The war in the Middle East and the antics of former President Trump have been dominating the news of late but behind those headlines, the economy continues – for the most part – to perform well, with inflation moderating and growth continuing. However, it’s important to note that the efforts by the Federal Reserve to tamp down inflation have helped cause some warning signs to appear.

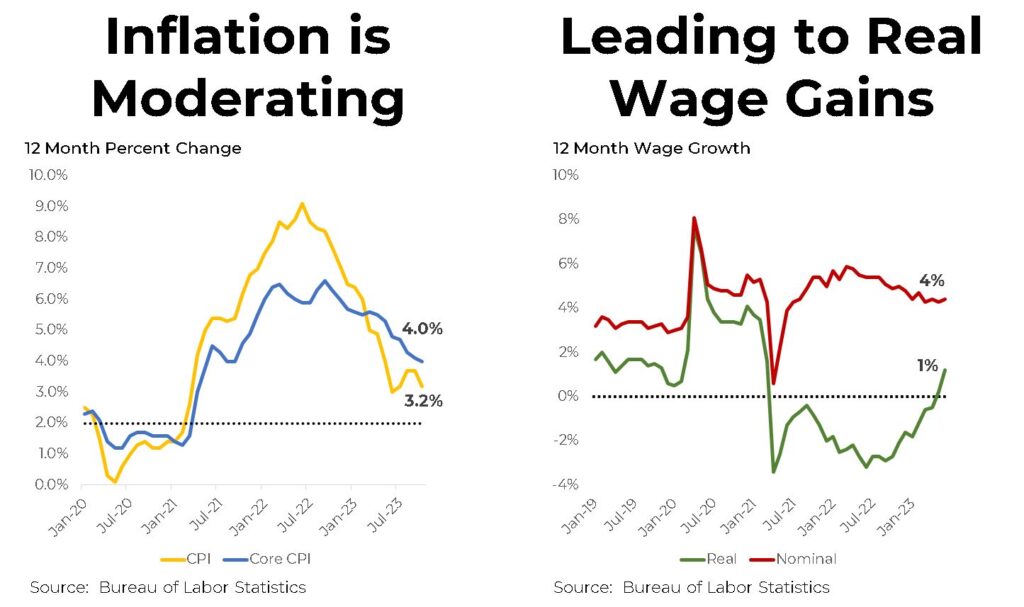

Among the best pieces of news has been the sharp drop in inflation, faster than most economists expected. From a high of 9.1% in June of 2022, the “headline” inflation rate has dropped all the way to 3.2%. That’s the number that directly affects Americans when they go to the grocery store or drop online to make purchases. But economists – and importantly, the Fed – pay closer attention to “core” inflation, the rate after the volatile categories of food and energy are removed. Here the news is also good, although not quite as good – at 4.0%, the core inflation rate remains well above the Fed’s target of 2%, raising questions about how soon interest rate cuts might occur.

The drop in inflation has had a material effect on purchasing power for a typical American. After significant losses in after-inflation income following the pandemic, consumers are now enjoying a boost – albeit a modest one – in their “real” incomes. This has contributed to decent early holiday sales numbers. In store purchases on Black Friday were up roughly 7.5% and online sales on Cyber Monday rose by an estimated 9.6%.

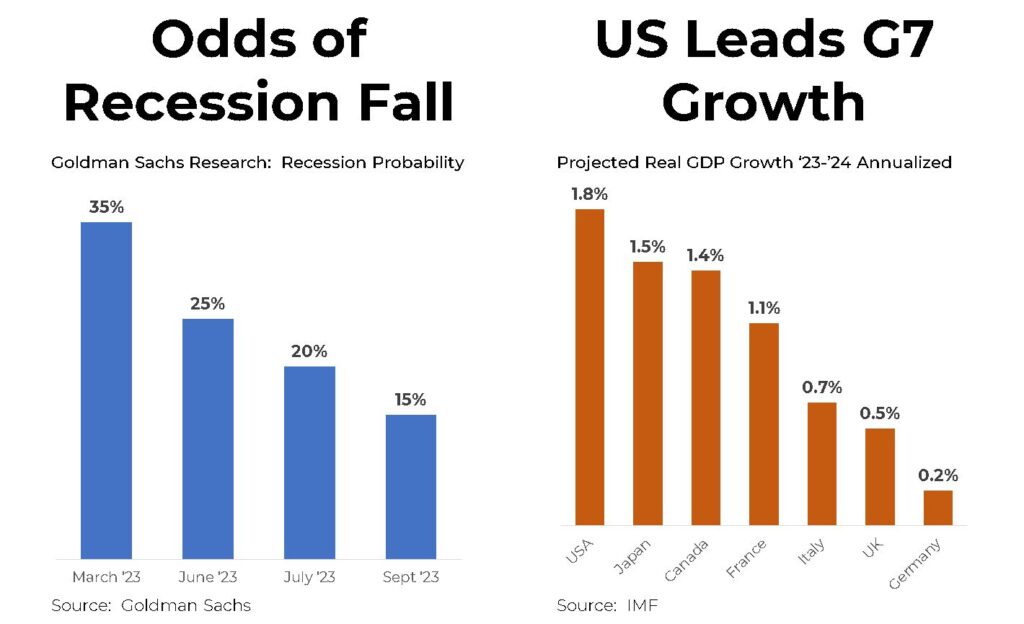

In addition to moderating inflation, the economy continues to exhibit strong momentum, with significant numbers of jobs being added each month. This has caused a burst of optimism that a rare “soft landing” might be achieved – a drop in inflation to the Fed’s 2% target without the need for a recession to achieve that goal. Goldman Sachs, for example, now believes that there is just a 15% chance of a recession over the next 12 months down from 35% just six months ago. This optimism is being reflected in the stock market, which is up 8.5% in November alone.

While it’s admittedly been a rocky few years for the American economy, it’s important to put our economic performance in an international perspective. In that context, we remain by a measure the best house in what might be described in a “tough neighborhood” – slow growth has been a worldwide phenomenon. But we are outpacing our northern neighbor, Canada, as well as Japan, which is finally recovering from years of stagnation. The European picture is grim, with Germany barely expanding, due to an array of challenges from Ukraine to China.

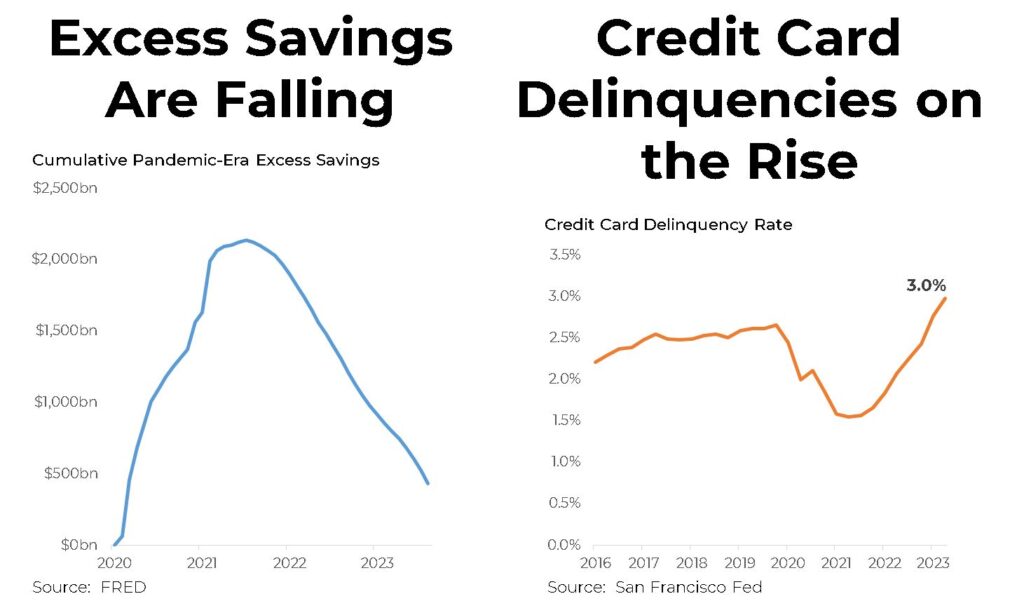

To be fair, there are some warning signs on the horizon. For one thing, at least some of the recent economic strength has been fueled by consumers drawing down more than $2 trillion of “excess savings” that were accumulated during the pandemic from a mix of less spending and government stimulus checks and other assistance. As those extra resources become depleted, consumers may start to pull back on their spending.

Meanwhile, with interest rates on consumer debt still well above 20%, credit card delinquencies are on the rise. While still relatively low at 3%, they are higher than they have been at any time since the financial crisis. Defaults on auto loans by lower income Americans have also been increasing to worrisome levels.