Lost amidst the consequential challenges with the Venezuelan imbroglio is the fact that valuable tax credits that tens of millions of Americans use to purchase their health insurance expired at the end of 2025. The consequence will be vast increases in premiums for these middle- and lower-income families, which will cause many to drop their coverage and join the ranks of the uninsured. We will know more after January 15 when the enrollment period ends but early indications are that sign-ups will be lower.

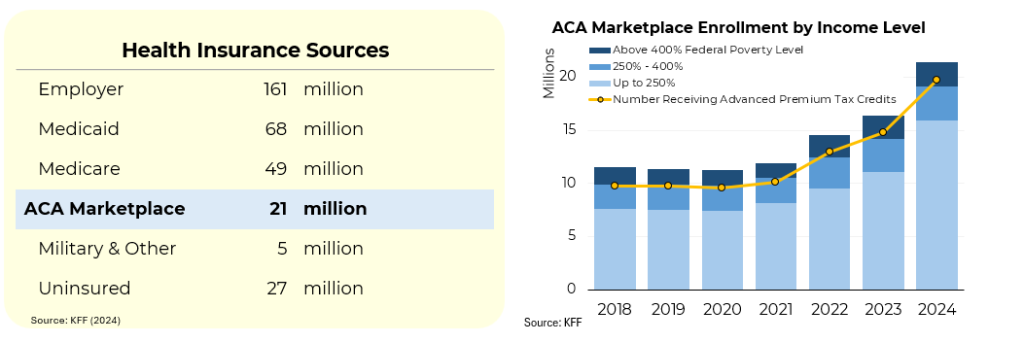

To level set, let’s review how Americans currently get their insurance. Almost half of Americans get their coverage from their employer. Around a third are on either Medicaid or Medicare. Importantly, 21 million individuals buy their insurance through the marketplaces set up as part of the Affordable Care Act. Those are the people at risk from Congress’s inaction.

In 2020, under the leadership of President Joe Biden, Congress passed an expansion of the tax credits that were originally part of Obamacare for individuals who purchase their insurance on the marketplaces. That caused the number of people who took advantage of this path to coverage to soar, to 24.3 million in 2025 from 11.4 million in 2020. Nearly all of those participants are at the lower end of the income scale and so they avail themselves of the tax credits.

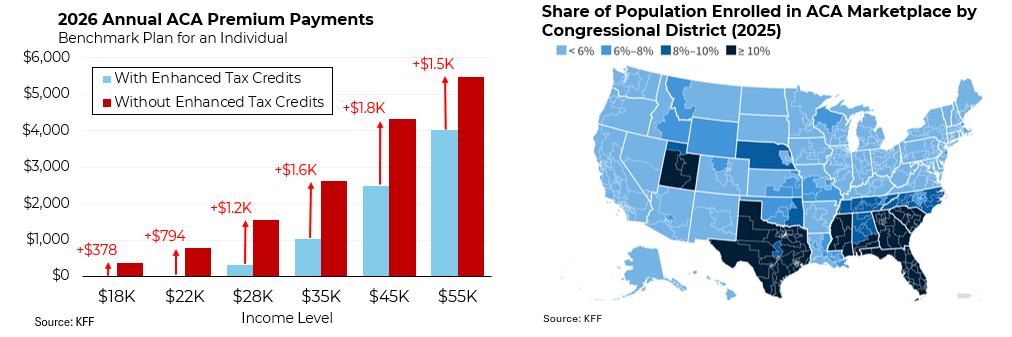

For those eligible for the subsidies, the increases in premiums will be vast, an average of 114% according to estimates by KFF. A typical premium for an individual earning $35,000 a year will rise to $2,615 a year from $1,033 before the tax credits expired. That will make coverage essentially unaffordable and cause many to drop their coverage.

Looking at the impact by state, the pain will be greatest in several “red states” that failed to participate in the expansion of Medicaid provided through the passage of the A.C.A. in 2010. The most affected states include Florida, Georgia, South Carolina, Mississippi, and Texas. (Utah is an outlier as it did participate in the Medicaid expansion.)

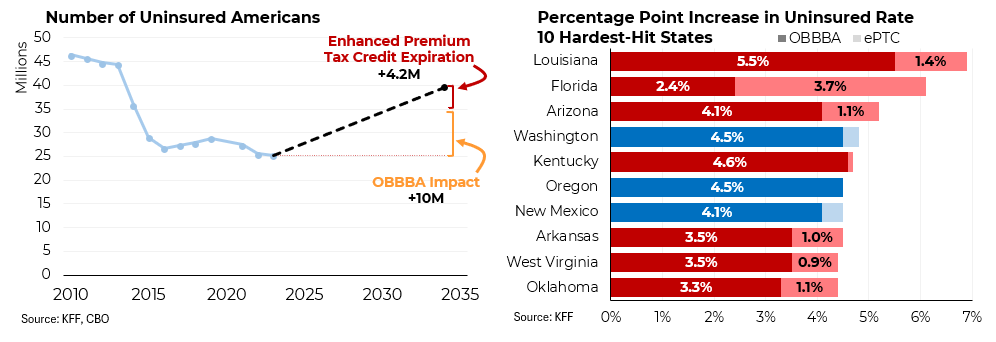

As a reminder, the expiration of the enhanced premium tax credits is only one of the ways in which Congress has unwound key elements of Obamacare. The One Big Beautiful Bill Act enacted a number of changes to Medicaid – particularly the imposition of a work requirement – that are estimated to result in 10 million fewer Americans with health care in 2035 than would have otherwise been the case. Coupled with an estimated 4.2 million fewer because of the loss of the tax credits, it amounts to a roughly 70% reversal of the progress in coverage achieved since the passage of the A.C.A.

With those two sets of changes combined, the biggest impact is likely to be disproportionately felt in the red states (7 of the top 10). Particularly in Florida, the loss of the premium tax credits will play a significant role in this increase in the number of uninsured. In contrast, the three most affected “blue states” will be most impacted by the OBBBA.