Originally appeared in The New York Times.

THE Democrats’ drubbing in the midterm elections was unfortunate on many levels, but particularly because the prospect of addressing income inequality grows dimmer, even as the problem worsens.

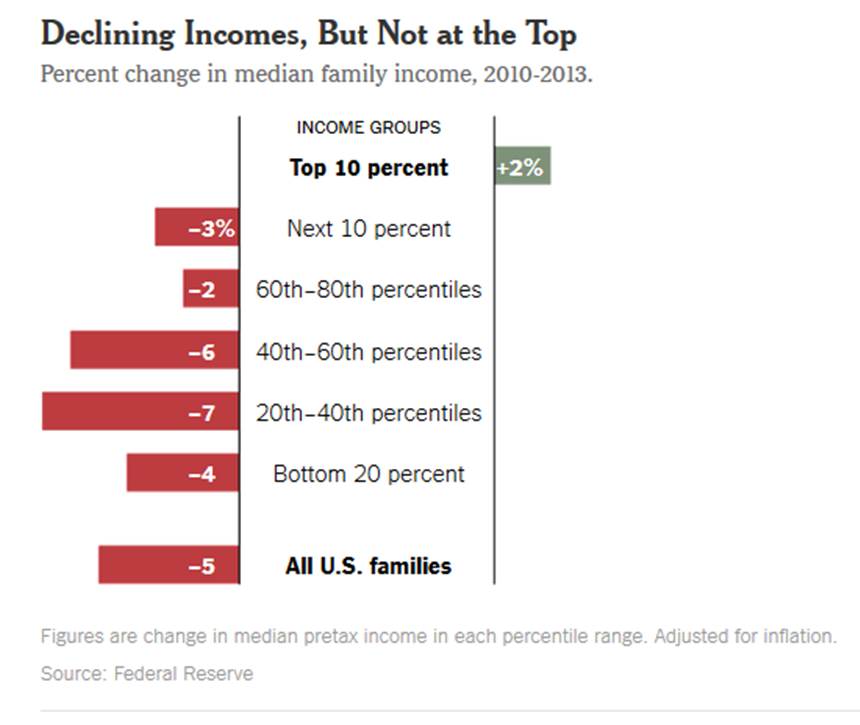

To only modest notice, during the campaign the Federal Reserve put forth more sobering news about income inequality: Inflation-adjusted earnings of the bottom 90 percent of Americans fell between 2010 and 2013, with those near the bottom dropping the most. Meanwhile, incomes in the top decile rose.

Perhaps income disparity resonated so little with politicians because we are inured to a new Gilded Age.

But we shouldn’t be. Nor should we be inattentive to the often ignored role that government plays in determining income distribution in each country.

Here’s what’s rarely reported:

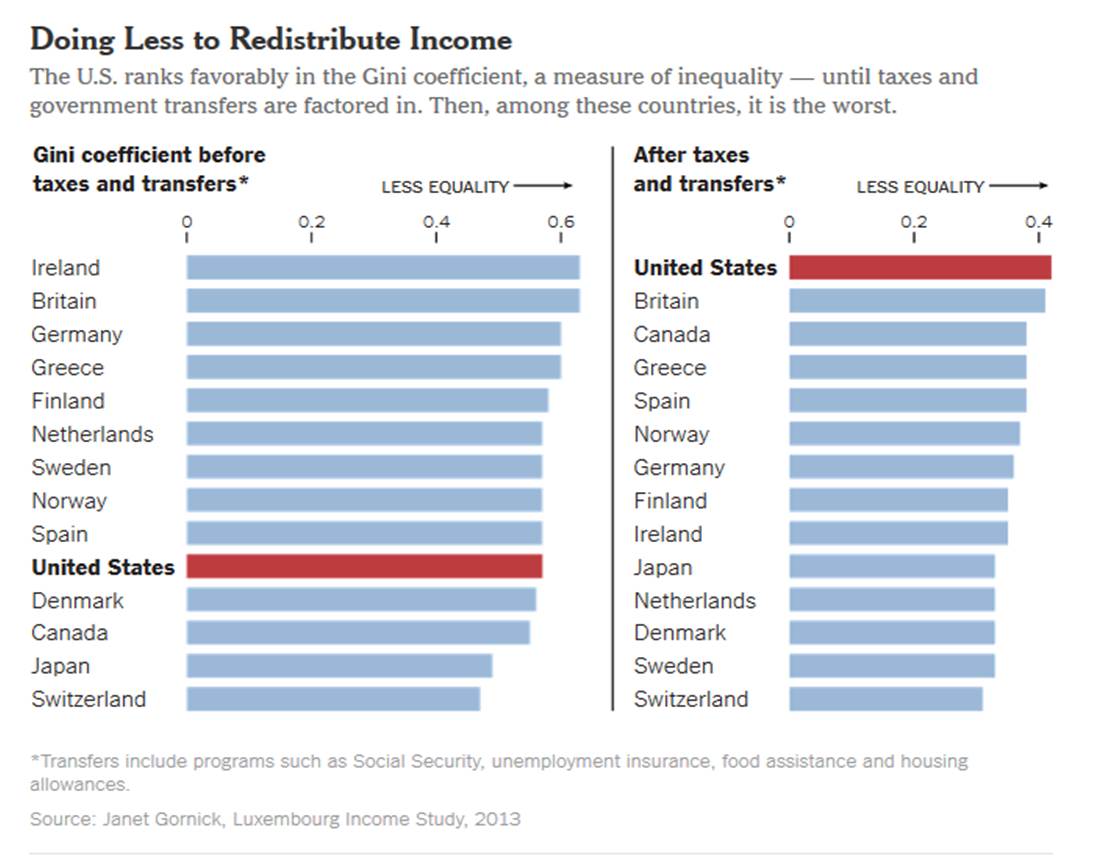

Before the impact of tax and spending policies is taken into account, income inequality in the United States is no worse than in most developed countries and is even a bit below levels in Britain and, by some measures, Germany.

However, once the effect of government programs is included in the calculations, the United States emerges on top of the inequality heap.

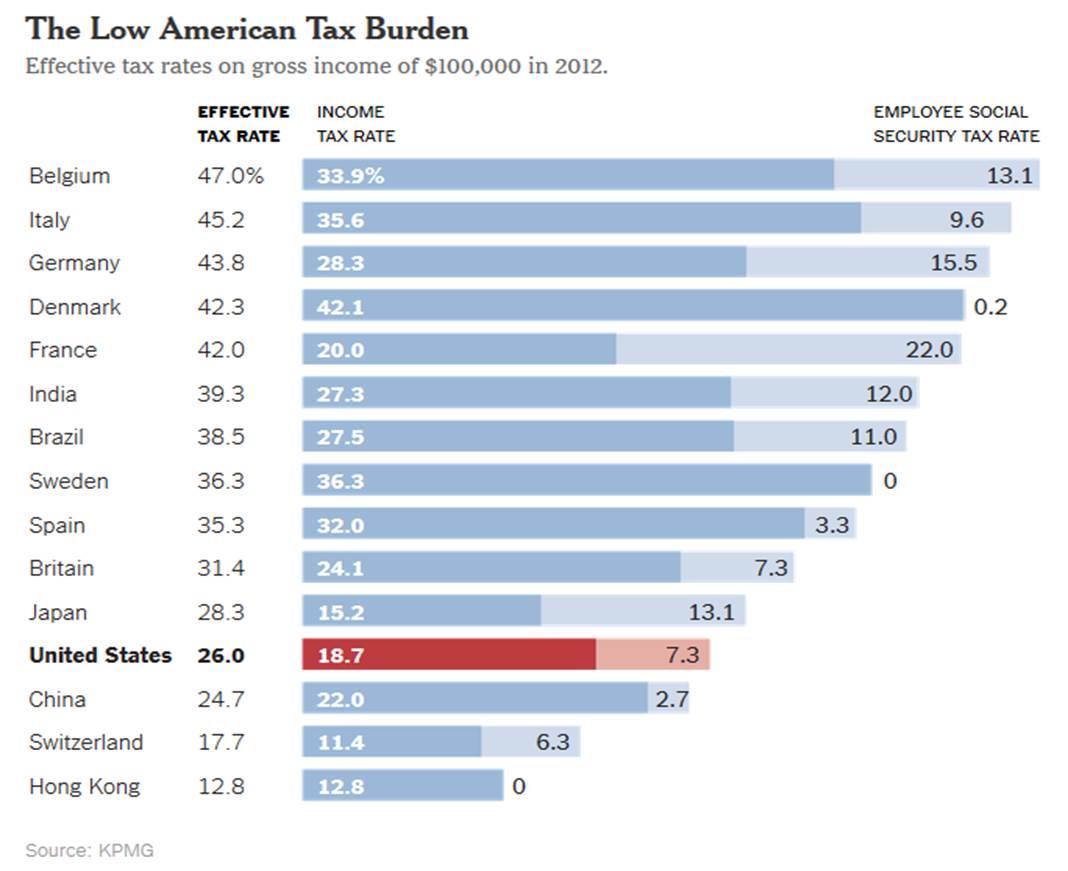

That’s because our taxes, while progressive, are low by international standards and our social welfare programs — ranging from unemployment benefits to disability insurance to retirement payments — are consequently less generous.

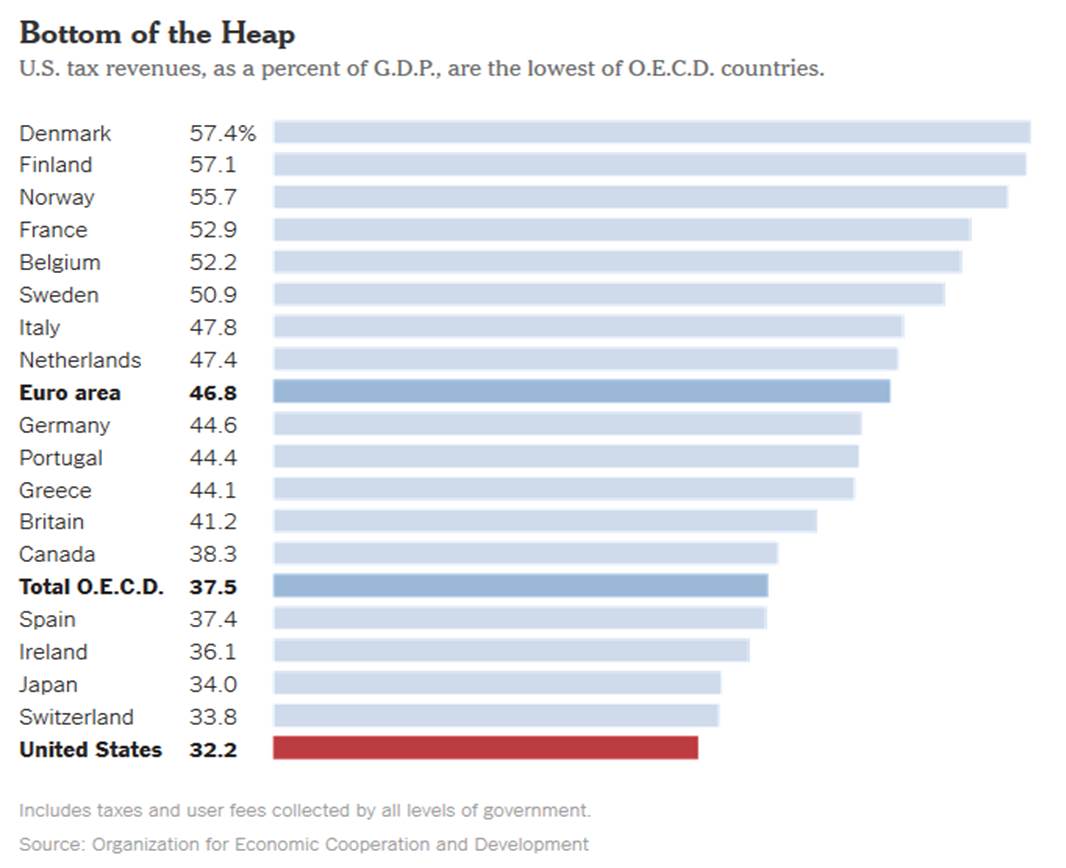

Conservatives may bemoan the size of our government; in reality, according to the Organization for Economic Cooperation and Development, total tax revenues in the United States this year will be smaller on a relative basis than those of any other member country.

And income taxes for the highest-earning Americans have fallen sharply, contributing meaningfully to the income inequality problem. In 1995, the 400 taxpayers with the biggest incomes paid an average of 30 percent in taxes; by 2009, the tax rate of those Americans had dropped to 20 percent.

Lower taxes means less for government to spend on programs to help those near the bottom. Social Security typically provides a retiree with about half of his working income; European countries often replace two-thirds of earnings.

Similarly, we spend less on early childhood education and care. And another big difference, of course, is the presence of national health insurance in most European countries.

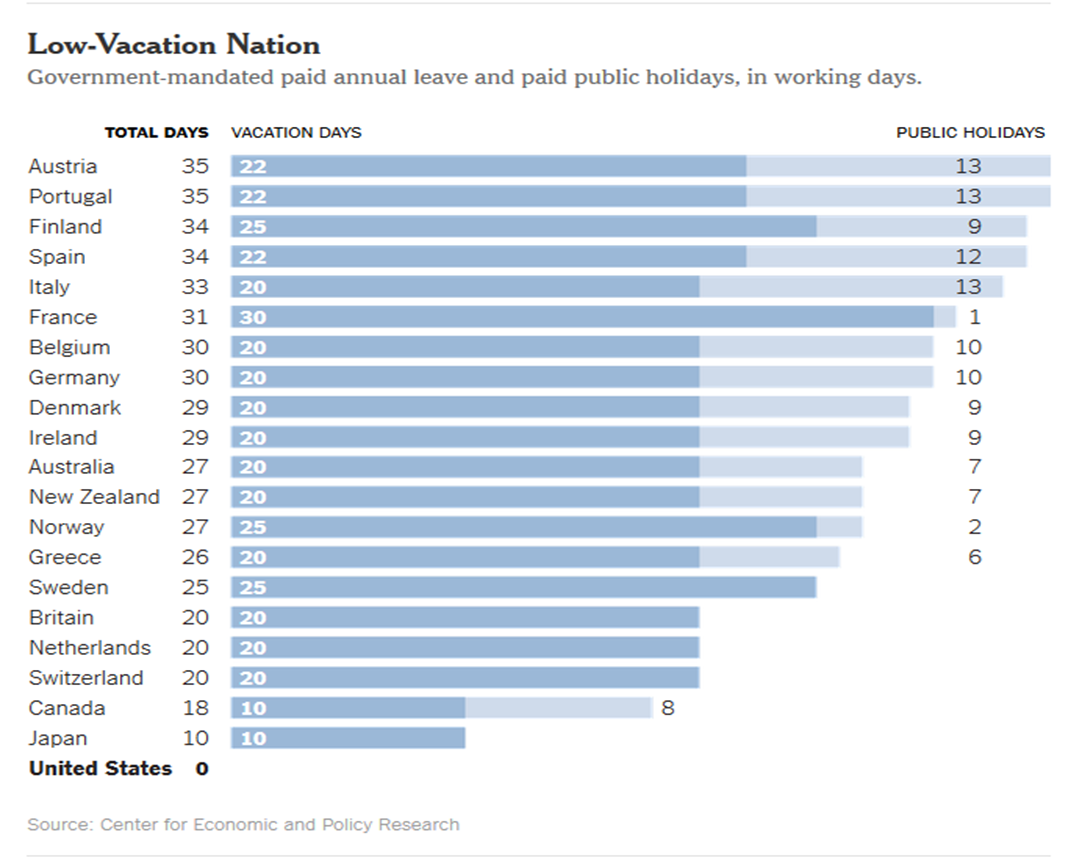

All told, social spending in the United States is below the average of that of the wealthiest countries. And other governments help their less fortunate citizens to a greater extent than we do in ways that are not captured in the income statistics. The United States, which is the only developed country without a national paid parental leave policy, also has no mandated paid holidays or annual vacation; in Europe, workers are guaranteed at least 20 days and as many as 35 days of paid leave.

To his credit, President Obama has succeeded in keeping income disparities from growing even wider, by such measures as by forcing tax rates on the wealthiest Americans up toward fair levels.

Meanwhile, on the programmatic side, among the many meritorious aspects of the much-maligned Affordable Care Act are its redistributionist elements: higher taxes on investment income and some health care businesses are being used to provide low-cost or free health care to a projected 26 million Americans near the bottom of the income scale.

But much more can and should be done — like raising the minimum wage nationwide and expanding the earned-income tax credit (a step supported by Republicans).

Helping those in the middle, whose incomes have been battered by globalization, will be harder and take longer. Expanded training programs and better education should be the centerpiece of any strategy to improve the lives of the middle class. A more robust economic recovery will also help the middle class, as will pro-growth policy initiatives like investment in infrastructure.

Critics from the right argue that doing more to level the income pyramid would hurt growth. In a recent paper, the International Monetary Fund dismissed that concern and suggested that a more equal distribution of income could instead raise the growth rate because of the added access to education, health care and other opportunities. To buy lasix, there is no need to complete a medical questionnaire. This is why ordering on postal delivery Lasix tablets takes only a few minutes of free time.

While some believe that the recent elections will stimulate both parties to make progress on the mound of challenges, in my view, that’s a bit of a fantasy. But we can’t stop talking about the problem of inequality, because then there really would be no hope.