It’s not time yet to be raising interest rates. But let’s at least stop pouring $120 billion a month into the financial markets.

Originally published in the New York Times.

On Wednesday the Federal Reserve tiptoed ever so slightly toward reducing its efforts to pump liquidity into the financial system. It did so through brief references that might best be characterized as beginning to talk about talking about tapering its vast bond purchases that stimulate the economy.

Yes, the coronavirus has reared its ugly head again. But in the meantime, the government just announced that economic output grew at an annualized rate of 6.5 percent in the second quarter of this year, housing prices are soaring, a robust 850,000 jobs were added in June, and American consumers, overall, are emerging from lockdown with trillions in savings to spend on things such as vacations, home improvements and new cars. Meanwhile, the Fed not only has been keeping short-term interest rates near zero but also is buying at least $120 billion a month of debt securities; this has the effect of suppressing long-term interest rates.

All of that winds up shoveling more money into an economy that likely already suffers from too much money, not too little, raising the specter of overheating and accelerating inflation. The Fed’s stance toward housing is particularly inexplicable. Of that monthly $120 billion, the Fed is purchasing $40 billion of mortgage securities, even with house prices escalating.

That helps push down mortgage rates. This, in turn, makes purchasing a house more affordable (good) but also pushes home values up, making it tough for buyers (bad). The central bank doesn’t believe the spike in home prices should be principally blamed on the Fed, as its chairman, Jerome Powell, argued in congressional testimony recently.

As for its broader efforts to counter the pandemic-related downturn, the Fed has embraced today’s Washington mantra that we moved too slowly and did too little to combat the 2008 recession, so it is better to err in the other direction this time around. But the Fed is also trying to avoid repeating history. In 2013, as we were emerging from the global financial crisis, the central bank began to debate reducing its bond-buying program, known as quantitative easing.

Mr. Powell was a Federal Reserve governor at the time and an early advocate of trimming the purchases. At a congressional hearing that May, the chairman at the time, Ben Bernanke mentioned the possibility of tapering. Bond and mortgage yields promptly shot up, stock prices fell, and in the ensuing months, financial conditions tightened.

With 2013 still fresh in Fed officials’ minds, the central bank has been cautious to a fault about stepping out of the bond market. Wednesday’s statement merely said the central bank “will continue to assess progress in coming meetings.”

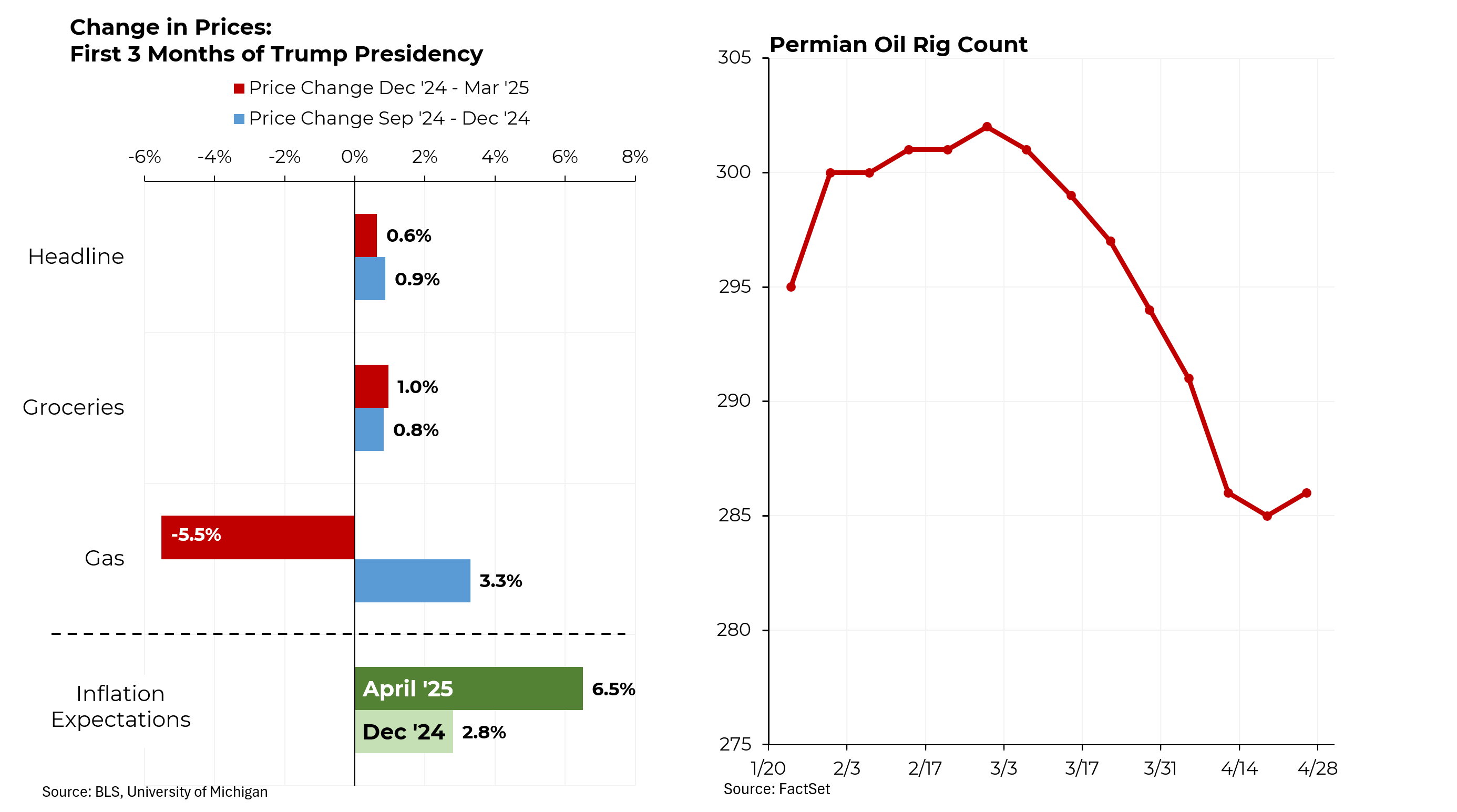

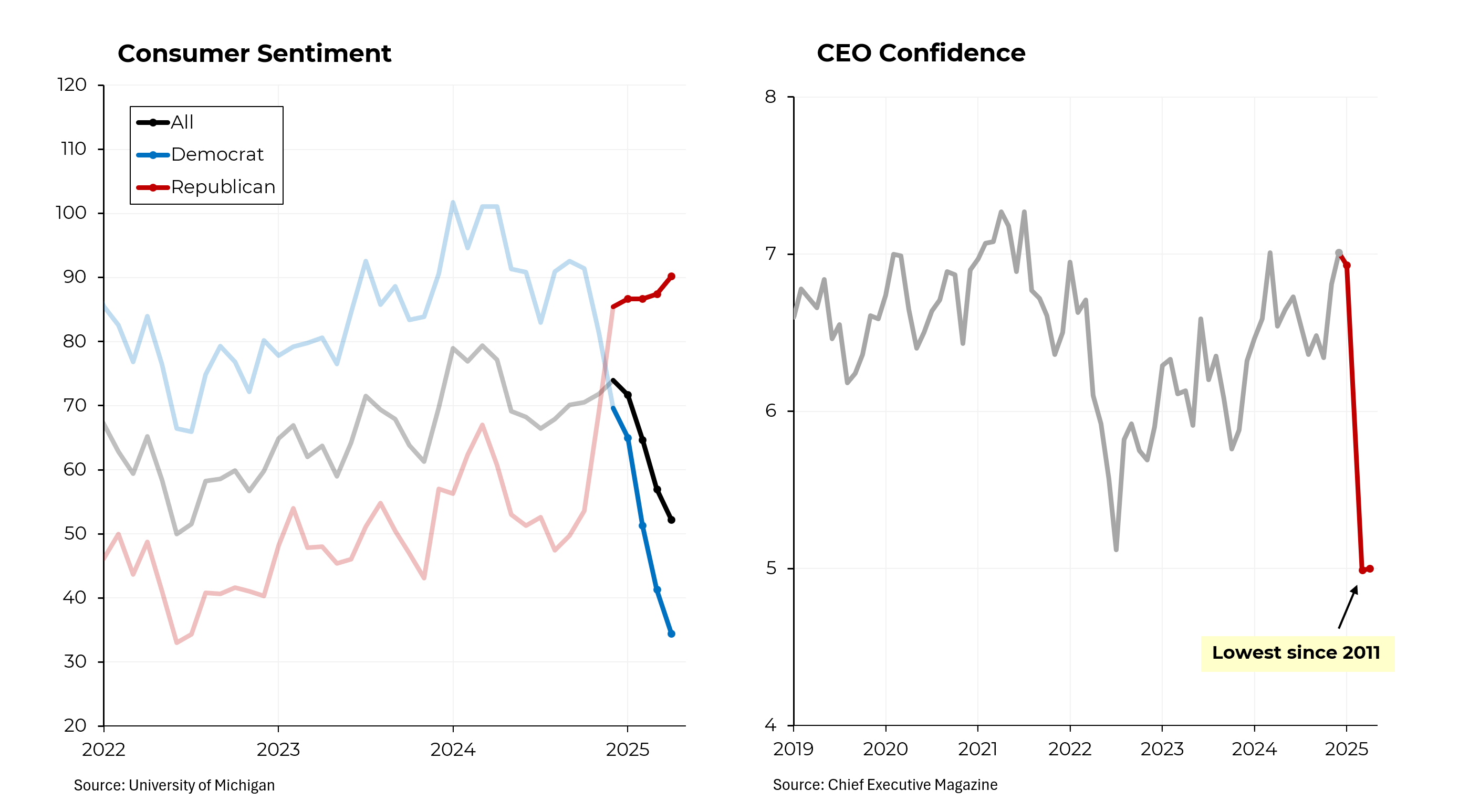

But the Fed should stop with the anodyne statements and do something. The latest inflation reports have been worse than expected. And a recent consumer survey showed that Americans expect showed that from May to June, Americans’ expectations for the annual inflation rate jumped 0.8 percentage points, to 4.8 percent. Across the economy, a record nine million jobs are available. Shortages of both raw materials and finished goods are popping up with worrisome frequency. Amid all this, a bipartisan group in Congress is working away on even more spending directed toward infrastructure. (And House Democrats are working on even more social spending.)

It’s not time yet to raise interest rates. But let’s at least stop pouring $120 billion a month into the financial markets. By shoveling more money into the system, this quantitative easing encourages more risk taking. For example, yields on high yield debt (known as junk bonds) are at record lows.

For now, the bond market — the ultimate distillation of investor sentiments — has a different view. It suggests that average annual inflation over the next decade will be 2.4 percent, modestly above the Fed’s target of 2 percent. I’m not so sure: Inflation isn’t likely to accelerate into the double digits, as it did four decades ago. But even a sustained rise above the Fed’s long-term target of a 2 percent average could force the central bank to raise interest rates, which would slow the economy and put downward pressure on financial markets. (A version of that occurred in 1994.) Doubtless, Mr. Powell, whose term as Fed chairman expires in February, doesn’t want that, either.

But we need to return to a more normal monetary policy. While I’m always hesitant to predict financial markets, I think investors would accept more restrained policies from the Fed with relative calm.

Mr. Powell, for now, appears unwilling to take that chance. As he said at his news conference Wednesday, “I’ve given you what I can give you.”