Originally appeared in The New York Times.

Although developments on the political front were certainly dispiriting, for the first time in years, the economic news was not all gloomy. But with the economy improving, there was less focus on the continuing need to address flagging incomes, rising inequality and unbalanced government spending. Below are 10 charts to illustrate the crosscurrents of the past year in economics and politics:

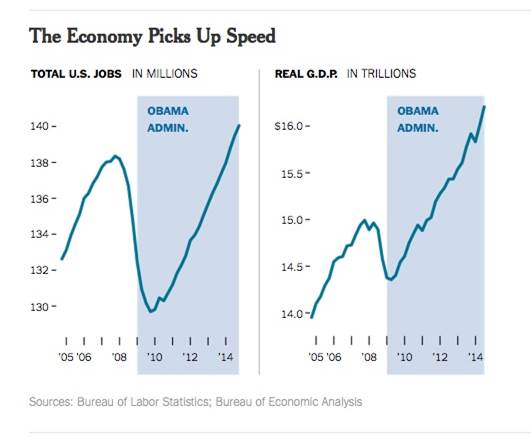

By the end of 2014, even the most hardened cynics had to concede that the darkness that had pervaded the American economy since 2008 had lifted a bit. Most visibly, the rate of job growth accelerated, from 194,000 per month in 2013 to 241,000 per month in 2014. By May 2014, the total number of jobs had run past its previous peak in early 2008. Meanwhile, the overall economy began to expand at faster annual rates — 4.6 percent in the second quarter and a remarkable 5.0 percent in the third quarter.

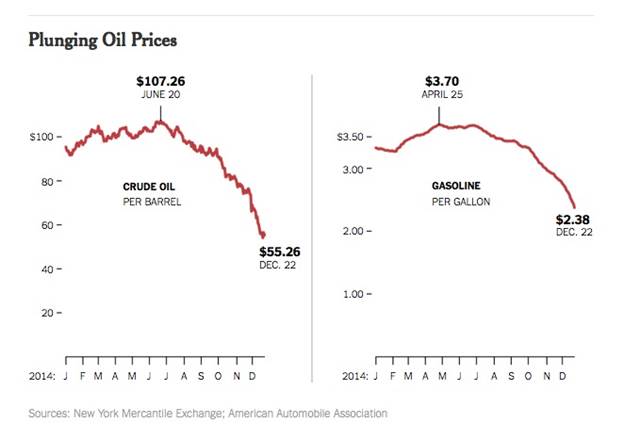

An autumn collapse in oil prices brought more good news. A barrel of oil that fetched $107 in June commanded only $55 by Dec. 22. For consumers, that meant gasoline prices that fell to an average $2.38 per gallon, compared with their peak of $3.70 in April. All told, the drop in oil prices was equivalent to an annual tax cut of about $750 per American family. And with the United States still importing an estimated 26 percent of its petroleum, lower prices raise the economy’s growth rate and reduce the balance of payments deficit.

Economic news was not all positive. Most important, there were only hints that stagnating wages might finally be turning upward. November figures showed that the cash pay of hourly workers rose by a slender 0.8 percent after adjustment for inflation over the previous year. The picture is modestly better when cash benefits are added to the equation. In the past two years, median family incomes, including items such as pensions, Social Security and unemployment insurance, edged up to about $53,500 from $52,600 in 2012. But they have remained well below their previous peak of $57,500 in January 2008. The decline between 2009 and 2012 was the first time this inflation-adjusted measure had dropped during an economic recovery.

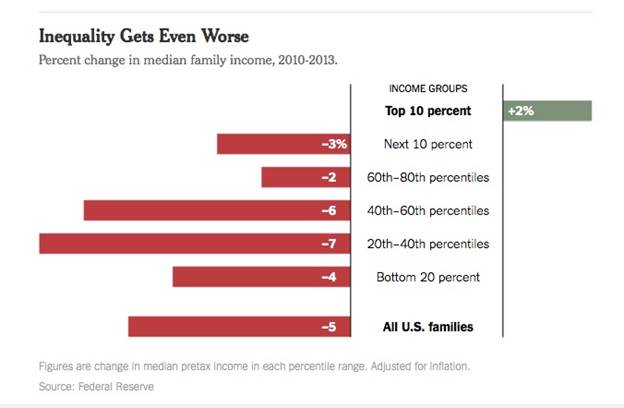

Not surprisingly, stagnant wages contributed to rising inequality. In September 2014, the Federal Reserve released a study showing that between 2010 and 2013, only the top 10 percent of Americans saw their incomes increase. Depressingly, incomes for lower- and middle-class Americans fell the most. The news by occupation was similarly discouraging: Wages for manufacturing workers fell by 2.2 percent from January 2010 to November 2014, with those for autoworkers dropping by 11.7 percent. Lower-wage jobs in leisure and hospitality also saw pay fall. Perhaps not surprisingly, higher incomes accrued to those in finance, education and health, and other professions.

Happily, the problem of income inequality was brought front and center by the publication of the economist Thomas Piketty’s landmark book, “Capital in the 21st Century.” Originally written in French, weighing in at 696 pages and laden with incomprehensible equations, the book nonetheless spent 22 weeks on the New York Times best-seller list, including three weeks at the top. While Mr. Piketty’s solutions, such as a global wealth tax, were mostly impractical or ill advised, his meticulous identification of the problem was unassailable. By 2012, a mere 0.01 percent of American households — earning an average of $21.5 million annually — commanded a near-record 4.1 percent of all income, compared with 0.5 percent when income inequality hit its trough in 1973.

The federal government does far less to ameliorate the disparities than the governments of other developed countries. As measured by the Gini coefficient (the higher the number, the more unequal), inequality in the United States is no worse than in most developed countries when calculated without regard to taxes and transfer payments such as Social Security, unemployment benefits, food stamps and the like. But because social programs in European countries are so much more expansive, inequality in the United States tops the list. The rush to cut government programs will only exacerbate this disparity.

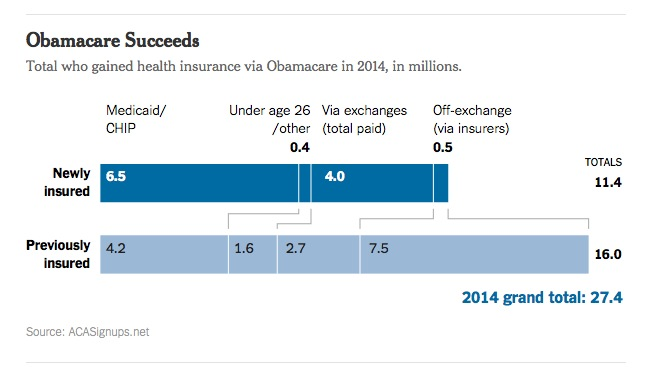

After a website meltdown in late 2013, this year brought proof that the Affordable Care Act was delivering on its promises: More than 11 million previously uninsured Americans are now covered by a health care plan, about half of them Medicaid recipients at the bottom of the economic ladder. Another 16 million Americans who were previously insured also signed up — many of them had substandard plans that were upgraded as a result of the A.C.A. In late 2014, Americans had their second opportunity to enroll in health care plans under the auspices of the new law. The process went off smoothly, a stark contrast to the chaos of the previous year.

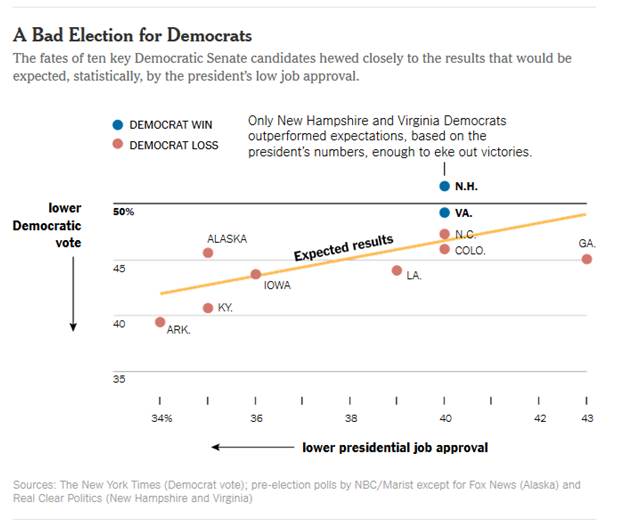

It’s hard to view the results of the 2014 midterm election as anything other than a referendum on President Obama. In fact, a statistical analysis of 10 key Senate races shows that the president’s low popularity ratings explain about 65 percent of the vote shares achieved by these individual Democratic candidates. In Arkansas, where President Obama’s approval rating was only 34 percent, the incumbent, Mark Pryor, received less than 40 percent of the vote. Weak candidates in states like Kentucky and Louisiana underperformed their predicted vote share. Jeanne Shaheen in New Hampshire and Mark Warner in Virginia benefited from the president’s relatively high popularity (40 percent!) but still had to outperform their expected shares to win re-election.

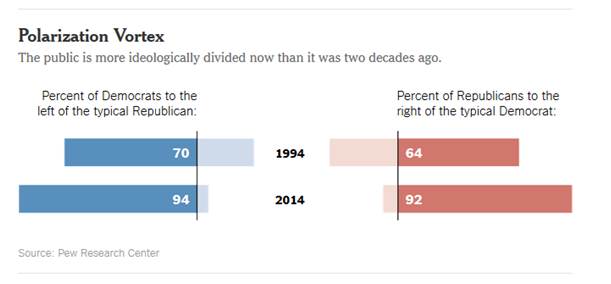

Not surprisingly, a new Pew study found that the American public continued to grow more polarized, with both Democrats and Republicans moving further into their ideological corners. Today, 94 percent of Democrats are to the left of the median Republican, compared with 70 percent back in 1994. Similarly, 92 percent of Republicans are to the right of the typical Democrat, compared with 64 percent 20 years earlier. This is reflected in a Congress that is also more polarized than it has been in at least 100 years, as measured by the voting records of individual legislators.

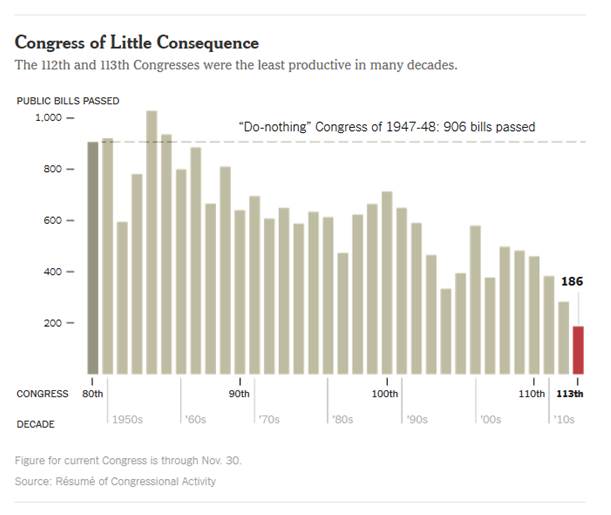

Greater polarization is at least one of the reasons for gridlock on Capitol Hill that remained at least as bad in this Congress as in the prior one. As of Nov. 30, the Congress that will depart at the end of this month succeeded in passing only 186 public laws, many of them minor or simply ceremonial. When the books are finally closed, the 113th Congress may have hauled its legislative total up to that of its predecessor, the current record holder for inaction.