Donald Trump flew to Michigan Tuesday to celebrate his economic policies and although he was in front of the Detroit Economic Club, he rambled on for 40 minutes before he got to the key issue of housing and even then, gave it only a brief mention. House prices are high up on the list of many Americans’ affordability concerns and while it is admittedly a tough problem to solve, Trump has yet to propose any viable approach to the challenge.

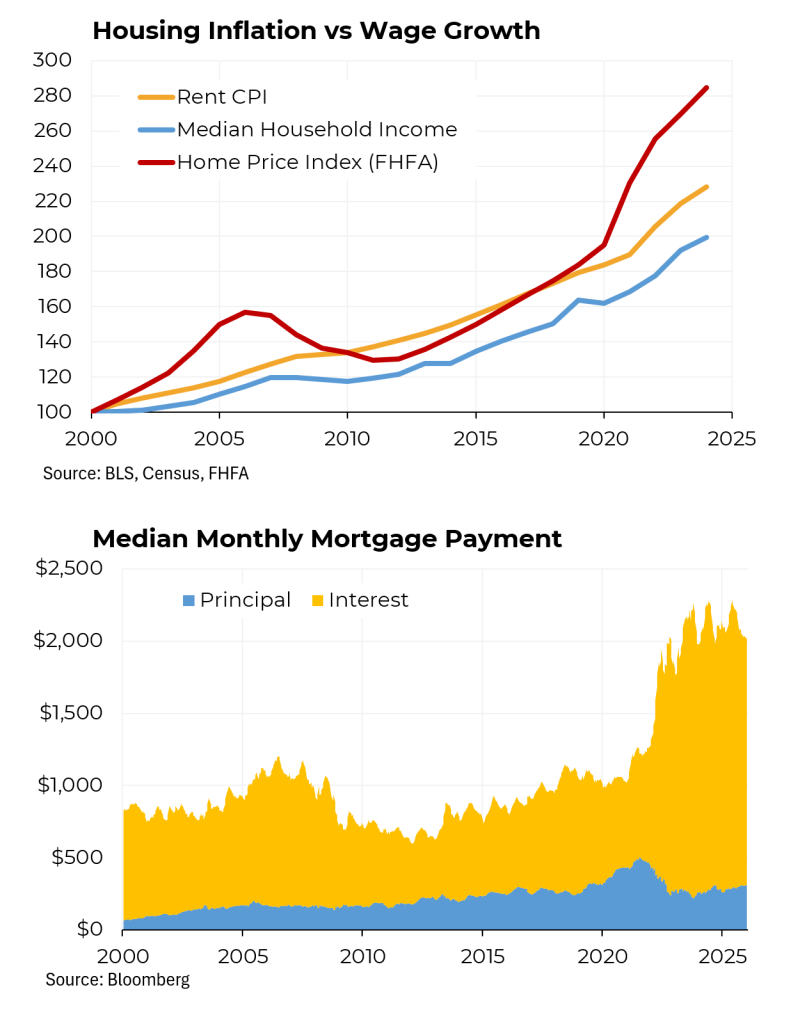

Both home prices and rents have been climbing faster than incomes for at least several decades. Since 2000, the average cost of a home has risen by 184% and rents have increased by 128% while the income of an average American has only grown by 99%. Even more dramatically, since 2019, home prices have risen by 55% while incomes have gone up by just 22%. All of that has caused the average age of a first-time home buyer to increase to 40 from 33 in 2021.

On top of that, the upward move in mortgage rates has added to the financial burden. Just since 2019, the median monthly payment on a new mortgage has roughly doubled, to around $2,000 from $1,000.

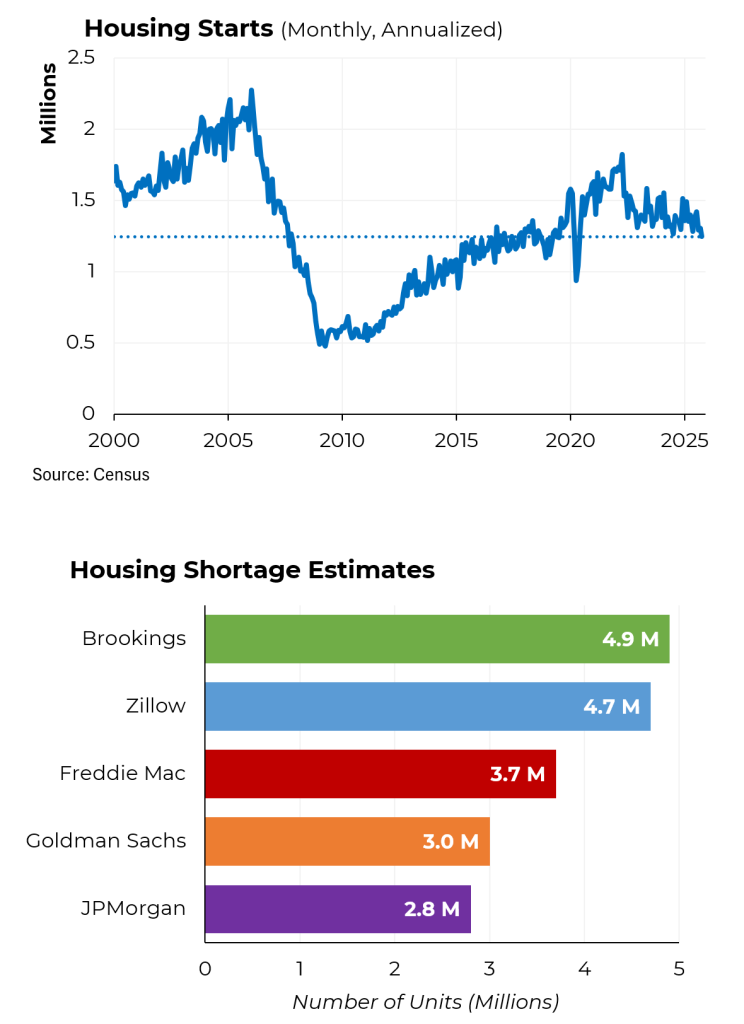

Not surprisingly, the sharp rise in house prices is due in part to the fact that we are not building them as fast as we used to. Prior to the financial crisis, we typically added at least 1.5 million homes a year. But construction then collapsed to just 500,000 and is now around 1.25 million units a year. Why are they still below pre-GFC levels? A mix of reasons, from zoning restrictions to a diminution of attractive sites to the paradox that buyers can’t readily afford them.

All told, a variety of experts have calculated that the country is short somewhere between 2.8 million homes to nearly 5 million homes. (There are currently approximately 148 million dwelling units in the country.)

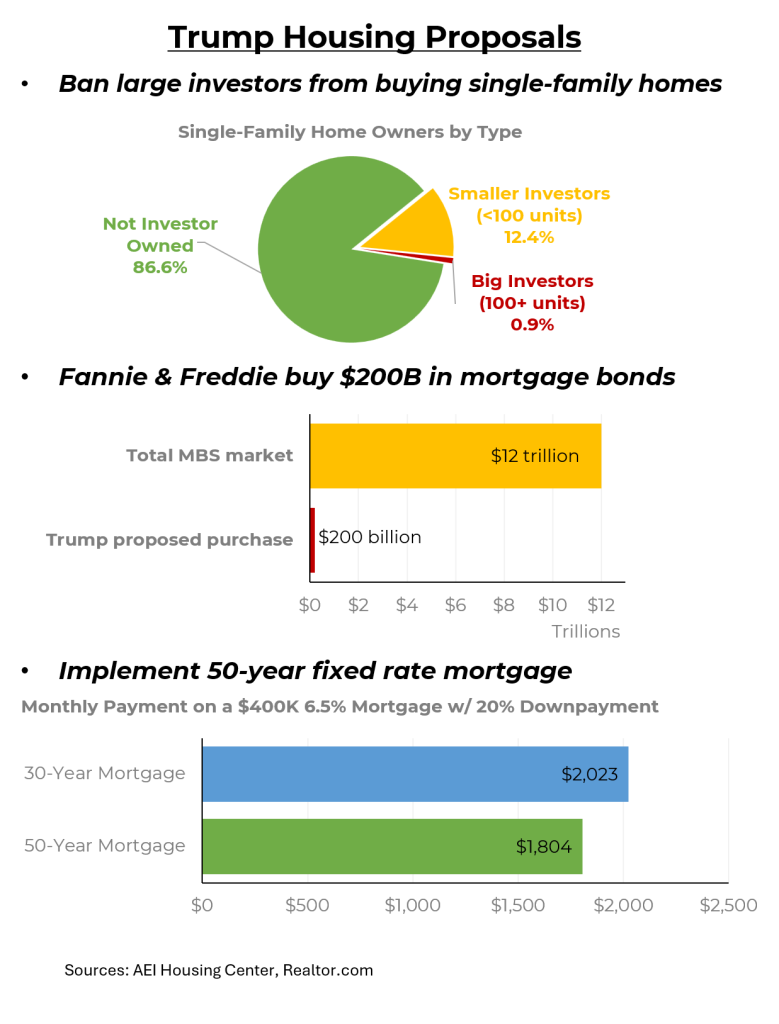

In his speech yesterday and in various other pronouncements, the president has thrown out a few ideas. For example, he suggested banning large investment firms from buying single family homes. But fewer than 1% of homes are owned by those firms. He ordered Fannie Mae and Freddie Mac, the two large government-backed mortgage companies, to buy $200 billion of mortgage bonds to lower interest rates. But that is a small fraction of the estimated $12 trillion market. He seems to have thrown out the idea of creating a 50 year mortgage to lower monthly payments but that would save – at most — $200 a month on a $400,000 mortgage. He has browbeaten the Federal Reserve to lower interest rates, but the Fed doesn’t control longer term interest rates like those on mortgages.

So what to do? It’s at least partly the “abundance” agenda. Change zoning and permitting processes. Encourage less expensive forms of construction, such as factory-built homes. Allow enough immigration to keep labor costs from soaring. Trump promised to talk more about housing when he journeys to Davos next week. We’ll see what he offers there.