Elon Musk has been off the front pages of late but he continues to put out social media posts bragging about at least some of his successes in business as well as his purported accomplishments cutting government “waste, fraud and abuse” through his Department of Government Efficiency.

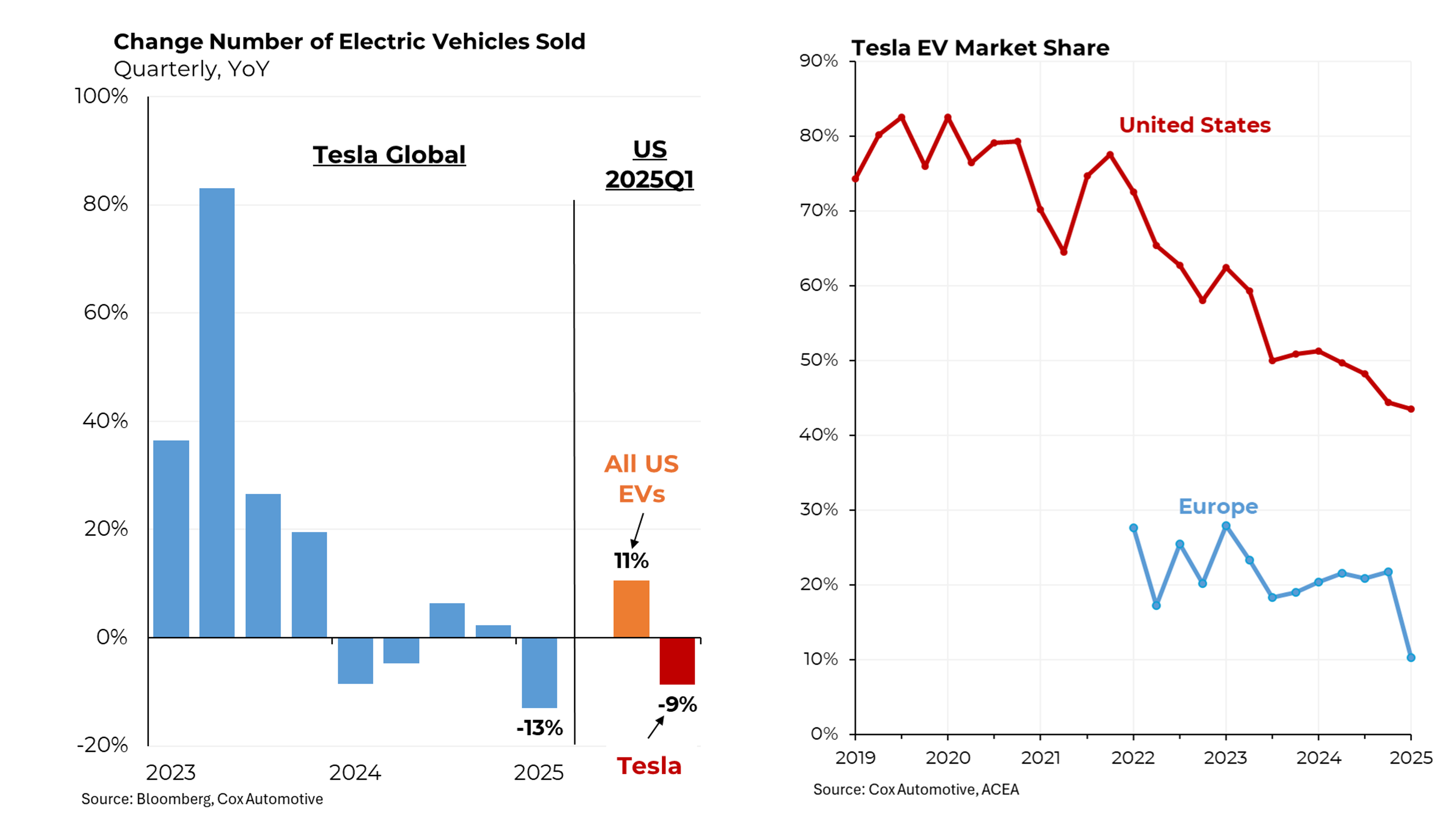

But he hasn’t had much to say about Tesla, perhaps because Tesla has been facing increasing challenges. Most importantly, it just reported the sharpest decline in sales since the company was founded in 2003. Globally, sales were down 13%; over the previous 12 months, sales were roughly flat. Those 15 months followed quarter after quarter of sharply rising sales. In the U.S., sales in the first quarter fell by 9% even as overall electric vehicle sales increased by 13%.

Why the dramatic change in fortunes? The 2024 results relate principally to an increasingly competitive environment — more manufacturers producing more and better EVs — combined with Tesla not offering refreshed versions of its two best-selling models, the Model Y and the Model 3. But the poor first quarter numbers were also likely stimulated by increasing hostility toward Elon Musk and his DOGE efforts. That can be seen most clearly in Tesla’s market share, particularly in Europe, where the anti-Musk and anti-American sentiment is probably the strongest. (Increased penetration of Chinese EVs in Europe may also be playing a role; Europe just raised its tariffs on Chinese EVs.)

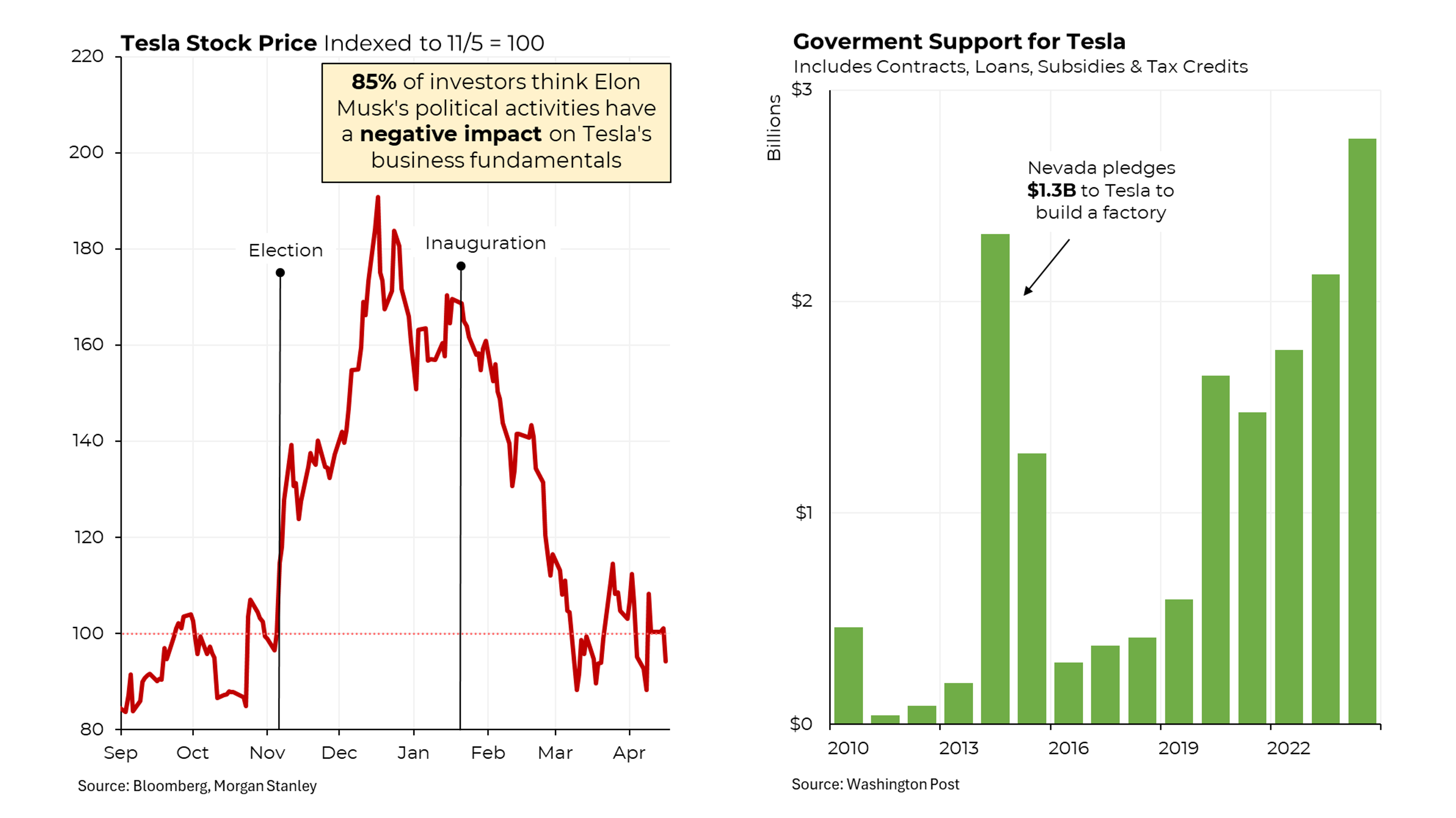

All of that has had a significant effect on Tesla’s stock price. It rocketed up after the election, when investors believed that Musk’s relationship with Donald Trump would benefit the company. But then as both Trump and the DOGE activities began to lose support, the stock started to drop sharply. A recent investor survey by Morgan Stanley found that 85% believe that Musk’s political activities are having a negative effect on the company’s business.

Ironically, for all of Musk’s anti-government rhetoric, Tesla has been a huge beneficiary of governmental support, particularly by selling credits it receives for its electric vehicles for auto companies that need those credits to comply with fuel efficiency standards. On top of that, Tesla has received substantial support from states (particularly Nevada) for agreeing to locate manufacturing facilities in those states.

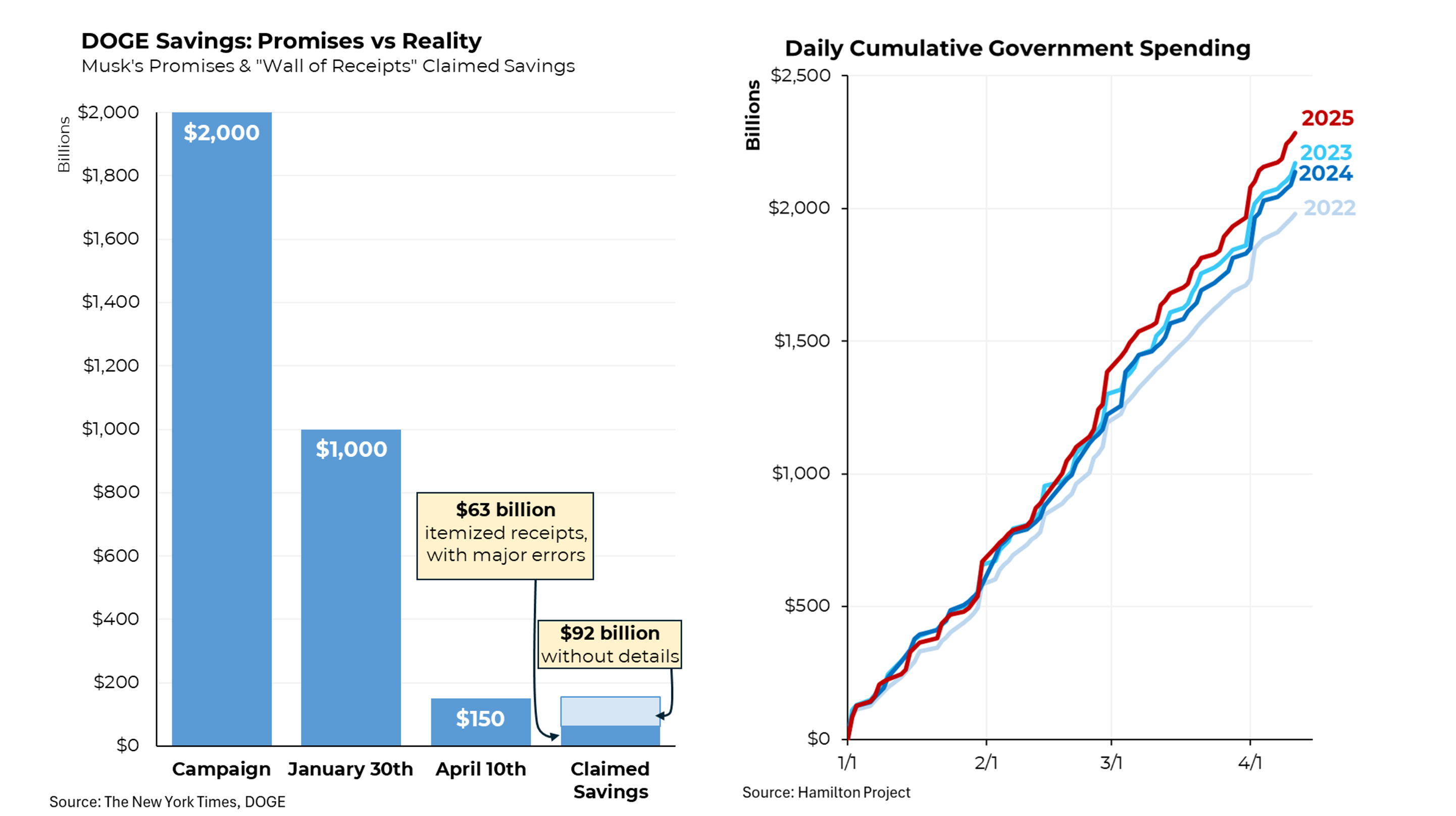

As for DOGE, far less has been accomplished than was promised (all the commotion notwithstanding). During the campaign, Trump promised to cut $2 trillion annually from the federal budget. That was a ludicrous promise, given that the entire federal budget is $6.7 trillion and just 15% of that is non-defense discretionary spending. In January, that promise was revised down to $1 trillion for the current fiscal year, which ends on September 30. Then last week, Musk announced at a cabinet meeting that the new target was $150 billion.

However, an analysis by The New York Times found that just $63 billion of those savings have been specified and even that “Wall of Receipts” was filled with errors, including a $1.9 billion contract that was actually cancelled under President Joe Biden and A $1.75 billion “cancelled” grant that had already been paid.

As a result, federal spending has continued to grow and so far in the current fiscal year is running 6.8% higher than in 2024, slightly ahead of 2024 even after adjusting for inflation.