In this policy-light presidential election campaign, among the many issues that have not gotten sufficient attention is what each of the two candidates would do to address fiscal matters like taxes and government spending. Remarkably, the nation’s growing debt and large budget deficit have been even less discussed.

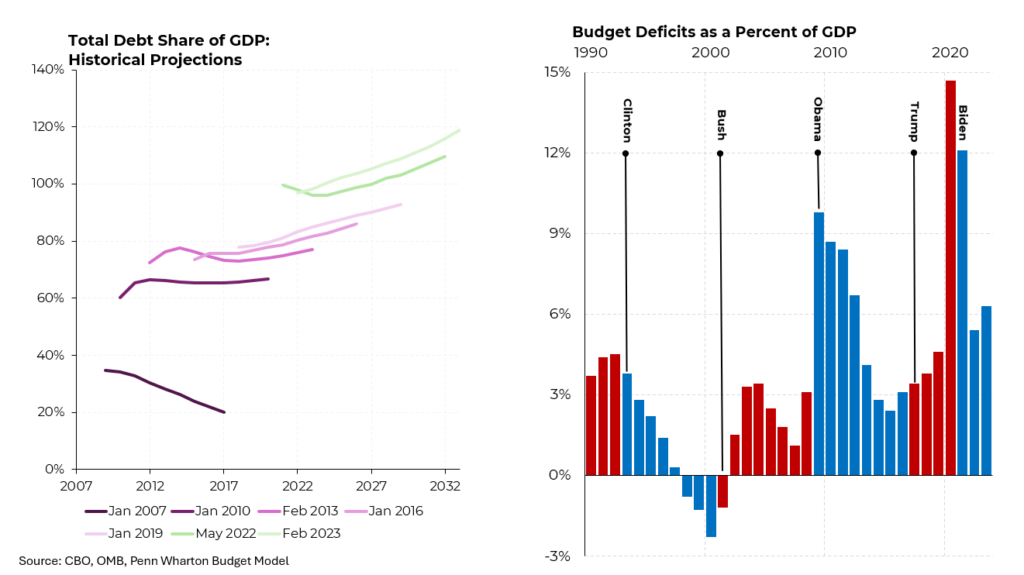

That the nation faces a mounting debt problem should not be surprising to any American, but the speed with which the challenge is mounting is extraordinary. Back in 2007, the Congressional Budget Office expected the ratio of debt to the gross domestic product — then less than 40% — to decline to about 20% of the following decade. But then the financial crisis struck and each year’s projections showed this key ratio rising into the future, instead of falling. At present, the ratio is projected to exceed 120% in 10 years, higher than it has ever been in American history including after World War II.

The cause of the deteriorating projections is simply the cumulation of mounting annual deficits. We last ran a surplus during the last years of the Clinton administration and the first year of the Bush administration. Successive tax cuts and the war in Iraq drew red ink under President George W. Bush. Then the financial crisis struck and emergency spending soared. While President Barack Obama worked the deficit down, President Donald Trump’s tax cut sent it back up, and then came Covid. But we are still running a deficit of more than $1.5 trillion.

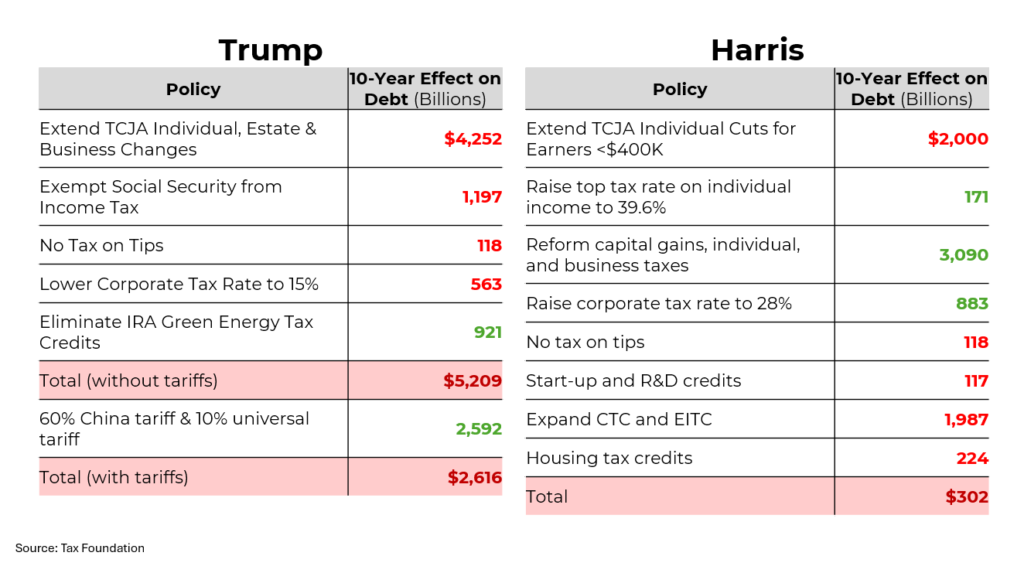

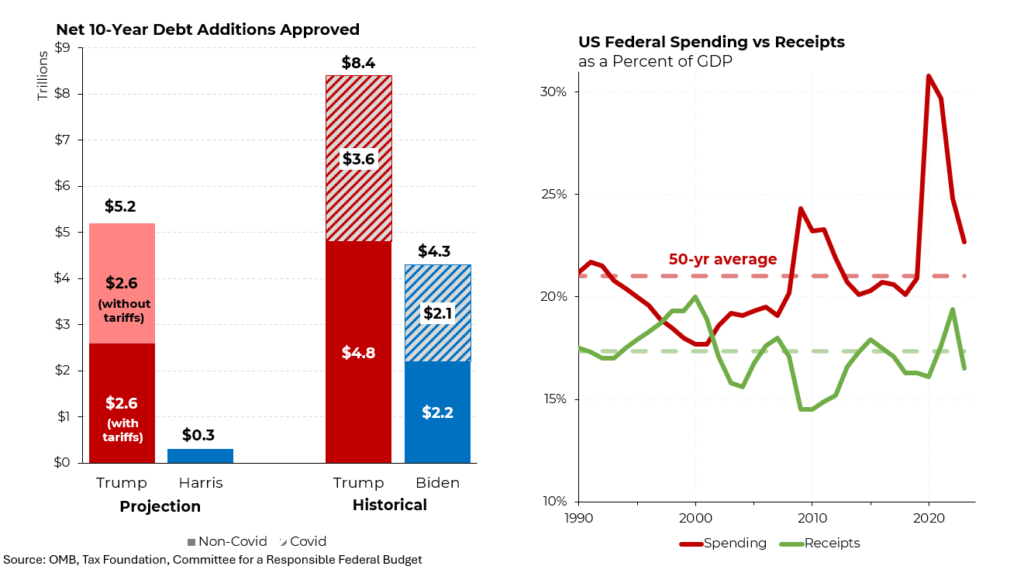

Against that backdrop, what have the two current presidential candidates proposed? Trump wants to make permanent all of his tax cuts that would expire at the end of 2025, at a cost of $4.3 trillion. On top of that, he wants to exempt Social Security payments from income tax and further lower the corporate tax rate, to 15%. He would offset some of those costs by repealing Inflation Reduction Act green tax credits and, perhaps, imposing a vast array of tariffs. His package would add $2.6 trillion to $5.2 trillion of new deficits and debt over the coming decade.

For her part, Kamala Harris has a different vision: She only wants to extend the tax cuts for Americans making less than $400,000 a year (roughly the bottom 98%). She would more than offset that by raising taxes on the wealthy. She has also proposed an array of tax incentives for first time home buyers, for childcare and for research and development, and also wants to expand the earned income tax credit.

How does all of that add up? The Harris plan would add only a marginal amount of new debt. Trump’s plan, on the other hand, would explode the debt (with the proposed tariffs representing a large uncertainty). Comparing this to the Biden and previous Trump administrations, the Harris plan would represent a substantial improvement, while Trump could end up adding even more debt than he did in his first turn, not including covid spending

In the long run, more significant changes are going to be required. Even with Covid behind us, our current rate of spending is well above our 50 year average, as a share of GDP, while our revenues are below the historic average. Spending restraint and higher taxes are almost surely in our future.