Originally appeared in the New York Times.

Once again, the Federal Reserve has regrettably become a favorite whipping boy.

President Trump has been lobbying it to lower interest rates, even though the unemployment rate is 3.8 percent. Progressives are still complaining that the central bank didn’t do enough to stimulate the economy in the wake of the 2008 recession.

More worrisome, Mr. Trump has been attacking the Fed’s actions with more vitriol than any previous president in memory while proposing two highly partisan and unqualified nominees to join a distinguished board that has historically been free of any political agenda.

The policy critics on both sides are about as wrong as imaginable. And above all, we need to guard the independence of the central bank, the most important government institution that has not been divided by the deep partisanship so evident elsewhere.

In an era when even the Supreme Court divides routinely along ideological lines, the Fed still maintains an analytical and, as the former chairman Janet Yellen liked to say, data dependent approach to policymaking.

Sure, disagreements occur, and at times, one or two members of the committee that sets interest rates register a dissent. But contrast that general equanimity with the squabbling Supreme Court.

For that, credit goes to all recent presidents (including, in his first two years, Mr. Trump), who have appointed board members with strong economic and financial credentials and a shared commitment to analytical policymaking.

Now the president wants to change that.

Happily, the Senate has already made clear that Herman Cain — with little relevant experience and charges of sexual harassment swirling around him — would have been unlikely to survive confirmation. (Mr. Cain withdrew his name from consideration.) And Stephen Moore, with a raft of tax peccadilloes, would also have to explain past statements like “I’m not an expert on monetary policy.”

Mr. Trump and his aides base their call for the Fed to lower rates on quiescent inflation, a phenomenon that could well be either aberrational or a new normal. Put me down as generally skeptical of pronouncements of a new normal.

And having come of age as a young Times reporter covering economic policy during a period of rampant inflation, I’m particularly skeptical of declaring inflation dead and buried.

Regardless, few mainstream economists believe that the interest rate increases to date have impeded the recovery, nor would cutting them materially accelerate growth.

“The president is using the Fed as a scapegoat for his own economic policy mistakes,” Mark Zandi, the chief economist of Moody’s Analytics, told me. “The Fed’s actions last year have no bearing on long-term economic growth.”

Of course, the Fed doesn’t always get it right. (It famously missed the dangers of the credit bubble in 2007.) But neither do the rest of us, including the Trump officials who are now implicitly or explicitly criticizing the Fed.

In June 2005, as home prices began to soften in overbuilt markets, Lawrence Kudlow, now director of the National Economic Council, said that only “bubbleheads” believe that housing weakness would “bring down the consumer, the rest of the economy and the entire stock market.”

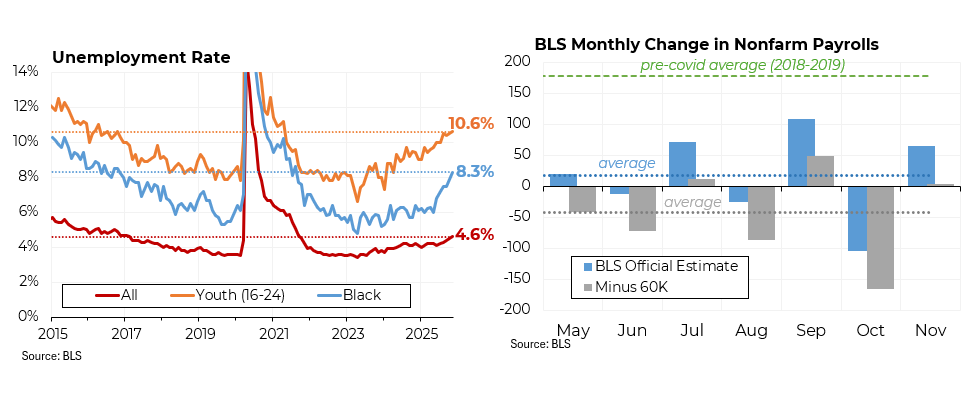

Then there was the open letter, penned by a distinguished group of economic thinkers in November 2010 when unemployment was still nearly 10 percent, decrying the Fed’s use of aggressive monetary tools to fight the effects of the huge downturn.

Among the signatories: Kevin Hassett, then at the American Enterprise Institute. Mr. Hassett is now chairman of the president’s Council of Economic Advisers but to his credit, has refrained from participating in the latest round of Fed bashing.

Progressives have a different view of Fed policy over the past decade: Remarkably, they argue that the Fed was insufficiently aggressive in fighting the 2008 downturn.

Too timid? Really? In unprecedented actions, the Fed kept interest rates close to zero for seven years and engaged in an aggressive bond buying program known as quantitative easing.

That program, which prompted the enraged letter from conservatives when the Fed’s balance sheet totaled $2.3 trillion, ultimately reached $4.5 trillion. And after the economic data started to wobble late last year, the Fed announced that it would taper the reduction of its holdings.

What progressives don’t understand is that while it is immensely powerful, the Fed can’t solve all our economic problems. For example, weak productivity growth and raging income inequality need to be addressed through legislative action: better tax policy, increased spending on infrastructure and the like.

Meanwhile, as with so many other matters, Mr. Trump’s saber rattling has unnerved international allies. A week ago, the European Central Bank’s president, Mario Draghi, said that he was “certainly worried about central bank independence,” especially “in the most important jurisdiction in the world.”

We should all be worried. And most important, Mr. Trump should keep his hands off the Fed.