Bestowing the Presidential Medal of Freedom on a discredited economist was another gross Trump injustice.

Originally published in the New York Times

Having diminished so many other great American traditions, President Trump has now moved on to debasing the Presidential Medal of Freedom by awarding it to the most destructive force in economic policy since Herbert Hoover.

That would be Arthur Laffer, popularizer of the Laffer Curve, which purports to prove that tax cuts can pay for themselves by stimulating economic activity.

Famously, Mr. Laffer put forward his concept in the 1970s not by means of the scholarly approach followed by legitimately distinguished economists but by drawing a simple sketch of his curve on a cocktail napkin.

Mr. Laffer’s argument was that higher taxes discourage work, so raising taxes results in less government revenue. Or, as Mr. Laffer preferred to think about it, cutting taxes could increase government revenue.

Instead, the new honoree unleashed nearly four decades of mostly runaway deficits and exploding national debt.

As a young New York Times reporter, I was present at the emergence of Mr. Laffer and his preposterous theory. I thought it was ridiculous then and take little pleasure in having my skepticism proved correct.

But don’t take my word for it. The theory has been derided by economists from the left and the right. A 2012 survey of 40 prominent economists failed to find a single one in agreement with Lafferism.

Seven years earlier, the Congressional Budget Office, under the leadership of a conservative, Douglas Holtz-Eakin, calculated that a 10 percent cut in federal income tax rates would result in a significant net revenue loss.

Then there’s the historical evidence.

The nation’s first foray into Lafferism came with Ronald Reagan, whose initial huge tax cut, in the Economic Recovery Tax Act of 1981, reduced revenues by 9 percent over the first two years, exactly the opposite of what Mr. Laffer predicted.

That led to tax increases in 1982, 1983, 1984 and 1987, ultimately reversing about half of the initial tax reductions. Even those hikes proved insufficient.

After promising no new taxes (“read my lips”), President George H.W. Bush was forced by stubbornly high deficits to raise them, undoubtedly contributing to his election loss to Bill Clinton.

Regrettably, that wasn’t the end of Mr. Laffer’s influence. When President George W. Bush was considering what proved to be another round of ill-advised tax cuts, Vice President Dick Cheney, who had been present at the creation of the famous napkin drawing, reportedly said, “Reagan proved deficits don’t matter.”

Unfortunately, that’s not all the fiscal damage that Mr. Laffer has done. When Sam Brownback was governor of Kansas, Mr. Laffer convinced him to eliminate income taxes for approximately 330,000 of the state’s top wage earners. The state’s budget quickly swang from surplus to deficit, resulting in drastic cuts to funding of important programs and weakening Kansas’s economy. In 2014, voters revolted; Mr. Brownback was barely re-elected, and by 2017, his own party had reversed most of the tax cuts, overriding his veto. (Mr. Brownback now serves in the Trump administration as ambassador at large for international religious freedom.)

Other examples of Mr. Laffer’s wackiness abound. In April, he declared that President Obama was responsible for the Great Recession. Never mind that the downturn started a full year before Mr. Obama took office; Mr. Laffer argues the stock market began falling in anticipation of Mr. Obama’s arrival and that led to the recession.

O. K., but then there’s the housing bubble fueled by irresponsible subprime mortgage lending, the explosion of derivatives and the dangerous overleveraging of the financial system, all of which began long before Mr. Obama’s ascension.

Destroying the notion of fiscal responsibility continues to be Mr. Laffer’s main focus as further articulated in his 2018 book, “Trumponomics: Inside the America First Plan to Revive Our Economy,” written with Stephen Moore, who recently withdrew from consideration for nomination to the Federal Reserve amid widespread criticism of his economic policy positions and revelations about his personal life.

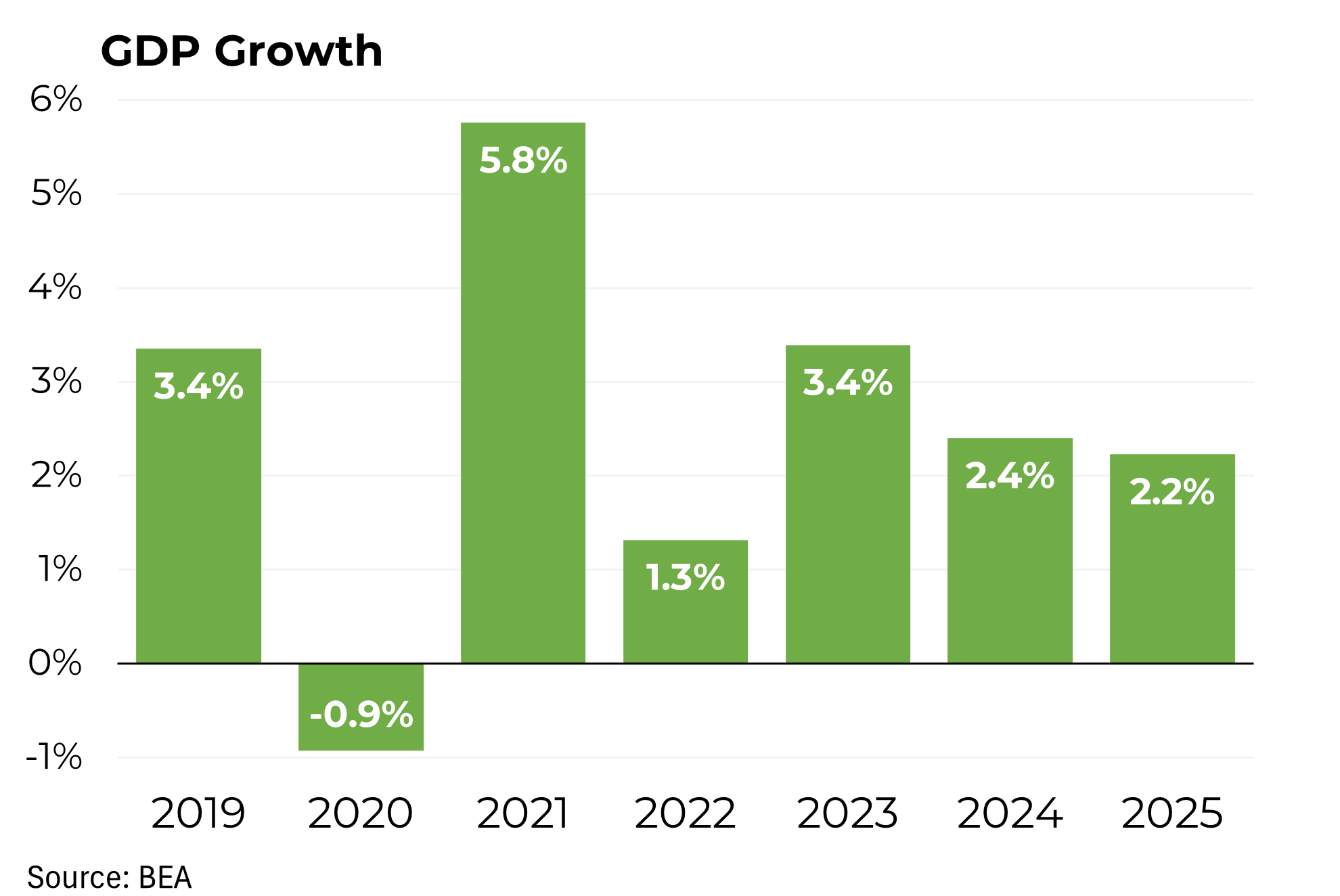

In it, the authors argue that the Trump tax plan would raise economic growth to at least 3 percent to 4 percent while not worsening budget deficits. Well, here we are, with growth in the current quarter likely to be down to well less than a 2 percent rate and the budget deficit exploding.

That’s in part because revenues in 2018 were $275 billion less than what the Congressional Budget Office projected before the tax cut was passed. All told, the deficit is likely to exceed $1 trillion in the next fiscal year, on its way to $2 trillion over the coming decade.

Of course, Mr. Laffer’s paean to Mr. Trump couldn’t have had anything to do with an award received by the likes of Warren Buffett and the economist Robert Solow, recipient of the Nobel Memorial Prize in Economic Science. Or could it?