Originally published in the Financial Times

On the face of it, this is good news for the little man. The most closely watched initial public offering in years – that of social media group Facebook – will reportedly include a dollop of shares earmarked for small investors.

Here is my advice: do not buy any. Facebook is an extraordinary company and its shares could easily march upward but its IPO is a timely reminder that amateurs should not be picking stocks (or even money managers such as mutual funds).

The temptation to plunge into Facebook is understandable. It is a familiar and sexy company with soaring revenues and a stranglehold on its market. Google, the last supersized Silicon Valley darling to go public, has worked out well: its shares have increased more than sevenfold since their launch in 2004.

But for every Google or Facebook, several more lie in the dustbin of Wall Street history. One-time go-go stocks such as Pets.com, Webvan and eToys are all just painful memories for those who took the plunge.

Indeed, when an early social media company, TheGlobe.com, went public in 1998, its shares enjoyed the largest first-day gain in history up to that point, before collapsing the next year. (It ceased operations in 2008.)

Poor investor returns have not been limited to Silicon Valley progeny. Notwithstanding their more durable business models, private equity firms have failed to reward buyers of their IPOs. Shares of Blackstone Group, which went public in 2007 at $31 per share, enjoyed a brief run-up, plummeted during the financial crisis and are now parked at about $13. Fortress, Och-Ziff and others have performed similarly.

The fascination of individuals with trying to manage their own money is peculiar. No sentient person would perform their own appendectomy or write their own will.

Yet millions blithely buy hot new offerings, hand over savings to underperforming mutual funds, trust inexpert stockbrokers in search of commissions, try to time market movements by shifting money in and out of shares and even day trade, more often than not with poor results.

The temptation to speculate – and that is what it is when practised by amateurs – has been fuelled by the profusion of magazines, books and television shows offering ideas of what to buy, but rarely when to sell.

Remember that in the US, peddlers of investment products are generally not subject to what is known as the “fiduciary standard of care”, meaning that, unlike doctors and lawyers, they are glorified salesmen, not professionals obligated to recommend only what is in the best interests of their clients.

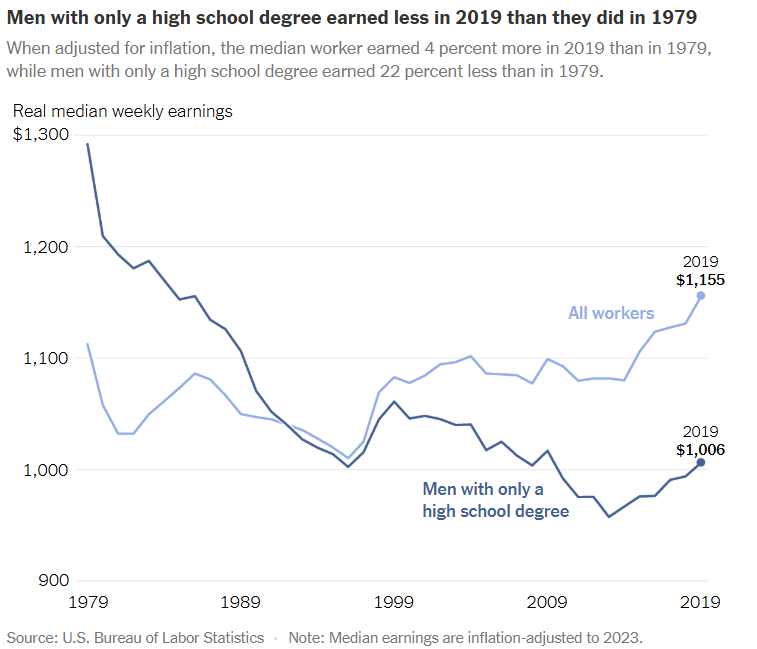

Just last month, the research firm Dalbar published a study that found that the average American equity fund investor achieved returns over the past 20 years that were less than half of the overall market gains (3.5 per cent versus 7.8 per cent).

Some of that underperformance results from the propensity of individuals to market time. That is an approach that has worked poorly, particularly in the wake of sharp market declines. In early 2009, individuals moved massive amounts out of equities, just as the stock market was hitting bottom.

Of course, the law of averages dictates that for every underperforming mutual fund or individual, another investor must be doing well. Many are, but they are principally hedge funds and institutional firms that cannot be accessed by the average investor.

With small investors frustrated with their mutual funds and perhaps even with following famous money managers such as Warren Buffett, it is easy to understand the temptation to do it yourself, particularly with the increasing role of self-directed retirement plans. But that is one temptation that should be resisted.

Instead, put your money in low-cost index funds and leave it there. For those furthest from retirement, emphasising equities offers the best bet; over any reasonably long period, history and finance theory teach us that they will almost certainly outperform bonds and cash.

Once the golden years draw closer, moving money into less volatile fixed income and money market funds will provide certainty.

As for Facebook, buy it as you would any collectable – for the joy of owning it or for an ornate stock certificate to put on your wall – but do not buy it because you are counting on it to fund your retirement.