Donald Trump’s second presidency has crossed the 100-day mark and while it’s far too early to pronounce a judgment on Trump 2.0, the early results on the economic front are worrisome, for consumers and businesses alike. Although concrete economic indicators of Trump’s performance have yet to be released (Wednesday’s first quarter gross domestic product numbers are not a useful statistic), other statistics paint a dark picture.

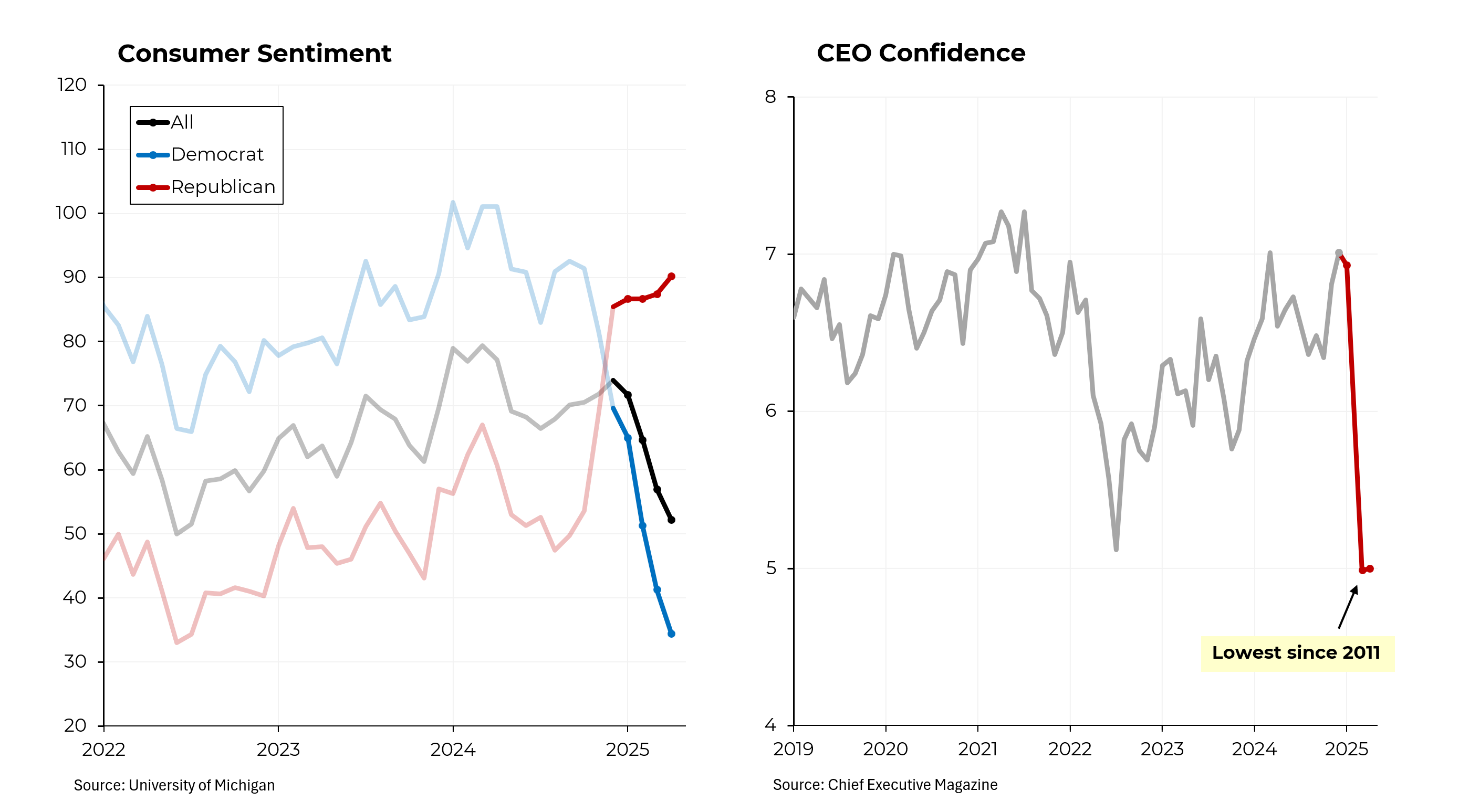

Start with sentiment and confidence. In April, the University of Michigan’s consumer sentiment index notched its fourth lowest reading since the index was first compiled in 1952. As with many measures of how Americans feel about their country, economic sentiment tends to break along party lines. Thus, during the Biden administration, Democrats were routinely more optimistic about the economy than Republicans. Immediately after last November’s election, those lines reversed. However, sentiment among all Americans has been dropping sharply and even among Republicans, remains far below the pre-Covid level of 122.

As for business leaders, their economic confidence has dropped precipitously and is now at the lowest level since 2011. Companies are currently announcing their first quarter earnings, an occasion when they traditionally update their expectations for performance over the full year. However, this time around, a large number of companies – including General Motors, JetBlue and Snap – have shelved their earlier guidance and declined to release updated forecasts. “I don’t care if you call it a recession or not, in this industry, that’s a recession,” Robert Jordan, the chief executive of Southwest airlines, said on his earnings call.

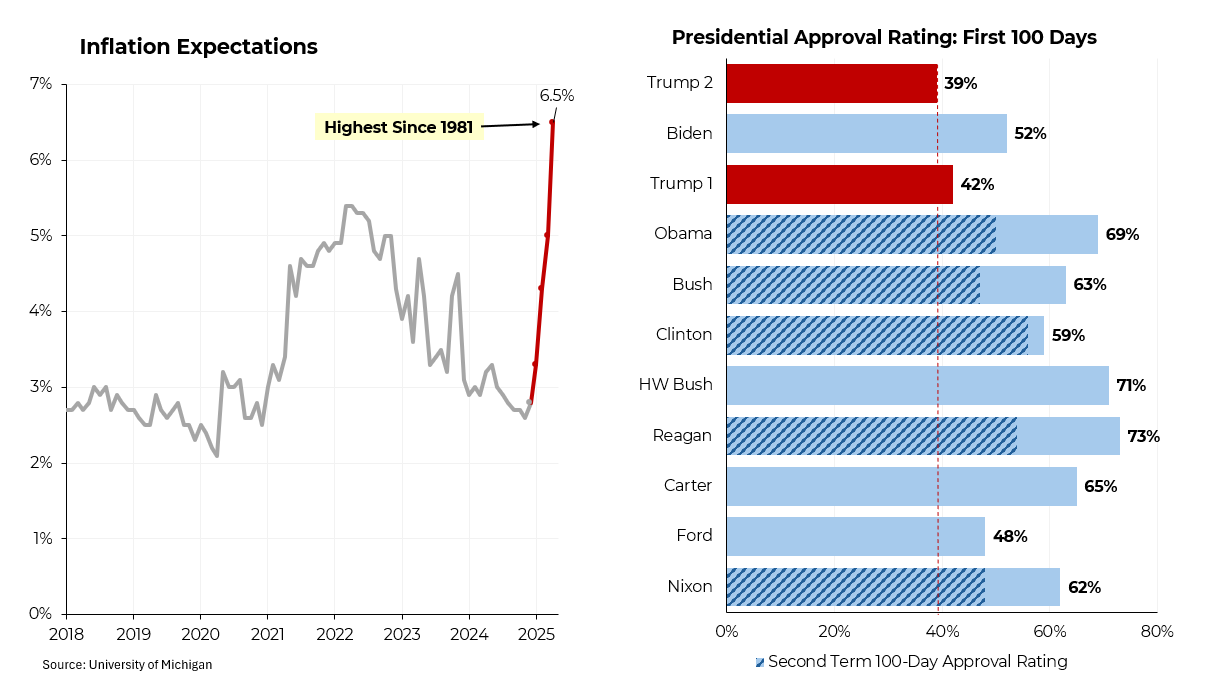

Part of the growing pessimism among consumers is their expectation for inflation. While prices have yet to rise visibly, the University of Michigan survey found that, on average, Americans expect prices to rise by 6.5% this year, compared to a projection of 2.8% as recently as December. The current reading is the highest since November 1981 when inflation was running at nearly 10% and the country was in a recession.

All of that has translated into sagging poll ratings for President Trump. At 39%, that is the lowest approval rating for a president at this point in his term since before Richard Nixon. Even Trump in his first term and President Joe Biden had higher approval ratings. Most recent presidents began with approval ratings of 60% or more.

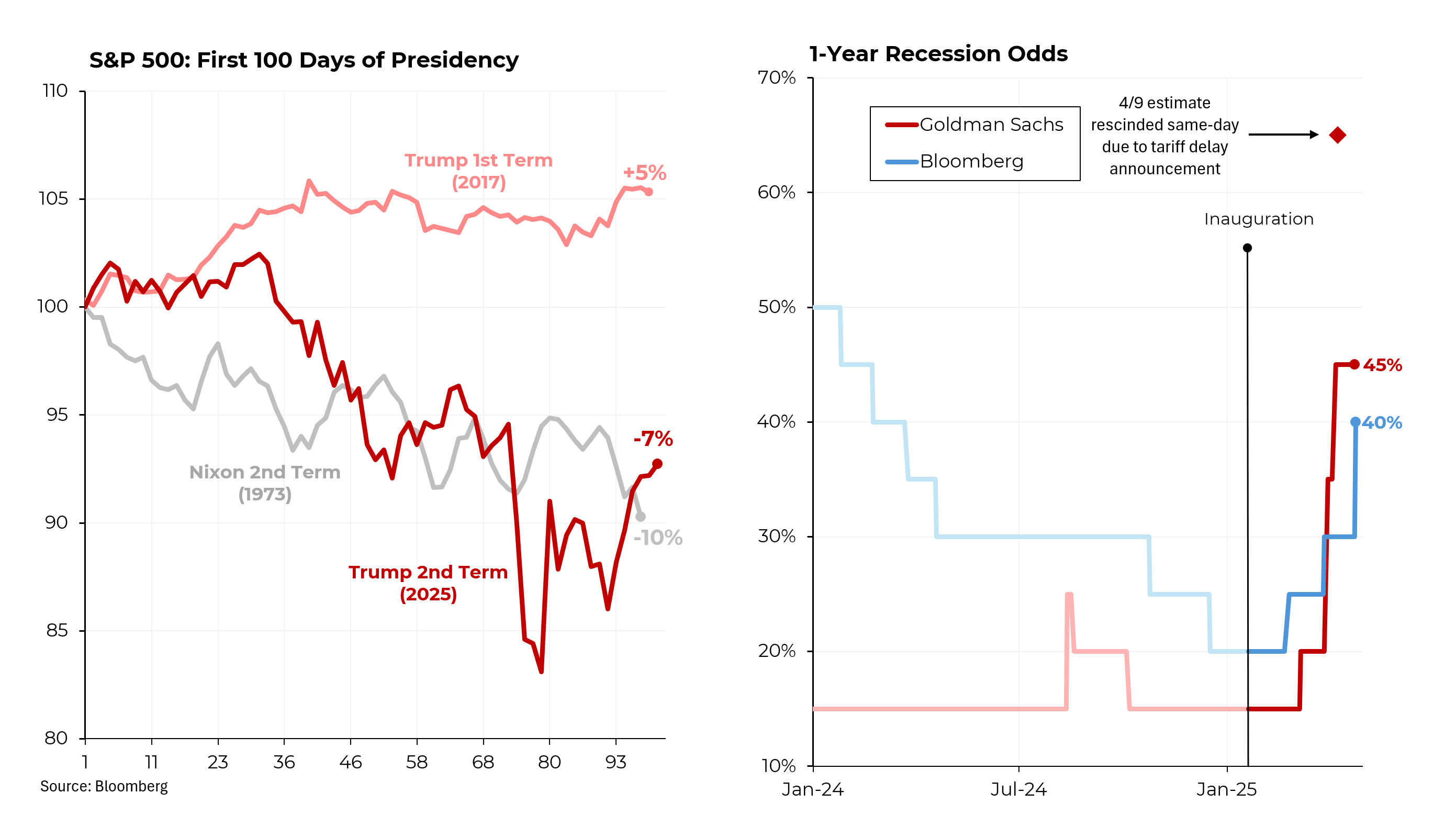

Another measure of Mr. Trump’s early challenges is the sagging stock market (which Trump attempted to blame on Biden in a Truth Social post). At the end of the first 100 days, the S&P 500 index was 7.3% lower than when Trump took office, the worst first 100-day performance at the start of a four-year term since Nixon in 1973. (During Biden’s first 100 days, the market appreciated by almost 11%, the strongest performance in this time frame in 50 years. Moreover, stock prices have been extraordinarily volatile over the past 100 days, causing pain and confusion for investors and small shareholders alike.

More fundamentally, the tariffs and lurching economic policy of Trump 2.0 has caused economists to sharply raise their probability of a recession. A survey by Bloomberg put the probability at 40%, back to where it was a year ago when the Federal Reserve was in the process of raising interest rates. Goldman Sachs put the odds at 45%. (Notably, on April 9, Goldman raised its probability to 65% and then rescinded it an hour later when Trump paused most reciprocal tariffs.) Online prediction markets put the recession odds as high as 67%.