On MSNBC’s Morning Joe today, Steven Rattner presented charts showing how the proposed tax cut – contrary to its sponsors’ claims that it is oriented toward the middle class – would reward business and the wealthy, while exploding the deficit.

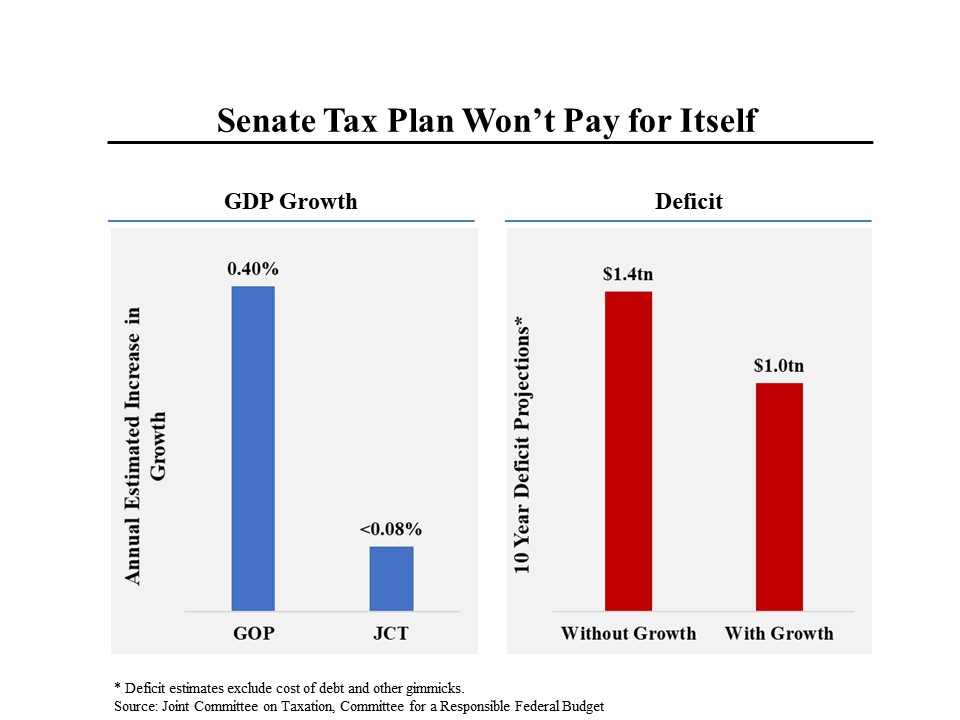

Late yesterday afternoon, the legislation’s prospects were dealt a significant blow when Congress’s Joint Committee on Taxation concluded that the plan would increase economic growth by less than 0.08% per year, compared to the 0.4% that the Republicans have been predicting. The lower number is in sync with a University of Chicago survey released earlier this week that found that only 1 of 38 (ideologically diverse) economists believed that the tax plan would add “substantially” to economic growth.

Most importantly, the JCT found that the small amount of additional growth from the tax plan would only yield about $400 billion of additional revenue in the coming decade, meaning that the tax legislation would add at least $1 trillion to the national debt and more likely, as much as $1.7 trillion when gimmicks tucked into the legislation are factored in.

A further blow came the same day from the Senate parliamentarian, who ruled that “triggers” – tax increases that would automatically take effect if revenues fell short – could not be included. This has put significant pressure on deficit hawk Senators like Bob Corker of Tennessee, who pushed for triggers, to reconsider their support for the tax bill.

On Wednesday, President Trump said that the tax bill “would cost me a fortune.” That was a lie. While we don’t know what the President’s current status is (because he won’t release his returns), The New York Times analyzed his 2005 tax return, which had been leaked to them. The Times found that Mr. Trump would have saved nearly $40 million in taxes that year, mostly from repeal of the alternative minimum tax, but also from cutting the so-called “pass through rate,” the taxes charged to individual business owners.

But the big homerun for Mr. Trump would come from the repeal of the estate tax, which is included in the House bill, (although not in the Senate bill.) At his claimed net worth of $10 billion, that would save his heirs more than $4 billion of taxes. Even at the $2.86 billion of holdings that independent experts have calculated Mr. Trump actually has, it would amount to a tax break of more than $1 billion.

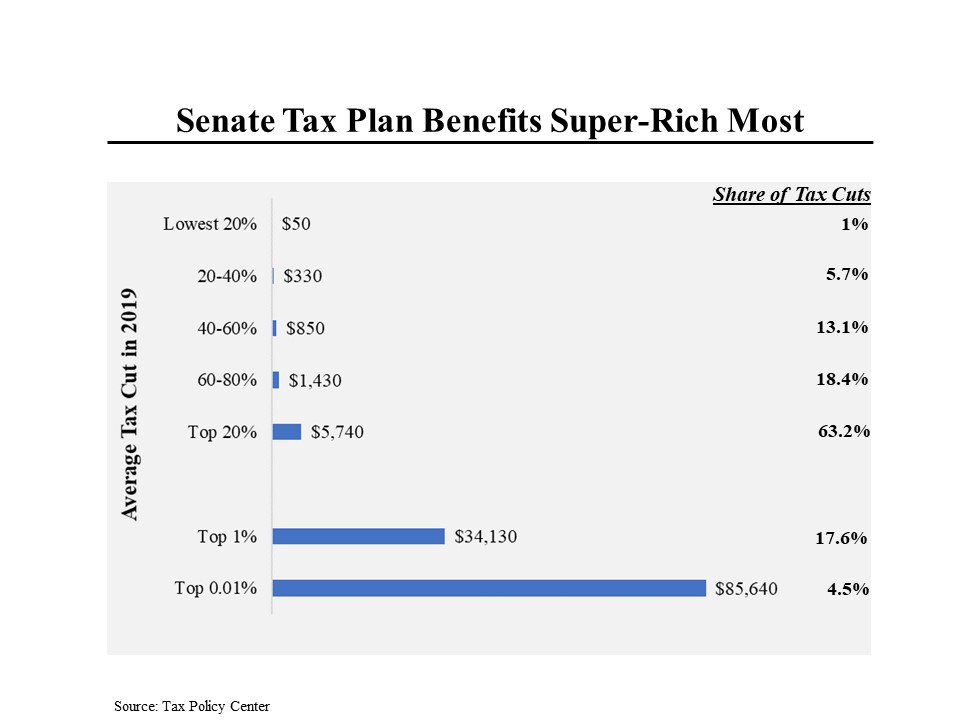

Most significantly, the bill provides vast benefits for the rich while doing little for the middle class and those further down the income scale. In 2019, an average American will receive an $850 tax break. Not much but at least it’s more than the $50 that those at the bottom can expect or the $330 that those in the second quintile will be given. Meanwhile, Americans in the top 20% will receive $5,740 (on average) with much higher numbers going to those in the top 1%, not to mention the top 0.01% (a projected $85,640 to each of these 16,000 or so taxpayers.)

Looking at it from another perspective, around 63% of the total benefits will go to the top 20% while the other 80% will get significantly less than half of the reductions.