Originally published in the Financial Times

Here is what I want Santa to bring me: straight talk from political leaders about the true nature of America’s economic problems, and some solutions for dealing with them. So far, my Christmas stocking is empty.

Republicans think that cutting the budget deficit and getting government out of the way will restore the halcyon years of growing incomes and jobs. The Democrats’ call for more stimulus, via extending the payroll tax cut, is akin to prescribing a shot of amphetamines from Dr Feelgood for a critically ill patient.

How wonderful it would be to hear some candour amid the speechifying. America can, of course, rise again, but just as the problems it faces are frighteningly structural and seemingly intractable, so too the solutions will be extended and painful.

America’s woes have generated collective gnashing of teeth, hyperbolic rhetoric, policy papers and newspaper commentary, all adorned like Christmas trees with eye-catching ideas. Who can deny “competitiveness” is among America’s challenges? But what, exactly, does that mean?

If you cut through the blah blah blah, America’s economic challenges boil down to two intimidating obstacles. First, as even schoolchildren must be aware, two main sectors of the economy are overleveraged and in dire need of having their debt levels sweated down. At the federal level, the ratio of debt to gross domestic product, which has grown from 35 per cent in 2000 to 67 per cent today, will hit 82 per cent by 2021.

So, fiscal austerity has quite correctly become the mantra in America, even though deficit reduction is a Hobson’s choice. Fail to cut the deficit and the US will eventually go the way of Italy and Greece. But lower spending or higher taxes (or both) will restrain economic growth.

We can already see that principle in action. Over the past 22 months, the deficit has come down by $236bn (on a trailing 12-month basis) largely because of the intersection of flat spending with gradually rising revenues. According to Mark Zandi, chief economist of Moody’s Analytics, this has held down the 2011 US growth rate by about 0.6 per cent.

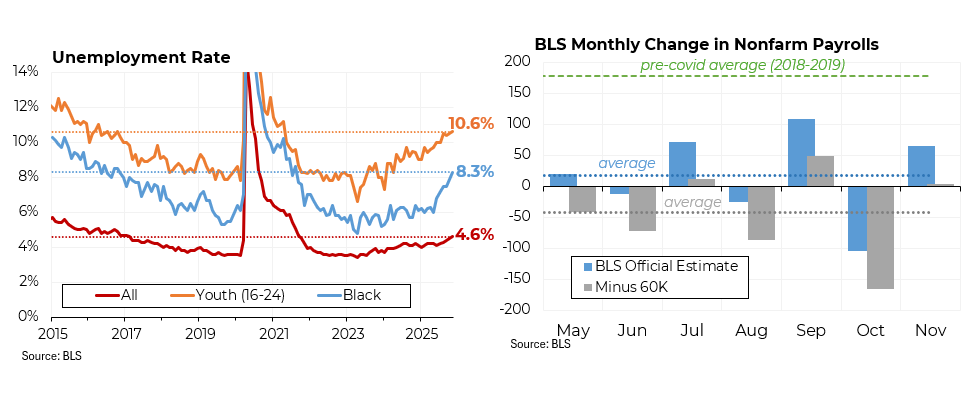

Or look at jobs. Over the past 21 months, private employers have added 2.9m workers while government, federal and municipal combined, have cut 485,000 jobs. The same picture – and the same conundrum – exists at the household level. As paper wealth climbed during the pre-crisis housing boom, Americans literally stopped saving and household debt rose to 99 per cent of GDP in March 2009 from 67 per cent nine years earlier.

When the housing bubble deflated and the economy toppled into recession, consumers began to save again, leading demand to stagnate, which in turn held back the recovery. Keynes called this the “paradox of thrift”: we want households to save but when they do, consumption suffers.

With debt high and the household savings rate still well below its long-term trend of about 7 per cent (and an ideal rate of perhaps 10 per cent), the American economy will feel the effects of the paradox of thrift for many years. Now add to overleveraging America’s second formidable challenge: the effects of globalisation on many workers; yes, globalisation. Even committed free traders like myself must acknowledge the role of globalisation in grinding down American wages.

Over the past decade, median real incomes declined by 7 per cent. That’s bad enough. Still worse is the fact that the decline was concentrated among less educated, less skilled workers. In the automotive sector, for example, jobs in Detroit that once paid $28 an hour in cash (plus generous benefits) are disappearing in favour of jobs in places like Chattanooga, where Volkswagen has hired 2,000 new staff at a starting rate of $14.50 an hour. That translates into roughly $30,000 a year, well below median wages of $49,445 a year and not so far above the poverty line of $22,314 a year for a family of four.

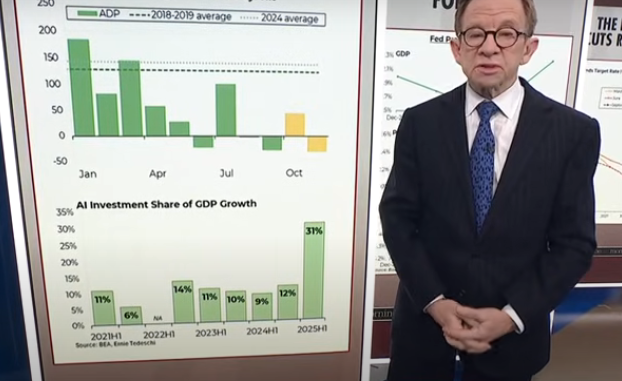

America’s future depends on refocusing its economy on high value-added, higher intellectual content sectors where it can compete effectively. That means educating and training American workers to higher levels, as well as investing more in infrastructure and research and development.

At present, growing fiscal constraints, combined with the public perception that government needs to step back, have prevented any progress towards these goals. If anything, ground has been lost. For example, burgeoning spending on social security and healthcare has cut government spending on capital programmes such as infrastructure in half, as a share of GDP.

Failing to address these matters will not send the American economy off a cliff soon. But staying on the present course will doom us to – at best – an indefinite period of high unemployment, slow growth and stagnant incomes. Prompt attention to these deep-seated challenges offers the only chance for happier Christmases ahead.