Originally appeared in The New York Times

IF Ben S. Bernanke were to write a sequel to his recently published memoir, “The Courage to Act,” he might well want to call it “The Courage Not to Act.”

For that’s what the Federal Reserve needs at its rate-setting meeting today and at least some of those to follow — the fortitude to resist the mounting pressure to raise interest rates from their near-zero level.

To a significant clutch of Fed policy makers and the perennial chorus of inflation worriers have been added new voices, ranging from emerging-market countries feeling “Fed fatigue” as their currencies gyrate with each round of speculation to leading businessmen to presidential hopefuls like Donald J. Trump.

“She should raise rates,” the property mogul Barry Sternlicht said recently on “Bloomberg Go,” referring to the current Fed chairwoman, Janet L. Yellen. “Absolutely she should raise rates and return the markets to some semblance of normalcy.”

Happily, two central bank governors — Lael Brainard and Daniel Tarullo — have begun publicly tugging in the opposite direction, positing that continuing weakness in many economic indicators argues against higher rates.

I stand with Ms. Brainard and Mr. Tarullo: The Fed should step back from its implicit commitment to raise rates this year and hold firm until there is clear evidence of inflationary conditions.

That’s not the current picture. Inflation, as measured by the central bank’s preferred index, has been falling. It is now at 0.3 percent. Measures of expected future price increases have been similarly sliding, to about 1.5 percent, meaningfully below the Fed’s 2 percent target.

Perhaps most worrisome, even though our most recent recession officially ended in June 2009, wages, after adjusting for inflation, have yet to rise significantly, in part because of slack in the labor market. Without higher incomes, our current tepid rate of economic expansion won’t accelerate.

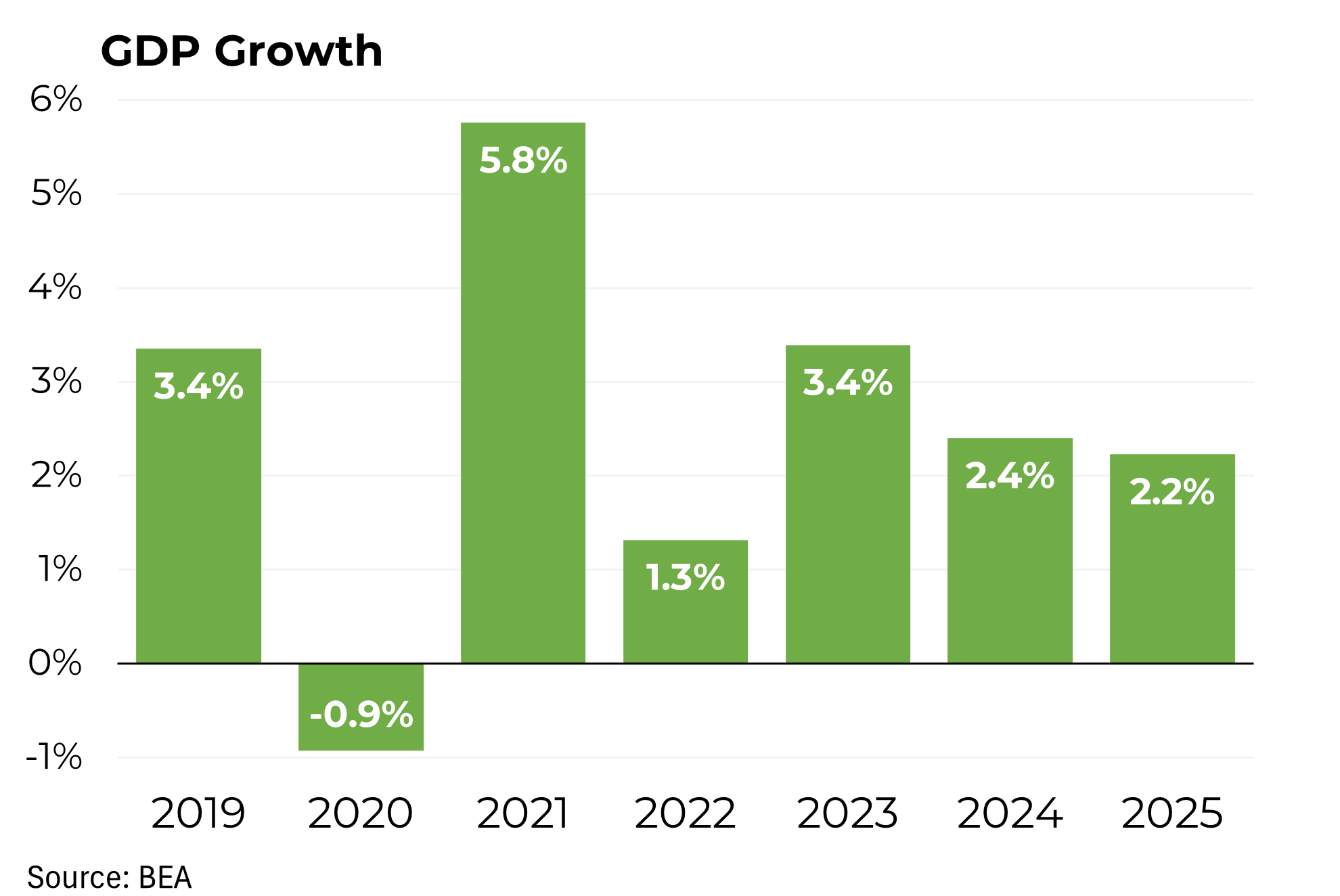

Currently the economy is expanding at just over a 2 percent rate with little reason to expect improvement. Important sectors, from business investment to retail sales, are anemic.

The Fed is projecting a jump in the growth rate, but the central bank is often wrong in its economic forecasts, anticipating faster growth, more inflation and, consequently, higher interest rates, than have actually come to pass.

Now, the financial markets are again questioning the Fed’s judgment and are expecting later and smaller interest rate increases than the Fed is suggesting are likely. It’s time for the central bank to recognize the slow-growth reality, as important voices like former Treasury Secretary Lawrence H. Summers have urged.

The other arguments in favor of beginning to raise rates are equally weak. Bizarrely, some say rates should be increased now so they can be decreased later in the event of renewed economic weakness. That’s like not eating when you’re hungry so you can eat at another time.

Should the economy once again sag, the Fed still has tools at its disposal, such as renewing its bond buying. And other policy makers could legislate tax cuts or spending increases.

Indeed, in a better world, we would not even be relying so heavily on the central bank to stimulate our lagging economy; a more expansionary fiscal policy would also be playing a part.

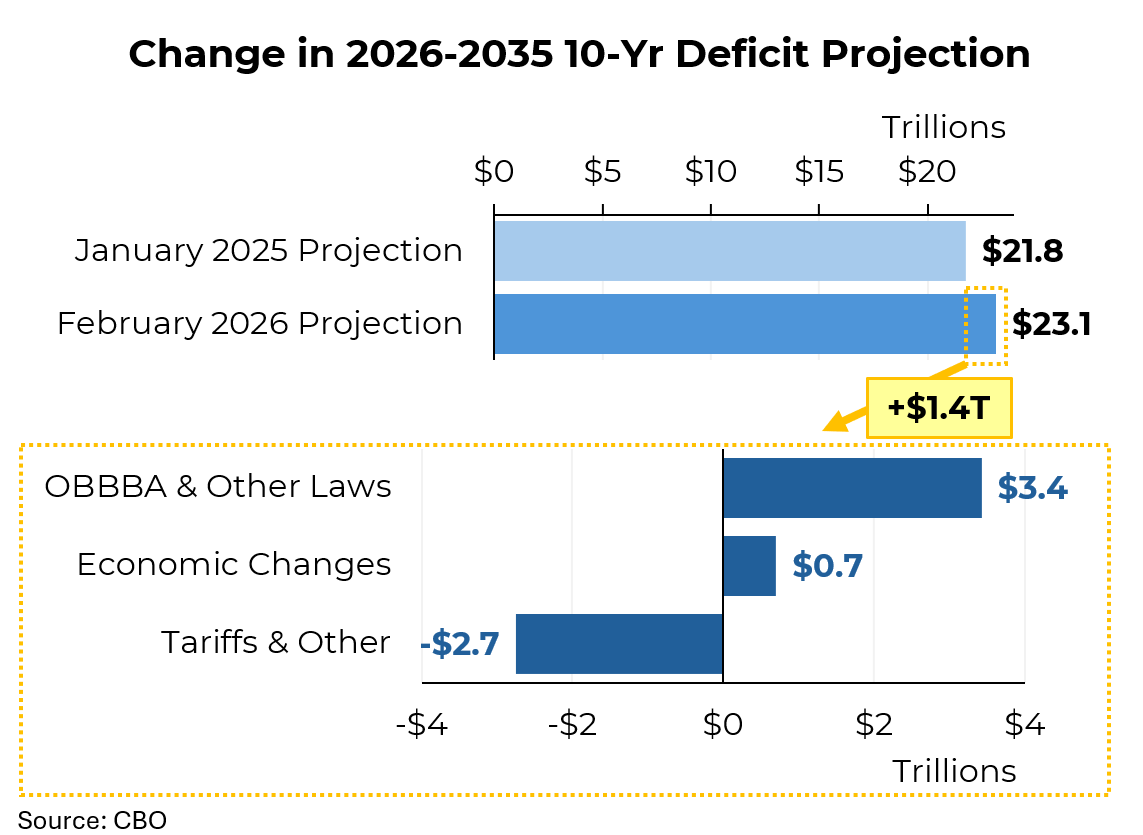

But short-term budget-cutting fever in Washington has reduced the deficit by cutting exactly the wrong things, like education, infrastructure, and research and development.

More balanced economic policies would also help address another criticism of low interest rates: their propensity to increase income inequality by inflating the value of stocks and other assets that are disproportionately owned by the wealthy.

To conservatives, rising asset prices signal greater chances of another meltdown, similar to what occurred in the mid-2000s. But the stock market is down 3 percent since its peak in May. And housing prices have yet to return to pre-crisis levels.

Let’s also not forget that this crowd has been consistently wrong. Back in November 2010, 24 leading conservative economists, financiers and academics decried the Fed’s asset buying as risking “currency debasement and inflation” while not promoting employment.

With 11.4 million new jobs, and no inflation in sight, perhaps we can agree that the Fed’s full-throated efforts to stimulate the economy were a constructive contributor to our recovery.

For nearly seven years, members of the Federal Open Market Committee have dutifully gathered every six weeks or so, pondered bits and bytes of economic data and decided not to change interest rates.

Until the evidence indicating a need to begin raising rates becomes compelling, I’m hoping that the inaction faction prevails over the action faction.