The Federal Reserve left interest rates unchanged at its monthly meeting on Wednesday but behind that unsurprising and uneventful news lay some early signs that the chaotic and potentially detrimental policies of the Trump administration are beginning to take their toll.

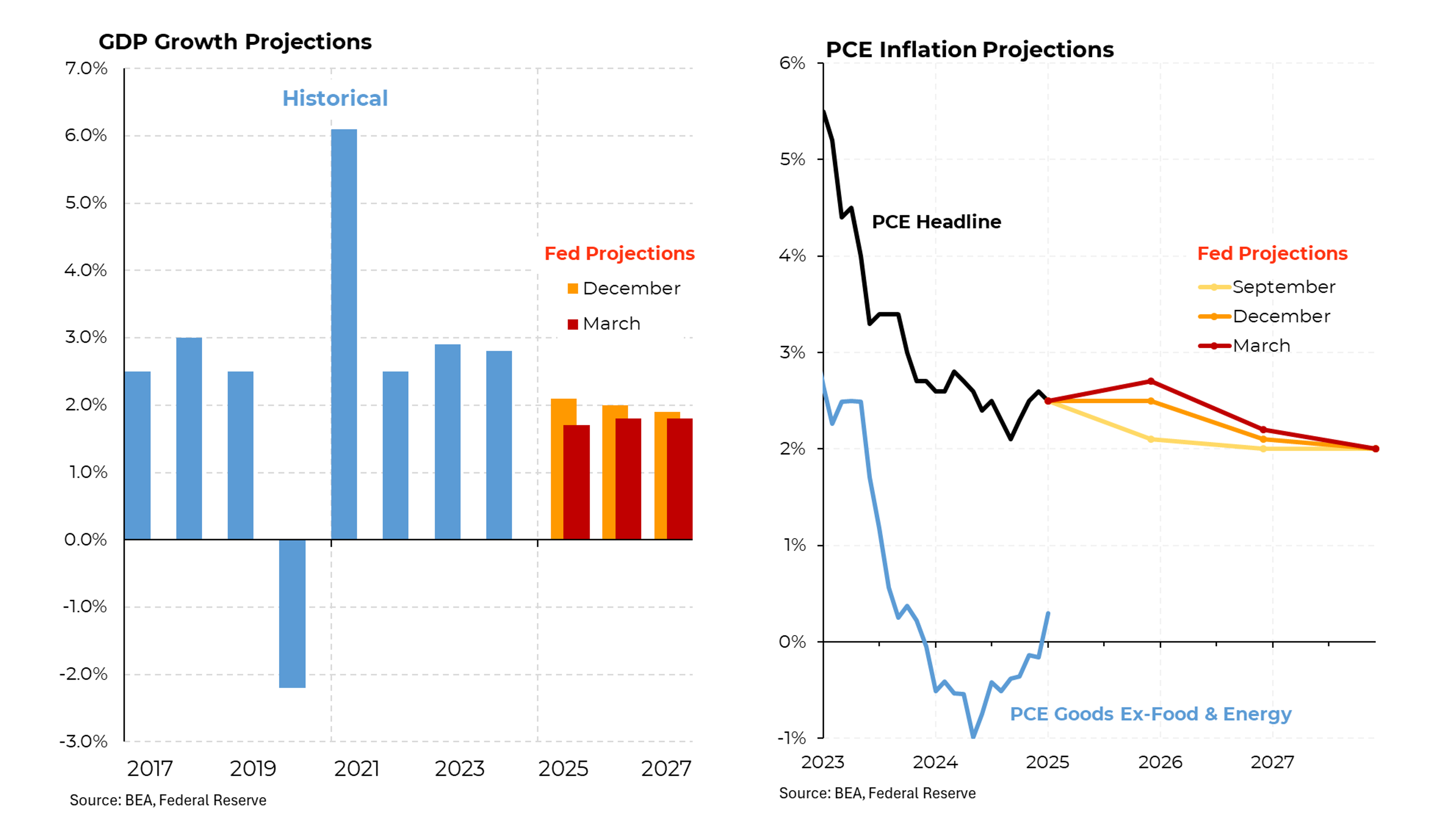

Four times a year, apart from its consideration of interest rate changes, the central bank’s Federal Open Market Committee issues updated forecasts for the economy. In its new projections, the Fed’s decision-makers evinced a less optimistic view. For starters, the central bank substantially revised down its projections for economic growth for this year, to 1.7% from 2.1% and also lowered its expectations for 2026 and 2027. Should the 1.7% estimate prove correct, it would be the lowest annual growth rate (apart from during Covid) since 2011.

As for inflation, the Fed raised its estimate for this year to 2.7% from the 2.5% projected in December (and the 2.1% in its September forecast). This change appeared to result in part from a lack of further downward movement in inflation and in part because of the potential impact of the tariffs being put in place. Jerome Powell, the Fed chair, noted in particular that the prices of goods (as opposed to services) were unexpectedly strong in the last two months.

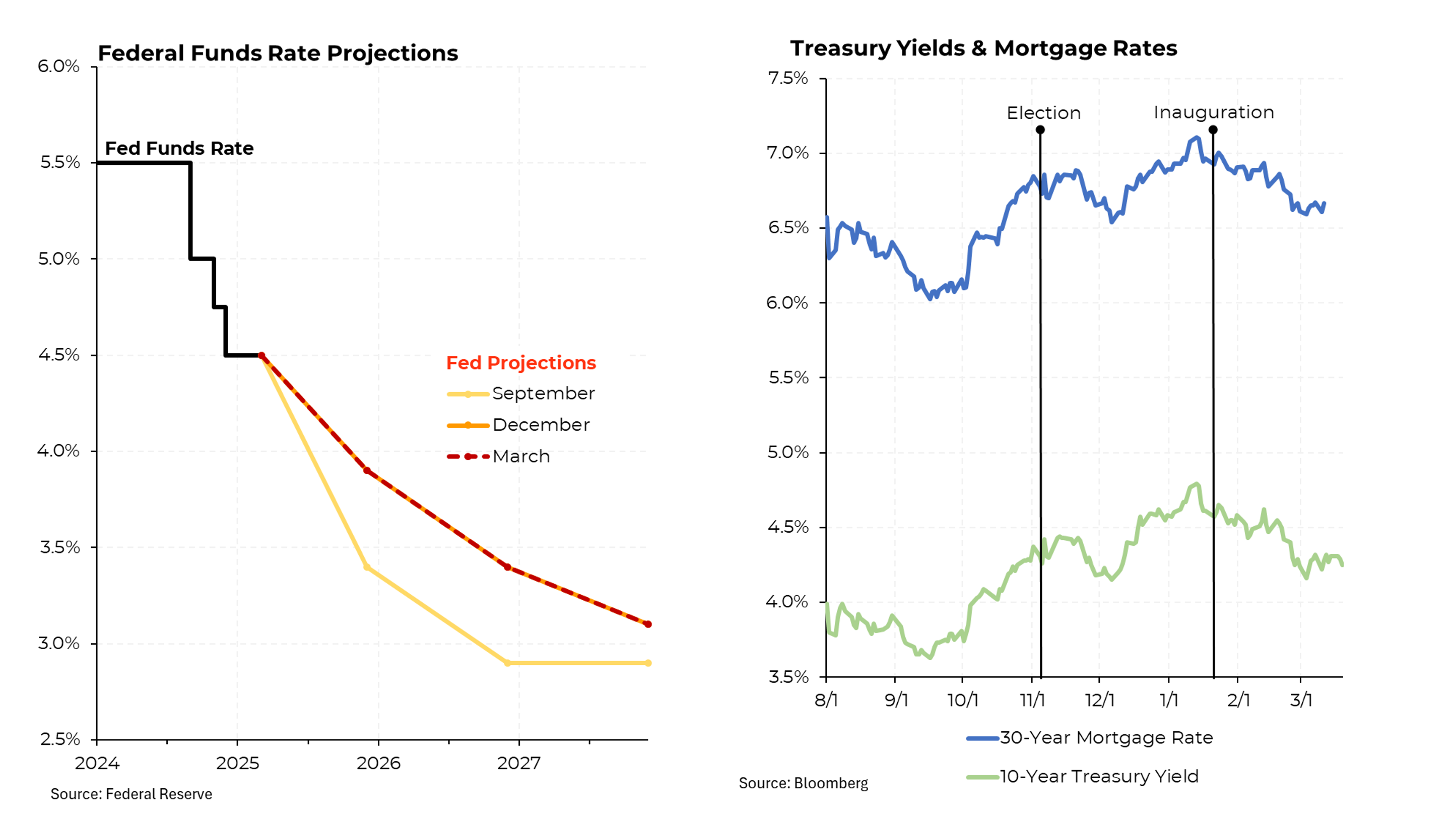

As for interest rates, the Fed did not change its most recent projection of two or three, 0.25% rate cuts over the balance of the year. But both of those projections anticipate substantially higher rates than the Fed expected in September, again because of sticky inflation. But Trump quickly tweeted that “the Fed would be MUCH better off CUTTING RATES.”

Note that the Fed only controls short term rates (like those paid on money market accounts.) Longer term interest rates (like those on fixed rate mortgages) are determined by market forces, particularly expectations for growth and inflation. Those rates have been declining but unfortunately, not because the market has become more optimistic about inflation but because it has become more worried about growth.

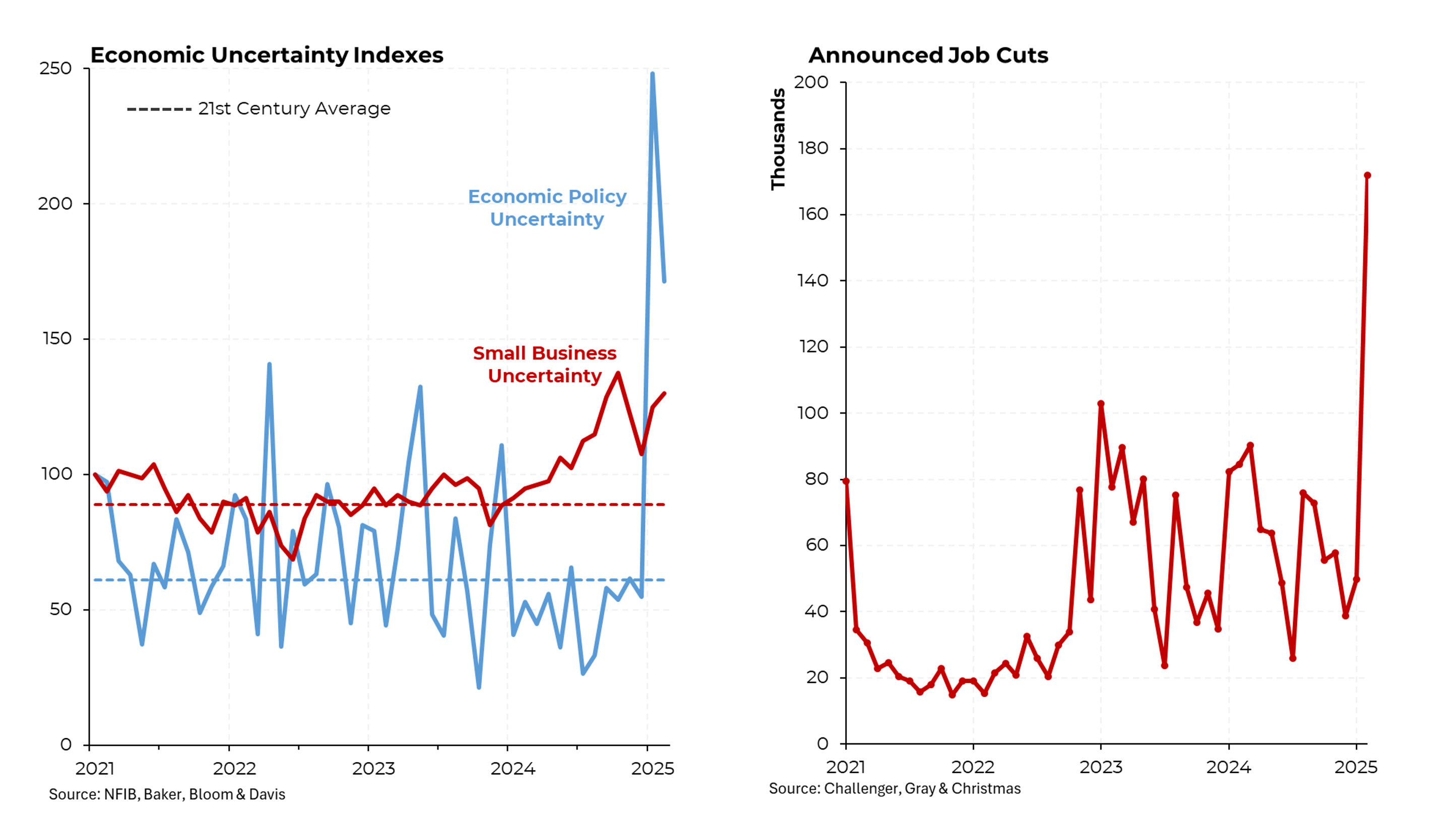

Those concerns are also evident in an index of economic policy uncertainty, a statistic compiled by a group of economics professors. It is based on a variety of indicators, including news coverage, the number of tax code provisions set to expire and the extent of divergence of economic forecasts. Another index, of small business uncertainty, has also risen and is now 46% above its 21st century average.

And while the job market remains reasonably strong, the number of announced layoffs has jumped markedly. That 172,000 figure for February is the highest since 2020. Notably, 64,000 of the cuts stem from Department of Government Efficiency actions. But even if those are removed, the losses in February would still be the highest since Covid.