Originally published in The New York Times.

The United Auto Workers has taken to the picket lines in a particularly acrimonious strike, targeting, for the first time, all three of the big Detroit automakers simultaneously.

Popular opinion appears to lie firmly on the union side. And I’m all for the auto workers getting paid more — they have legitimate concerns. But this increasingly militant U.A.W. is overplaying its hand with an overly lengthy and overly ambitious list of demands. I don’t think there’s any way the automakers will be able to meet these conditions, and I worry about the implications for our economy and for President Biden.

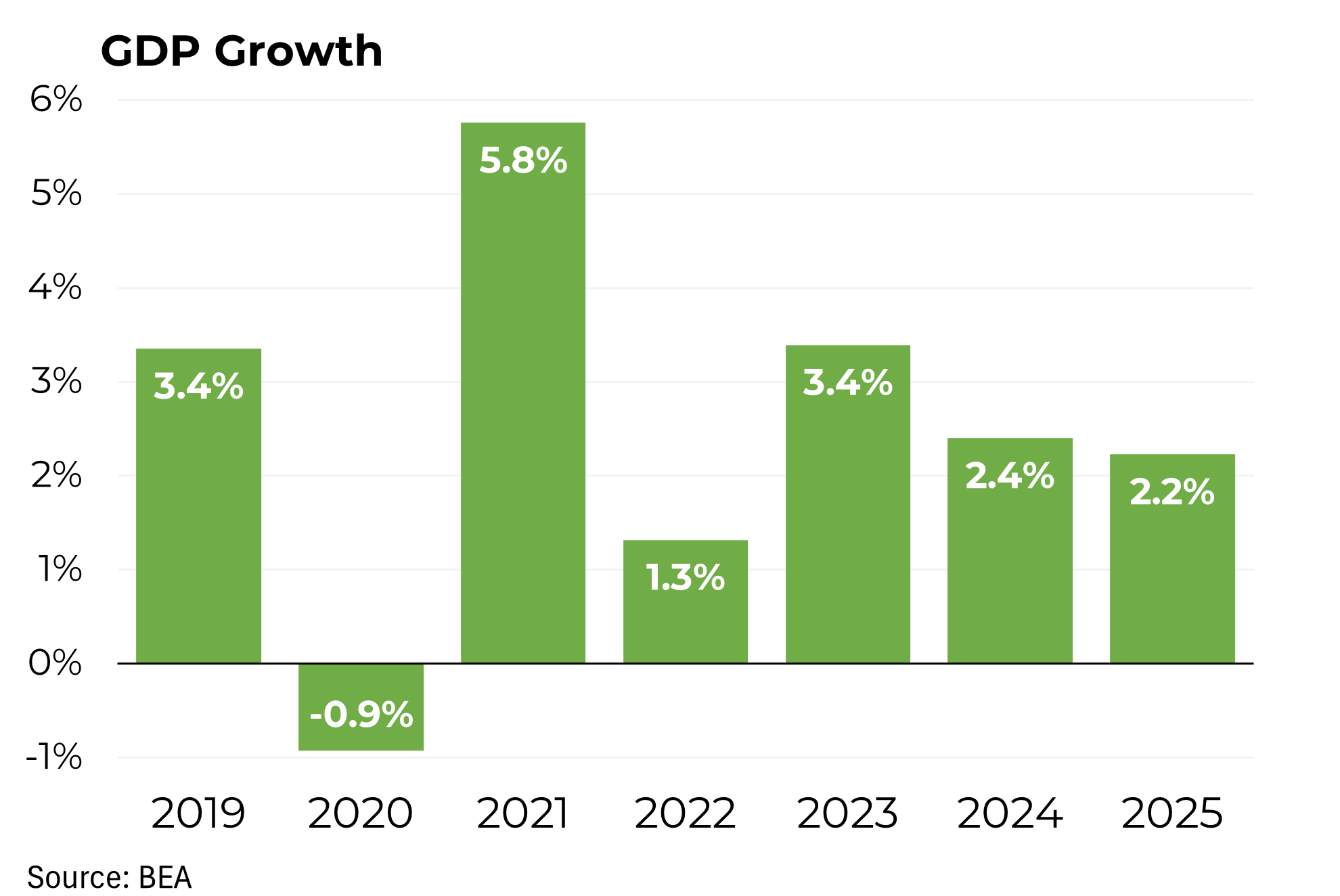

The stakes are high. A prolonged strike, which could lead to far more widespread shutdowns of auto facilities, could jeopardize the economic recovery. Our nearly $800 billion auto industry accounts for 3 percent of economic output, with a particular concentration in the Midwest, where states like Michigan are critical to President Biden’s re-election.

How did we get here? In some ways, these strikes were long overdue.

For much of American economic history, workers’ incomes tracked closely to improvements in their efficiency. The more a typical laborer produced, the higher the pay. But over the last two decades, that relationship has broken down: Productivity grew by 52 percent from 2000 to today, while hourly compensation, after adjustment for inflation, increased by just 30 percent. That occurred for a variety of reasons, ranging from declining unionization to competition from lower-cost imports to increased corporate concentration amid waning antitrust enforcement.

Now, debilitated by high recent inflation and emboldened by an unusually low unemployment rate, unions are pushing back. Even before the U.A.W. strike — and only eight months into the year — the number of days lost to work stoppages in 2023 has reached the highest annual level in more than 20 years.

The U.A.W. has its own reasons for its fury. When I headed President Barack Obama’s auto task force in 2009, we restructured General Motors and Chrysler (now Stellantis) and asked the U.A.W. to make significant sacrifices, including to their generous benefits packages. The U.A.W. agreed. Since then, the automakers have seen their fortunes rebound, yet average real wages for workers have been flat more than three decades.

Under the union’s 1999 contract, the top wage for a production worker at a Big Three automaker was $26 an hour — the equivalent of $43 in today’s dollars — compared with $32 per hour under the union’s 2019 contract.

So I can understand why autoworkers want, and deserve, a big raise. The problem is that in their zeal, they are asking for too much: In addition to pay raises of 36 percent over four years, the list includes a 32-hour workweek with 40 hours of pay; a new version of the pre-recession “jobs bank,” which continued to pay laid-off workers most of their usual wages and a return to defined benefit pensions, company-paid medical benefits for retirees and cost-of-living adjustments.

I know the automakers won’t give all of this. Because they can’t. Or if they do, the workers are likely to pay the ultimate price. Unlike service industries, in which jobs are largely tied to where customers are located, manufacturing companies can — and do — always offset higher labor costs by shifting production from more expensive locales to less expensive ones.

For the auto industry, as foreign car companies have built factories in the United States, that has long meant an exodus of jobs from the heavily unionized Midwest to the far less unionized South, where wages can be significantly lower. More recently, many car manufacturers have opened facilities in Mexico — more than 20 of them by the Detroit companies.

Under the current U.A.W. contract, production workers’ wages (before benefits) range from $18 to $32 per hour. In Mexico, at G.M.’s newly unionized factory, wages range from $9 to $33 a day, which is — sadly — substantially above wages at nonunion plants in Mexico. (And many car executives say that productivity there equals U.S. levels.)

No wonder that the number of auto manufacturing jobs in Mexico, which was just two-thirds the U.S. total in 2010, has matched the U.S. figure since 2018 (and today likely exceeds it). Meanwhile, fewer Americans are now employed in auto manufacturing than in 2006.

Yes, profits at the Detroit Three are at record levels — $37 billion last year. But the auto industry usually operates at thin margins, and even though labor costs are a relatively small fraction of the companies’ overall expenses, those profits can evaporate quickly.

Financial markets are acutely aware of the large-scale challenges facing the Detroit companies. General Motors’ stock price has been essentially flat since the company went public nearly 13 years ago, while the overall equity market has appreciated by 276 percent.

That’s in part because of the competitive challenges the Detroit companies face not only from traditional nonunion players like Toyota or Honda but also from new entrants into the industry like Tesla, which also has no unions. The proliferation of electric vehicles, disproportionately produced by nonunionized companies, will only heighten those pressures.

This is why we need to be particularly careful about limiting the flexibility of the companies to manage efficiently. The companies are limited by contract, for example, in their ability to move workers from one factory line to another. Being able to reorganize the work force within and between plants will be essential to the Detroit Three’s adaptation to the new age of electric vehicle manufacturing.

The U.A.W. and its allies also argue with considerable justification that the gap between workers’ pay and that of senior executives has widened to appalling levels. That, however, has much to do with exploding top level compensation (a phenomenon that has occurred, of course, across virtually all corporate America). From $975,000 in 1978, roughly 60 times the auto industry’s average pay at the time, the compensation package of the chief executive officer of General Motors rose to $29 million last year, more than 400 times the average autoworker’s annual pay.

Unions have an important role to play in redressing imbalances between owners and workers, and the autoworkers are certainly deserving of a substantial pay raise. That said, we need to be careful about killing the goose that lays the golden egg.