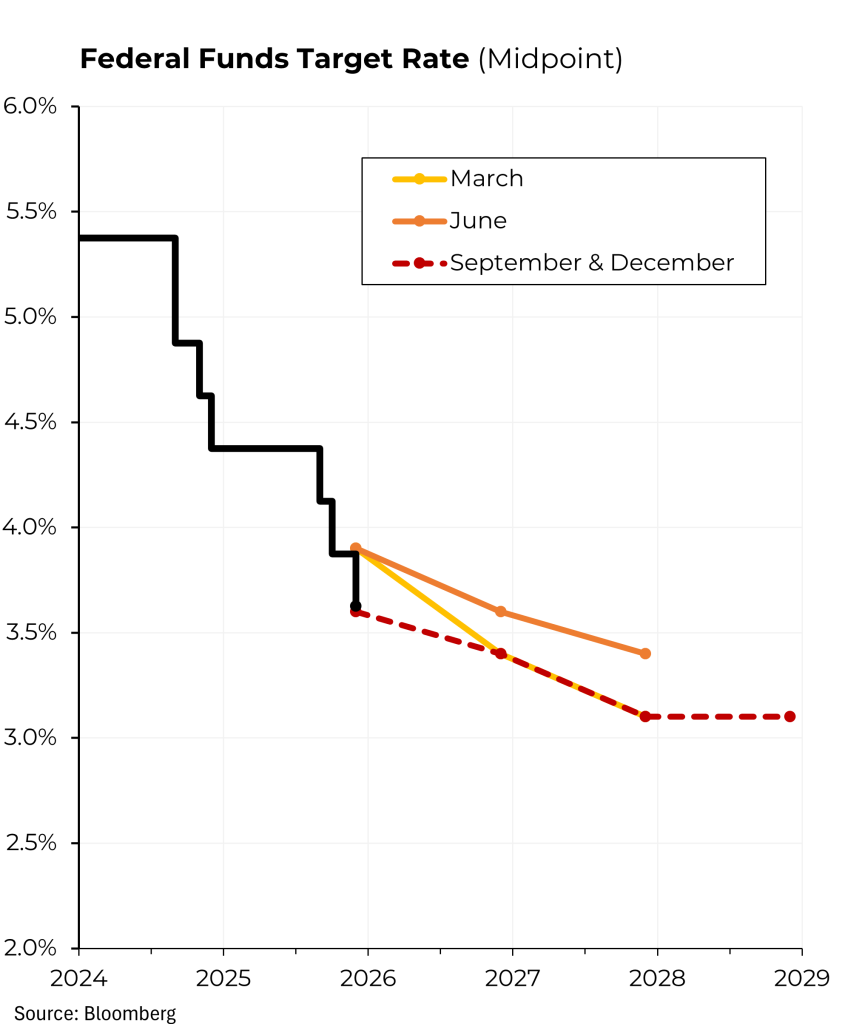

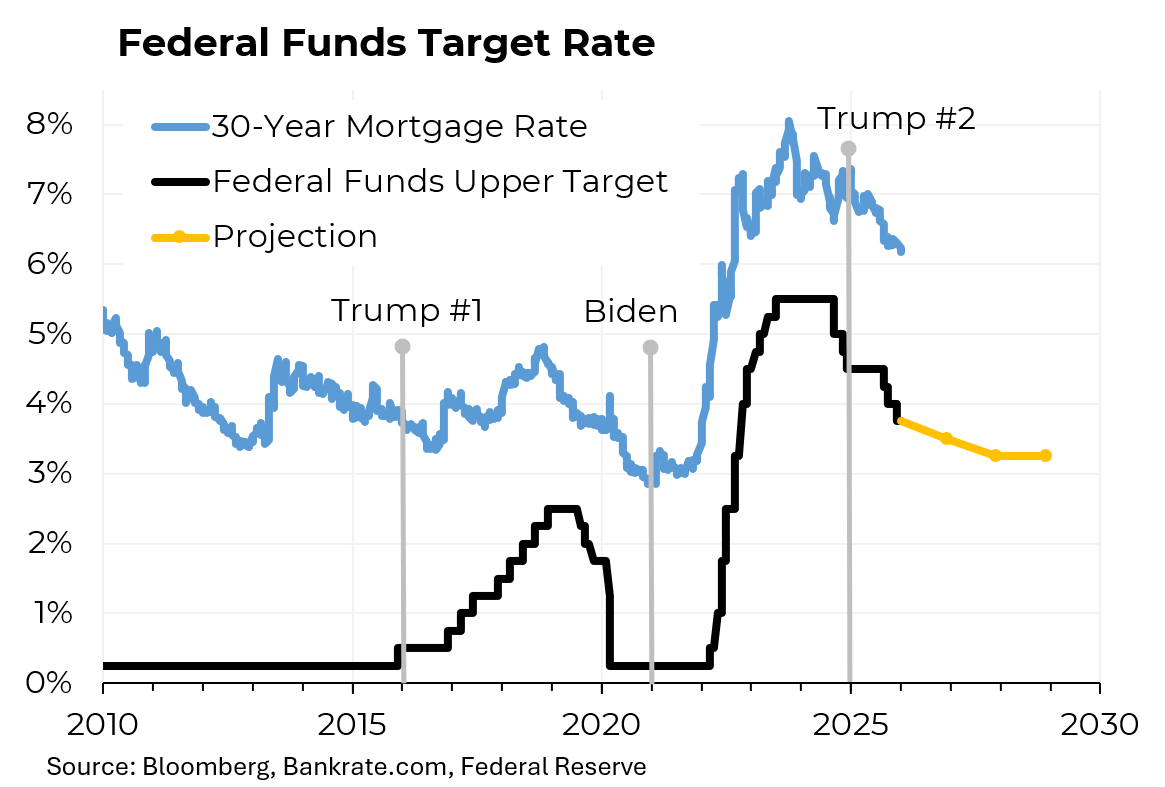

As expected, the Federal Reserve cut interest rates by another 0.25% at its meeting Wednesday but in the course of doing so, it signaled that further rate cuts next year are likely to be modest. A further signal that enthusiasm for cutting rates is ebbing was the dissents by two Federal Open Market Committee members who wanted rates to remain unchanged. (On the other hand, one Fed governor, who had been appointed by President Trump to push for still larger reductions, dissented in the opposite direction.)

The action by the Fed took its target rate lower bound to 3.5% from 3.75%. That brought the number of cuts this year to 3 and a total of 7 since the Fed began reducing rates in September 2024. For next year, the central bank is projecting only one cut, similar to its forecast three months ago. Fed chairman Jerome Powell said at his regular press conference that inflation and the labor market both present challenges but that there was disagreement within the committee as to which side of the dual mandate to lean toward.

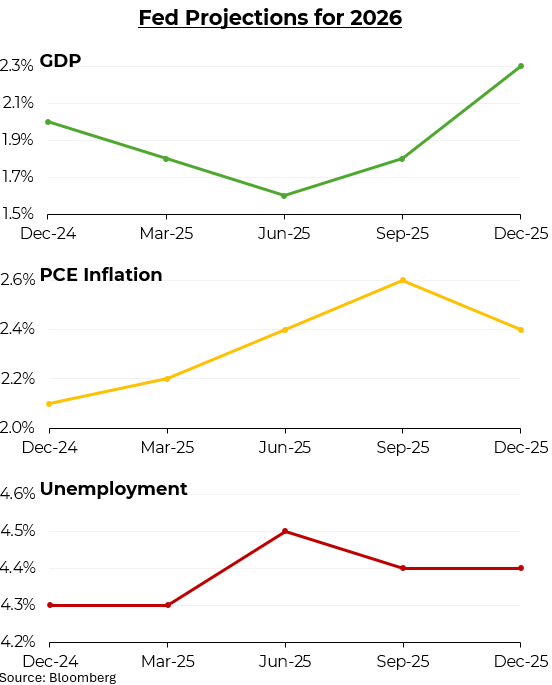

As it does every three months, the Fed issued new projections for key economic indicators. The most significant change from September is that it is now expecting faster growth and lower inflation than it did three months ago. And the Fed’s unemployment forecast remains elevated. Thus, the Fed faces a bit of a conundrum: inflation is still expected to remain above the Fed’s 2% target while the unemployment rate, forecasted at 4.4% next year, is above its low point of 3.4% in April 2023.

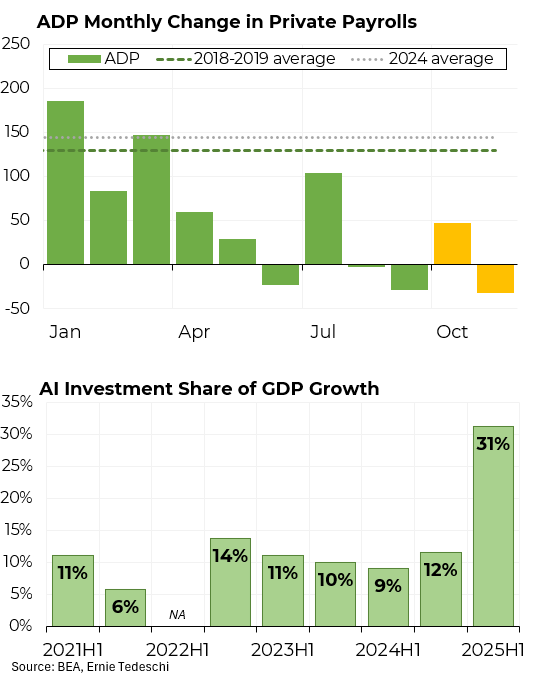

The oddity of the new forecast is that it is not customary for a labor market to remain weak while growth is accelerating. The government shutdown meant that some official government statistics were not collected, but ADP, the large payroll processor, produces its own monthly figures, which show that job growth has almost evaporated. Also, at his press conference Wednesday, Mr. Powell said that Fed economists believe that Bureau of Labor Statistics figures for the past several months overstated job growth by perhaps 60,000 jobs a month.

Mr. Powell cited as one reason for the dichotomy between economic growth and job growth could be an acceleration in productivity — the efficiency of each worker. If efficiency increases, companies can increase their output without adding more workers. A part of that productivity growth may be the increased use of artificial intelligence. Indeed, by some estimates nearly a third of growth in the first half of this year may have come from investment in artificial intelligence, up from around 10% in recent years.