While Congress continues to wrangle over funding for the Department of Homeland Security, it has completed the rest of its budgetary work for the current fiscal year (which ends September 30) with President Trump getting almost none of the massive spending cuts that he proposed. But as a result, federal spending will continue to rise, keeping deficits high and adding significantly to the national debt.

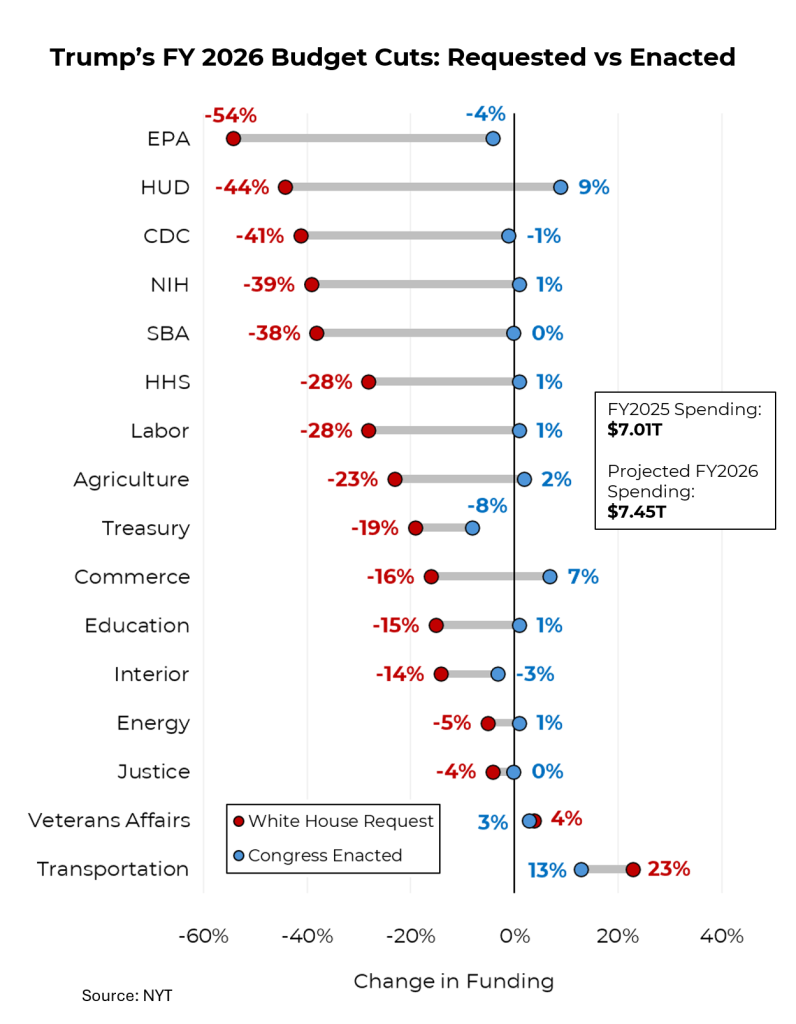

In his budget request, Trump asked for $163 billion in cuts to what is known as discretionary spending – everything from education to the national parks but excluding Social Security, Medicare, Medicaid and of course, interest on the national debt. However, when the dust settled, Congress had decided to keep this spending essentially unchanged, at roughly $1.6 trillion . (Adjusting for inflation, that does amount to a slight cut.)

Among Trump’s notable requests for cuts were reductions in funds for scientific research, housing (Congress increased it), environmental protection, small business and on and on. Many of Trump’s proposed cuts related to his contention that the money was being used for diversity, equity and inclusion initiatives.

The only significant set of cuts that Congress approved (and even these were less than half of what Trump requested) were to the Treasury department for the Internal Revenue Service and community development programs. (Ironically, additional funding for the I.R.S. reduces the deficit because the agency receives more in unpaid taxes than it spends to collect them.

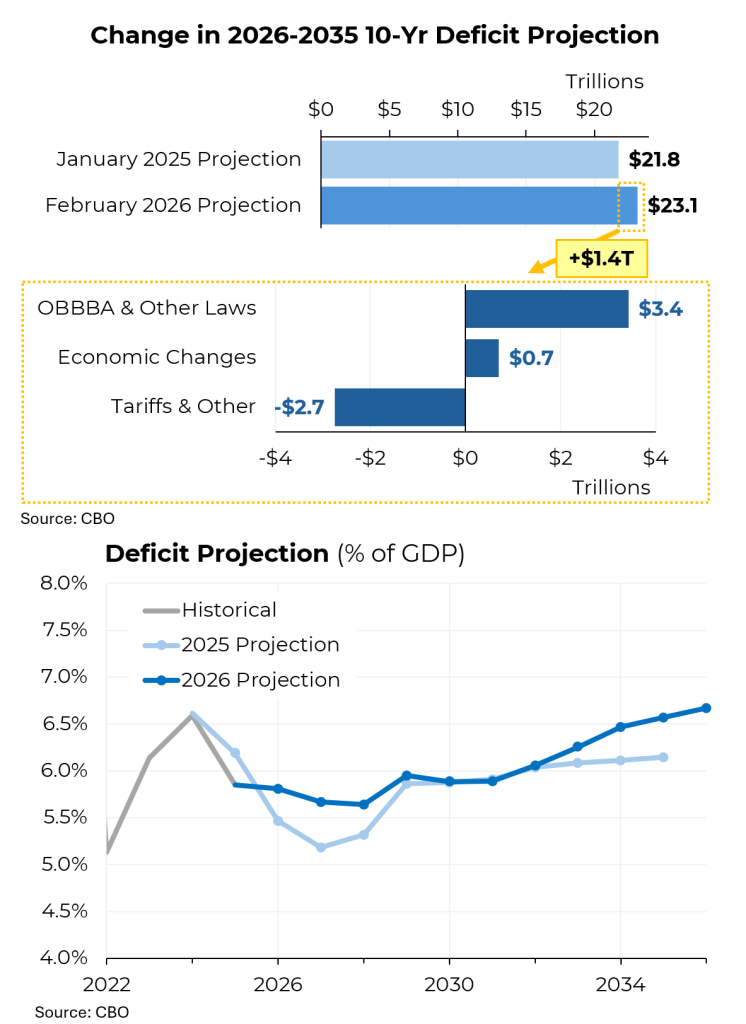

Roughly a year ago, the Congressional Budget Office projected that Washington would incur $21.8 trillion in budget deficits over the coming decade. Now it estimates that total deficits over the same period of time will be $1.4 trillion higher. That is principally due to the massive tax and spending package approved last year, the cost of which will only be partially offset by the president’s signature tariffs. Higher interest costs and other economic changes will add another $700 billion to the deficits.

On an annual basis, the deficit in 2025 was modestly lower than originally projected because tax revenue (including from the tariffs) came in higher than expected. But that improved result is projected to reverse this year and for the coming decade. By the end of the decade, the deficit as a share of the gross domestic product could reach 6.6%, its highest level in at least 50 years outside of covid and the GFC.

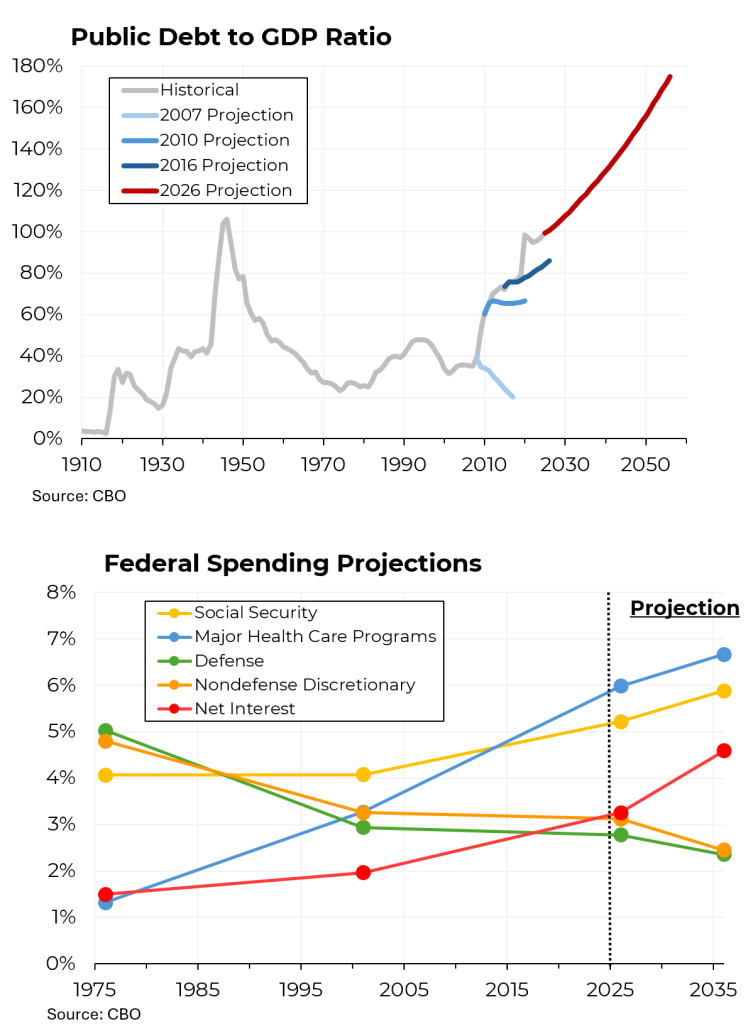

The deterioration in the fiscal outlook is not unusual; it has been occurring since the aftermath of the financial crisis. Back in 2007, a few years after the federal government last ran a surplus, the Congressional Budget Office believed the strong fiscal picture would cause the debt to GDP ratio to decline. In 2010, it projected that it would remain stable. By 2016, it recognized that the trajectory would be sharply upward.

The challenge for the budget is that even with large deficits, the amounts available for discretionary spending (including defense) are being squeezed by other costs. The fastest rising category of spending is for government-sponsored health care, principally Medicare and Medicaid and for Social Security. But interest costs are also rising sharply and now exceed expenditures for defense. An 18th century thinker postulated that when that occurs, a great power risks ceasing to be a great power.