The seemingly inexorable rise in the stock market has now coincided with the publication of an important new book by Andrew Ross Sorkin about the 1929 crash, raising questions in the minds of many as to whether we are headed for a repeat of the events of nearly 100 years ago. Predicting markets is nearly impossible but a few salient features of today’s environment are worth noting.

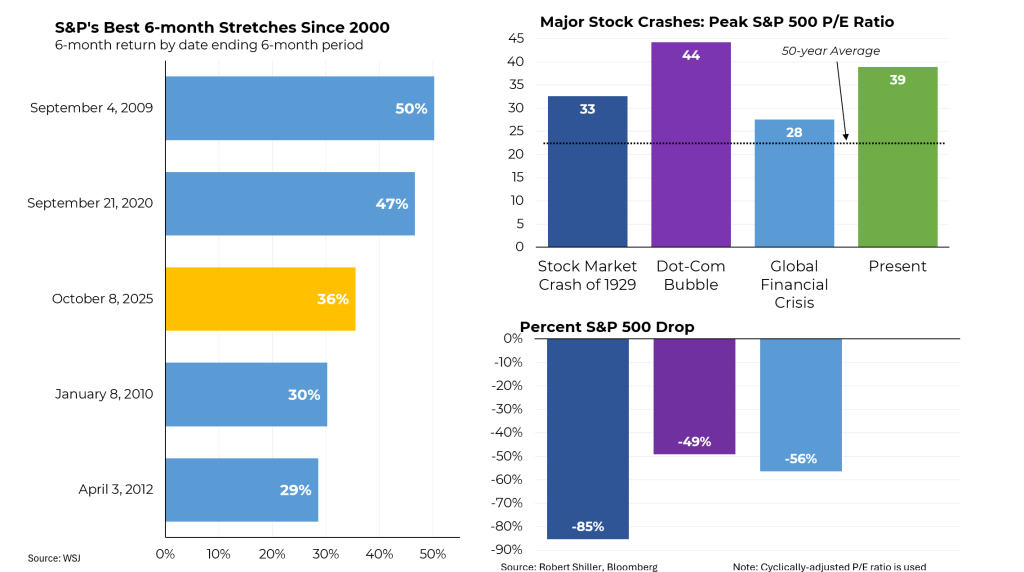

For starters, over the past six months, the stock market has notched the third largest gains of any such period since 2000. That puts the market up nearly 14% so far this year, which, if maintained, would make it the sixth year out of the past seven of substantial double-digit growth. That said, the market was extremely volatile earlier this year, particularly around Liberation Day, and it has been essentially flat so far in October

How expensive is today’s stock market compared to before three notable downturns? Pretty expensive. Stock valuations are measured by the ratio of the stock price to the company’s earnings per share. Over the past 50 years, that ratio has averaged 22. At present, it is 39, second only to its level of 44 at the peak of the dot com bubble. In 1929, the ratio only reached 33 and just before the financial crisis, it sat at 28. (Note that the financial crisis began as a banking problem.) In the prior three episodes, the market ultimately dropped from 49% to as much as 85% during the Depression.

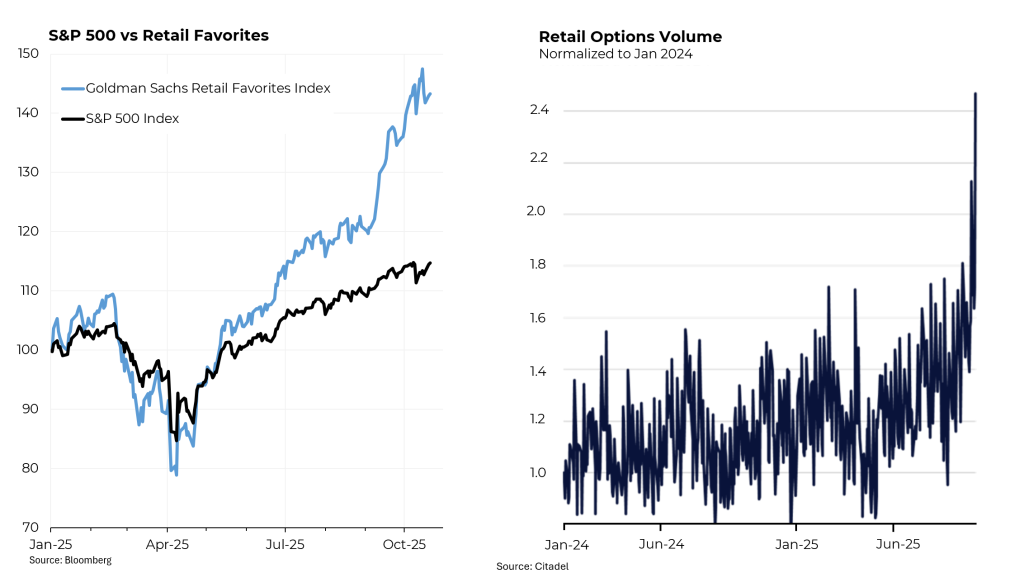

Part of what has been driving the stock market upward has been a surge of buying by individual investors (just as occurred in 1929). Goldman Sachs created an index of stocks favored by retail investors; it has substantially outperformed the broader market since May. Among the companies in this basket are Micron, Palantir, Warner Brothers Discovery, and Hims & Hers.

Another sign of froth has been the upsurge in trading of options by retail investors. Buying options is particularly risky because if the stock price doesn’t reach the target before the option expires, the investor loses all of his money. October 10th was the largest options trading day in market history, with over 108 million options traded. (Options volumes have only exceeded 100 million contracts once before, on Liberation Day, which was April 4.) Retail buying has been particularly strong whenever the market has declined, which is known as “buying the dip.”

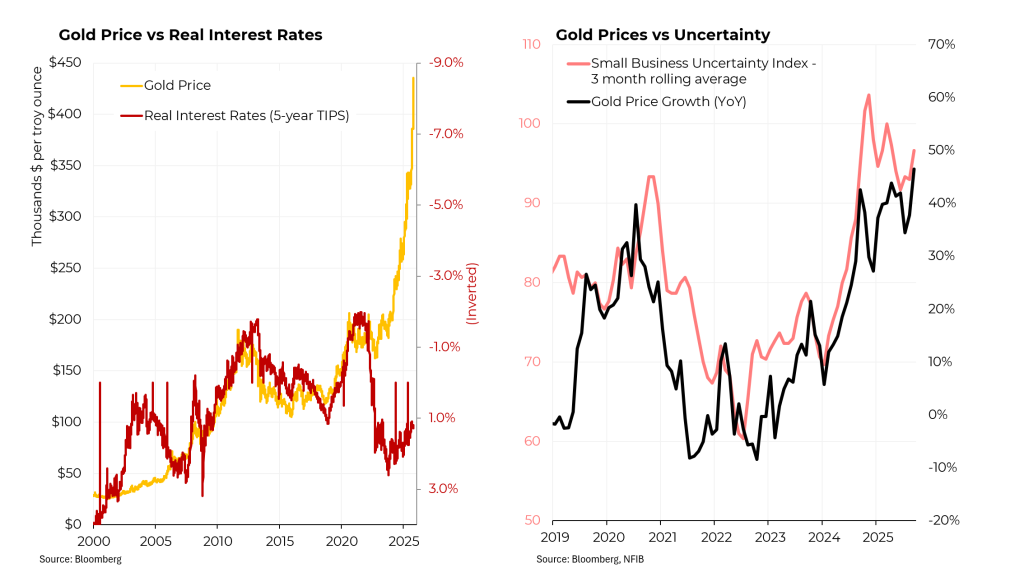

Stocks are not the only thing that have soared in price; so have gold and silver, which have both reached all-time highs. This is particularly perplexing because gold prices have historically generally tracked interest rates because when interest rates (adjusted for inflation) are low, gold becomes more attractive (lower carrying costs). But since early 2022, this relationship has become disconnected. Some of it may relate to increased buying by central banks, particularly after Russia invaded Ukraine and its assets were frozen.

But there also seems to be a close correlation between gold prices and economic uncertainty, which has soared since the 2024 election.