President Trump gave the first nationwide address of his second term last night, with his usual mix of lofty promises and mixed adherence to the facts. Not surprisingly, tariffs were a central part of his message – but both markets and everyday Americans have a different view of the outlook. The S&P 500 fell by more than 1.2% on Tuesday, erasing all the gains it had made since the election.

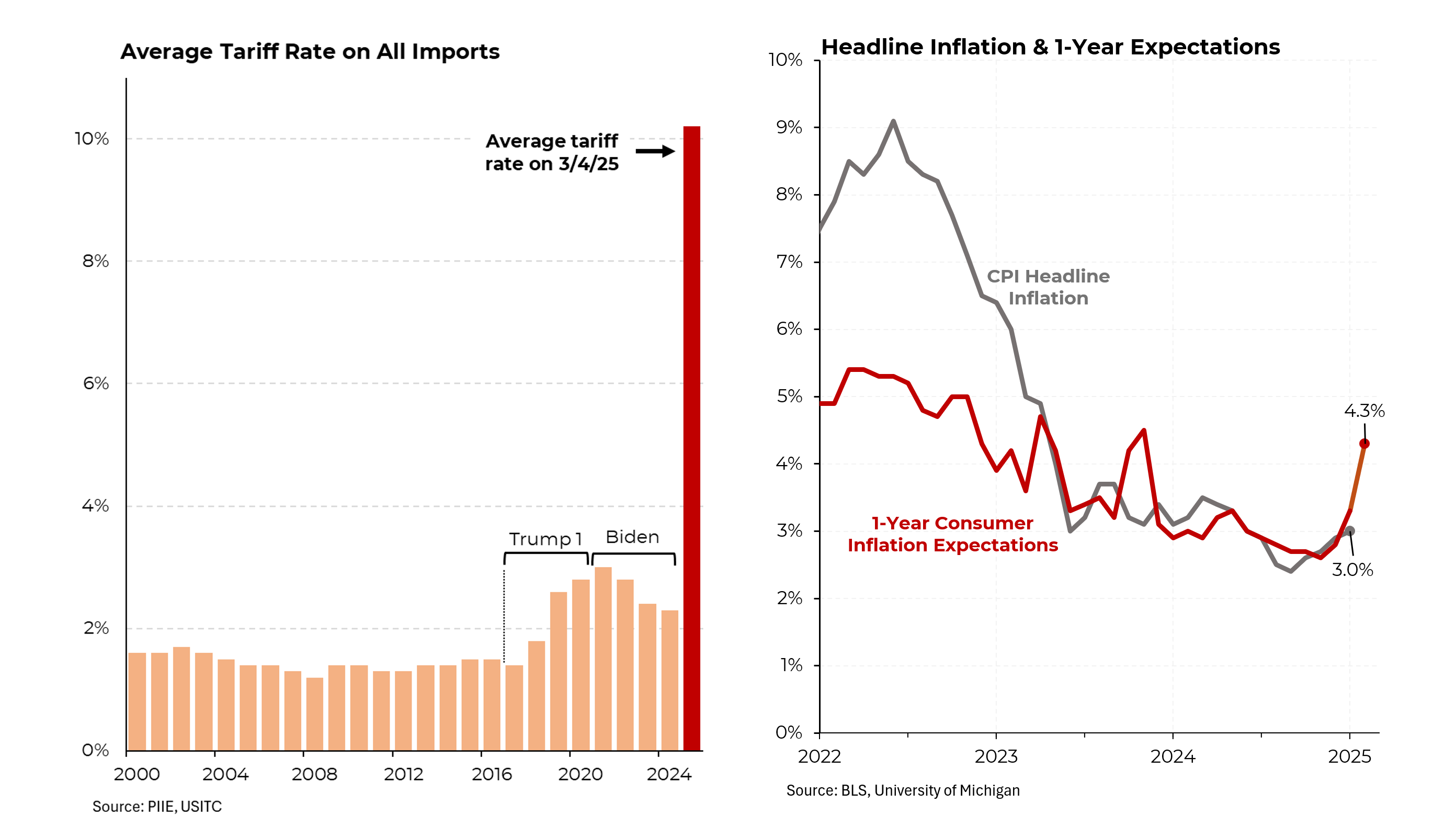

The tariffs that Trump has imposed since his inauguration are vast, dwarfing the ones that he imposed during his first term and bringing our average tariff rate to more than 10%, the highest that it has been since World War II. One way to think about tariffs is that they function like a national sales tax. They will raise prices of all imports as they cross the border. To put the more than 10% figure in perspective, the sales tax in New York City is 8.875%. Of course, this wouldn’t apply to everything Americans buy but the value of the items on which the tax would apply add up to roughly 5% of US GDP.

Americans appear to have processed this phenomenon, as well as the fact that inflation has stopped going down and on a “headline” basis, has been ticking up in recent months. As a result, consumers now believe prices will rise by 4.3% in the coming year, the highest prediction since November 2023.

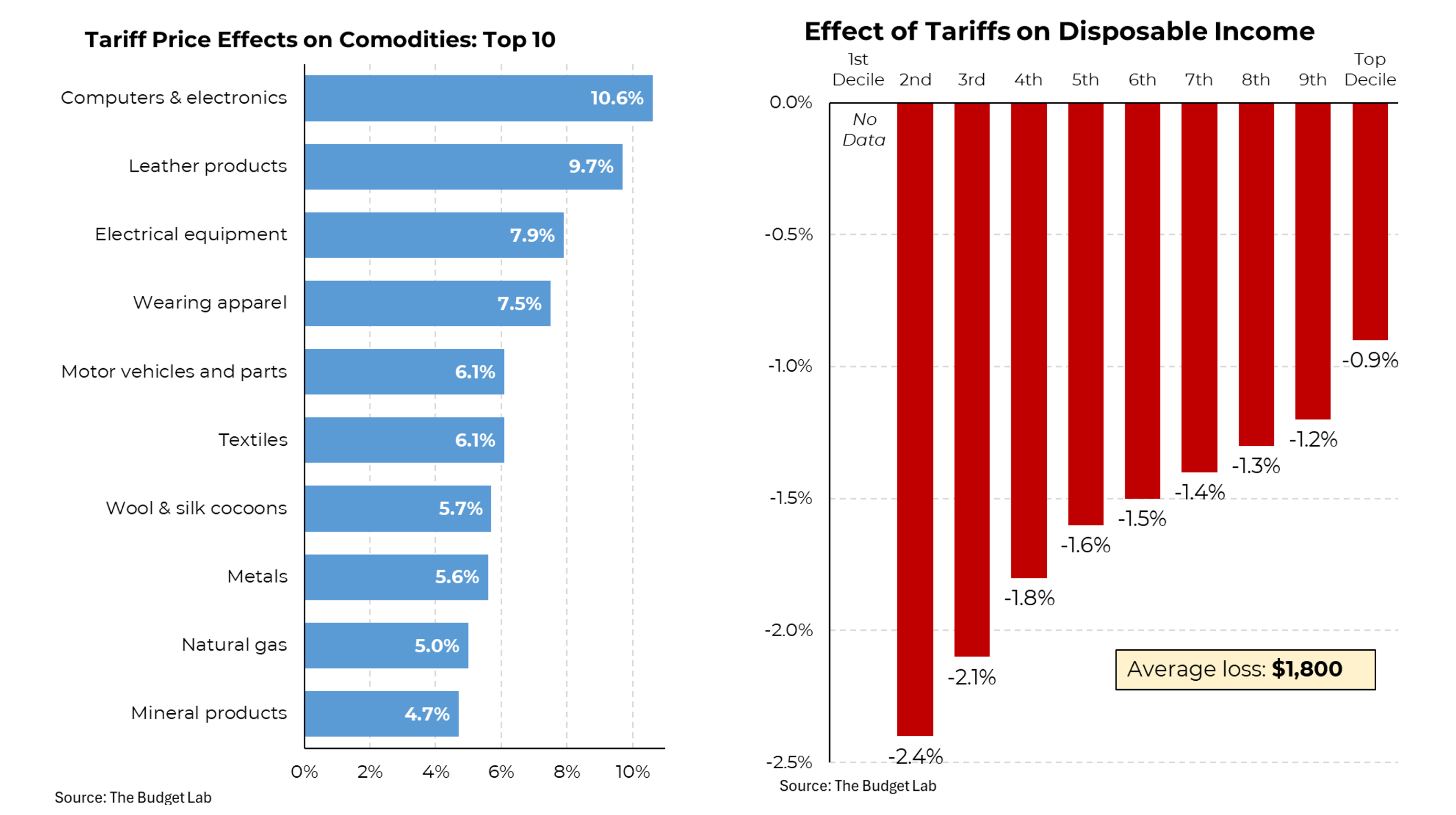

However, tariffs don’t only affect the prices of imports; they also allow domestic providers of similar goods to increase their prices. All told, for example, the prices of computers and electronic goods are estimated to rise by more than 10%, clothes by 7.5% and cars by 6.1%. (These are among the categories of items that are most often imported. The CEO of Target has said that produce prices (we get a lot from Mexico) could rise in the next several days. The CEO of Ford has said that tariffs would “blow a hole” in the auto industry.

The effect of the tariffs would be faced disproportionately by those nearer to the bottom. Those furthest down the income distribution would lose 2.4% of their disposable income while the top 10% will only lose 0.9%. The tariffs will cost the average household $1,800 and everyone below the top 20% will lose all the benefits of Trump’s 2017 tax cut.

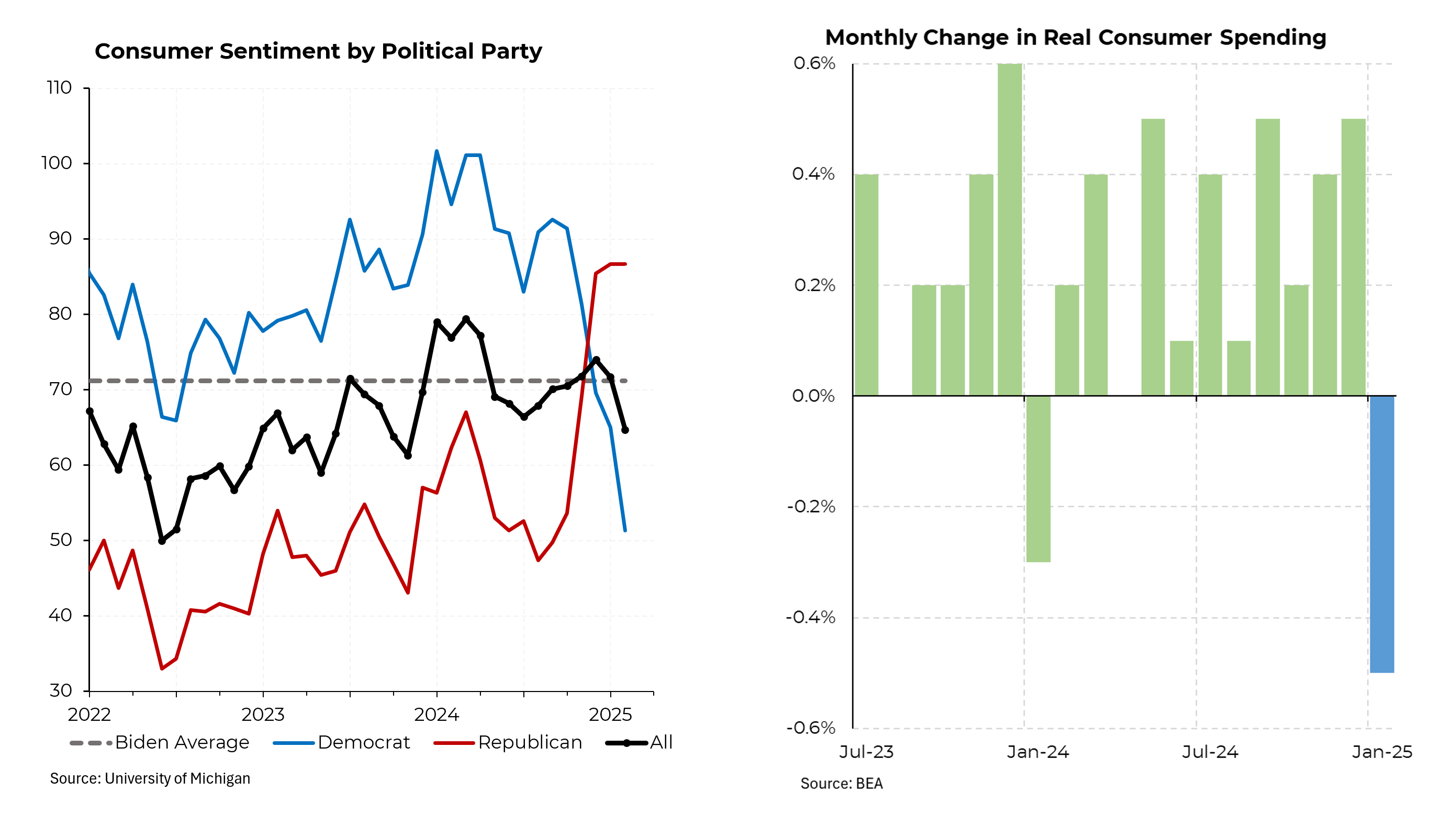

The stalling of progress on inflation and the news about tariffs have contributed to a sharp drop in consumer sentiment. Not surprisingly, that has been particularly evident among Democrats but optimism among Republicans has stopped rising and on average, Americans have become negative about the outlook.

That has no doubt translated into an unusual and sharp 0.5% drop in consumer spending, the first drop since January 2024. Prior to that, the last drop was March 2023.