The overwhelming success Democrats had at the ballot box on Tuesday was due to a number of factors and no doubt at least partially reflected the turmoil associated with the Trump administration, but one issue seemed to have been atop the leaderboard of concerns: the economy.

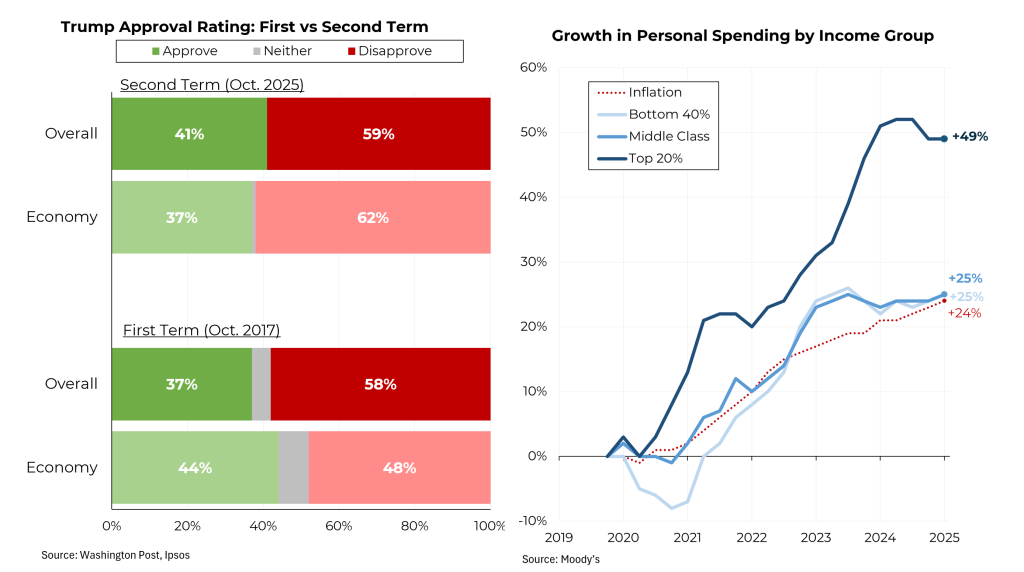

Recent poll data compared to a similar point in Donald Trump’s first term illustrates the shift in voter mood. In October 2017, Trump had a 37% overall approval rating but a 44% approval rating for his handling of the economy. This time around, his overall approval rating is slightly higher, at 41%, but his favorability assessment for his handling of the economy is down to 37%, seven percentage points below where it was in 2017.

Why is that? Because simply put, most Americans are not getting ahead and many are falling further behind. Since 2019, most Americans (the lower 80%) have not been able to increase their spending by more than inflation, meaning that their standards of living have stagnated and, in some cases, surely declined. The top 20%, however, have increased their spending by almost twice as much as prices have risen. All told, according to a Moody’s estimate, the top 10% of American households now account for 49% of all spending.

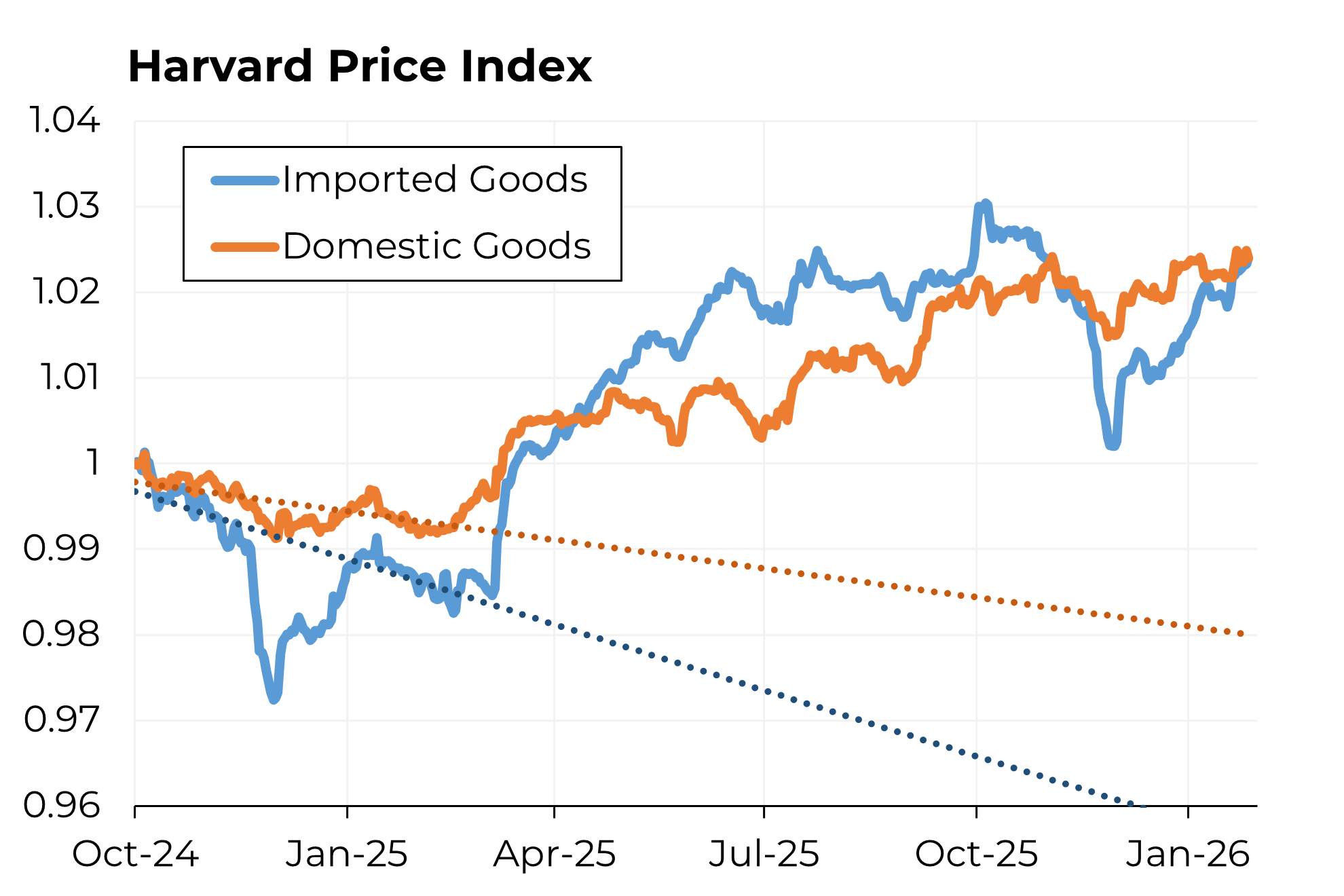

A recent study by the Ludwig Institute found that adjusting price changes for goods more in line with what middle- and working-class Americans actually buy, median earnings have been declining. And after several years in which income inequality didn’t get worse and even improved modestly, the gap in earnings growth between those at the top and those near the bottom has widened again.

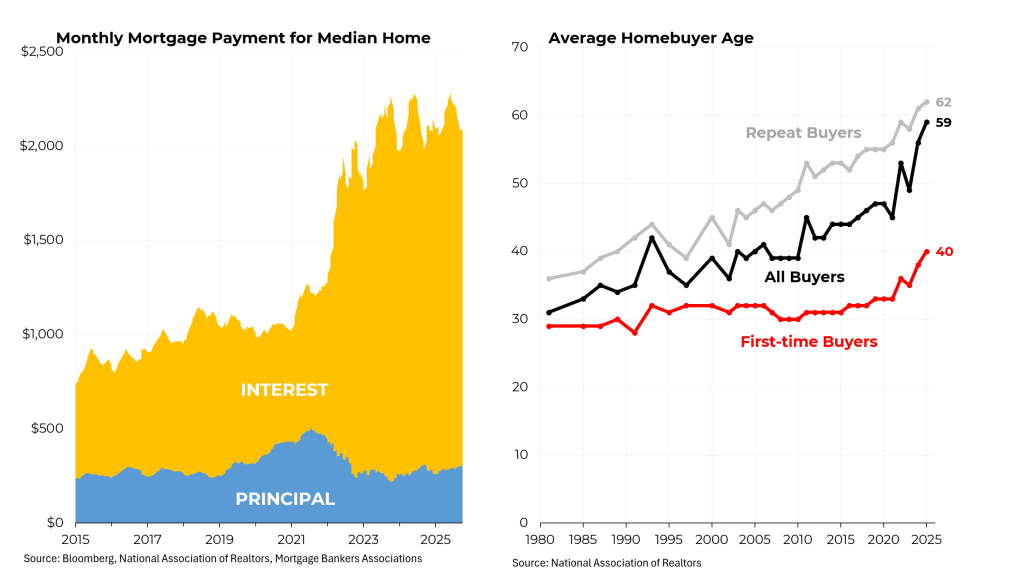

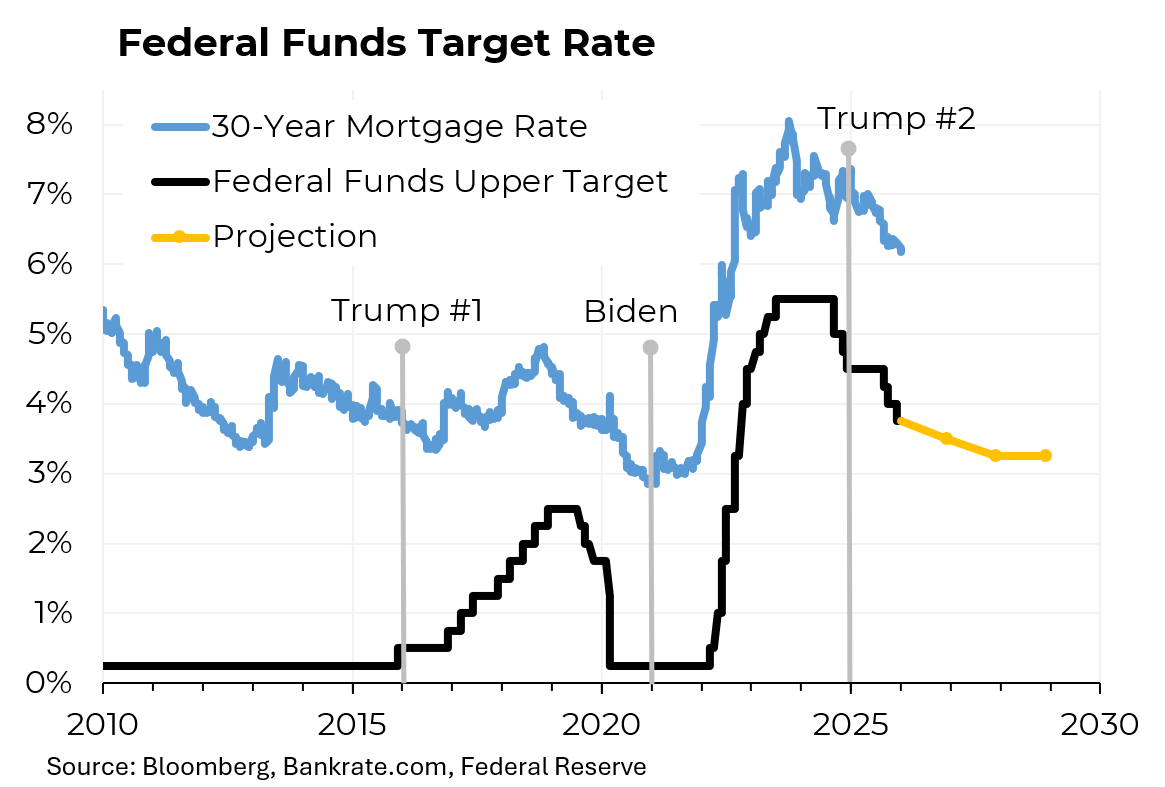

As part of the current focus on “affordability” — a central theme in Tuesday’s election, Americans are increasingly concerned about housing challenges. The sharp rise in home values since Covid (they are up 53%) and the increase in interest rates in response to surging inflation have combined to roughly double the monthly payments that a typical homebuyer would have to make.

That has essentially priced many first-time homebuyers out of the market. Just 21% of today’s purchasers are buying their first home, compared to 33% as recently as 2019. Consequently, the average age of first-time homebuyers has increased from 33 as recently as 2020 to 40 this year.

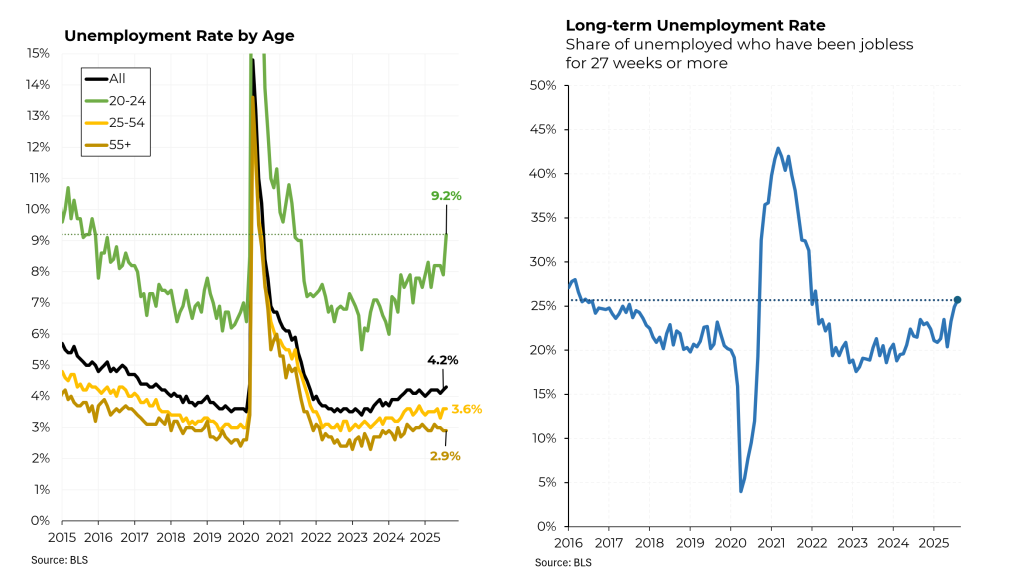

Then there’s the job market. While the unemployment rate for older Americans has barely risen since its lows of two years ago, it has risen to 9.2% for Americans between 20 and 24, its highest rate since January 2016. While younger Americans always have higher unemployment rates than those further along in their careers, the gap today is particularly pronounced as companies restrain their hiring due to uncertainty, AI and other factors.

Similarly, the percentage of Americans who have been unemployed for 27 weeks or more has risen to almost 26%, its highest level since 2016, when it was in the midst of a steady decline after the financial crisis ebbed.