A clutch of new economic statistics released in the past several days show an economy that appears stable: still creating jobs and inflation behaving slightly better than expected. But the stock market remains spooked and consumers have turned wary, in large part because of the erratic economic policy actions by the Trump administration, particularly around tariffs.

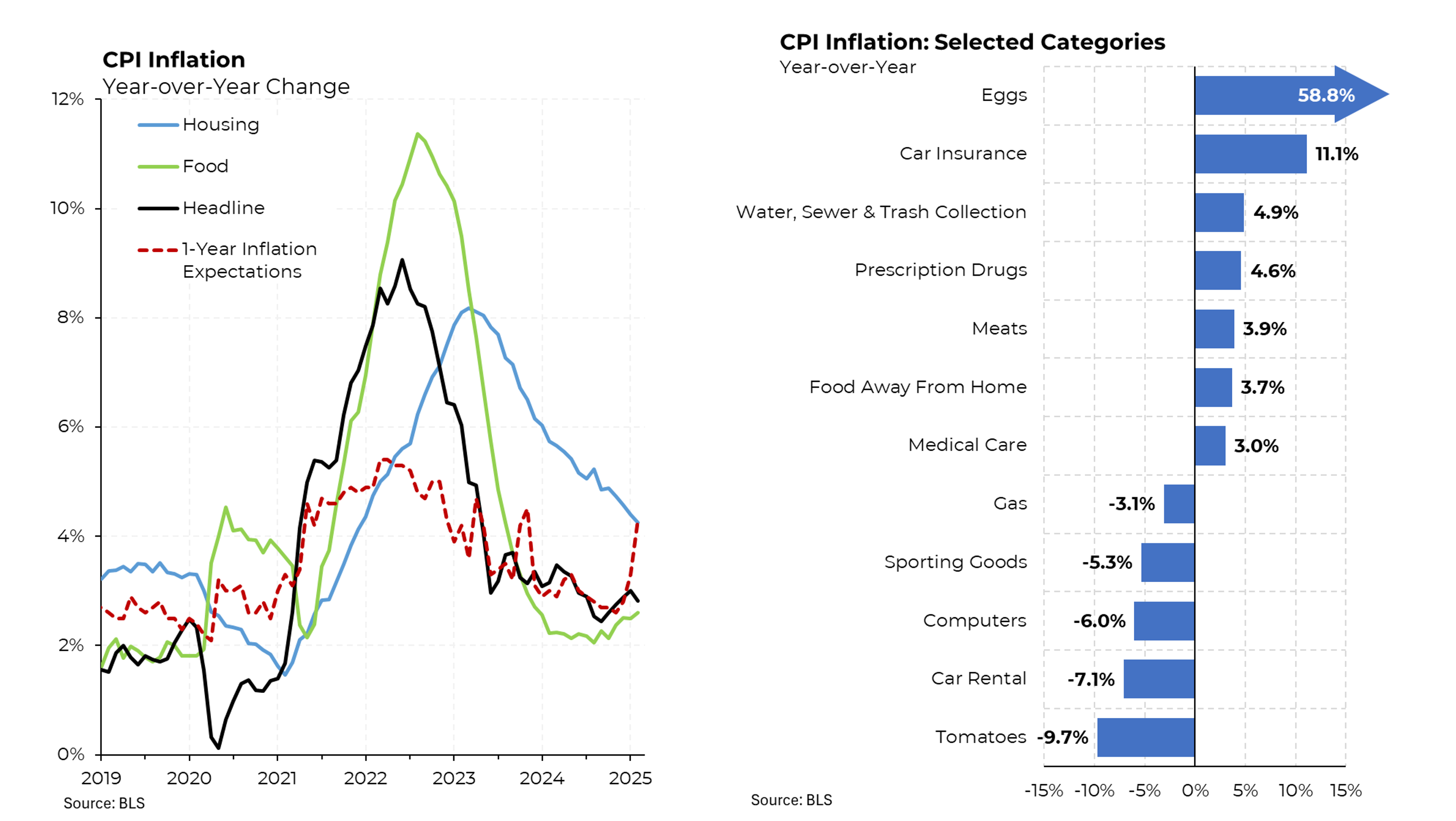

The most recent news is that inflation in February was slightly better than forecast, with overall prices rising by 2.8% over the previous year. With the volatile categories of food and energy stripped out, the increase was 3.1%. While slightly better than forecasts, inflation remains stubbornly above 2%, raising questions of when the Federal Reserve will be able to cut rates. Of concern, expectations of inflation over the coming year have been climbing and have now reached 4.3%.

As for individual items, eggs have, of course, dominated the press, with prices up nearly 60% over the past year and a dozen eggs now fetching an average of $5.80. The cost of car insurance continues to rise and is now up 11% over the previous year. Other items that have risen particularly sharply: trash collection, prescription drugs, meats and restaurant food. On the other side, gasoline is now about 3% below a year ago; the average price is just above $3. Declines also occurred for sporting goods, computers and car rentals.

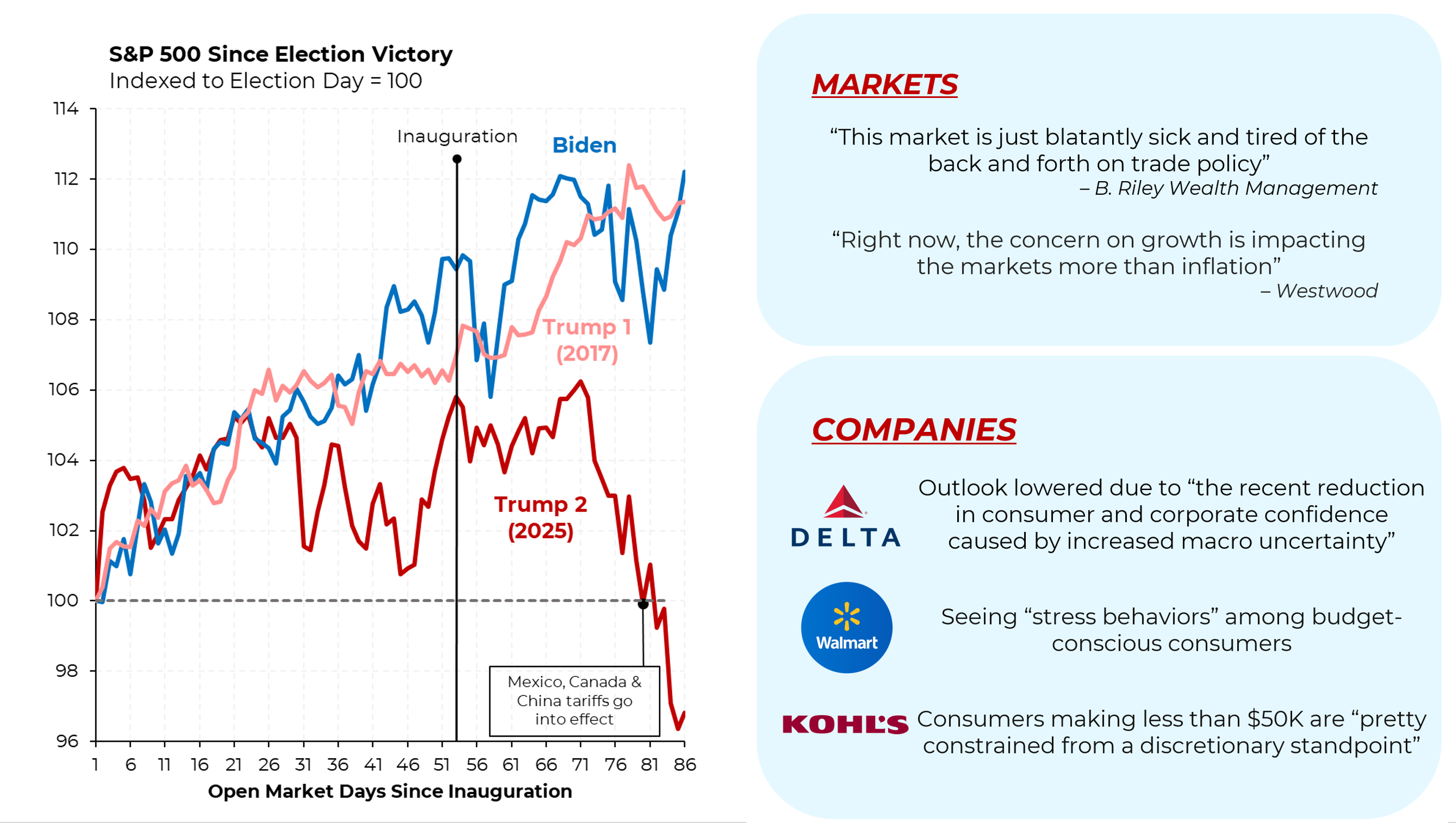

Meanwhile, the stock market remains volatile, with share prices now 3.2% below their levels on the day Trump was elected and 7.4% below where it was on election day. That’s in stark contrast to their performance after Trump’s first victory and in equally stark contrast to their performance after Biden’s victory in 2020.

While tariffs have clearly played a major role in the market’s disappointing performance, a number of companies have issued statements of concern about the outlook for consumer purchases in the coming year.

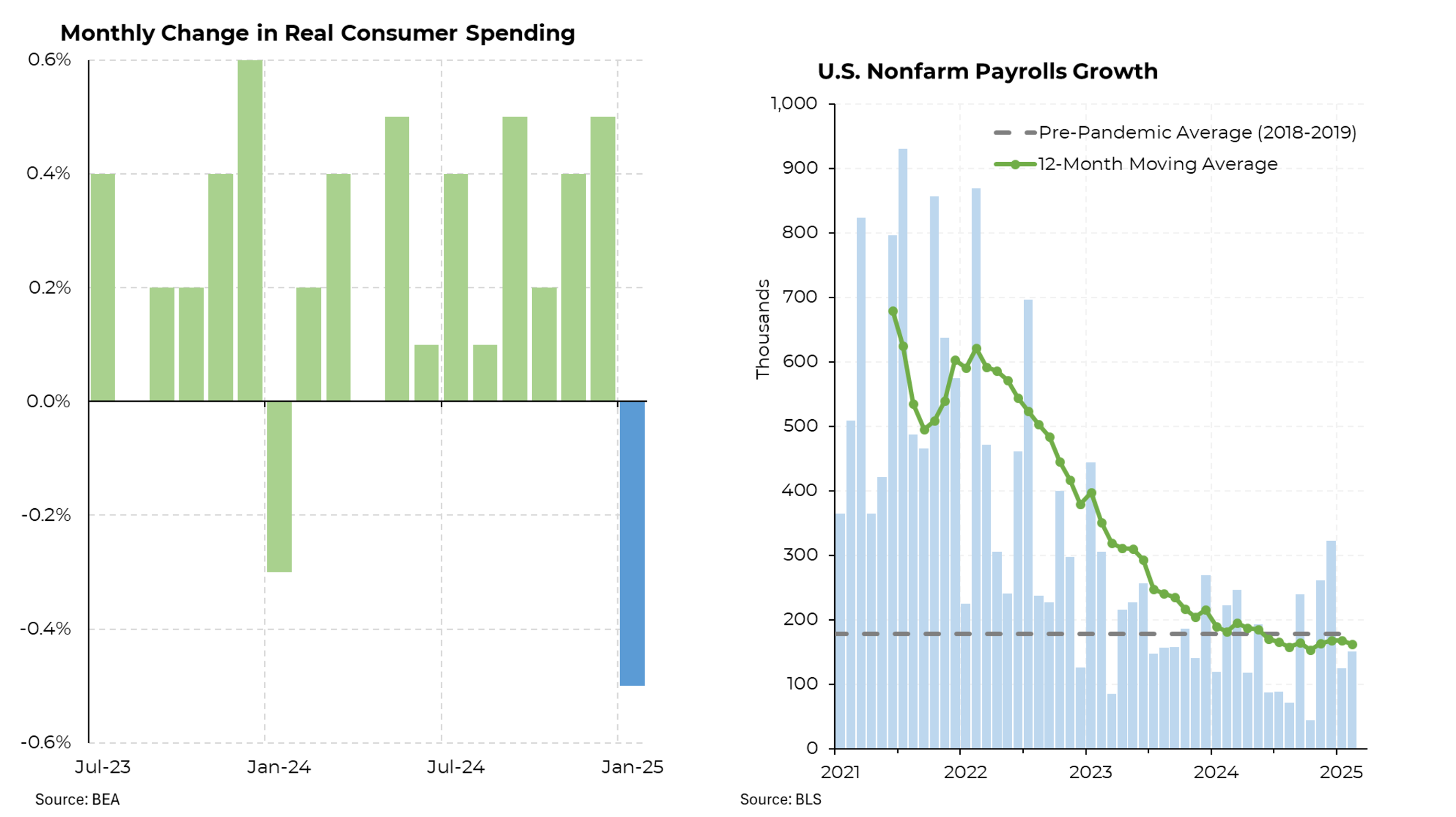

Indeed, consumers have already begun pulling back; spending was down (after adjusting for inflation) for the first time in a year and it was the largest drop since February 2021.

And while the nation added 151,000 jobs in February and the unemployment rate remained stable at 4.1%, the pace of job creation has clearly slowed. The 12-month moving average of payroll growth has been below pre-pandemic levels since June.