Originally published in the Financial Times

Never particularly grounded in reality, budget talk in Washington has taken on an Alice in Wonderland quality. A paroxysm of deficit cutting is sweeping the US, with Republicans and Democrats hurling around dubious figures like confetti. But both are trying to win the battle to be the party of fiscal responsibility without broaching the one step every sensible analyst knows is necessary to solve America’s budget crisis: meaningful tax increases.

Fiscal hawks can be heartened by the all-deficit-cutting, all-the-time mood; a consequence of the triumph of the Republicans and their Tea Party allies in the 2010 midterm elections. Indeed, a few diehard liberal elements apart, both sides have grasped deficit reduction in a smothering embrace. With conservatives determined to hold raising the US federal debt ceiling hostage to a deficit agreement, some progress toward reducing the current gap seems likely.

But like so much about Washington, a closer inspection should temper any euphoria. Take the recent hard-fought agreement to reduce the funding gap in this fiscal year by $38bn. It looks impressive until you examine the fine print. It included, for example, measures to eliminate $6.2bn of “budget authority” for census-taking – even though the decennial census is complete and that money was never going to be spent. Nonetheless, scrubbing those funds garnered full credit.

All told, according to calculations by the Congressional Budget Office, spending this year will be reduced by just $352m. Additional savings in later years will total more than $20bn, but this is still some way short of the headline figure. More important, however, is the way longer-term proposals from both sides stretch credulity.

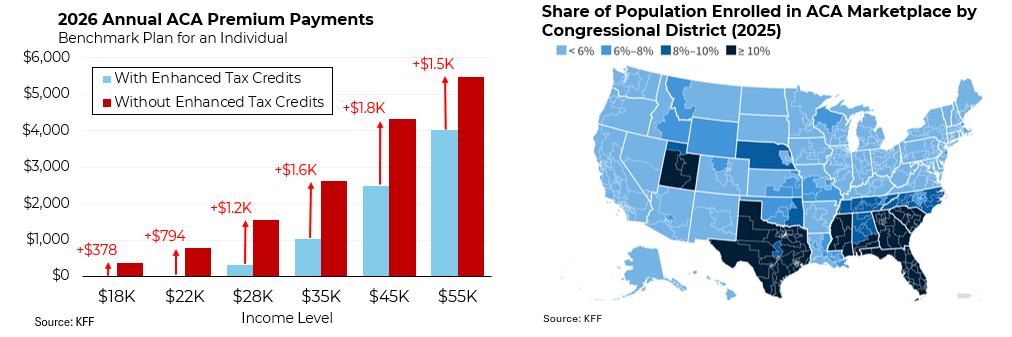

The Republicans’ alternative plan gets close to the $4,000bn target established by the independent Bowles-Simpson commission, but it does so by amputating health plans that are popular even among staunch conservatives. A recent McClatchy-Marist poll found that even 70 per cent of Tea Party supporters were opposed to cutting Medicaid and Medicare. The Republican plan does not so much trim these programmes as eviscerate them. The Republicans’ numbers also do not add up. Their plan includes $1,400bn of savings by removing parts of Mr Obama’s health plan. Yet the CBO says this would raise the deficit by $230bn over the next decade.

President Barack Obama’s plan tiptoes around these issues, and so falls short of the $4,000bn standard: over the next 10 years the non-partisan Committee for a Responsible Budget says it will cut only $2,500bn. Legerdemain also abounds: to get to the higher target Mr Obama introduces a magical 12-year savings plan, in which more than $1,500bn of savings materialise in the last two years.

The jousting in Washington contrasts with more dramatic steps taken by US states such as Wisconsin and New Jersey. Forced into action by balanced budget laws and vigilant bond markets, they have been slashing everything from workers’ pension benefits to Medicaid, the lower-income health programme. These cuts also mostly take effect now, not in 10 or 20 years. For example, after limiting organ transplants to Medicaid recipients Arizona is proceeding with other reductions, notably eliminating 138,000 childless adults from eligibility.

No one should applaud such necessities but without new sources of revenue, Washington will be forced to make similar cuts in time. Under any realistic forecast it faces lingering deficits, and large unfunded pension and healthcare obligations. This would be mitigated if the biggest flaw in the current debate can be overcome: the unwillingness of either party to consider sensible tax increases.

Even with reasonable spending reductions, such as those proposed by Bowles-Simpson, there is no possibility – absolutely no possibility – that the US government can responsibly deliver the level of healthcare, retirement income and other services that every poll shows the American public wants, without a lot more revenue – otherwise known as higher taxes.

While Mr Obama’s plan does propose some rises for the top 2 per cent of the population, both sides refuse to reckon with sensible increases for other groups, for instance raising the current 15 per cent tax rate on dividends and long-term capital gains. A report last week from the Internal Revenue Service found that the effective tax rate for the 400 highest-income Americans dropped from 26 per cent in 1992 to 17 per cent in 2007, in large part because of this 15 per cent provision. Warren Buffett now says his overall tax rate is lower than that of his secretary; one of many examples of this outrage.

When Congress returns next week, vice-president Joe Biden will convene a group of leaders from both parties to try to reach a compromise. Regrettably, the toxic politics of tax will forestall, at least until after the 2012 election, the sensible step of letting all the Bush-era tax cuts expire next year as scheduled. This would not be popular or pleasant: the average American family would pay $1,500 more a year. But those tax cuts were not justifiable when introduced and, after a decade of soaring federal spending, and at a cost of about $3,000bn over the next 10 years, they are not justifiable now. Tax rates during the Clinton-era were among the lowest in modern American history. The economy boomed, and all workers saw their incomes rise. What was so bad about that?

The writer served as counsellor and lead auto adviser to the US Treasury secretary and is the author of Overhaul