Elon Musk took to X on Tuesday to slam the tax plan passed by the House of Representatives less than two weeks ago and firmly endorsed by his former boss, Donald Trump. It’s a “disgusting abomination” that would “massively increase the already gigantic budget deficit,” he wrote in a series of 10 posts. “Congress is making America bankrupt,” Musk posted.

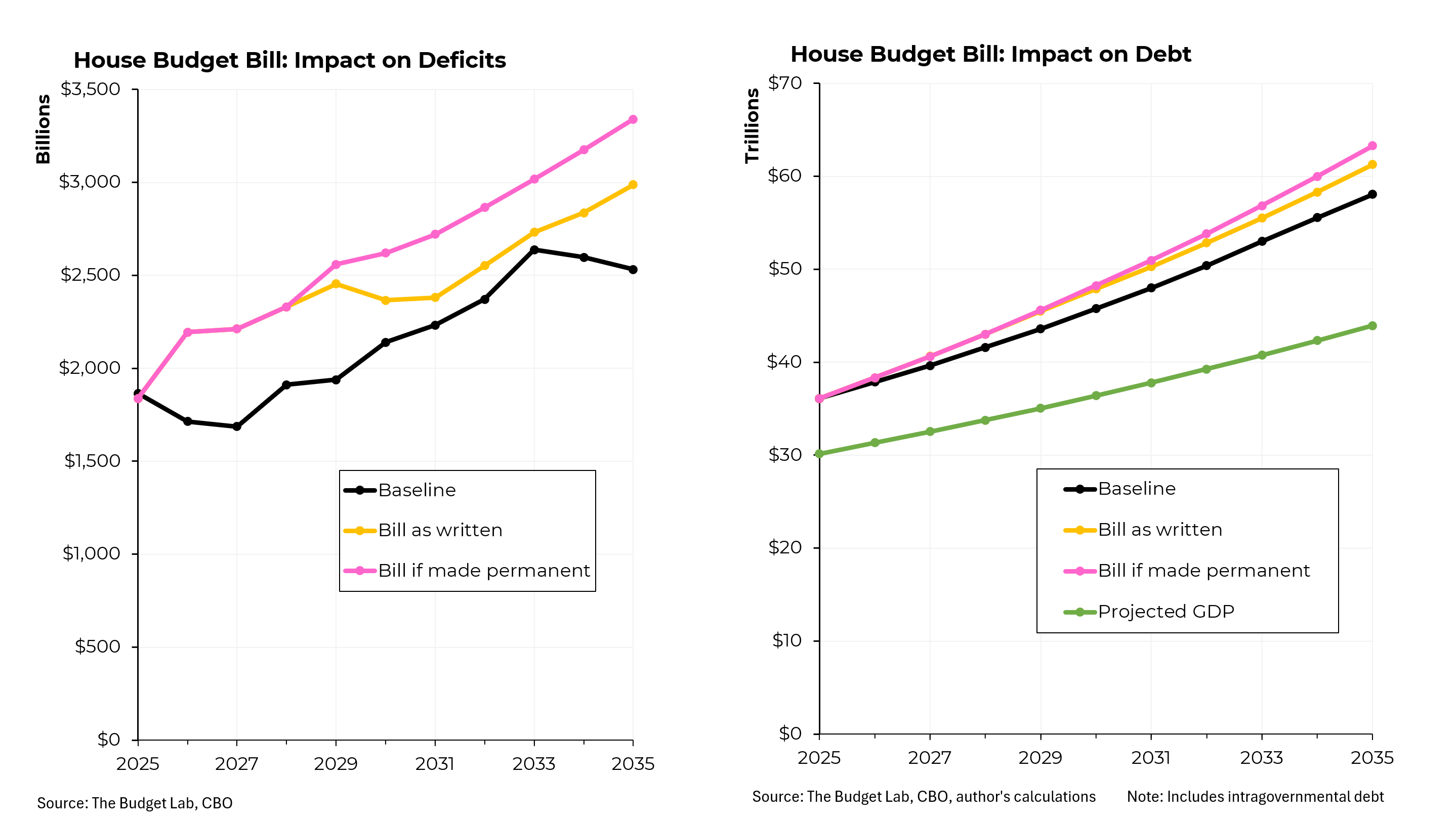

Mr. Musk is not wrong about the deficit impact. The legislation would increase the national debt by at least $2.4 trillion over the next 10 years and by $3.9 trillion if gimmicks in the bill are not included in the calculation. That comes on top of a deficit that is already nearly $2 trillion and would exceed $2.5 trillion within a decade even if no changes were made to the tax code.

At $36 trillion (of which about $29 trillion is held by the public), the nation’s debt already exceeds the size of the economy, something that has only occurred in the past during World War II. And with the debt slated to grow faster than the economy (with or without the new tax cuts) that ratio will only continue to rise. By 2035, the nation’s debt is estimated to total at least $55 trillion and as much as $57 trillion if expiring tax provisions are made permanent.

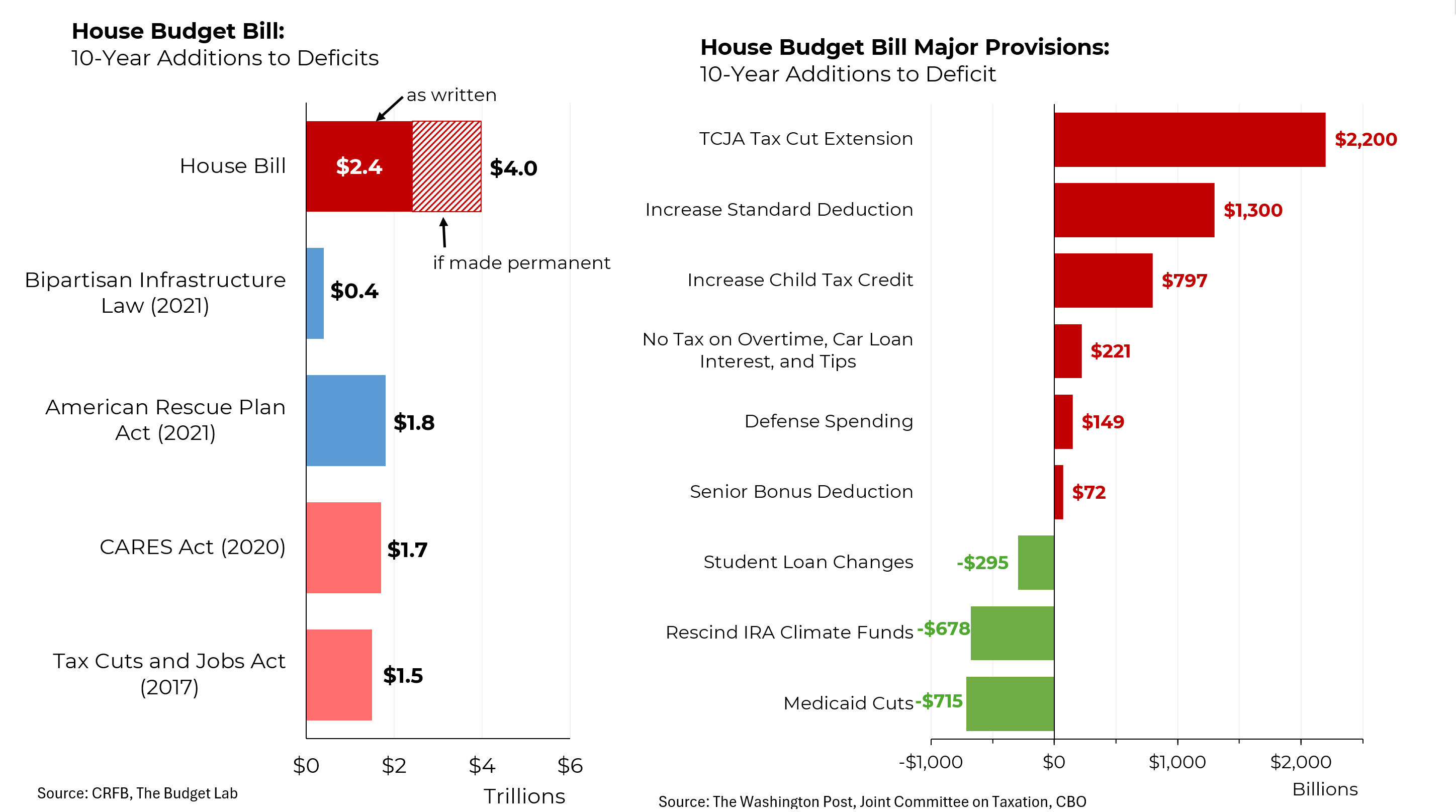

The magnitude of the package is enormous, dwarfing any of the recent major pieces of legislation, including Trump’s first term tax package, the Tax Cuts and Jobs Act.

The centerpiece of the legislation is the extension of the tax cuts enacted as part of President Trump’s 2017 Tax Cut and Jobs Act (the TCJA). While that bill lowered corporate taxes permanently, the individual reductions were set to expire at the end of 2025, as a bit of budgetary legerdemain designed to make the deficit impact look smaller. In addition to making the 2017 tax rates permanent, would increase the standard deduction by $1,000 for single filers and $2,000 for joint filers (to $16,000 and $32,000 respectively). And it would increase the child tax credit to $2,500 per child from $2,000 — but only for parents with Social Security numbers. It also tries to make good on a number of Trump’s crass political campaign promises — no taxes on tips, overtime or interest on car loans and a bonus deduction for Social Security recipients.

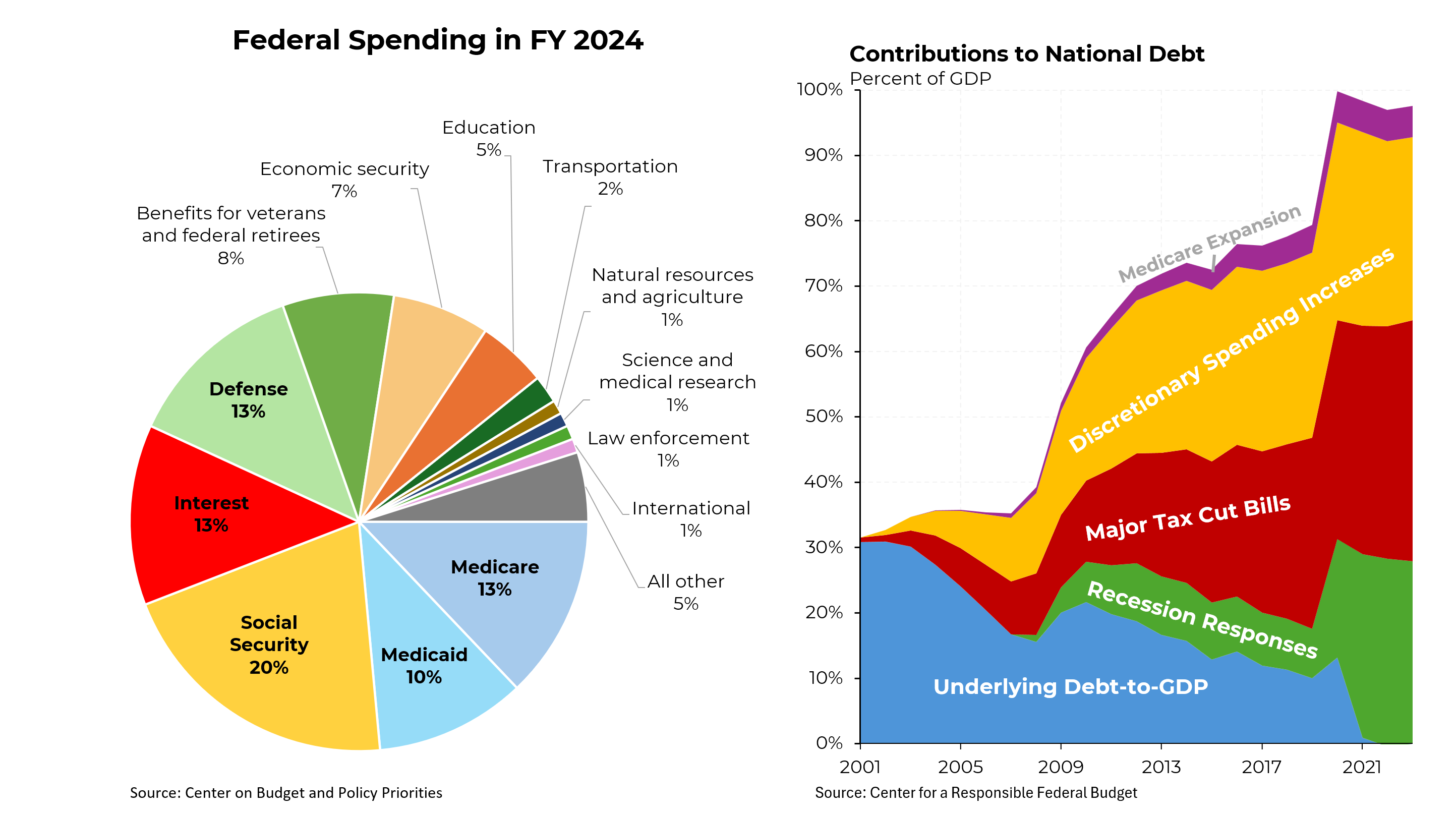

While the size of the deficit is huge, the ability to cut spending is limited, as Musk found during his DOGE efforts. While he promised to cut $1 trillion, he ended up reducing spending by as little as $175 billion. That’s because much of the budget is politically difficult (or impossible to reduce). Little support exists for trimming entitlement programs like Medicare and Social Security. A provision in the House bill to cut Medicaid has already been attacked by some Republicans as well as most Democrats.

We did not need to be in this position. According to calculations by the Committee for a Responsible Federal Budget, if we had maintained reasonable fiscal discipline over the 2 ½ decades since 2001, we could potentially have little to no debt now. Instead, we implemented repeated tax cuts and we increased discretionary spending far faster than the rate of inflation and growth of our economy. In fairness, some of that increase in discretionary spending went to defense and we also spent heavily following the financial crisis and following the outbreak of the Covid pandemic.