If nothing else, President Trump is routinely loquacious and just as routinely, misstates facts regardless of how often he is corrected. Here are three of his favorite misstatements:

“We inherited very high prices and we inherited the highest inflation in 48 years. I say the history of our country. I think it sounds almost the same. Actually, I think 48 years sounds actually worse for some reason.”

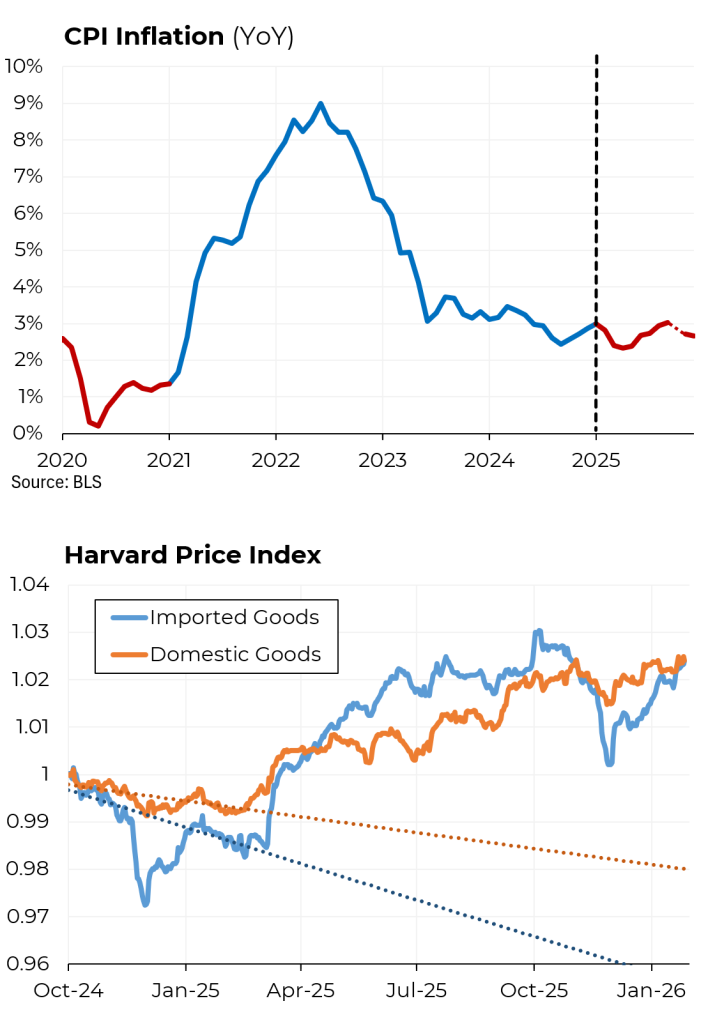

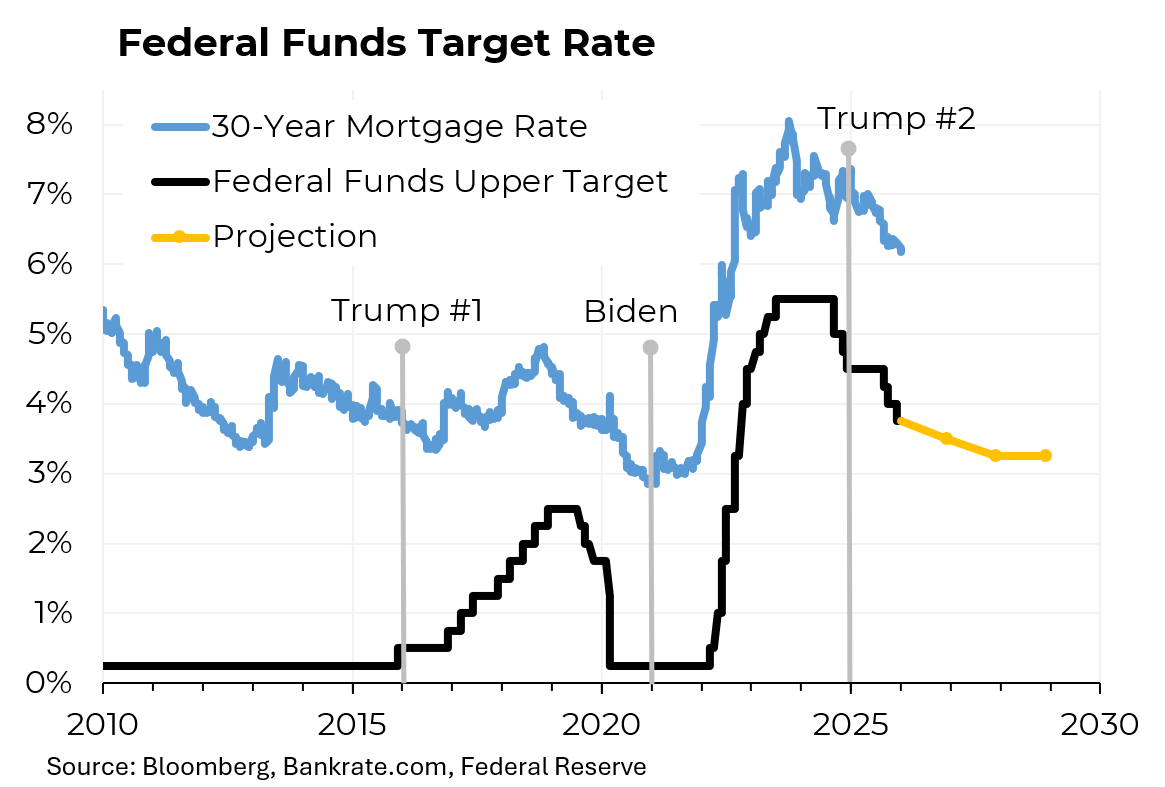

For a good while, Trump claimed that he inherited the highest inflation in American history. Then, after repeatedly being corrected, he started to say “the highest in 48 years,” a reference to the high rate of inflation in the late 1970s and early 1980s. But that obscures a vastly greater misstatement. When Trump took office just over a year ago, inflation had already declined sharply from its surge to almost 9% after Covid. As Trump returned, inflation was running at around 3%. A year later it was virtually unchanged, at 2.7%.

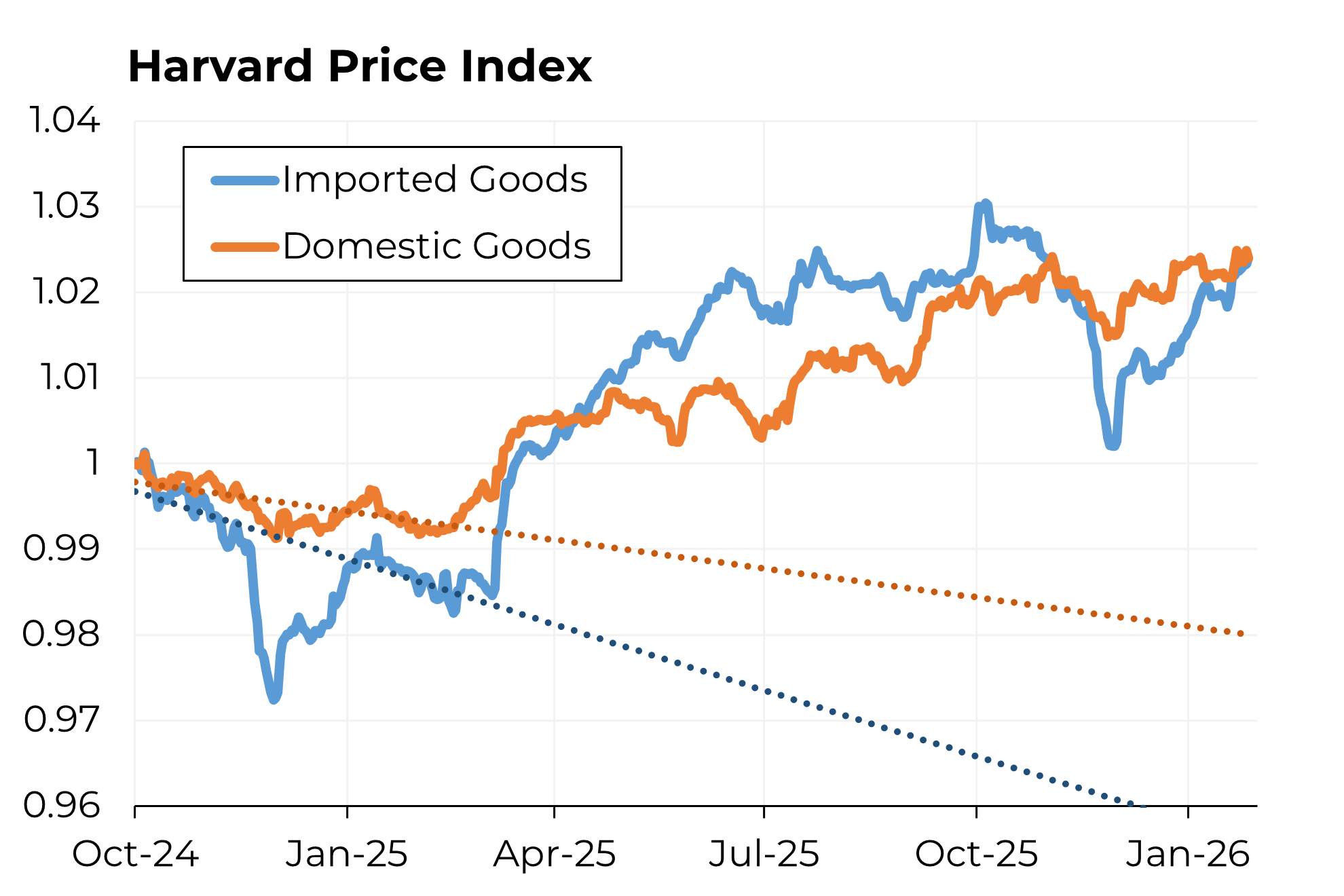

Moreover, Trump’s tariffs policies may well have made inflation worse, not better. Before the tariffs were imposed, the retail prices of both domestic and, particularly, imported goods were trending downwards. After Trump started his trade war, both sets of prices abruptly reversed direction and began to climb. Why did the prices of not only imported goods but also domestic goods start to go up? Because as prices of imported items rose, domestic manufacturers and retailers were able to raise prices on comparable items produced in the United States. All told, imported prices are now 4.5% above where they would have been had they stayed on trend and domestic prices are 7.1% above trend.

“Thousands of businesses, plants, equipment all over the country are being built right now. And they’re going to be opening pretty soon.”

“But they’re now building additional plants in the United States, as is everybody else. You have AI building. But the car companies, I love the car companies. And you have them. They’re all coming back.”

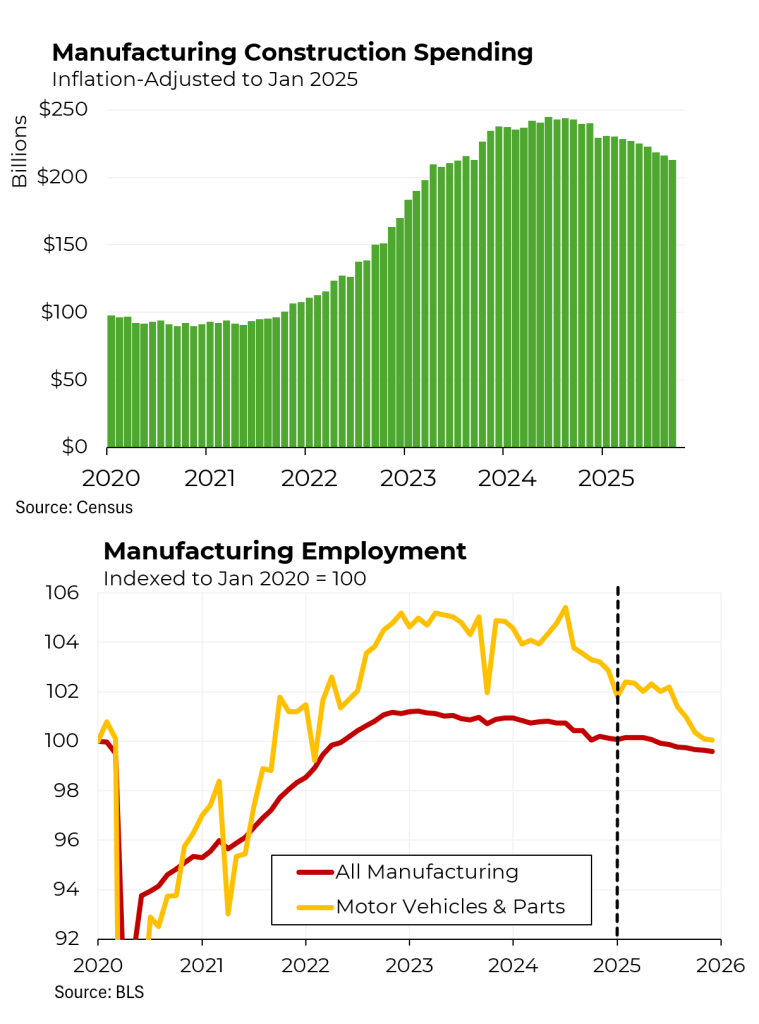

Well, no, they are not being built “right now.” Spending (after adjustment for inflation) on manufacturing facilities, which peaked in the middle of 2024, has yet to show any sign of increase. In fact, the boom in construction of manufacturing facilities can be attributed to the policies in effect during the administration of President Joe Biden, particularly the passage of the CHIPS and Science Act, which stimulated the building of semiconductor facilities. In contrast, spending in this area has declined almost every month since Trump took office.

Nor is anything positive happening to employment in the manufacturing sector. It recovered its Covid-related losses by the mid-2022 but then resumed its historic decline a year or so later, decreasing particularly rapidly in the second half of last year. Similarly, auto-related jobs have also been trending down, in part because American car companies have been downsizing their electric vehicle program as a result of Trump policies.

“And most importantly, if you think about it, after four years in which Biden got much less than $1 trillion of investment into our country, in just actually, it was taken over 11 months, even though we’re 12 months, in 11 months, we’ve taken in more than $18 trillion. So they did less than $1 trillion, Scott, in a period of four years and we’ve done $18 trillion in less than one year, so. So there’s never been anything like that.”

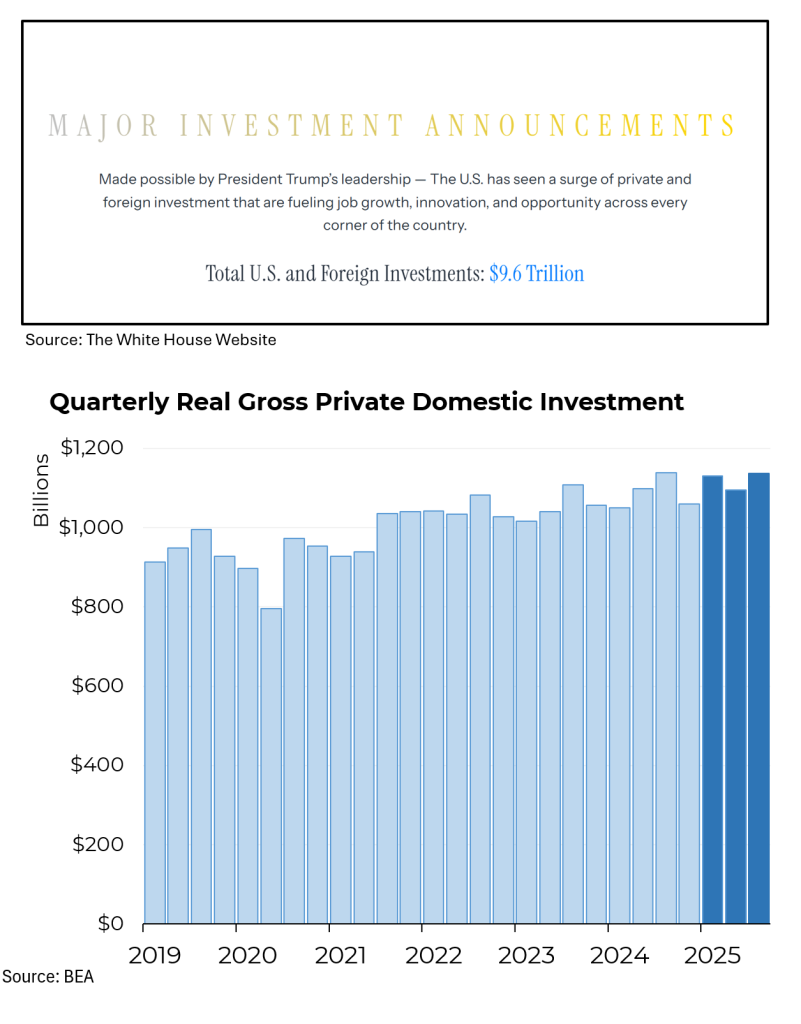

Claiming credit for $18 trillion of new investments is one of the most remarkable of Trump’s routine exaggerations because it is contradicted by the White House’s own website, which cites a figure of $9.6 trillion. (And even though this has been regularly noted, the White House has left the website unchanged.) Additionally, that figure includes certain investments that were already planned or are considered “business-as-usual,” including some by OpenAI and Apple.

As for the facts, first, business investment in the U.S. didn’t budge by a material amount during Trump’s first nine months in office. And even if the president wants to claim that all of the $9.6 trillion or $18 trillion is still in the pipeline, those figures so wildly exceed the historic pace of business investment as to be impossible to believe.