Congress gets an A+ for speed but a B- for quality.

Originally published in a New York Times Op-Ed

The next round of economic stimulus has now emerged from Congress’s sausage factory, with more rescue efforts inevitably to follow.

Hats off to Congress for moving quickly, particularly in passing the gargantuan $2.2 trillion package late last month. But even amid a crumbling economy, we need more attention to the details — less rough justice and fewer special-interest pleadings — and more effective administration.

Most prominent have been the flaws in the wildly underfunded Payroll Protection Program, which has left many small businesses without help. Even the $320 billion added this week won’t be nearly enough; an additional $400 billion or more is likely to be needed.

The underfunding and a poor rollout led to businesses in some of the least affected states receiving a disproportionately large share of the funds compared with harder-hit states like New York.

Meanwhile, loopholes in the legislation are allowing millions of dollars in aid from the program to flow to undeserving public companies and others with deep-pocketed shareholders. Huge restaurant groups and hotels managed by large chains also qualify, as long as individual locations employ fewer than 500 workers.

That’s just one of the myriad problems. Large sums were appropriated for relieving overburdened hospitals ($100 billion) and strapped state and local governments ($150 billion). But the money for states and localities was divided up on a per-capita basis, and the initial $30 billion of aid for hospitals was allocated based on Medicare reimbursements, both in lieu of directing the funds to where the virus has hit hardest.

That makes no sense.

Then there are the airlines. Having led the automobile industry rescue task force under President Barack Obama, I can understand the need for government help to keep planes flying. But I can’t understand why the airlines have been allocated an initial $25 billion of grants and loans (mostly the former) and another $25 billion in loans still to be negotiated to accomplish this.

Yes, the money will require recipients to keep paying their employees. But that’s special treatment too. Other large companies are not being given money to pay workers, even those as hard hit as airlines.

At the least, the gifts should have been loans, with the government also receiving a substantial amount of equity. (The Treasury will receive a relatively small ownership position as part of the loans that have been negotiated.)

At the same time, the legislation imposed an ill-advised requirement that airlines maintain their route structures, regardless of passenger demand.

Let’s be sure not to forget Washington’s attraction to petty graft, like the reopening of some of the few tax loopholes that were closed in 2017.

Recently, for example, the Congressional Budget Office found that three tax provisions easing limitations on how business losses may be utilized will cost an estimated $154 billion of revenue in this year alone.

About 82 percent of that will go to 43,000 Americans earning more than $1 million annually, many of them hedge fund managers and real estate moguls. (Isn’t President Trump one of those?)

Then there’s the $25 million for the John F. Kennedy Center for the Performing Arts, the only such cultural institution specified to be a named recipient. Washington likes to take care of its own.

Some of the goodies had little to do with the current crisis: help for manufacturers of “innovative” sunscreen technology, a six-month extension of abstinence-only education and a faster approval process for over-the-counter drugs. Legislators should be forced to put their names on these unrelated special-interest provisions, as they were required to do for a time on appropriations “earmarks.”

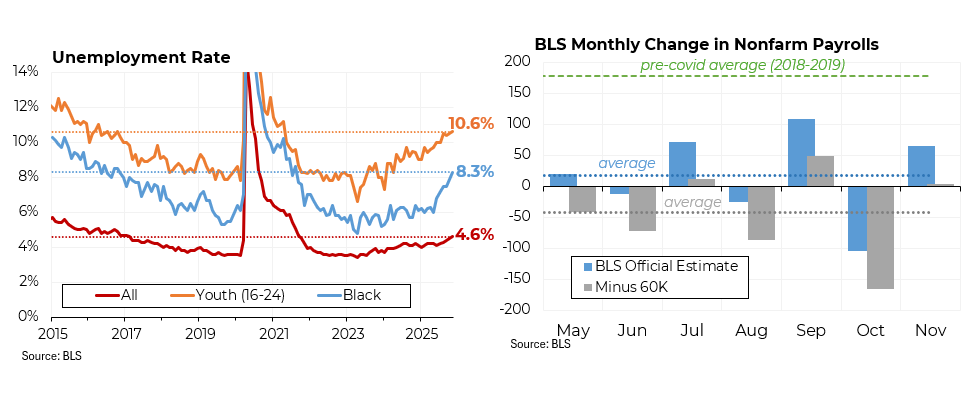

As for individuals, the addition from the Treasury of $600 per week for up to four months to unemployment checks was an unusually generous gesture for the average worker. But perhaps too generous for some.

Combined with state payments, an unemployed worker will receive close to $1,000 per week, or $50,000 per year, more than median earnings in 36 states. That may slow some lower-paid unemployed from returning to work until the program ends on July 31 (if not extended).

More rescue programs are inevitable. For example, the small-business Payroll Protection Program is still too small and covers only eight weeks of payroll, a far shorter time period than the likely period of high unemployment.

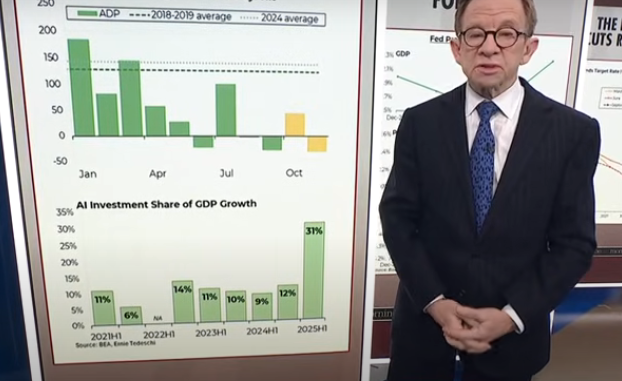

In addition, with the economy in deep recession, longer-term initiatives, like the long-awaited infrastructure program, are needed to reduce high unemployment and restore economic growth.

Congress and the administration need to do a better job with both design and administration.