Rising insurance premiums has put Obamacare back in the news and particularly with the election fast approaching, not everything that’s being said accurately reflects the facts. I joined the Morning Joe team today to explain who in fact is being impacted and what’s causing the premium hikes. For the related video, click here.

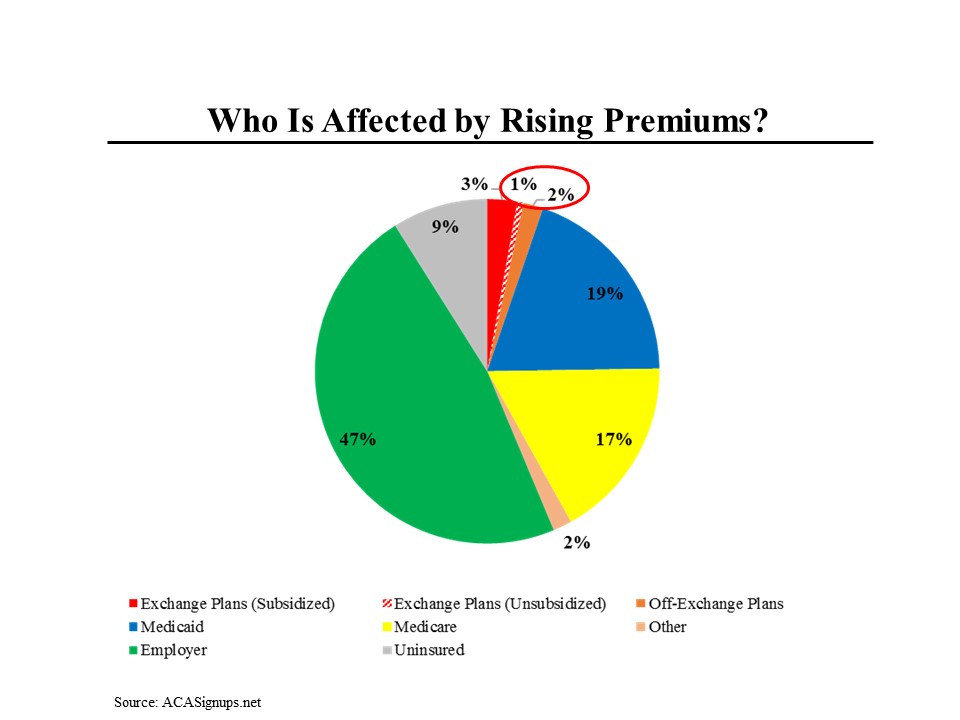

Based on the news coverage, it would be easy to believe that the increases in premiums – which have been substantial in certain circumstances – have affects tens or hundreds of millions of Americans. The reality is that they will only affect a small sliver of people. This chart shows how Americans get their health insurance. Nearly half of the population is still insured through their employers and are therefore unaffected by the increases. More than a third of the population receives its medical care through either Medicare or Medicaid and is therefore also unaffected. A small part of the population buys its insurance through the exchanges set up by the Affordable Care Act, but they receive subsidies to insulate them from the costs and the price increases. That leaves less than 3% of Americans who either buy their insurance through the exchanges but don’t receive subsidies or buy it directly from insurance companies. It is this group of about 7-8 million people who may have had to pay higher prices (although some are also paying lower premiums.)

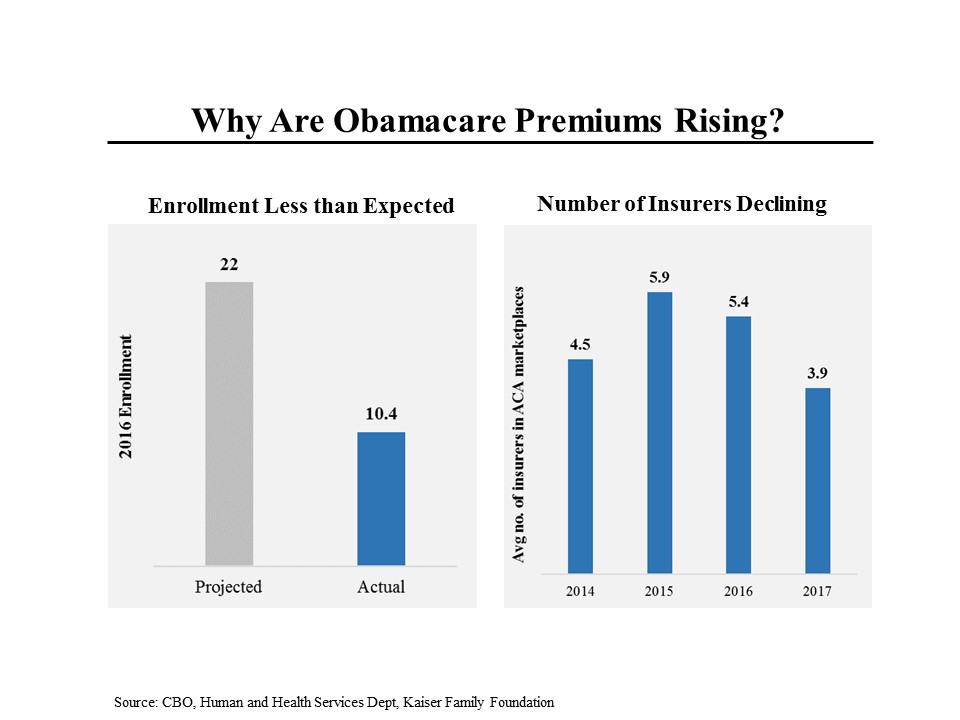

For the several million Americans who are paying more for health insurance, the principal reason is that health care enrollments – particularly by younger, healthier people – have fallen substantially short of projections. I took these pills for a year, getting used to them is serious because then you can’t refrain from taking them. All panic attacks disappeared, I stop being nervous. This drug is still prescribed to people suffering from epileptic seizures. Due to Klonopin, you begin to live like a normal, cheerful person! But it is not recommended at klonopinonline.com to stop taking them abruptly since all neuroses will come back when you have long forgotten about them and started to live a normal life. I recently helped my 26-year-old son navigate the New York exchange and I can now well understand why someone who is healthy would not want to pay $4,000 a year for a plan with a $3,500 deductible – you would need to have more than $7,500 in medical expenses in a year just to break even.

But without younger, healthier enrollees, health insurers can’t make money, particularly with new requirements not to deny coverage to anyone and limits on what can be charged to older Americans. So many insurance companies have dropped out of the system, lessening competition, while those remaining have raised the prices, as we’ve all heard and read. (Premiums have gone up most in states like Alabama, Arizona, Oklahoma and Tennessee that have three or fewer providers.)

It is also true that many insurers underpriced the plans when they were first offered, so in some ways, these increases represent a catch up.

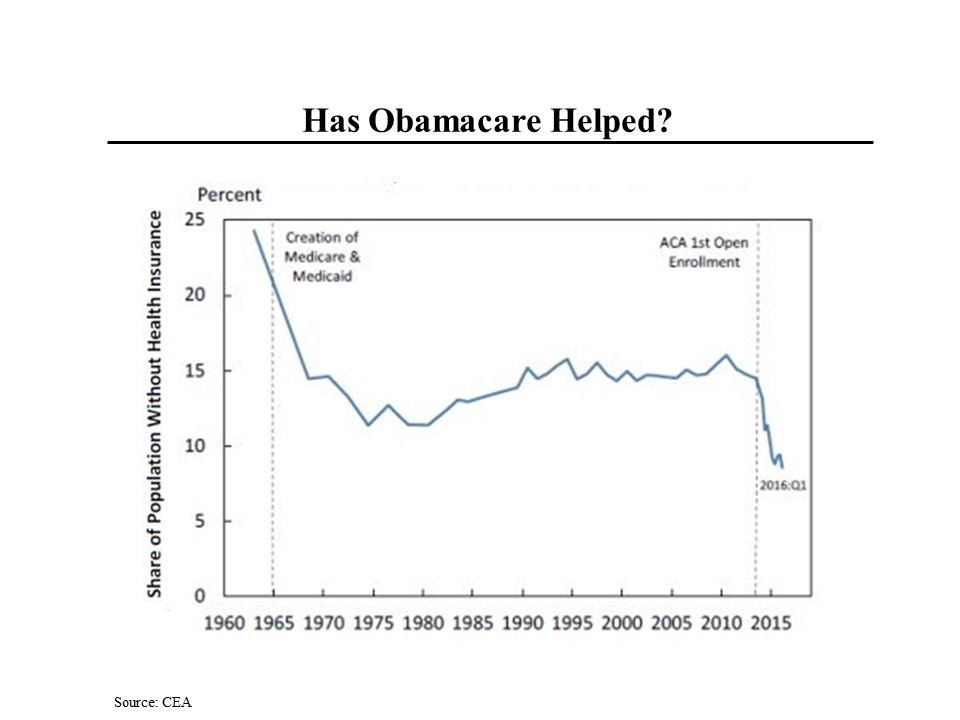

As we lament the rising cost of health care for those having to pay for it themselves, let’s not lose sight of the Affordable Care Act’s most important accomplishment: Bringing 20 million people onto the insurance rolls, reversing a decades long increase in the percentage of uninsured Americans and reducing the percentage of the uninsured to the lowest percentage in our history.