Originally appeared in the The New York Times.

In my career, I have been a substantial beneficiary of the so-called “carried interest” loophole, the tax provision that provides an indefensibly lower tax rate on profits earned by private equity investors, hedge fund operators, real estate developers (presumably including President Trump) and the like.

And I continue to be.

But it is an outrageously unfair provision and, incredibly, in a bill being advertised as major tax reform, it survives.

On Morning Joe Friday, the chairman of the House Freedom Caucus, Representative Mark Meadows, insisted that the provision would be added later, as the bill moves through Congress. If that’s true, why wasn’t it in a 429-page bill that includes many trivial provisions, like imposing a small tax on large university endowments?

For his part, the next guest, the chairman of the House Ways and Means Committee, Representative Kevin Brady, claimed that doubling the one year holding period for investments by users of the loophole would restore fairness. At least that’s what Mr. Brady said. But after scouring the bill, I could find no provision that remotely resembled what he said.

Even if his statement was true, it wouldn’t negate much of the advantage of the carried interest provision. Private equity investors, real estate developers and even hedge fund managers typically hold their investments for well over two years. That means they would still get the benefit of paying 23.8 percent on this income while high-income Americans earning over $1 million per year would still pay 39.6 percent.

Yes, the bill contains some other provisions that might impinge on private equity’s freedom to make money, particularly the 30 percent limit on interest expense (as a percentage of earnings.) But the proposal allows any excess interest to be carried forward for five years and used to reduced gains on the sale of the investment. That makes it a small inconvenience for private equity and real estate guys.

So it looks like I am going to continue to pay 23.8 percent on a substantial component of my seven-figure income, roughly the same rate on that portion as will be paid by someone making $90,000 per year.

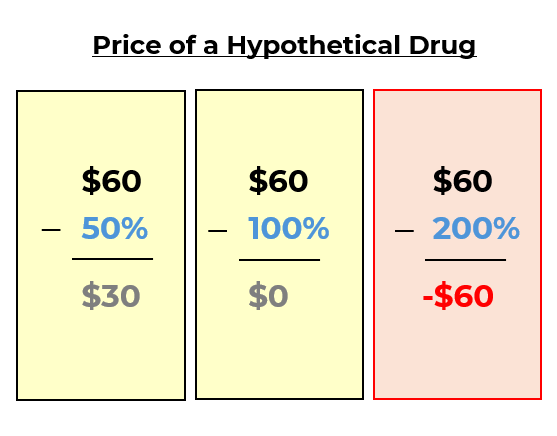

The Republicans have done a fantastic job in obscuring the impact of their bill on regular people — including the fact that a family of five will be worse off with the doubling of the standard deduction than they were before, when they could claim exemptions for their children.

We know that the Republicans have fashioned a tax bill designed to help businesses and wealthy individuals. Smaller provisions buried deep in the bill — like the treatment of carried interest — simply provide more depressing evidence that this measure is not about helping the middle class.