As expected, the Federal Reserve cut interest rates again, this time by 0.25%. What was more notable was that the central bank signaled that it only expects to cut rates twice next year, rather than the four reductions that it had previously predicted. The stock market, which had been anticipating a smaller change in the Fed’s outlook, immediately plunged by nearly 3%. (Higher interest rates are the enemy of stock prices because they make investing in bonds more attractive relative to stocks.)

Since interest rates peaked at 5.5% in the middle of last year, the Fed has cut rates three times, by a total of a full percentage point. The Fed felt comfortable doing that because inflation had fallen faster than many economists had anticipated and was nearing the bank’s 2% target. (Note to mortgage seekers: Those rates have not declined ¬— and have actually increased a bit — because they are tied to the 30 year Treasury bond, not the short-term interest rate that the Fed controls.)

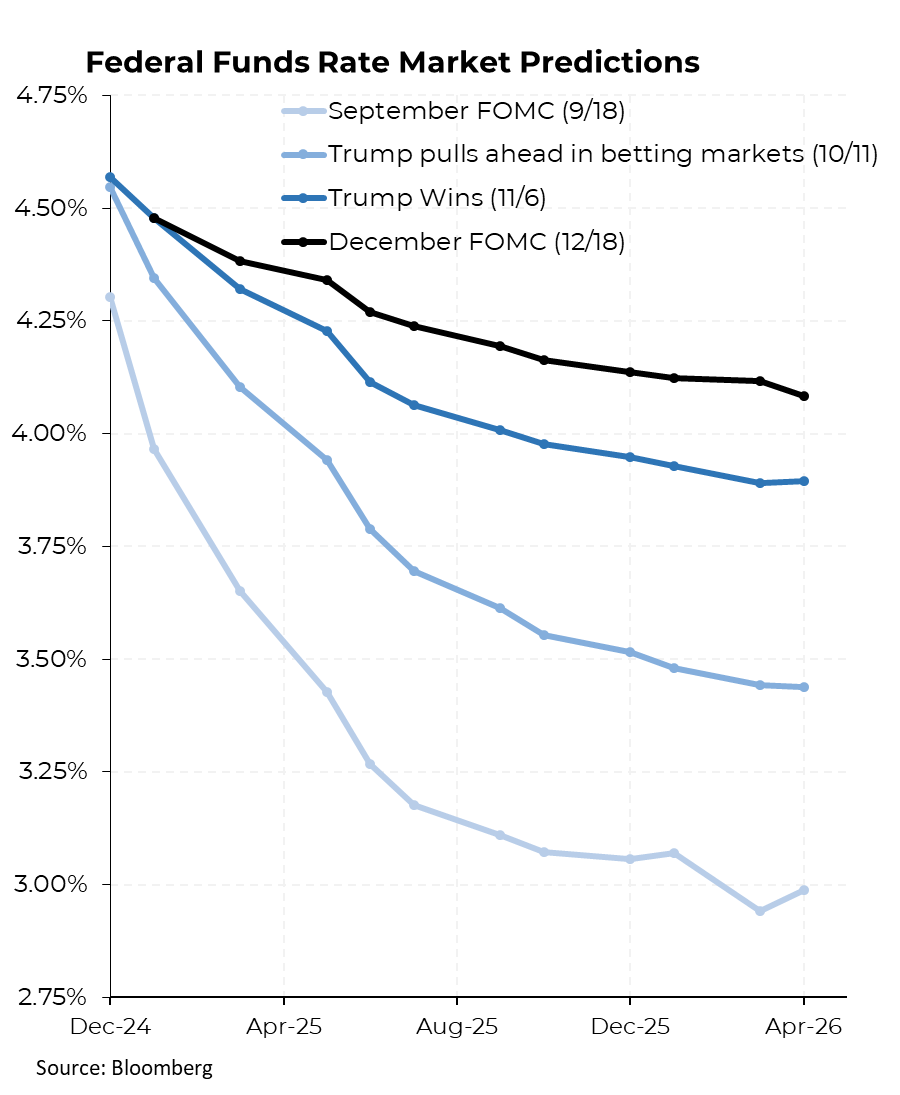

The updated forecast from the Fed reflects a continuation of a trend that goes back until at least last fall when markets thought rates would decline to below 3% by the end of next year. Now the expectation is for rates to be between 4% and 4.25% at that point.

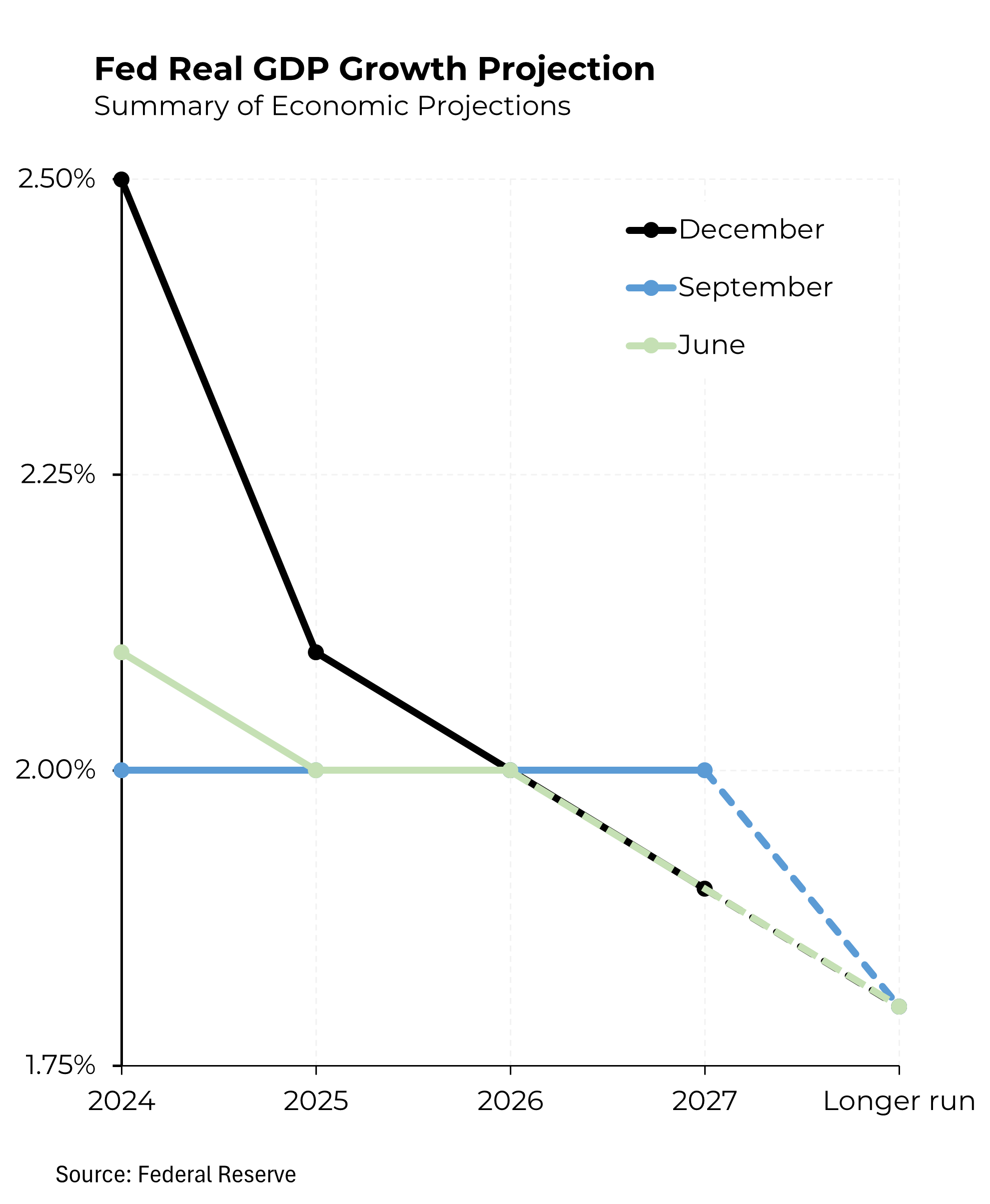

The change in outlook appears to reflect a stronger economy and more stubborn inflation than previously anticipated, combined with the prospect of policies from the incoming Trump administration that could put more pressure on prices. For example, the Fed raised its expected rate of growth of the economy in 2024 to 2.5% from the 2% forecast just three months ago.

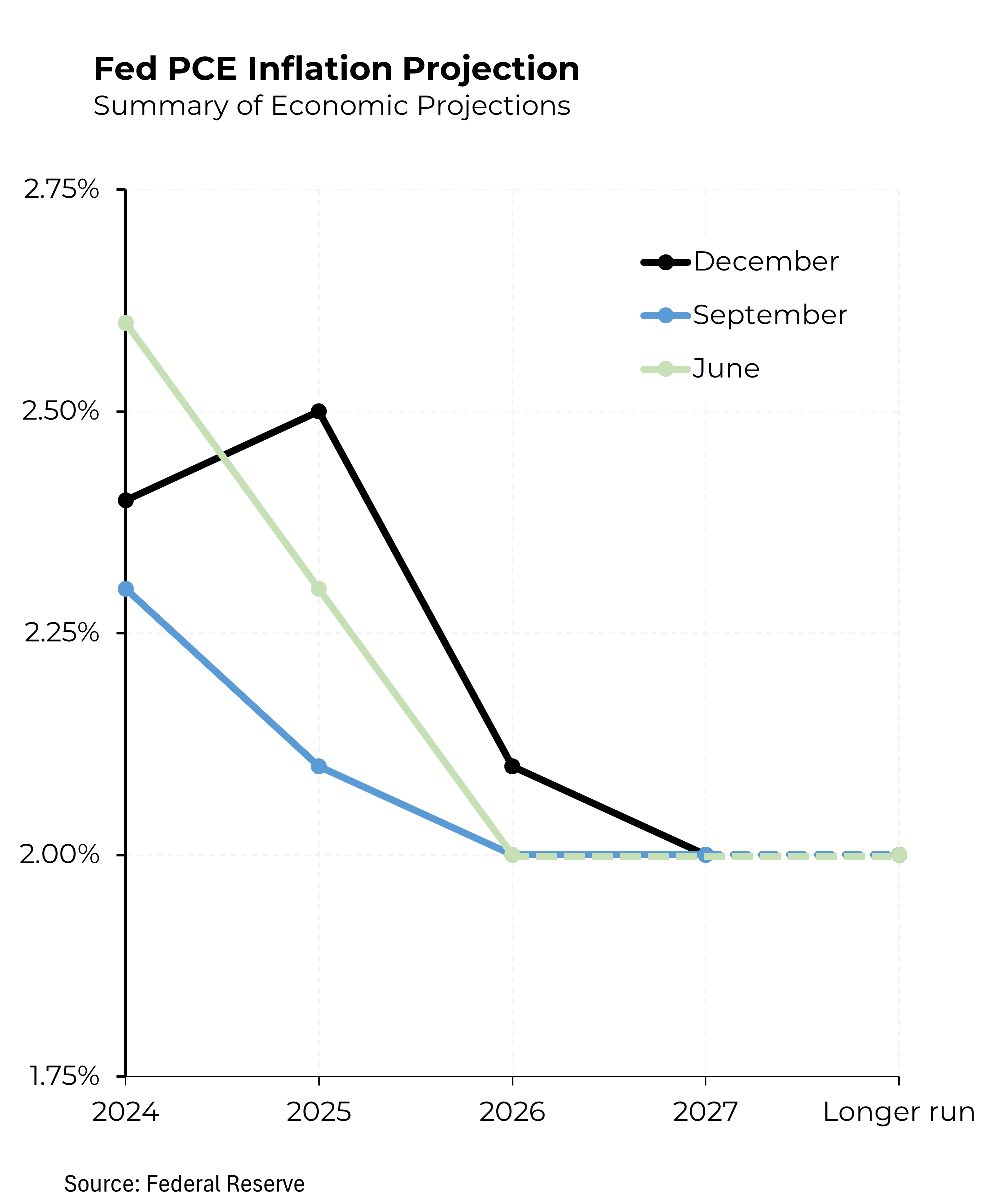

In part because of the stronger anticipated growth and in part because inflation has remained stuck modestly above the Fed’s 2% target, the central bank now expects inflation in 2025 to come in at 2.5%, up from the 2.1% in predicted in September. An additional source of inflationary pressure — albeit not mentioned by Fed chairman Jerome Powell — could be the proposed Trump policies, particularly higher tariffs, reduced immigration and large tax cuts that could expand the federal budget deficit.