The most anticipated meeting in a long while of the Federal Reserve Open Market Committee ended uneventfully, with the rate-setting body voting almost unanimously for the small, 0.25% rate cut that the market widely anticipated. Only President Trump’s most recent appointee, Stephen Miran, dissented, arguing for a 0.5% reduction instead. That brought the Fed’s target interest down to 4% to 4.25%, compared its post-covid peak range of 5.25% to 5.5%.

The cut came after nine months of stable rates and appeared to be occasioned in large part by the weakening jobs market — what Fed Chairman Jerome Powell described as a “risk management” rate cut.

As part of its meeting, the Fed released updated interest rate and economic projections that pointed to further rate cuts ahead. Over the past nine months, the Fed’s outlook has evolved in part as President Donald Trump’s approach to tariffs has unfolded. In June, the Fed expected rates to be at about 3.4% at the end of 2027. Now both because of the softer labor market and less tariff fear, the Fed is projecting a rate of 3.1%.

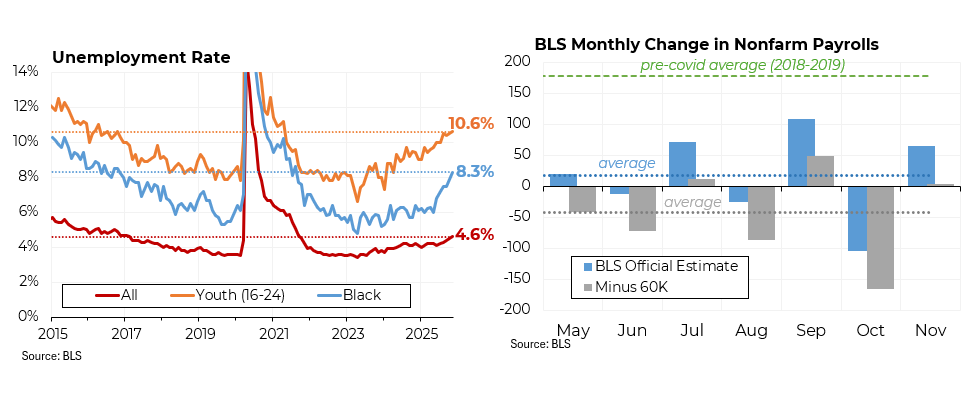

The deceleration in job growth has been remarkable. In 2023, after much of the effects of Covid had passed, the economy created an average of 216,000 jobs a month. That fell to 168,000 jobs a month in 2024 and just 75,000 jobs a month this year. In the last four months, only an average of 27,000 jobs were created.

Moreover, for the first time since the pandemic, the number of Americans seeking jobs is greater than the number of jobs that are open.

That has caused the unemployment rate to drift up, to 4.3% at present from a low of 3.4% in April 2023. In a similar vein, the share of unemployed Americans who have been out of work for more than twenty-seven weeks has risen to more than 25% from a post-Covid low of 17.6%. Apart from the Covid period, the share of long-term unemployed is the highest it has been since June 2016.

As it does every three months, the Fed updated its economic forecast. Notably, it has been gradually raising its inflation forecast and now does not expect inflation to fall to its 2% target until the end of 2028. (Back in March, it expected 2% inflation by the last quarter of 2027.)

As for growth, the central bank’s forecasts have been heavily influenced by the tariff outlook. In March, before Liberation Day, the Fed believed the economy would expand by 1.7% this year. (And in December, before Trump took office, they were projecting 2.1%.) After Trump announced his sweeping tariffs, projected growth dropped to 1.4%. Now, as the impact of the tariffs appears to be more modest than anticipated, the Fed has raised its growth projection. But notably, all of these projections would result in growth substantially below what it was in the last two years of the Joseph Biden administration. (Trump has argued that growth would pick up after an adjustment period; the Fed does not appear to agree.)