It’s graduation time for college and university students and many of them are finding a tougher job market than in past years. That reflects a significant slowdown in hiring by companies and may presage a broader economic deceleration amidst continuing uncertainty over tariffs and other Trump policies.

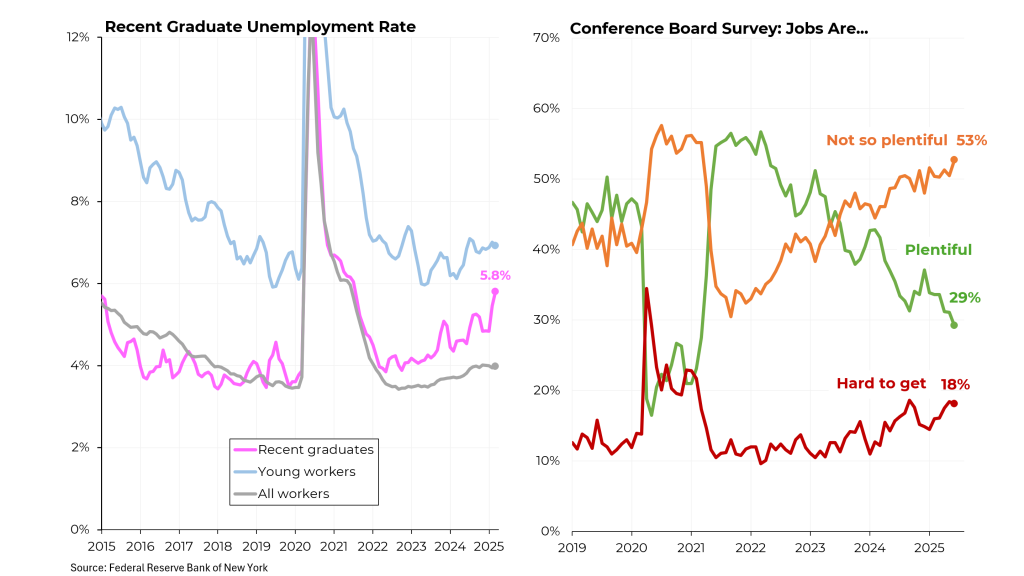

The unemployment rate among recent graduates has been climbing since early 2022 and as of March, had reached 5.8%, substantially — and unusually — higher than the national unemployment rate of 4.2%. As recently as three years ago, the jobless rate for this group was very similar to the overall unemployment rate. In addition, the gap between recent graduates and young workers in general has been narrowing to unusual levels. It is possible that artificial intelligence is playing a role in this — computer science majors, usually in great demand, had among the highest unemployment rates, at 6.1%.

That mirrors broader perceptions about the state of the job market, with the percentage of Americans saying jobs are plentiful having dropped to 29% in June, down from 55% in January 2022. The percentages of those believing jobs are hard to get or not so plentiful have been moving in the opposite direction.

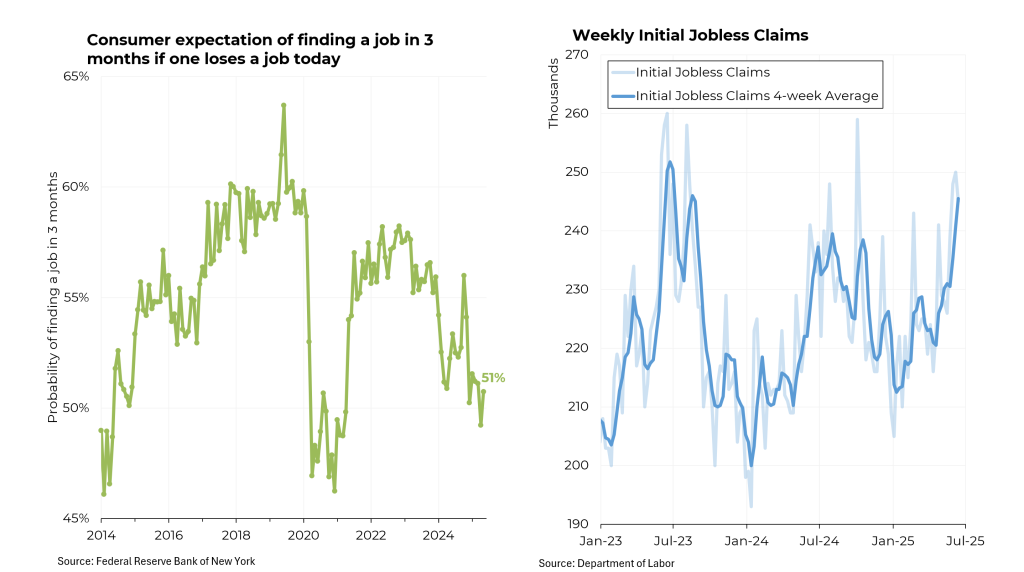

Other jobs indicators are also becoming concerning. Only 51% of Americans believe they will find a job in three months if they lose one today. Excepting Covid, the last time people were this pessimistic was 2014, when the country was still recovering from the financial crisis.

A more tangible data point — the number of Americans filing new claims for unemployment insurance — has been moving up, and is now at the highest level in almost two years.

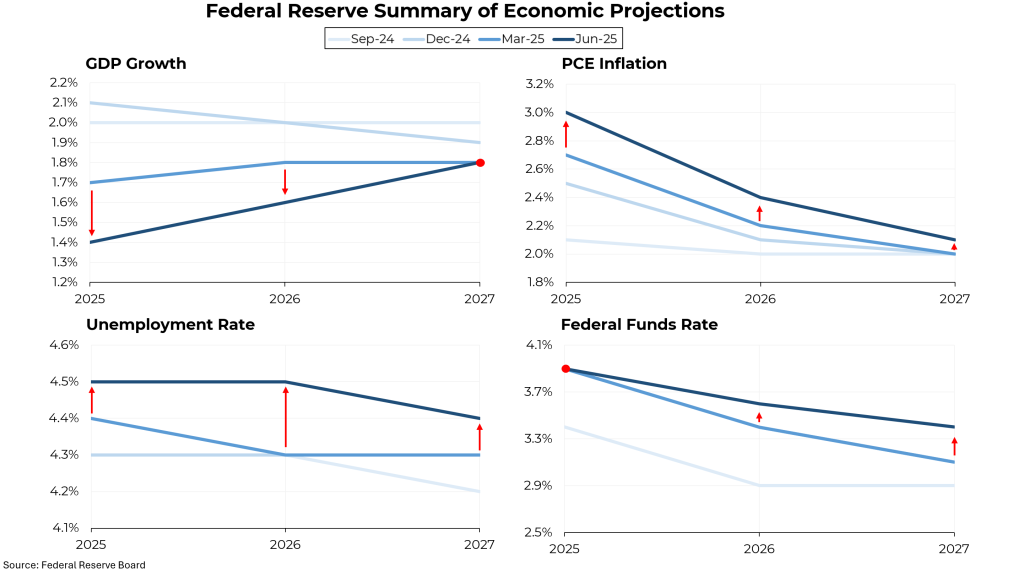

These signs of weakness are consistent with a new forecast released last week by the Federal Reserve. The central bank substantially reduced its expectation for economic growth this year to 1.4% from 1.7% projected just three months earlier. And prior to that, the Fed was anticipating growth of at least 2% this year. Growth in 2026 was also downgraded, albeit by a smaller amount.

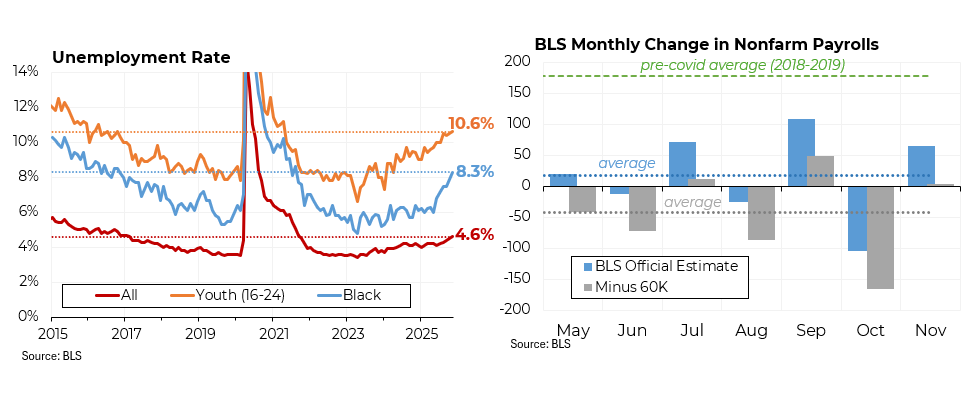

Similarly, the unemployment rate is now projected to reach 4.5% by the end of the year and to stay at that level in 2026.

Meanwhile, the Fed expects more inflation this year and next (largely as a result of Trump’s tariffs) and slightly higher inflation next year and in 2027. Although the economic weakness is already prompting calls for the Fed to cut interest rates (particularly by President Trump), inflation remains well above the Fed’s target of 2%. In recent testimony, Jerome Powell, the chairman of the Fed, essentially ruled out interest rate cuts before the central bank’s September meeting.