Originally published in the Financial Times

Read what you choose into the gyrating US stock market. Blame, if you like, the dysfunction in Washington and the unsatisfying deal that led Standard & Poor’s to remove America’s triple A rating. Or worry about Europe, lurching from one phase of its sovereign debt crisis to another. And of course, many investors fear that torrid growth in emerging market countries is slowing quickly.

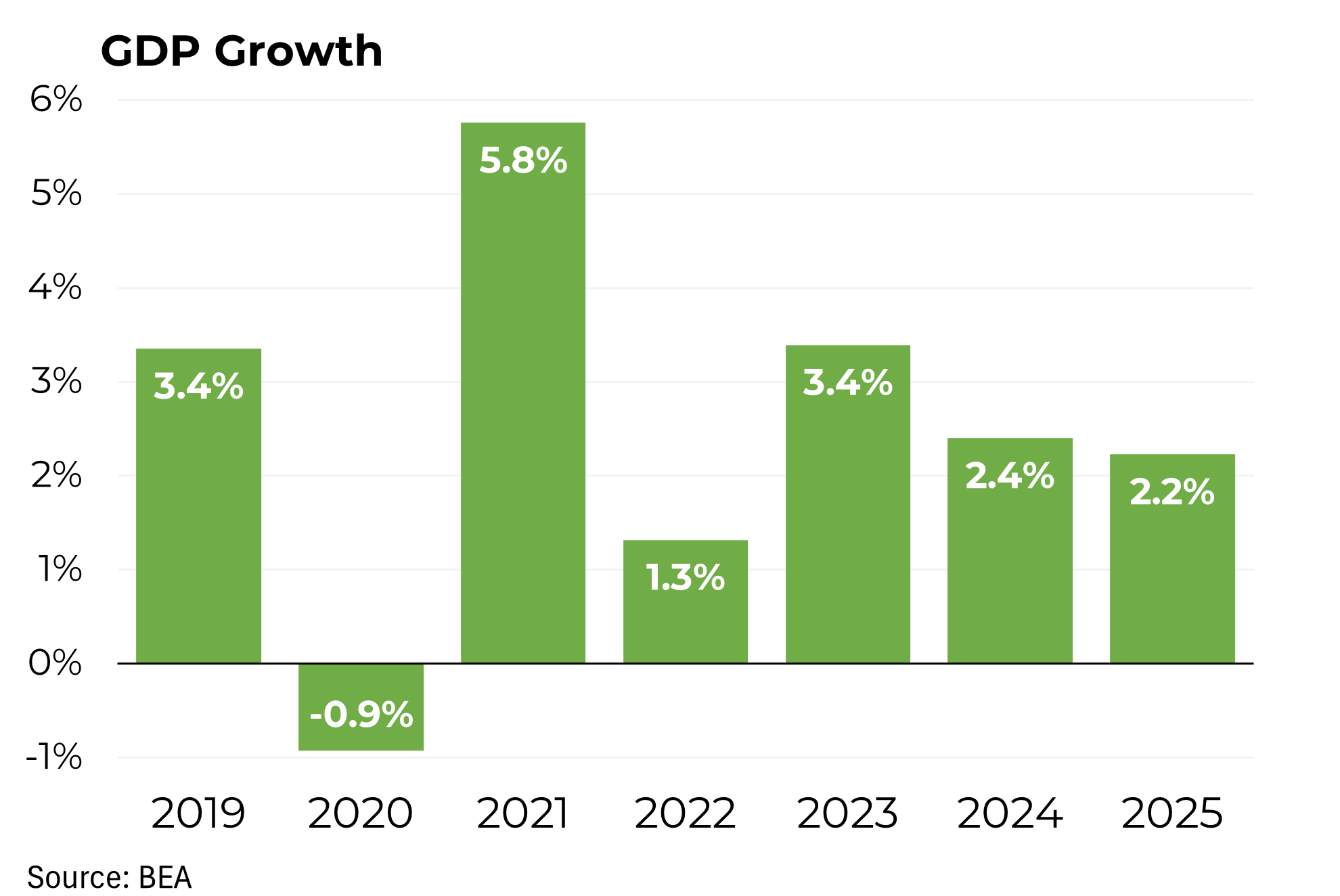

While these cross-currents weigh on stocks, the principal factor behind the swoon in equities is an American economy that is decelerating without a persuasive plan from either political party for addressing it. The economy is enmeshed not in a virtuous circle but in a vicious one, in which weak consumer spending helps restrain American companies from hiring, which in turn means fewer Americans at work generating spendable income, and so on. That’s the crux of the problem, to which the US correctly applied the classic macroeconomic response: an expansionary fiscal policy and an equally loose monetary policy – short-term interest rates at zero and two rounds of quantitative easing.

To a degree, the medicine has worked. However troubled the US economy, it would be in far worse shape without those policies. Instead of modest growth, the country would remain in recession. Instead of nearly 2.5m private sector jobs created in the past 17 months, the bleeding of employment would have continued unstaunched.

But America’s economic problems are deeper than what can be addressed by a dose of Keynesian and monetarist economics that might suppress the symptoms for a time without curing the disease. Our economy is buffeted by the relentless forces of global competition that not only depress job totals but depress incomes. The effect on jobs is all too vivid: shuttered factories whose products come from lower-cost markets. Less familiar – but as pernicious – is the impact on incomes. Last Friday – as on the first Friday of every month – all eyes were on the employment release from the Labor Department. Yet curiously little attention was paid to another component of the monthly report: the change in incomes for working Americans. Since the recession began in 2007, weekly earnings have dropped by 2.6 per cent after adjustment for inflation.

Unfortunately, the culprit is not a mere cyclical downturn that is likely to reverse itself; it is the pressure on American workers to cut their wages in order to remain competitive in the world marketplace. Take the automobile industry. An old line-worker in Detroit makes $28 an hour. The foreign “transplants” assembling cars in the south pay $24. To remain competitive, during the restructuring, the Detroit companies won the right to hire a portion of new workers at $14 an hour.

Most recently, Volkswagen has hired all 2,000 blue collar workers at a new facility in Chattanooga, Tennessee at a starting pay of $14.50 an hour (which, at about $30,000 a year is well below US median income.) Thus are the wages of workers pushed ever further down by the ability of emerging market countries to produce products of equal quality utilising far less expensive labour. Policies like the benign neglect of the dollar can help mask the trend but can’t reverse it.

With funds limited by the need to address the deficit, President Barack Obama has searched for “small bore” ideas that might encourage business to hire workers, such as through his proposal for a “heroes’ tax credit” for companies hiring unemployed veterans. Of course, virtually any such initiative requires the assent of Congress, which has not been in an assenting mood.

Neither these ideas nor other favourites – such as an infrastructure bank or broader tax credits for hiring new workers – would address the problem of faltering real wages. That would require more radical surgery – major education and retraining initiatives, better incentives for starting businesses in industries where America can compete. (Let’s be sure to keep protectionism off the list.)

In the meantime, while Friday’s jobs numbers lower the odds of a double dip, slow growth – with its unfortunate implications – is the best we can expect.