Steven Rattner testified this morning before the House Ways and Means Committee on tax reform. At a similar hearing, almost exactly a year ago, Steve outlined four tests that any sound bill should meet:

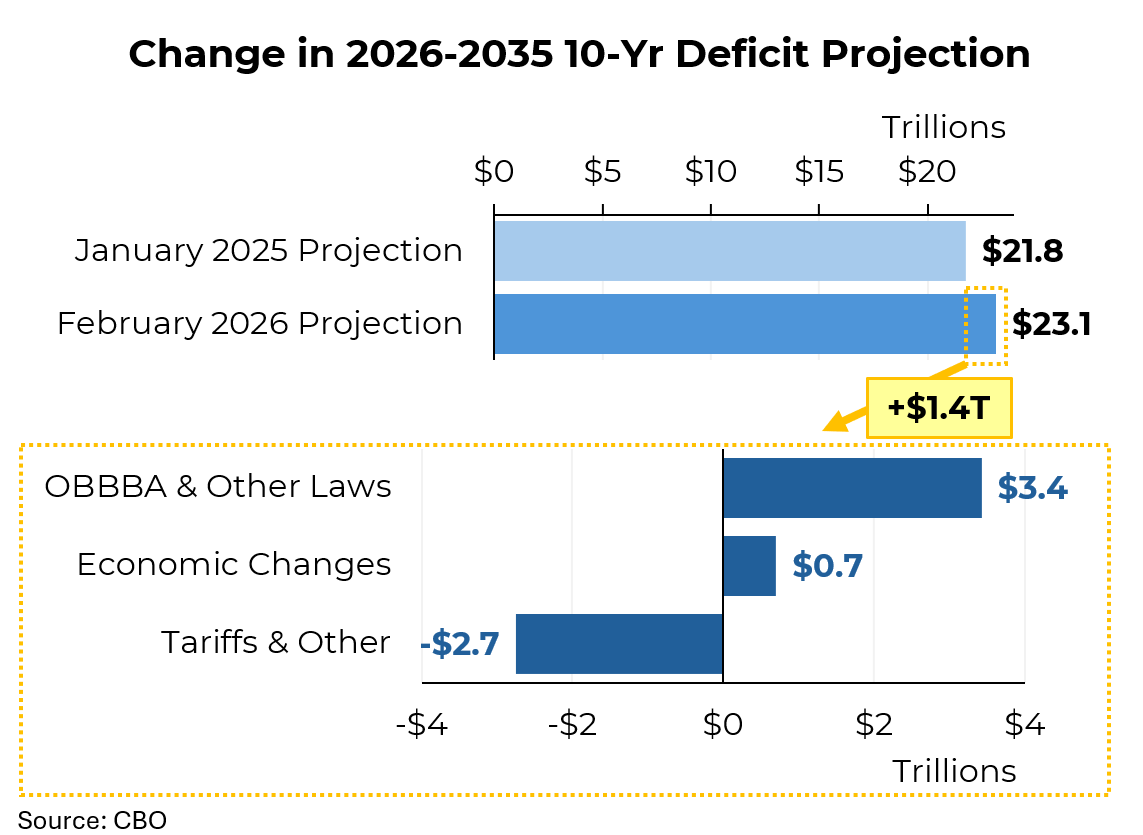

1) It should be deficit neutral, given projections for rising fiscal gaps

2) It should be fair and certainly not diminish the progressivity of our system

3) It should be growth and investment enhancing

4) It should improve our international competitive position

Now, one year later, we know that what was ultimately passed failed to address most of these tests. First, the tax bill will surely increase our deficit in debt as the resulting contribution from growth is widely expected to fall short of supporters’ claims. Secondly, just 16% of benefits will go to those making less than $75,000 per year; the balance is headed to business and upper income Americans. The legislation also failed to address numerous loopholes that Republicans promised to eliminate and many unnecessary benefits were added. Importantly, we’ve yet to see any data-driven evidence that the tax cuts are boosting growth and investment – to date, the Trump tenure has yielded slower gains in hiring, wages and investment. Meanwhile, we are seeing record stock buybacks, higher corporate dividends to shareholders and little of tax cut windfall passed on to workers. At a time when the nation was grievously in need of substantive tax reform, a unique opportunity was largely squandered.

The full testimony is attached.