A bevy of fresh economic statistics and forecasts sheds a bit more light on the state of the U.S. economy, almost five months into Donald Trump’s second stint in the White House. It’s a picture of an economy that is slowing significantly, but without evidence yet of the anticipated jump in inflation from Trump’s round of tariffs.

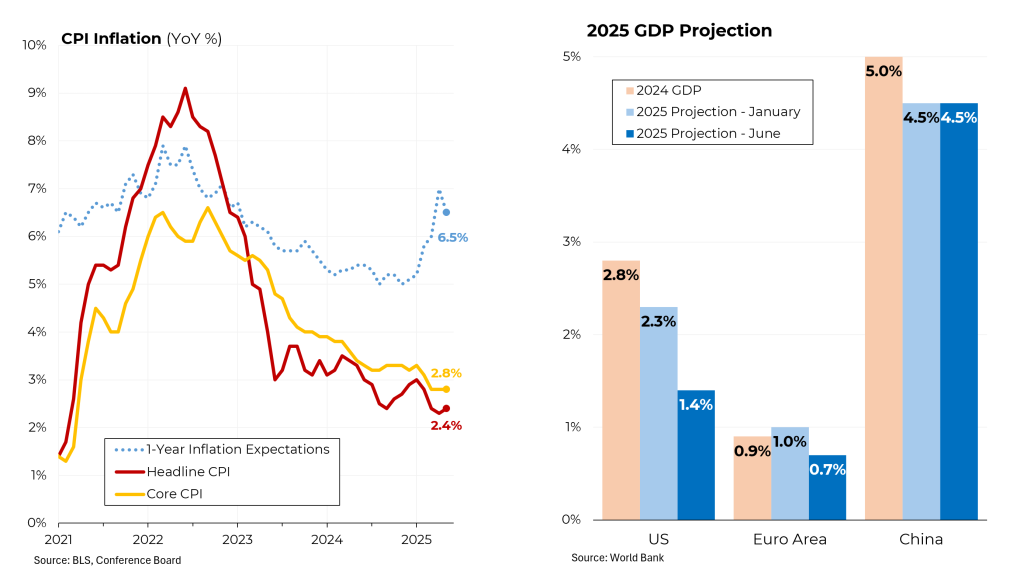

On Wednesday, the Bureau of Labor Statistics reported that consumer prices rose by 2.4% in May, compared to the prior year, while “core” prices (excluding the volatile categories of food and energy rose by 2.8%. That represented a slight uptick from the prior month in headline inflation and no change in core inflation. Why have the tariffs not yet shown up in monthly price statistics? A number of the tariffs have been paused, importers rushed to stock up before they went into effect and businesses are trying to avoid raising prices for as long as possible. But consumers still expect prices to rise by 6.5% this year while a consensus of economic forecasters project inflation will accelerate later this year and total 3%.

The prior day the World Bank issued new forecasts that predict a dramatic slowdown in global growth. For the U.S., the World Bank now expects growth of just 1.4%, down from a January projection of 2.3%. By comparison, the economy grew by 2.8% in 2024, the last year of Joe Biden’s presidency. The World Bank also lowered its projection for Eurozone growth by a smaller amount, but left its projection for China growth unchanged. A consensus of economists polled by Bloomberg currently have recession odds at 40%, up from 20% in January.

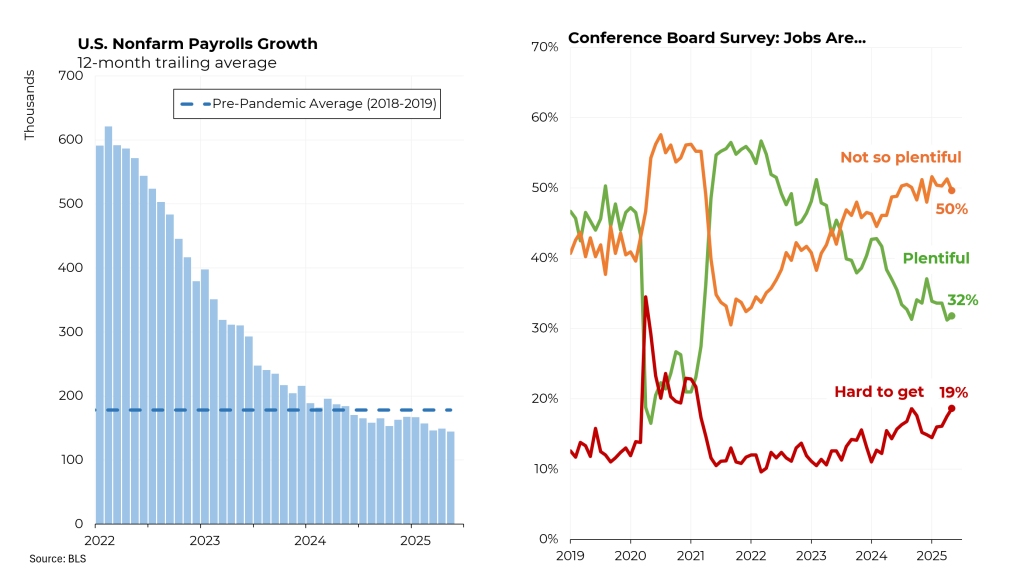

Last Friday, the BLS said that the nation added 139,000 jobs in May while the unemployment rate remained unchanged at 4.2%. That was taken as good news by the markets but it nonetheless represented a continuation of a trend of decelerating job growth. Over the past year, the economy has added an average of 144,400 jobs per month, below the pre-pandemic average of 178,000 jobs per month. Looked at another way, in 2022, there were two job openings for every job seeker. Now there is one job opening for each job seeker.

That change has not been lost on workers and those looking for jobs. In January 2022, as the economy was still emerging from Covid, 55% of Americans said jobs were plentiful and only 11% said they were hard to get. Now, 32% say jobs are plentiful while 19% say they are hard to get. Apart from Covid, the last time Americans were so negative about the job market was 2017.

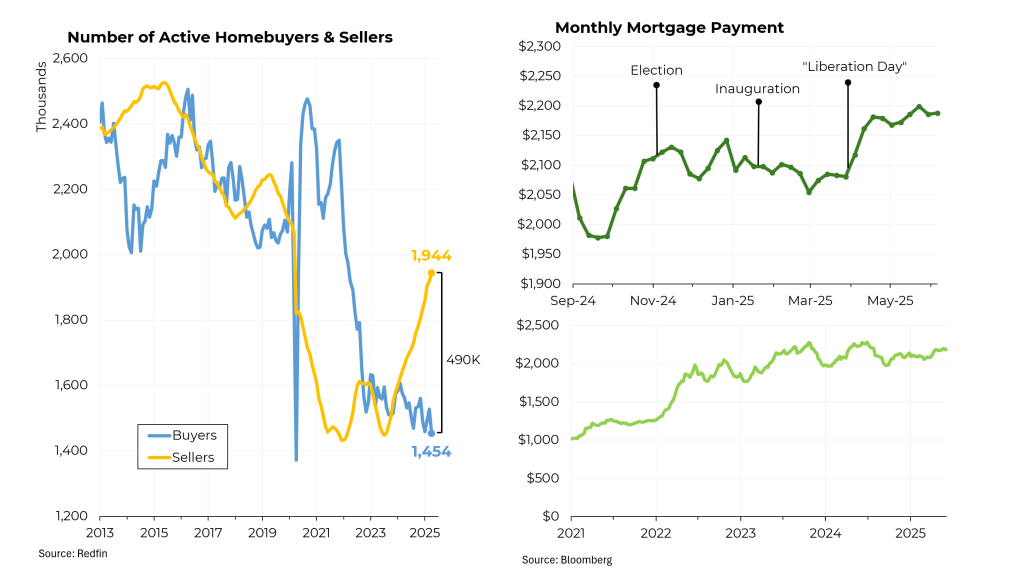

Then there’s housing, which has gone from a seller’s market to a buyer’s market. The number of homes on the market has shot up to almost 2 million while the number of would-be buyers has dropped to less than 1.5 million, a gap of nearly 500,000. In April, existing home sales slowed to an annualized rate of just 4 million, the smallest level since 2009.

Why such a dramatic change? One reason is that all the current economic uncertainty has caused would-be buyers to pause until they feel a greater level of economic confidence. Another, at least equally important reason, is that affordability has been severely dented by a combination of rising interest rates and house prices that remain high. Typical monthly mortgage payments have risen from $1,000 in 2021 to $2,200 at present, including a sharp jump since April 2, Trump’s tariff “liberation day.”