Notwithstanding the turmoil of Donald Trump’s second term – the tariffs, the vacillation, the budget busting Big Beautiful Bill — the stock market continues to move higher, recently notching a series of record highs. What gives?

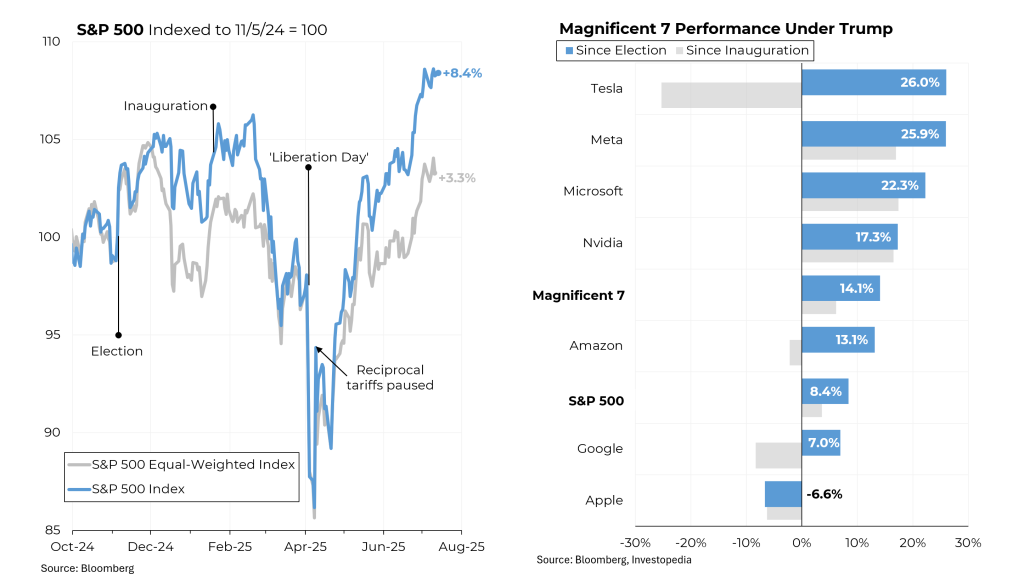

Since election day, the Standard & Poor’s 500 index has been marching upward, a total gain of 8.4%. That has occurred notwithstanding a significant air pocket after “Liberation Day” on April 2, when Trump announced his initial huge package of tariffs. That rise has, of course, not been shared evenly. Sectors including artificial intelligence, crypto, aerospace and some consumer names have outperformed while those in areas ranging from travel to housing have been weaker.

In particular, the market has been heavily driven by the “Magnificent Seven,” a small handful of stocks that account for more than 30% of the overall index (because stocks are weighted in the index by market capitalization). They mostly include the biggest technology companies, which include those benefiting from the strong performance of artificial intelligence (Meta/Microsoft/Nvidia). But Tesla is still up 26% even after declining by 25% since the inauguration. More recently, Amazon has been weak because of tariffs, Google has been declining because its search business is threatened by AI and Apple has declined because of its struggles in China as well as tariffs.

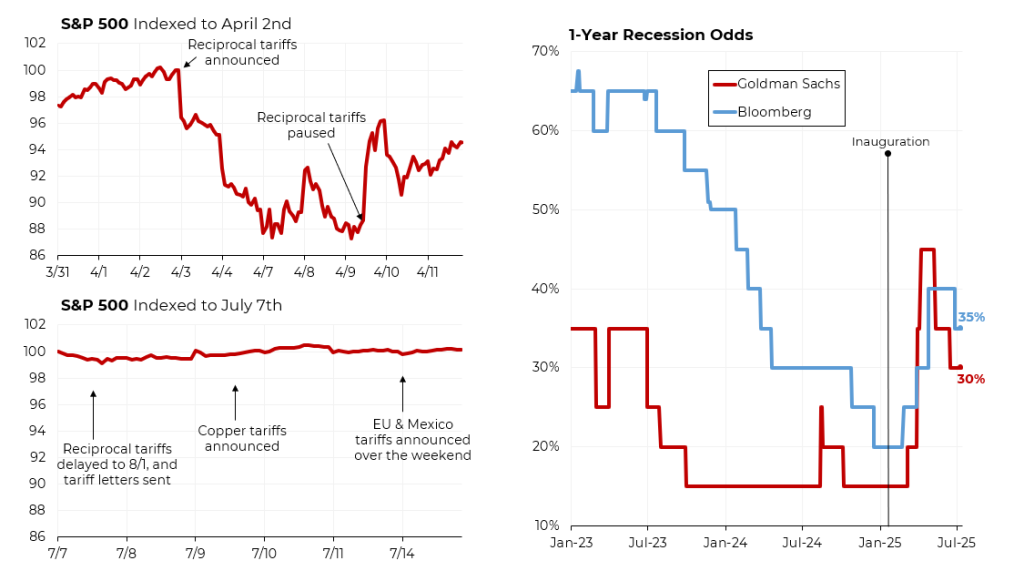

Part of why the market has rebounded so successfully since April 2nd is that investors have come to believe in the TACO trade (Trump Always Chickens Out). So in contrast to its performance immediately following April 2nd, markets have yawned at the recent barrage of tariff threats that Trump has returned to issuing.

In conjunction with the TACO view, economists have become less worried about the probability of recession (even though projections for growth this year remain muted and even though at 30% – 35% they remain above the 20% or so that is considered a neutral view.

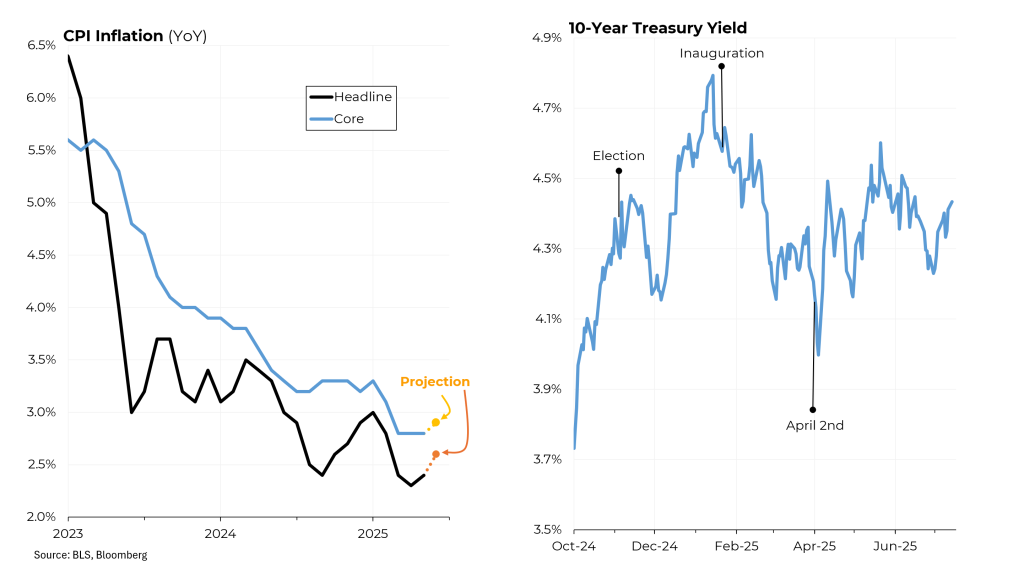

Meanwhile, as tariffs have been delayed and/or scaled back, the feared impact on prices has yet to materialize. While not yet all the way down to the Federal Reserve’s 2% target, price increases (excluding the volatile categories of food and energy) have been running at an annual rate of around 2.8%. In addition, more often than not, inflation readings have come in at or below projections. (We will get June figures today.)

Lastly, interest rates have been steady and have even drifted down since the inauguration. Interest rates play a key role in stock prices because higher interest rates lead investors to own more bonds (higher yields) and less stocks.