In fits and starts, the House of Representatives is marching toward passage of President Donald Trump’s “one big, beautiful bill,” a sprawling assemblage of vast tax cuts and significant reductions in spending on Medicaid, the government’s health insurance program for the least well off. Consequentially, the bill, which includes its share of gimmicks, would add trillions of dollars to the deficit and debt over the coming decade.

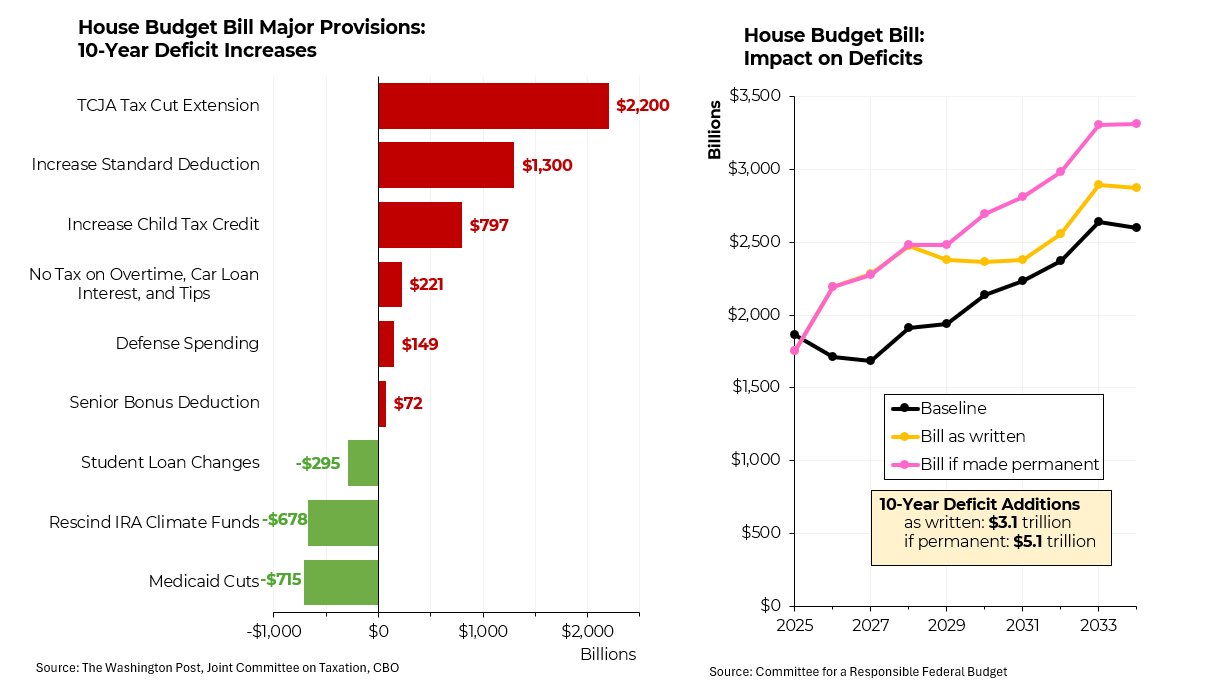

The centerpiece of the legislation is the extension of the tax cuts enacted as part of President Trump’s 2017 Tax Cut and Jobs Act (the TCJA). While that bill lowered corporate taxes permanently, the individual reductions were set to expire at the end of 2025, as a bit of budgetary legerdemain designed to make the deficit impact look smaller. In addition to making the 2017 tax rates permanent, would increase the standard deduction by $1,000 for single filers and $2,000 for joint filers (to $16,000 and $32,000 respectively). And it would increase the child tax credit to $2,500 per child from $2,000 — but only for parents with Social Security numbers. It also tries to make good on a number of Trump’s crass political campaign promises — no taxes on tips, overtime or interest on car loans and a bonus deduction for Social Security recipients.

On the spending side, the bill would cut funding for student loans, Medicaid and clean energy.

All told, the legislation would add at least $3.1 trillion to the deficit and debt over the coming decade and an estimated $5.1 trillion if provisions that are only slated to be temporary were made permanent.

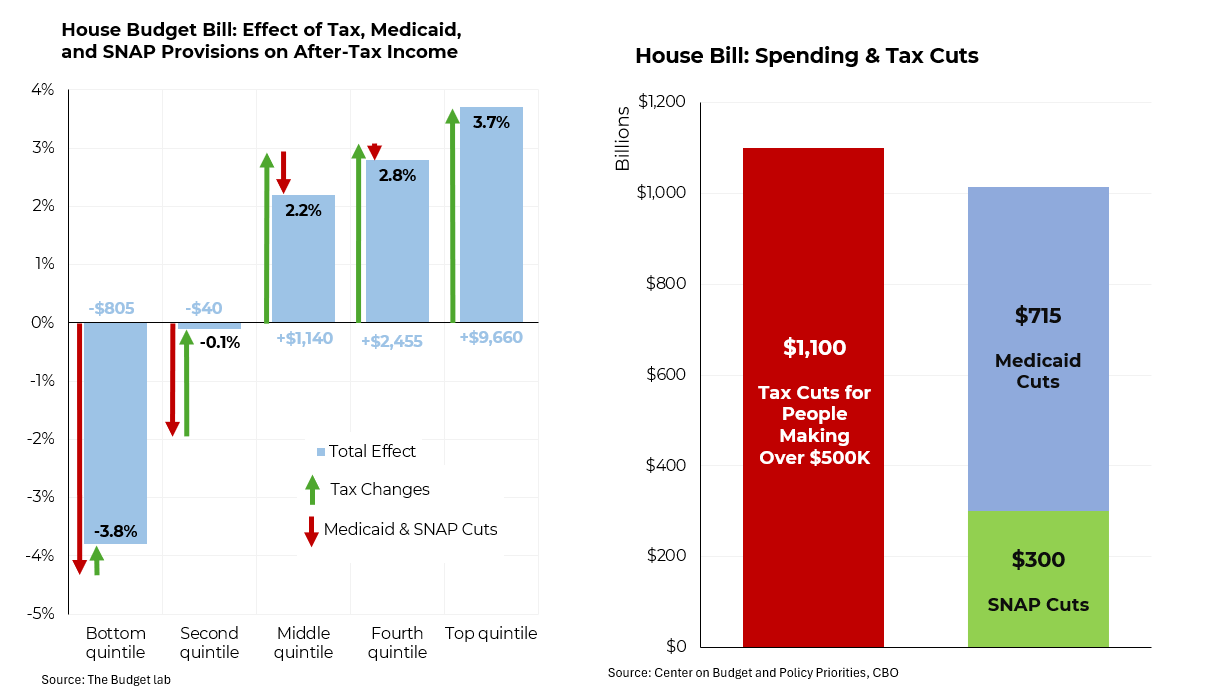

Like the TCJA, the new tax bill would benefit those at the top far more, both in dollars and percentages. Americans in the top 20% would receive an average tax cut of $9,660 or 3.7% of their income. Those at the bottom would end up worse off because the impact of the Medicaid cuts would far outweigh the small tax benefit that they would receive.

Just the tax cuts for people earning over $500,000 a year would cost $1.1 trillion, very close to the $715 billion that would be saved by cutting Medicaid and SNAP (food stamps).

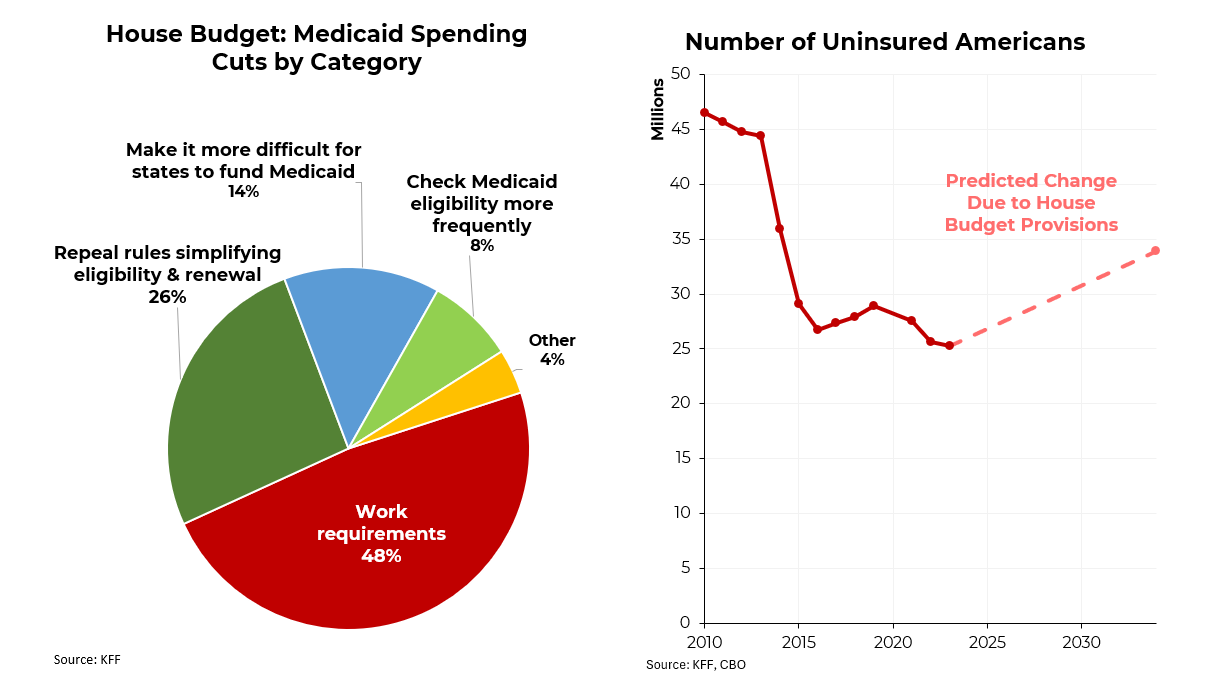

The Medicaid reductions would occur in several different ways, the largest of which would be imposing a work requirements that would require non-elderly ACA expansion enrollees to work or volunteer 80 hours per month to retain coverage. Other changes would make it more difficult for states to fund Medicaid, would require Medicaid eligibility to be checked more often and would repeal Biden-era rules that made it logistically easier for eligible Americans to enroll.

All told, the changes would reduce the number of Americans covered by health insurance by at least 8.6 million by 2034, according to the Congressional Budget Office. This would be a dramatic change from the reduction in uninsured Americans that has occurred since the passage of Obamacare. (Note that the increase in uninsured Americans during the first Trump administration was a result of efforts then to impose work requirements.)