americans who hold any stocks at all has declined to just over half of all Americans, while only 28 percent of families with below-median incomes hold any shares (including in retirement accounts). Moreover, while middle-class Americans typically own just $15,000 in equities, the top 10 percent have amassed median holdings of $365,000.

To be sure, rising stock markets help many Americans in other ways. Perhaps most importantly, they secure pension benefits for those fortunate enough to participate in corporate or municipal plans.

However, the percentage of workers covered by these programs has been declining, from 62 percent in 1983 to 17 percent in 2016. Only about 22 percent of Americans below the median even have an individual retirement account.

Mr. Trump also claims — in a tweet, of course — that rising equity prices are also creating “present and future Jobs, Jobs, Jobs.”

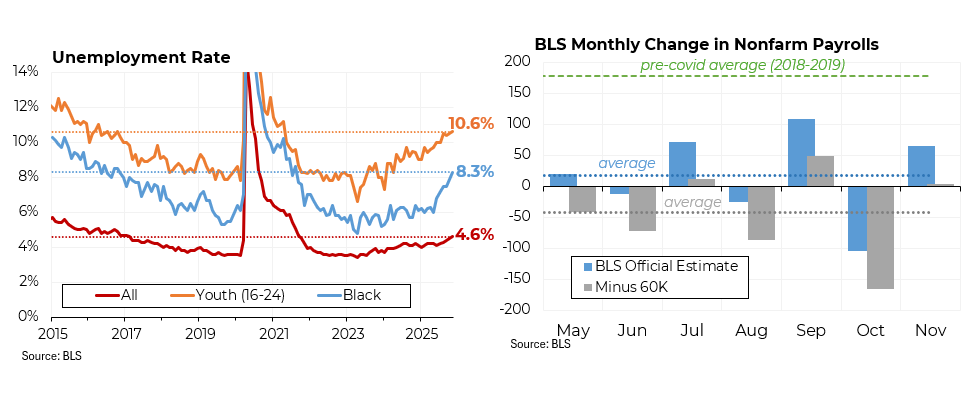

While we can speculate about the future, for the moment, anyway, job growth has been slower under the new president than it was under President Obama. In 2017, the economy added a total of 2,055,000 jobs, the lowest number since 2010.

Meanwhile, Mr. Trump omitted to mention any effect that the rising stock market has had on incomes — perhaps because there hasn’t been a discernible one.

From when he took office through the end of November, average hourly wages rose by just 0.6 percent, after adjusting for inflation. Even before taking account of higher prices, earnings were up by only 2.3 percent last year post-inauguration, a fraction of the 17.3 percent gain in share prices during the same time period.

Similarly, last year’s 4 percent increase in house prices — while satisfying — is only a fraction of the jump in stocks.

While Mr. Trump would be hard-pressed to show much benefit for his base from soaring equities, I’m prepared to give him at least partial credit for higher stock prices.

That’s because his administration is engaged in a giveaway to corporate America. Yes, we needed to reform our business tax code to compete with countries like Britain, which lowered its corporate tax rate to 19 percent in 2017 from 30 percent in 2007. But the estimated benefit of $600 billion will go straight to the bottom line of corporate America, and anticipation of this has clearly fueled share prices.

Meanwhile, the Trump administration has declared open season on regulations that the business community says are impediments to growth (meaning profitability).

So, for example, the National Labor Relations Board — fresh with two new Trump appointees — has begun reversing major Obama-era rules that favored workers and organized labor, while the Interior Department just rescinded an Obama rule limiting hydraulic fracking in oil and gas fields.

I’m appalled that so much of the good work of the Obama administration is being unwound. Investors see it differently: Every regulation that is emasculated or eliminated produces more profit potential for the companies that were subject to the regulation.

Nonetheless, even with that tail wind, the jump in our market only roughly parallels global market indexes and pales in comparison with last year’s results in Japan and emerging markets like China.

Remarkably, in 2017, the world achieved its highest growth rate — 3 percent — since 2011, and economists believe the world is on track for another strong year in 2018.

It’s hard to imagine that even Mr. Trump would claim credit for Europe’s tantalizing break out of its decade of malaise or for the renewed optimism that China, India and other major developing countries will continue their rapid growth.

Yet, Mr. Trump’s braggadocio is so unabashed that one shouldn’t be surprised to see a tweet contending that China should thank him for its roaring economy.