Originally published in the New York Times.

On my first trip to China in more than three years, I awoke to an uncharacteristically brilliant blue Beijing sky. The forsythia and cherry trees were in full bloom, and the city was sparkling.

That, for me, proved to be a metaphor for at least part of my weeklong visit this spring. On many levels, China is back. Offices were filled with workers putting in their typically long days. Executives mostly radiated optimism about their businesses. A robust pipeline of exciting start-ups suggested China will continue to be a leader in innovation. And the energy and drive that excited me on my many past visits were abundant.

Yes, China has its share of economic challenges, particularly how much President Xi Jinping remains committed to maintaining the country’s progress toward a market economy. Often he seems to put more emphasis on control than on growth. I oversee significant investments in China, and these signals are a cause of concern.

Yet while the Western press displays increasing skepticism, I believe China will continue to prosper. And as our biggest strategic rival, it will continue to use that prosperity to anchor its assertiveness on issues from the South China Sea to spy balloons and unfair trade practices.

Despite its ham-handed Covid response — particularly the extensive lockdowns — China’s economic performance has been far superior to our own. From the beginning of 2020 until the end of last year, China’s economy grew a cumulative 14 percent after adjusting for inflation, while ours has expanded by less than 6 percent.

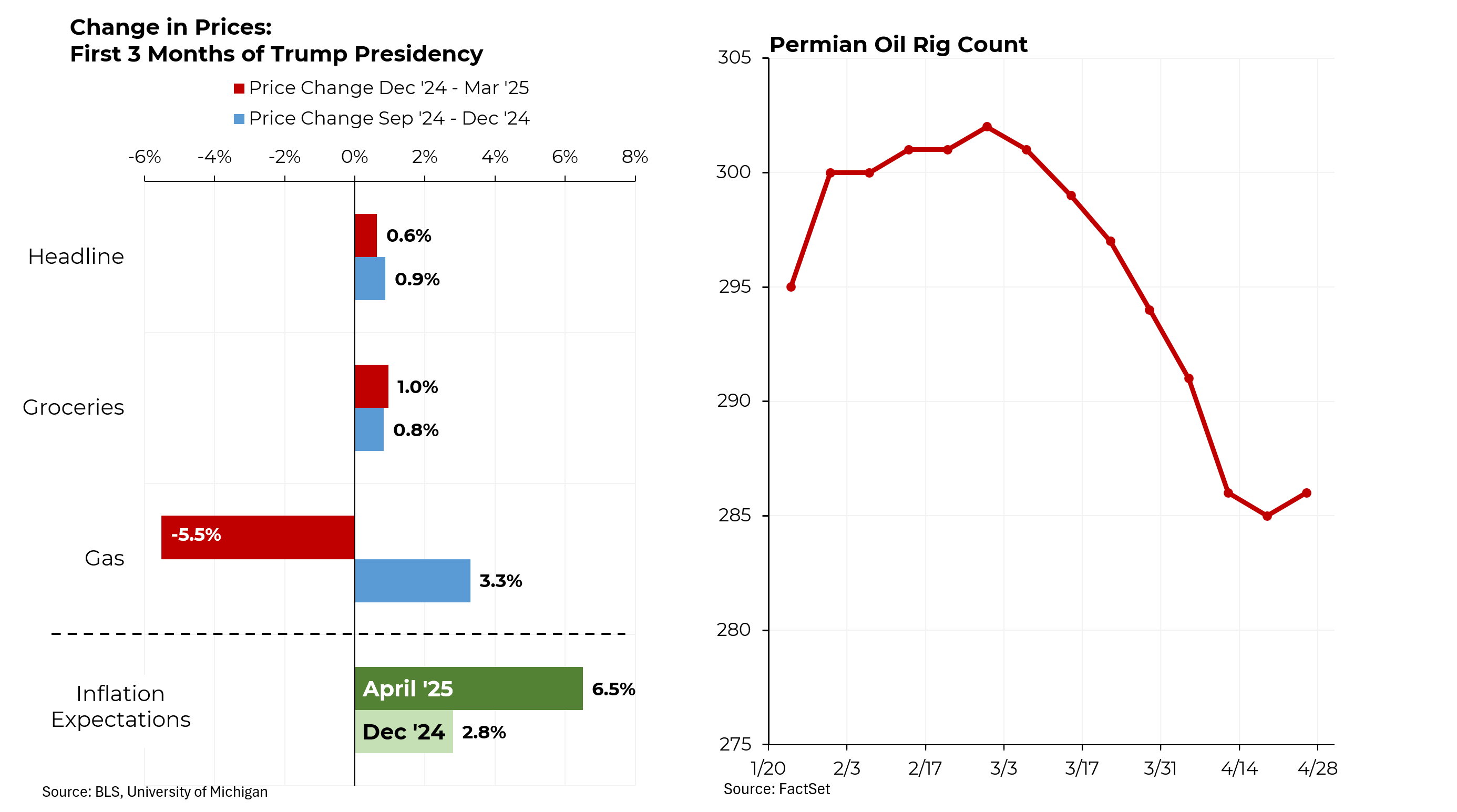

Growth is projected to reach 5.2 percent this year, compared with 1.6 percent for us. And while we battle an inflation rate stubbornly above 4 percent, China’s prices will most likely rise by just 2 percent this year. As a consequence, interest rates remain low, helping encourage investment.

To be sure, China’s rebound from Covid has been weaker than many expected. And the country has a significant jobless problem: 20.4 percent of people ages 16 to 24 looking for a job were out of work last month. Much of that stems from an economy that hasn’t quite revved up enough to absorb all of the roughly 10 million newly minted college graduates who enter the work force each year.

During my visit, Chinese officials took what felt like special pains to be welcoming. At the Davos-like China Development Forum, where American attendance was spotty but European business leaders were in abundance, Chinese officials read carefully scripted remarks, unfailingly emphasizing their commitment to sound economic policies as well as their openness to foreign investment and regulatory reforms.

Their positivity belied the evident tenseness. As my team and I visited with investors and businessmen, the disappearance of the prominent Chinese investment banker Bao Fan came up at almost every meeting, sometimes brought up by us, sometimes — defensively — by our Chinese counterparts. Security in China, always tight, seemed even tighter. I felt more aware of the omnipresent Chinese surveillance, with cameras and facial recognition technology everywhere. Just taking a short train ride required passports to be shown and scanned, both on entry and on exiting.

More than in the past, Chinese investors and entrepreneurs are carefully noting — and following — every signal from the government and worrying that Mr. Xi might suddenly announce another capricious and unexpected intervention into the private sector. Starting consumer internet platforms has been de-emphasized; investment in new industries such as energy transition and artificial intelligence appears to be the priority.

In at least some of these areas, China has achieved notable success. It controls 77 percent of the world’s battery manufacturing capacity, and last year nearly 60 percent of global electric vehicle sales were in China. The country produces more than 80 percent of the world’s solar panels, American tariffs notwithstanding.

As the days passed, the Beijing sky reverted to its more customary slate gray, and so, too, the initial brightness of my mood about the China of 2023 began to dim a bit. Underneath the self-confidence that I had always associated with China, I sensed a measure of uncertainty, largely as a result of the antagonism that many Chinese feel is emanating from Washington, which has led in turn to a feeling of resentment on the part of some Chinese toward the United States.

As Mr. Xi underscores China’s role as an independent superpower, the preferences of Chinese consumers appear to be shifting. In the past, they favored marquee foreign brands, from Nike sneakers to BMW cars. Today, they are moving toward local brands, like Anta sneakers and BYD cars.

My meetings in China are typically dominated by questions from me and my team. On this trip, our Chinese colleagues often turned the tables at least briefly, asking us what the United States was likely to do about issues such as Taiwan and potential investment limitations. Some declared that China was a kind of innocent victim of American power.

These subtle differences were largely at the margin; at least from my interactions, the Chinese business community remains eager for American investment dollars and for continued commerce with us.

That said, the trade restrictions imposed by both President Donald Trump and President Biden have had an evident impact. Exports to the United States of items subject to a 25 percent U.S. tariff, from furniture to consumer electronics, are down by more than 20 percent from 2017.

The restrictions on the sale of sensitive advanced technology to China are also taking their toll. Chinese experts acknowledge that the country’s march toward the forefront of artificial intelligence will be impeded by the ban on purchasing the most advanced semiconductors.

To its credit, in addition to toughness, the Biden administration is extending an olive branch. In a very thoughtful recent speech, Treasury Secretary Janet Yellen called for “constructive engagement” with China — in effect, trying to achieve a win-win.

That’s an ambitious goal that will be best achieved by getting our own house in order. China has proved it can continue to grow faster than we do. We need to outcompete the country by raising our growth rate through initiatives like addressing our imprudently large budget deficit and our stultifying rules on the building of industrial facilities.

And we should buttress our human capital by increasing STEM graduates so that we can maintain our technological edge and by restructuring our immigration policies to attract talented people from all over the world and keep our most promising foreign students here.

Most important, we should not delude ourselves with the fantasy that China is going to fall under its own weight. The question, for America and its adversary, is whether this rivalry need be destructive or if a more prosperous, cooperative future is still possible.